[ad_1]

Brief Time period Ache (possibly)?

Yesterday’s sell-off in fairness markets coincided with one other weak Treasury bond public sale. That minor catalyst was compounded by the low liquidity of vacation markets.

Friday’s Core PCE inflation numbers ought to put the ultimate nail within the coffin for any Fed Minimize doubters. I doubt you will note any extra officers paraded out (with a straight face) to attempt to stroll again Powell’s dovish pivot after Friday’s print.

There may be good intuition from many market individuals that we’ve come “too far, too quick” – in current weeks – and should now have a correction. They’re in all probability proper – to a level… Right here’s what they’re taking a look at:

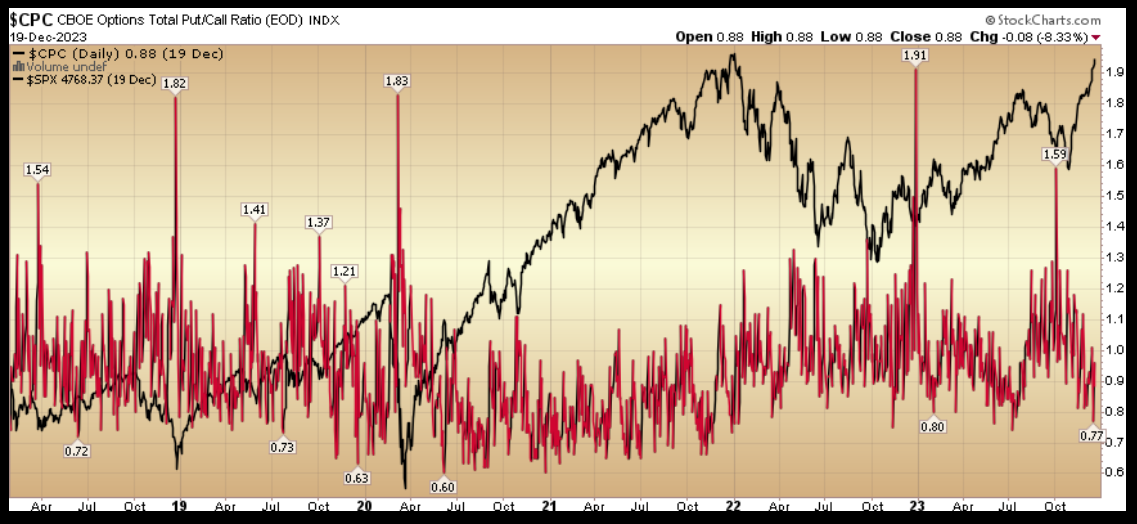

Put/Name Ratio-

All the largest bears who’ve missed the rally for the reason that October 2022 (and Oct 2023) lows at the moment are reluctantly and resistantly turning bullish “opinion follows pattern”

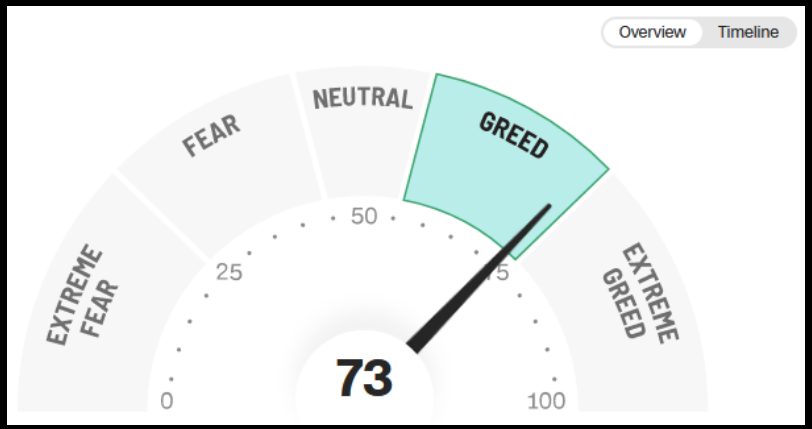

CNN Concern and Greed:

