[ad_1]

Alex Wong/Getty Photographs Information

I have been overlaying Palantir Applied sciences Inc. (NYSE:PLTR) for years and have at all times been very skeptical in regards to the firm. My promote thesis labored wonderful all through 2022, however the rise of latest synthetic intelligence, or AI, applied sciences gave the firm’s shares an enormous increase, as did the event of its inner operational processes, which revived the expansion charges of gross sales, EBITDA, and earnings per share figures.

Many analysts, as soon as they’ve issued a ranking, stick with it for a really very long time, even when the basics change dramatically and the entire thesis now not is sensible. I’ve to confess that I endure from this “analyst illness” myself once in a while – maybe that is the illness I skilled within the case of PLTR when the inventory began to get better on faster-than-expected EPS development charges and I continued to view it as simply one other “rip.”

In at this time’s article, nevertheless, I need to take a look at the corporate with no preliminary bias with the intention to perceive its development prospects and what at first look seems to be a excessive valuation.

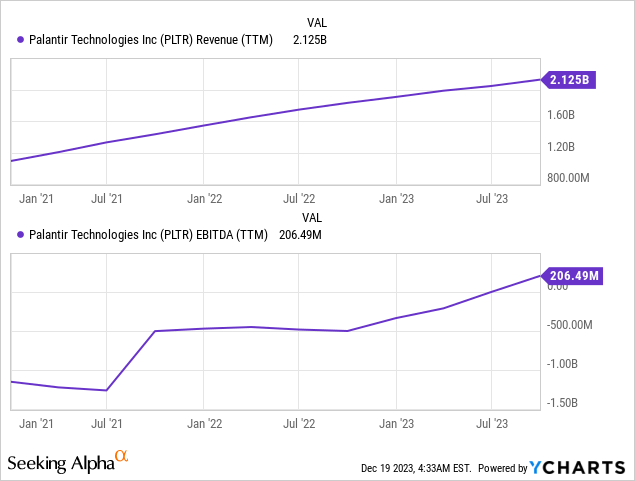

Palantir’s Operations Development And Financials

The current monetary quarter (Q3 FY2023) turned Palantir’s 4th consecutive quarter of GAAP profitability. The corporate closed 80 offers of $1 million or extra throughout 30 industries, in response to the press launch. The U.S. industrial enterprise grew 33% year-over-year, with a major affect from prospects that began with Palantir in 2023. The U.S. industrial buyer depend rose by 12% QoQ, reaching 10x the depend of simply 3 years in the past.

The corporate highlighted the success of its go-to-market strategy across the AIP (Apollo Intelligence Platform) bootcamps, which made it doable to create actual workflows with actual buyer information in 5 days or much less. This resulted in quicker time-to-value for patrons, IT stakeholder engagement, and a better variety of corporations working with PLTR. By the tip of November, the corporate had carried out boot camps for over 140 organizations, nearly half of them that month alone.

PLTR’s IR supplies

In the course of the Q3 earnings name, Palantir emphasised the huge enhancements in unit economics from preliminary contact to buyer conversion. It helped PLTR to realize a reacceleration in income development, reaching $558 million in Q3, reflecting a 17% YoY enhance and a 5% sequential uptick.

Of explicit word, the U.S. industrial enterprise demonstrated substantial development, increasing by 33% YoY. The corporate is specializing in conquering the well being trade with its new boot camps, breaking my previous assumption of an additional slowdown in gross sales development.

Adjusted gross margin stood at a powerful 82%, excluding stock-based compensation (“SBC”) expense. Furthermore, the adjusted EBIT margin reached 29%, surpassing expectations and marking the 4th consecutive quarter of increasing margins.

