[ad_1]

The potential approval of a Bitcoin ETF (Change Traded Fund) is sure to open new alternatives for merchants. The expectations surrounding this occasion impression the market now, however an professional believes they’ll have a extra substantial impact within the coming months.

As of this writing, Bitcoin trades at $37,400 with a 1% revenue within the final 24 hours. Over the earlier week, the cryptocurrency stayed within the inexperienced with a 3% revenue, holding the essential stage of $37,000 regardless of the rise in promoting stress.

The Profitable Technique In Anticipation Of Bitcoin ETF Approval

As Bitcoin’s worth soars with a outstanding 125% enhance this 12 months, a brand new buying and selling technique emerges, promising excessive returns within the wake of the anticipated Bitcoin ETF. A seasoned market analyst, Markus Thielen, unveils insights into leveraging the evolving crypto market dynamics for worthwhile buying and selling in an essay posted by choices platform Deribit.

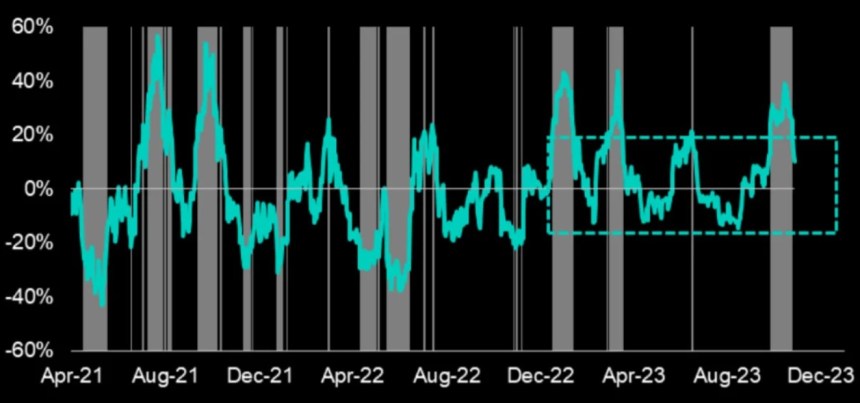

Thielen’s evaluation reveals an “uncommon” development within the Bitcoin market: regardless of its vital rally, the 30-day realized volatility stays at a modest 41%, starkly contrasting to the 5-year common of 63%.

In response to the analyst, this subdued volatility displays a declining curiosity in leveraged Bitcoin choices, a direct consequence of institutional gamers coming into the crypto enviornment.

These gamers, holding vital Bitcoin property, will possible promote volatility, fostering a extra secure market atmosphere that mirrors conventional monetary markets.

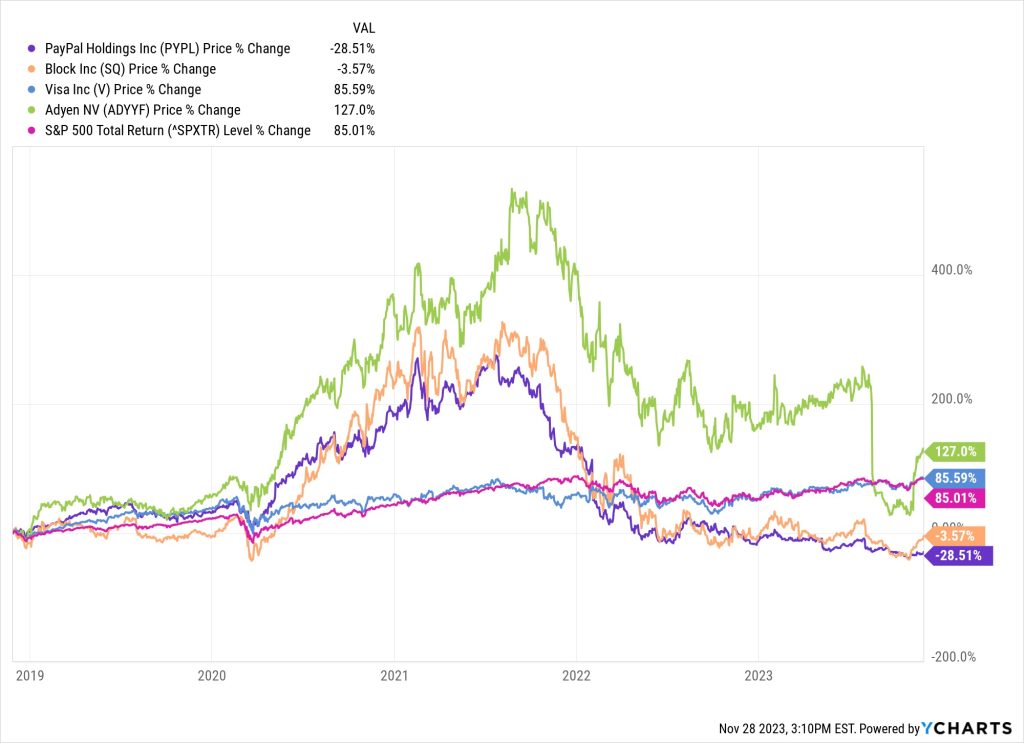

On this panorama, the technique of promoting strangles (120% name and 80% put) on a 30-day rolling foundation stands out. In response to Thielen, this method has proven profitability in roughly 23% of circumstances over the previous 12 months, as seen within the chart under, marking a big enchancment from the decentralized finance (DeFi) summer time’s high-risk profile.

At the moment, DeFi protocols attracted billions in capital to the crypto ecosystem contributing to the incipient Bitcoin rally. Whereas there are variations within the present market dynamics, choices gamers are more likely to profit from this technique.

This technique, notably efficient throughout low-risk intervals, suggests a window of alternative for merchants to capitalize on earlier than introducing institutional affect.

Institutional Involvement Anticipated to Stabilize Bitcoin Market

The anticipated launch of the Bitcoin ETF is about to rework the market additional. This occasion is anticipated to recalibrate the put/name ratio, which leans closely towards calls.

Thielen compares it to the S&P 500, the place the put/name ratio has been extra balanced. The Bitcoin market would possibly quickly witness the same equilibrium, presenting a chance for merchants to harness volatility via a sell-put technique.

Moreover, Thielen notes that the post-ETF approval section could possibly be the final likelihood for merchants to take advantage of excessive volatility ranges. As soon as institutional gamers start systematically promoting volatility, the market is anticipated to enter a section of diminished worth fluctuations, making volatility-based methods much less efficient.

The evaluation additionally touches upon Bitcoin’s correlation with broader market indicators just like the VIX index. Whereas the Bitcoin market has maintained excessive volatility relative to the VIX index, this hole is anticipated to slender, providing merchants a strategic edge in timing their trades successfully.

In conclusion, because the Bitcoin ETF approaches and institutional participation will increase, savvy merchants can look in direction of promoting strangles as a strategic method to capitalize on the present market situations.

Cowl picture from Unsplash, chart from Deribit and Tradingview

[ad_2]

Source link