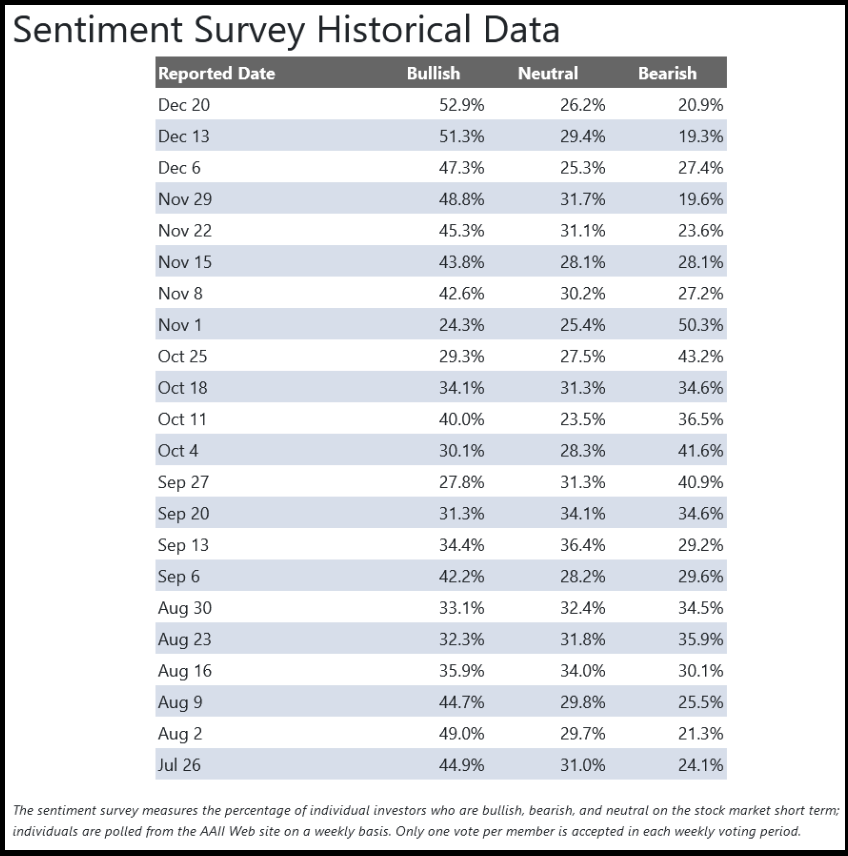

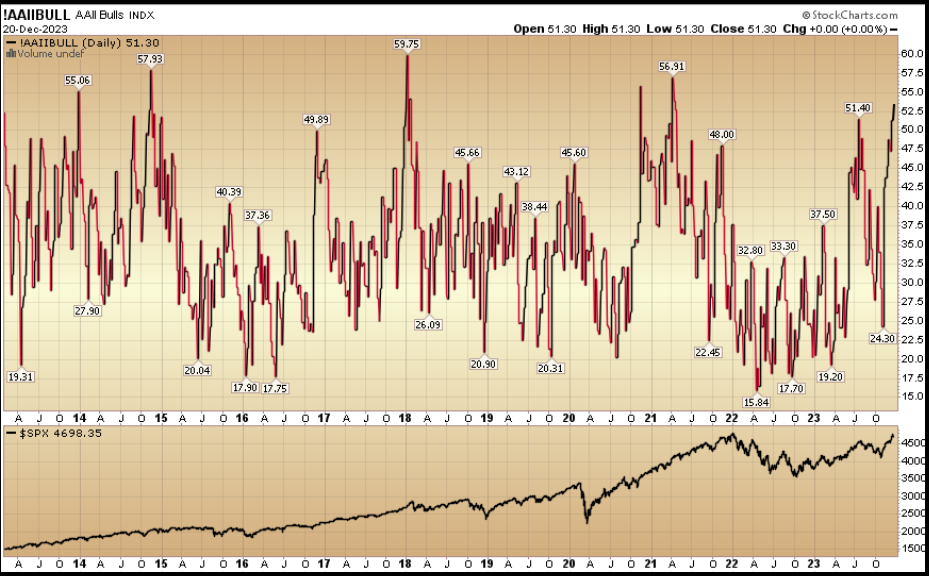

AAII Sentiment Survey Stretched:

Nationwide Affiliation of Energetic Funding Managers Fairness Publicity Index:

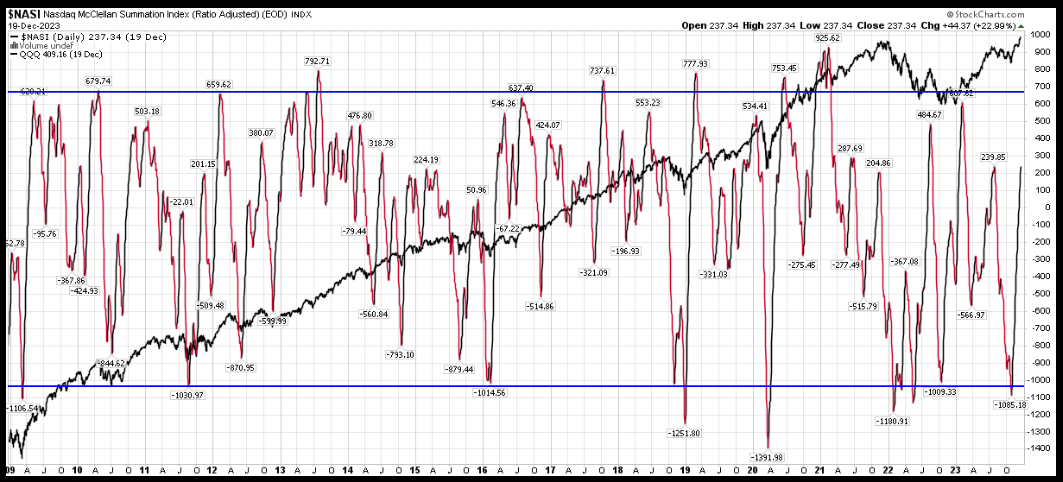

McClellan Summation Index:

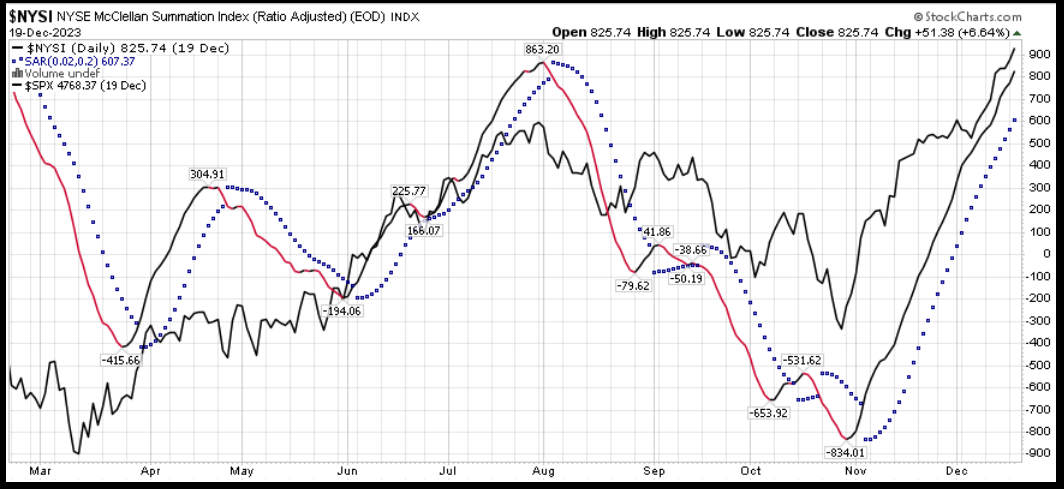

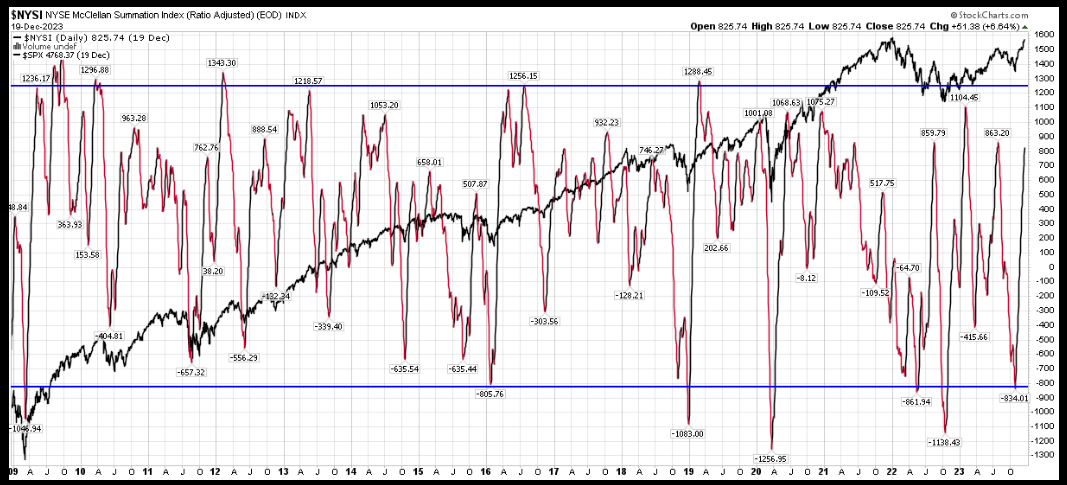

NYSE McClellan Summation Index:

Possibility Skew:

Bullish P.c:

Bullish P.c:

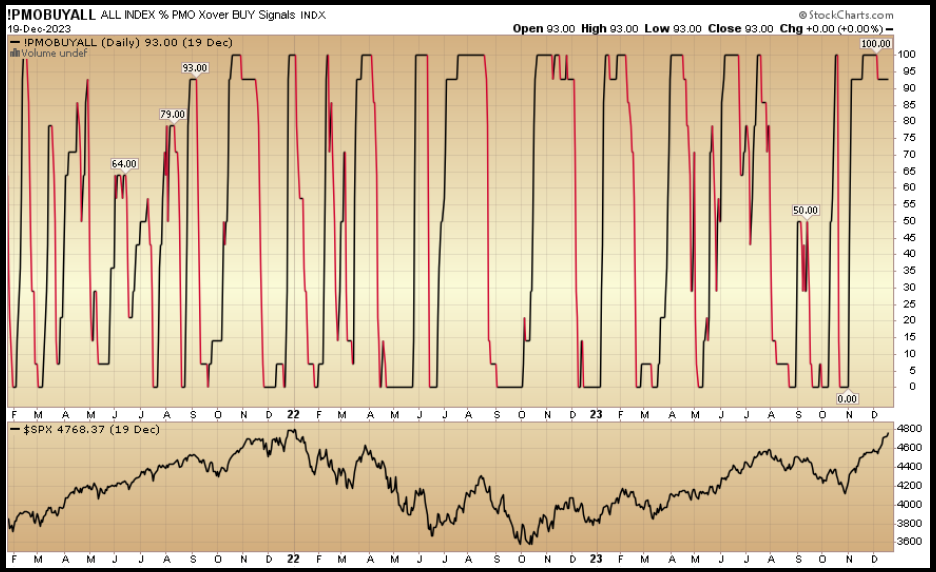

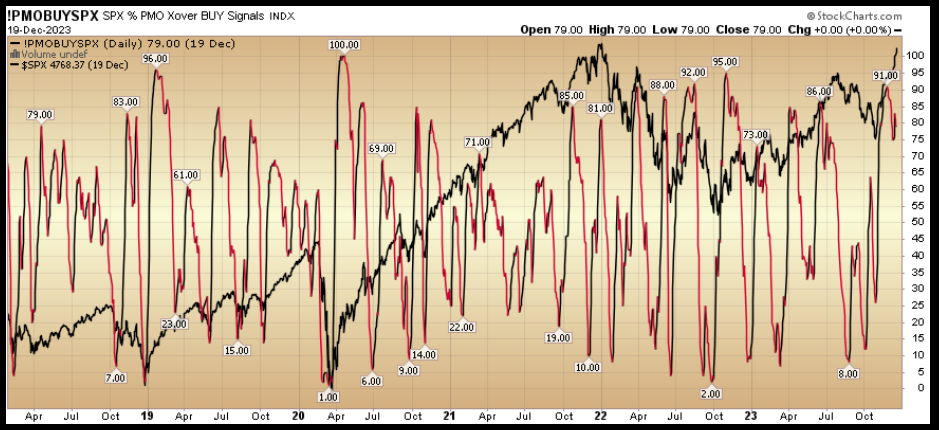

P.c of shares on PMO crossover purchase sign:

P.c of S&P 500 shares on PMO crossover purchase sign:

Or, Lengthy Time period Acquire (our view)?

We’re massive proponents of “zooming out,” and whereas we acknowledge there are features that time to quick time period “overstretched” circumstances, we don’t intend to get too cute with it. Right here’s what WE are taking a look at:

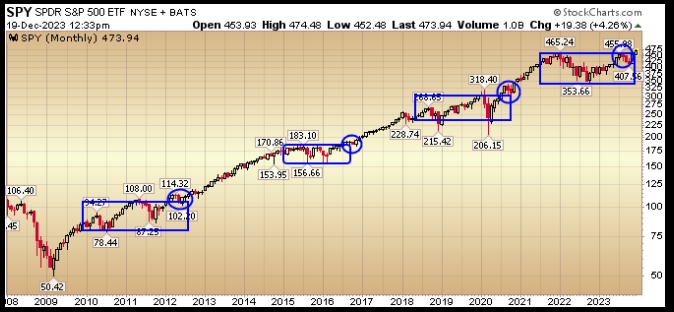

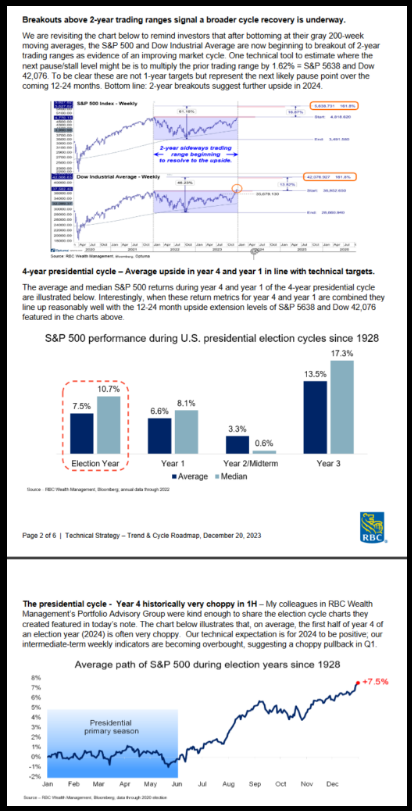

The above chart exhibits the final 14 years of multi-year correction recoveries adopted by ~2 12 months consolidations of good points (blue bins). It seems we’ve got simply completed a 2 12 months consolidation (with ~0% good points for the S&P 500 since 2021) which might be adopted by a number of years of good good points. You can even see on the finish of every consolidation (blue field), you get 2-3 months of a test again earlier than you see the subsequent transfer greater. It seems we acquired our “test again” within the 3 circled crimson months from Aug-Oct. Most individuals are strangled by recency bias (as a result of the final two years have been steady “hope dashing” – resulting in a view that this time can’t be actual and it’s time to “take earnings”).