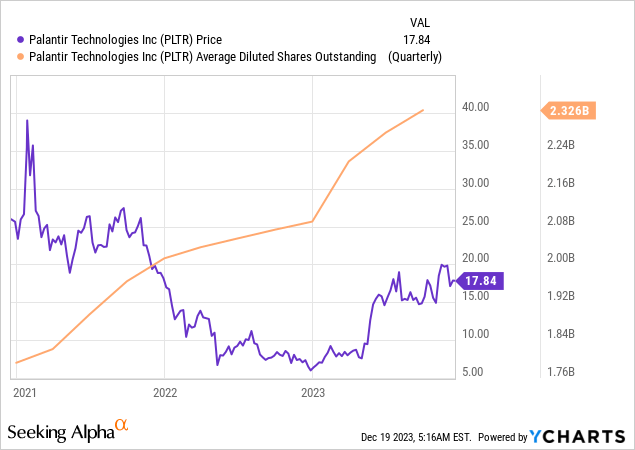

However my previous assumption that PLTR depends on SBC nonetheless holds. Furthermore, PLTR’s shares excellent saved going even increased than I anticipated:

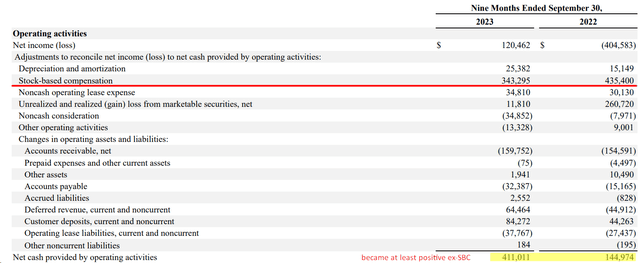

The constructive factor on this entrance is that the corporate has lastly generated constructive money circulation excluding SBC, which isn’t similar to what we noticed final 12 months:

PLTR’s 10-Q, creator’s notes

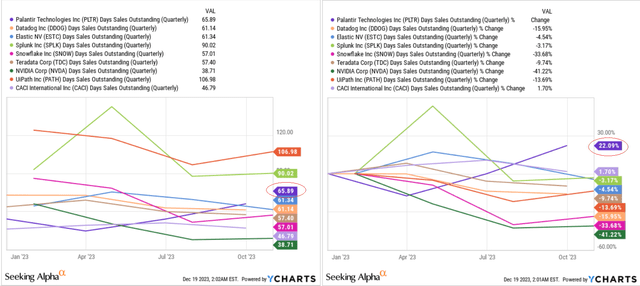

One other concern that lies on the floor is rising DSO, as one other Searching for Alpha analyst, Ironside Analysis, famous in his evaluation earlier this month. And certainly, PLTR’s DSO is rising a lot quicker than what we’re seeing within the trade. In case you do not know, DSO measures the typical variety of days it takes for an organization to gather fee after a sale has been made. So, an growing DSO means that money is tied up in accounts receivable for a extra prolonged interval. However in absolute phrases, the ratio seems to be in step with norms (perhaps barely increased).

YCharts, creator’s notes

As well as, the expansion on this metric could also be associated to the income stream shift that the corporate is at the moment present process, so the web affect of this enhance on future gross sales development stays to be seen, in my opinion.

Wanting on the firm’s financials and plans for scaling operations in healthcare and different areas of their Industrial section, I see that the acceleration of PLTR’s gross sales development could possibly be far more sustainable than I beforehand thought.

However will this development be sufficient to develop out of the present valuation multiples?

Palantir Inventory Is Not As Costly As You Suppose

In the course of the time I have been overlaying PLTR inventory right here on Searching for Alpha, I’ve tried many valuation fashions to worth the inventory: discounted money circulation (“DCF”), absolute and relative valuation multiples, the sum of the elements (“SOTP”) – you identify it. At the moment, I need to present you my subsequent growth primarily based on a mix of COMPS and future monetary information (expectations). I’ve taken a number of corporations which might be related in nature of operations to check with PLTR. I even included Nvidia (NVDA) on this checklist, which isn’t a direct peer to PLTR, however roughly represents the identical sector.

