[ad_1]

This week, vital occasions within the crypto house garnered a surprisingly calm market response

Preliminary panic subsided inside 24 hours because the market digested a possible energy shift within the cryptocurrency trade

Bitcoin bulls are at present aiming for a rally towards $40,000 and the probability will increase if it closes the week above $38,000

Safe your Black Friday good points with InvestingPro’s as much as 55% low cost!

This week marked vital developments within the cryptocurrency trade, with the DOJ imposing a historic positive on Binance and the alternate’s admission to critical accusations resulting in the pressured resignation of Changpeng Zhao. Regardless of the gravity of those occasions, ‘s eventual response was fairly subdued.

Surprisingly, the preliminary panic that ensued following these revelations dissipated inside a brief 24-hour interval, and the market swiftly resumed its course. Notably, the market actively embraced latest developments indicating a possible shift within the steadiness of energy inside the cryptocurrency trade, with institutional buyers lending their assist.

Trade consultants, commenting on Binance’s reconciliation with US authorities, have asserted that it’s in the very best curiosity of the market. Furthermore, the elevated rhetoric round transparency within the sector is believed to strengthen the probability of approval for the spot Bitcoin ETF, a improvement that has considerably influenced the market in latest months.

Bitcoin’s value chart this week additionally exhibits that the Binance incident was shortly priced in. Bitcoin, which fell 5% on Tuesday amid panic promoting on the information of the settlement, recovered its losses the subsequent day and continued to take care of its optimistic outlook.

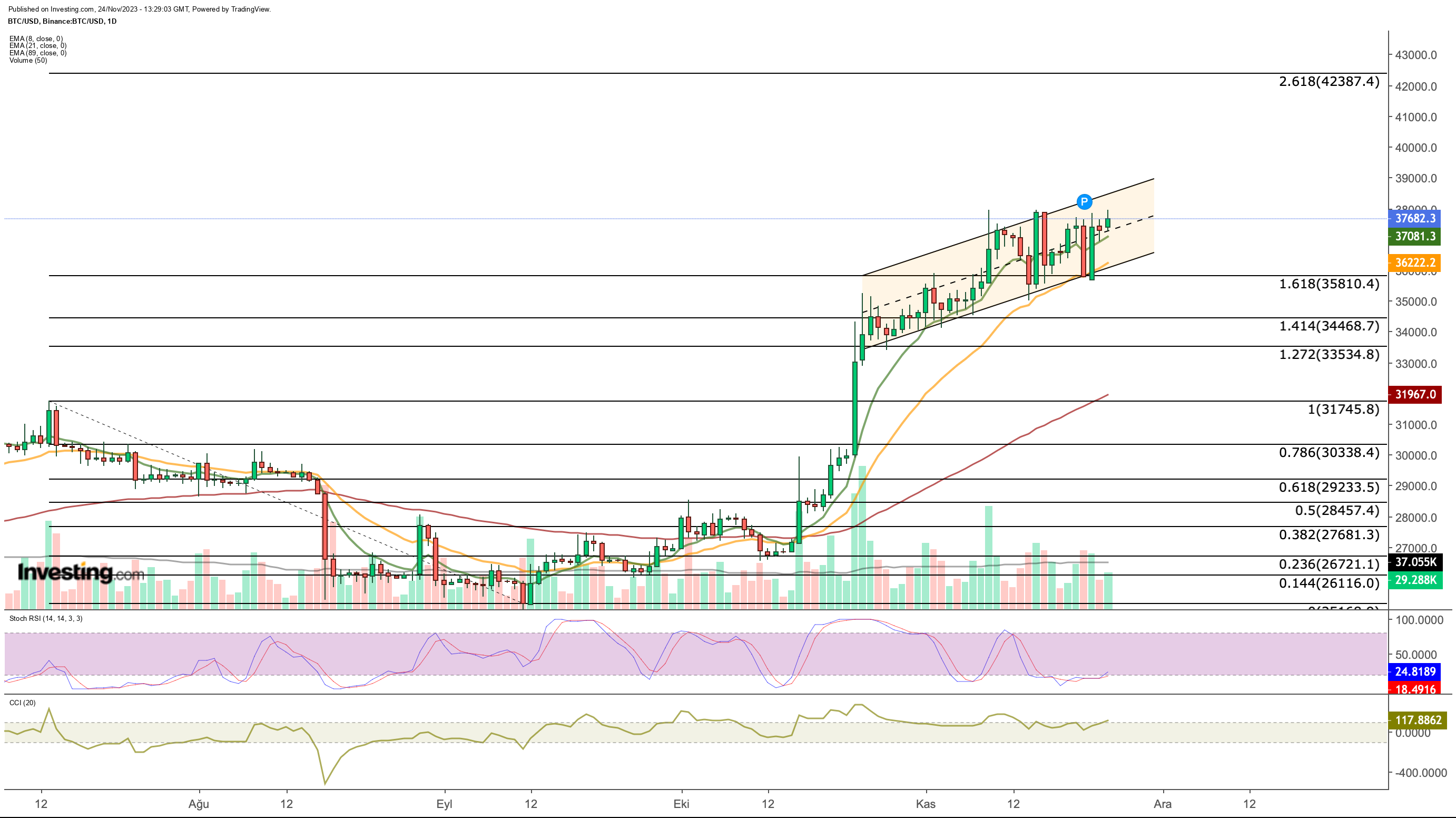

Bitcoin has remained in a sideways sample within the $35,500 – 37,500 vary inside the ascending channel in November. At this level, the cryptocurrency, which has exceeded the Fibonacci enlargement space in response to the final bearish momentum, has turned the Fib 1,618 worth into assist. In November, an intermediate resistance was shaped within the slender band of $37,500 – 38,000. Simply above this resistance, a second resistance line at $38,500 – 38,600 could type within the brief time period.

Is $40,000 Seemingly for Bitcoin?

In response to the short-term value motion, Bitcoin, which witnesses elevated demand once more within the second half of the week, may see its subsequent cease within the $40,000 area if it may possibly notice a weekly shut above the resistance line within the $38,000 band. This doable pattern is supported by the Stochastic RSI, which tends to interrupt out of oversold territory on the day by day chart, and the BTC value stays above the short-term EMA values.

Alternatively, if consumers fail to generate sufficient quantity to step into the $38,000 band, we may see that the cryptocurrency could retreat in direction of round $35,800, which is short-term assist inside the band motion, with sellers lurking.

Whereas sustaining this worth, which corresponds to the decrease band of the ascending channel, can hold bullish expectations alive, a transparent day by day shut under it may be thought of as the start of a correction. Accordingly, in a doable correction, the potential of Bitcoin retreating to $ 33,500 will enhance.

***

Purchase or Promote? Get the reply with InvestingPro for Half of the Value This Black Friday!

Well timed insights and knowledgeable choices are the keys to maximizing revenue potential. This Black Friday, make the neatest funding resolution out there and save as much as 55% on InvestingPro subscription plans.

Whether or not you are a seasoned dealer or simply beginning your funding journey, this provide is designed to equip you with the knowledge wanted for extra clever and worthwhile buying and selling.

Black Friday Sale – Declare Your Low cost Now!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, or advice to speculate as such it’s not meant to incentivize the acquisition of property in any means. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding resolution and the related danger stays with the investor.

[ad_2]

Source link