They might be proper for a number of p.c transfer, however I’d not get too cute attempting to play it. Certain there could also be some revenue taking in Jan (or Feb), however do you actually need to be out of nice firms in the event that they haven’t but reached your predetermined goal of intrinsic worth – simply to avoid wasting you a few tums tablets for brief time period volatility? I don’t. Do you need to surrender 1-3% of your fairness upside in order that your “month-to-month” assertion seems fairly (with low volatility), when it should solely value you compounding within the intermediate to long-term? I don’t.

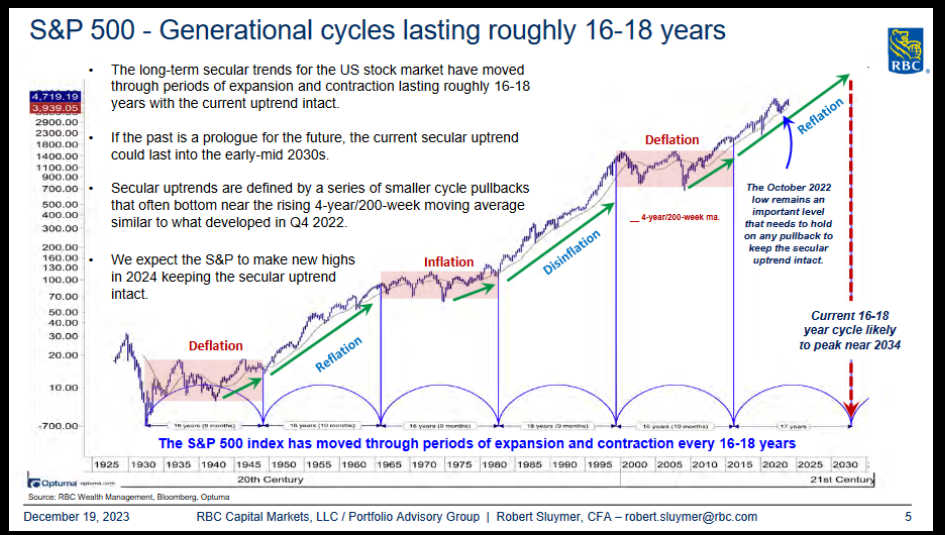

Right here’s the lens we’re wanting by means of and have shared with you since 2020. We consider we’re mid-cycle in a standard secular bull market (18-20 years) that broke out to new highs ~2013:

Robert Sluymer model RBC (TSX:)

That is predicated on the biggest portion of the inhabitants being ~33-34 years outdated (Millennials) and starting housing and household formation. Historical past exhibits this consumption stage persists till they attain their early 40’s after which slows down dramatically. That takes us to the early 2030’s. Previous to then, it stays a “purchase the dips/corrections” surroundings. There might be loads of bumps within the highway however the pattern is up and it will likely be a interval the place fortunes are made because of consumption, innovation and productiveness tailwinds.

Put merely, fortunes might be made and multiplied over the subsequent 6-8 years. If you happen to should not have cash allotted to equities or fairness supervisor you’ll miss out on a uncommon interval in historical past. Perhaps not within the subsequent few days or perhaps weeks (it’s possible you’ll even really feel good lacking a number of p.c of volatility), however over months or years you’ll kick your self. These alternatives present up a pair occasions in a lifetime. If you happen to snooze, ready for the proper “dip” you’ll free. You solely must journey these alternatives appropriately ONCE…

We’ve talked about a number of the particular names in current weeks’ podcast|videocast(s) and our purchasers can see various them of their portfolios.

Excessive Yield Credit score Spreads declining (value/availability of capital):

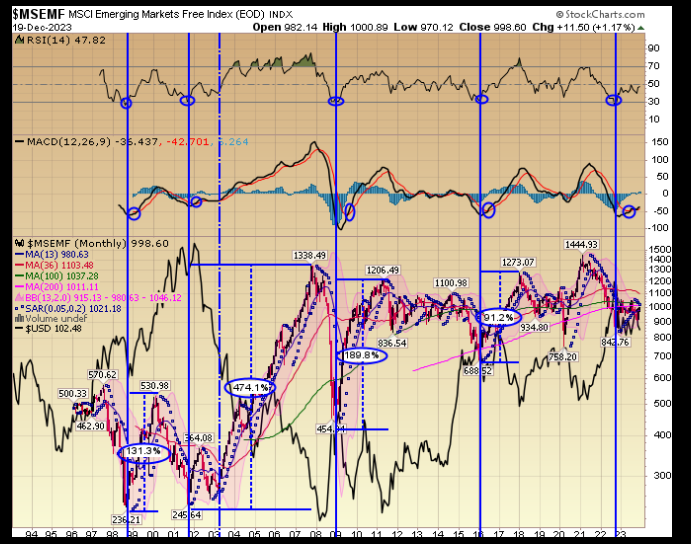

Rising Markets Beginning flip up as Fed steps again and Greenback weakens (a giant focus prospectively):