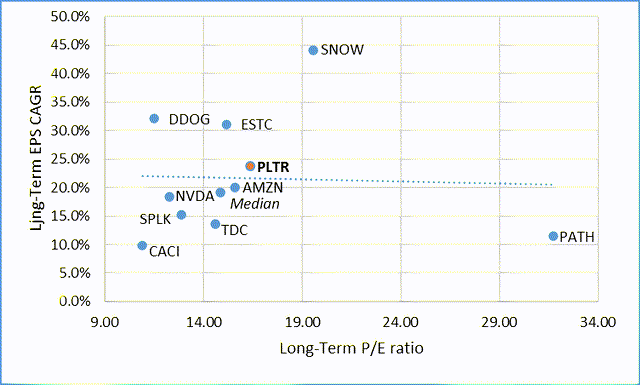

What do I take a look at? To start with, the P/E ratio. Many say that PLTR’s P/E ratio is just too excessive, whereas the bulls say that PLTR is a development firm whose P/E ratio is irrelevant. For my part, each camps ought to meet within the center: When evaluating a development inventory, I suggest wanting on the long-term P/E ratio and long-term EPS development collectively. By long-term EPS development, I imply Wall Road’s projections for the corporate’s earnings in a number of years, and by long-term P/E ratio, I imply the implied valuation a number of (e.g., EPS in FY2030 divided by at this time’s market capitalization).

So, what do we now have on our 2D dot plot?

Creator’s work, Searching for Alpha information

PLTR seems to be a reasonably valued firm with a projected long-term EPS development (7-year CAGR) of 23.7%, which is 456 foundation factors above the median of the pattern. The corporate’s FY2030 price-to-earnings ratio is ~10.3% increased than the median, however this seems to be offset by the EPS development.

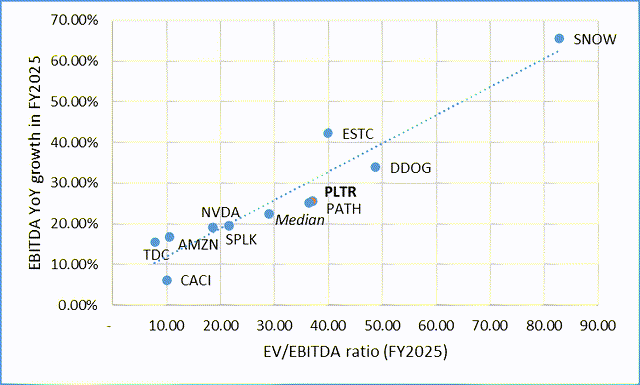

Now let’s take a look at the EV/EBITDA ratio and the expansion of the underlying. Let’s not assume forward to 2030, however cease at 2025. In 2025, PLTR’s EBITDA is anticipated to develop by 25.4% year-on-year (i.e., in comparison with FY2024), leading to an implied EV/EBITDA ratio of 37.08x for FY2025 – that is rather a lot. However that is solely at first look, as a result of in comparison with different corporations within the trade, PLTR’s dot is under the pattern line, fairly near the median worth:

Creator’s work, Searching for Alpha information

Palantir has turned out to be not as costly as I initially thought, however then again, I can’t say that the inventory is reasonable, both.

The actual fact is that PLTR’s EV/EBITDA is ~28% increased than friends’ development, whereas its projected EBITDA development in FY2025 is just 3% increased (25.4% vs. median of twenty-two.4%).

Conclusion

To be sincere, I discover it tough to stay bearish on PLTR inventory at this time. After I take a look at the corporate’s newest monetary outcomes, I notice that they’re fully totally different from what I anticipated a 12 months in the past (and even earlier this 12 months). Palantir Applied sciences Inc.’s enterprise is rising a lot quicker, and it appears that evidently the corporate has discovered one other lever for development by means of its bootcamps and due to its deal with the healthcare trade.

The valuation of the inventory would not appear too excessive if we take a look at PLTR multiples by means of the lens of future EPS development. There are particular points with EBITDA-related multiples, however nonetheless, Palantir appears to be near its truthful worth regardless of the seemingly excessive multiples. Nonetheless, my findings are primarily based solely on comparative evaluation and consensus estimates, that are topic to alter at any time. We can not rule out the likelihood that your complete trade is overvalued at this time – smooth touchdown or not, when the interval of a number of contraction comes, PLTR shall be one of many first to fall. A a number of contraction appears to me to be one of the possible eventualities for subsequent 12 months, however that could be a subject for a full-length macro report.

Based mostly on the above, I am upgrading Palantir Applied sciences Inc. inventory from “Promote” to “Maintain,” which signifies that I am impartial on the inventory till I see a margin of security in it.

Thanks for studying!

[ad_2]

Source link