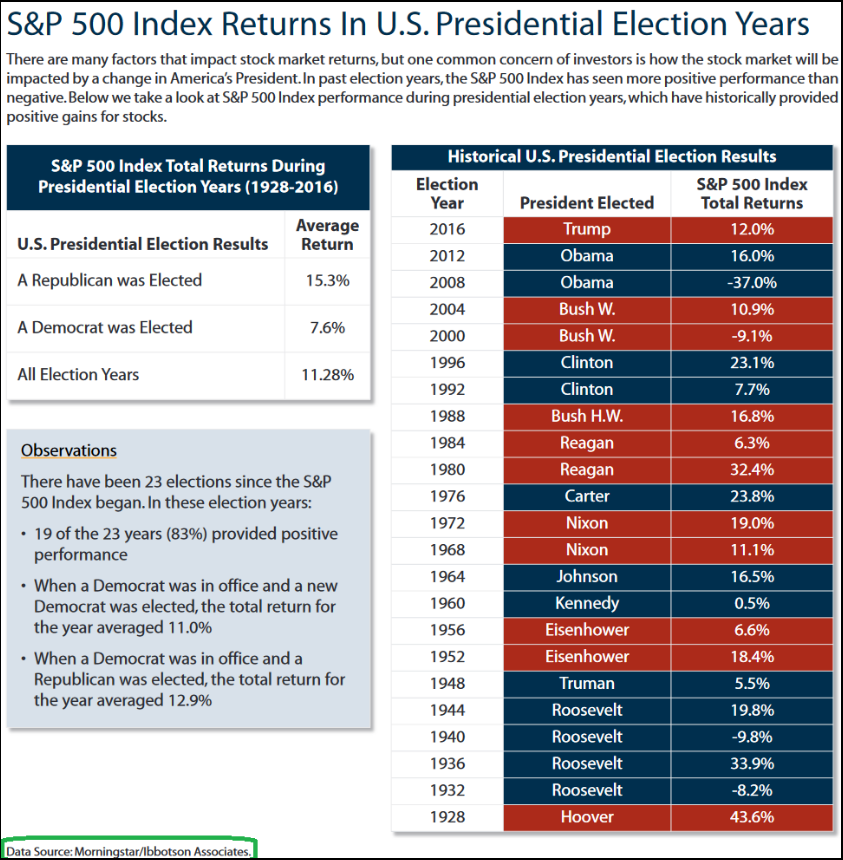

Breakouts and Election Years (Robert Sluymer RBC):

Breakouts and Election Years

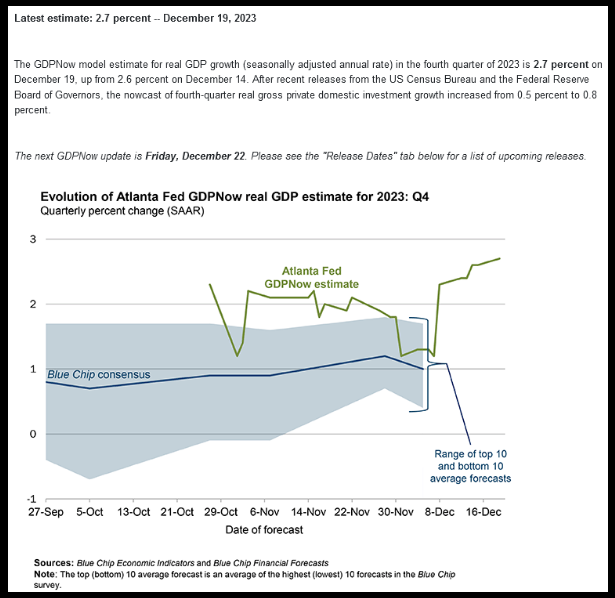

GDP continues to pattern UP:

Evolution of Atlanta Fed GDPNow actual GDP estimate for 2023: This fall

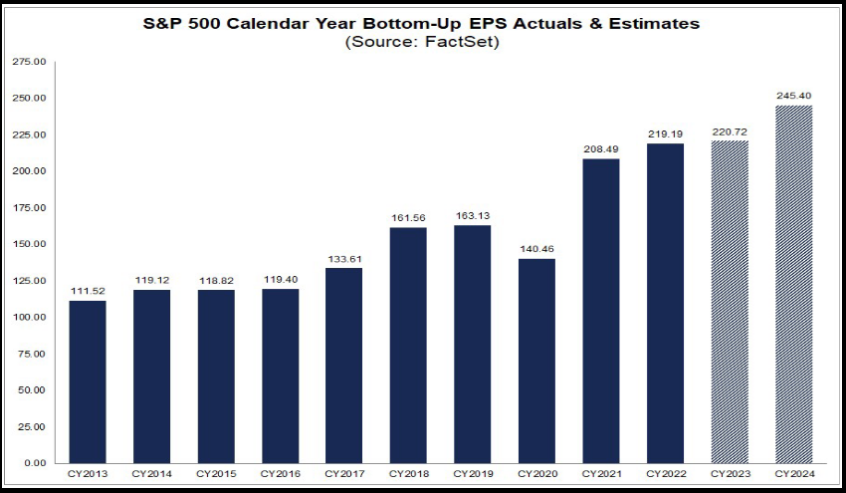

Earnings development (and margins) re-accelerate(s) in 2024:

Quantitative stats. Like 2020 (and 2009) once you get a violent transfer off the lows – individuals at all times anticipate a leg down as a result of they both missed the transfer or are fooled by recency bias:

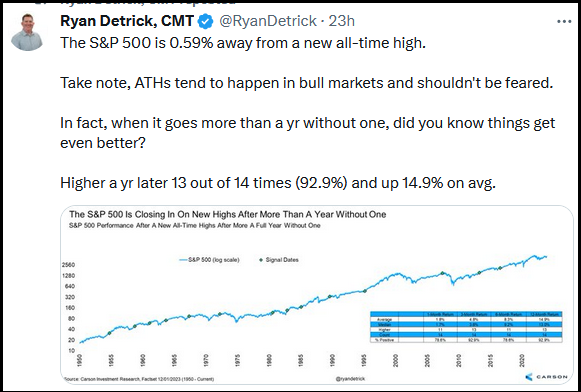

The S&P 500 is Closing in on New Highs After Greater than a 12 months

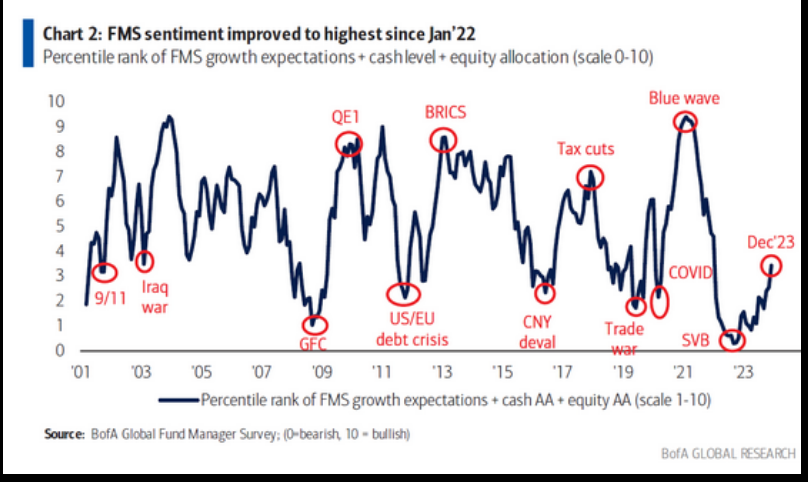

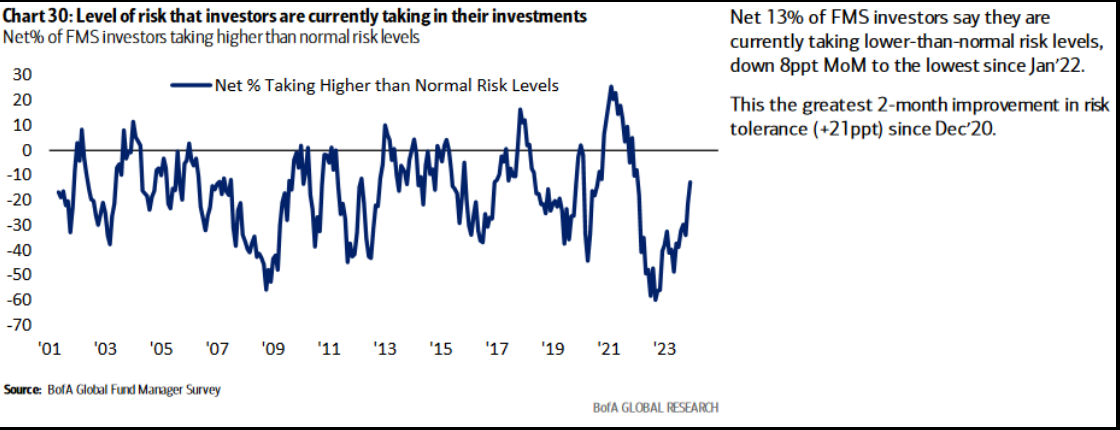

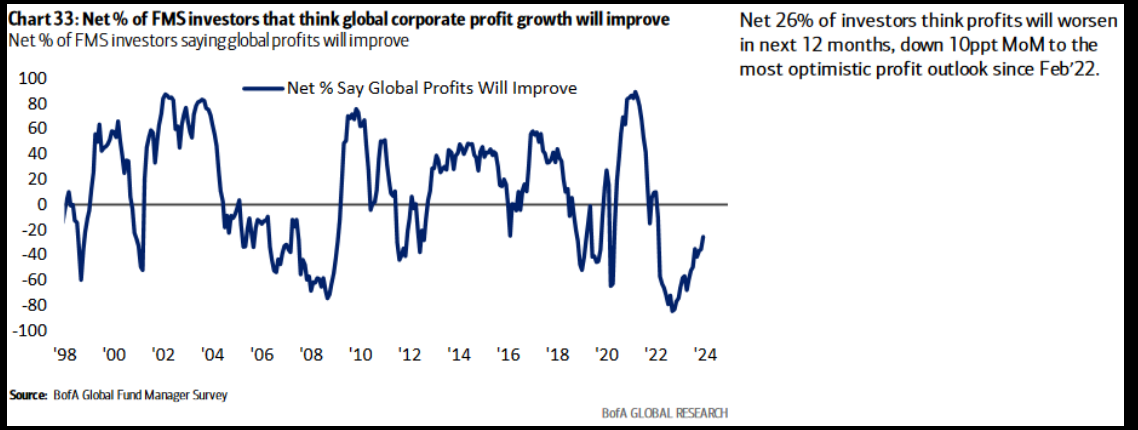

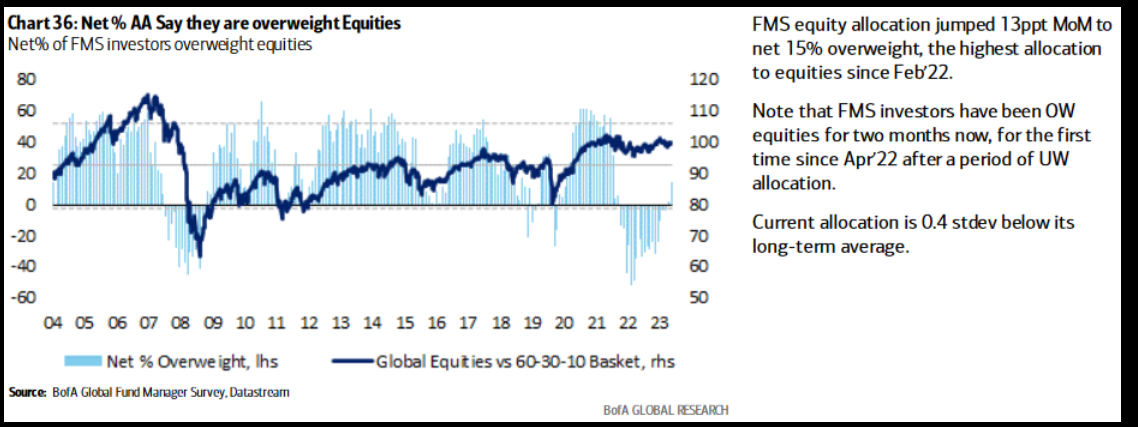

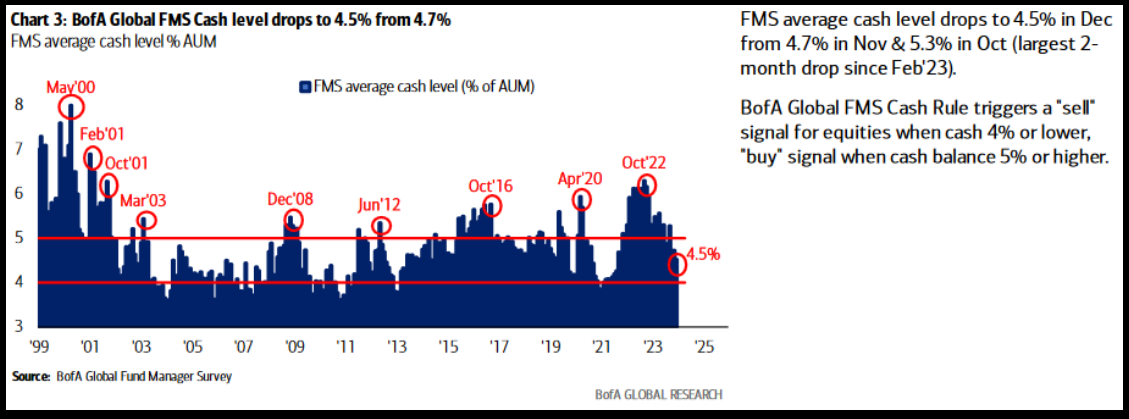

Institutional Positioning, Sentiment and Outlook JUST GETTING OFF THE MAT (full abstract for Financial institution of America (NYSE:) Survey HERE):

This content material was initially revealed on Hedgefundtips.com.

[ad_2]

Source link