[ad_1]

And now it’s time to provide some credit score the place it’s due… what had been probably the most profitable teaser picks of 2023?

Every year, we spend a couple of minutes highlighting the worst concept from the funding publication world once we title our “Turkey of the Yr” at Thanksgiving… however because the yr involves an finish, we additionally need to pin down the perfect concepts of the previous yr, and perhaps assume a little bit bit about what made them the perfect performers.

It was an significantly better yr than 2022, for positive, final yr was all about oil and fuel costs spiking following the invasion of Ukraine, and concerning the comedown from the wild COVID bubble in little progress shares and SPACs that popped across the time the calendar turned from 2021 to 2022. In 2022, typically surviving was sufficient to make you seem like a winner.

The runaway winner a yr in the past was the Argentine oil firm YPF (YPF), teased proper when oil costs had been going bonkers with the Russian invasion of Ukraine — I assumed that was a “it’s so low-cost that it might go loopy” inventory, but additionally one which merited some warning as a result of it had been so low-cost for therefore lengthy, and for good causes (it’s Argentina, and the corporate is majority managed by the state, so the nice causes had been principally “the federal government”). And that efficiency has continued within the wake of Argentina’s stunning election, so the inventory has doubled once more because it topped the record a yr in the past…. and by any typical metric you need to use, it’s nonetheless low-cost. And nonetheless dangerous, for just about the identical causes that had been clear in 2022.

Who’s on prime of the pile this time round?

All of this knowledge comes from our Teaser Monitoring spreadsheets, which anybody can view, and we pulled the info on December 21 and ranked them by relative efficiency vs. the S&P 500 (so that you don’t win simply by being fortunate and hitting the underside of the broad market)… and our commonplace caveats apply: We don’t subscribe to those newsletters, that is based mostly on the Thinkolator outcomes for all of the teasers we’ve investigated all year long (traditionally, the Thinkolator is correct 99% of the time… however 99% and 100% are very completely different numbers). We additionally don’t know what an editor may need carried out with a inventory after teasing it, whether or not they purchased or offered since or mentioned one thing completely different to their precise subscribers, we’re left to imagine they purchased it on the day they had been teasing it and held it perpetually.

It’s additionally attainable that by the tip of the yr on Friday, the rankings will probably be barely completely different… however listed here are the highest twenty teaser shares of the previous yr (the date hyperlinks to the unique teaser resolution article):

(And sure, as we do with the Turkey of the Yr, we return a bit to be sure that we give a inventory time to percolate… so any nice picks made within the closing months of 2022 had been eligible for the record, as nicely, we actually return 14 months or so to attempt to keep away from disadvantaging picks that occur be made within the Fall every year).

What stands out as attention-grabbing from this record?

There are a number of repeats — each Shopify (SHOP) and NVIDIA (NVDA) make the highest twenty three completely different instances, each had been teased by Andy Snyder at Manward and Whitney Tilson on the (now defunct) Empire Monetary, and each of them teased NVDA and SHOP in the identical multi-stock pitches (Snyder was teasing them as “Metaverse” performs, only a couple months earlier than the AI enthusiasm actually took off — Tilson as “Every thing On Demand” picks in January after which “A.I.” picks in April, round that theme began to essentially warmth up). And in a repeat from final yr, Rolls-Royce is once more on the record — that pitch has been round for a very long time, Karim Rahemtulla has been operating comparable adverts since March of 2022 (and the inventory has now gone up fairly a bit since then).

And down close to the underside of the record we see one oil inventory that was picked by two completely different pundits, too, and made the record principally because of a takeover — Earthstone Vitality (then ESTE) was acquired by Permian Sources (PR), and PR has held up fairly nicely previously few months, so these are nonetheless beating the market regardless of a tricky yr for oil shares. And we must always in all probability set off some fireworks or one thing, as a result of that is the uncommon instance of a predicted takeover provide really coming by means of — Garrett Baldwin teased 5 completely different oil shares again in Might as takeover targets within the Permian Basin, and considered one of them really was acquired, and at a value above the place it was teased. And humorous sufficient, he additionally teased Permian Sources as a takeover goal in that very same advert, and that did fairly nicely, too — solely a type of 5 oil shares is trailing the S&P 500 since Might, in order that’s fairly spectacular. The opposite pundit to choose Earthstone was Marc Lichtenfeld, at across the identical time, although he did in order a part of a “commodities supercycle” pitch that teased some metals shares which have carried out poorly, so the 4 shares common out to nearly even proper now (Intrepid Potash (IPI) can also be up fairly properly, however Talon Metals (TLOFF) and DRDGold (DRD) drag down the outcomes).

The far and away winner was a biotech inventory, which has occurred a couple of instances — typically these shares are nearly like lottery tickets when buyers are shocked by a giant FDA approval or a profitable medical trial, and Alexander Inexperienced known as a winner in Immunogen (IMGN) again in April, and that 600%+ achieve stands head and shoulders above all the pieces else. (As luck would have it top-of-the-line picks was featured in considered one of my shortest articles… who knew?) That’s the one inventory that saved NVIDIA from being the highest teaser inventory of the yr.

And synthetic intelligence (A.I.) was clearly a giant driver of many of those shares — it wasn’t Luke Lango’s major motive for pitching IonQ (IONQ) the primary time he teased that as an “Space 52” inventory, again in March… however later within the yr, IONQ undoubtedly obtained the “quantum computing will allow the following leap ahead for A.I. remedy, from Lango and others, and the inventory delighted within the consideration.

It wasn’t simply market darling NVIDIA and IonQ, although, A.I. was in all probability a major driver of a lot of the tech shares that obtained a carry this yr… and it was actually behind the surge we noticed from Palantir (PLTR), which Dylan Jovine touted for it’s “Residing Software program” and function in Ukraine, for the briefly-adored penny inventory VERSES AI (VRSSF) pitched by Alex Reid (and in addition by Tobin Smith earlier within the yr, at a value a lot larger it nearly certified for the Turkey of the Yr award final month).

And A.I. was additionally the theme for the tease of drug discovery inventory Absci (ABSI), which has been relentlessly pitched by Alexander Inexperienced… and it’s partly luck that considered one of his teases hit our inbox when the inventory was round $1.60 again in September and October, in order that has proven a superb achieve with the inventory spiking larger within the newest rally (he additionally teased it at over $2.50 a yr in the past as his “#1 Inventory for 2023”, the most recent variation of these advert displays calls it his “#1 Funding for 2024,” so he’s apparently nonetheless on board, although the adverts have by no means gotten up to date a lot and it’s been known as a “$3 inventory” all yr). ABSI was a part of a five-stock microcap pitch from Alex Inexperienced again in December of 2022, I ought to be aware for some context, and the opposite 4 — Farfetch (FTCH), Amyris (AMRS), Zevia (ZVIA) and Wheels Up (UP) — have all carried out terribly… such is life with microcaps, I suppose.

And with extra speculative stuff like warrants — Nomi Prins has taken the reins of what was the Casey publication which focuses on warrants, and has pitched a bunch of various warrant investments over the previous couple years… considered one of them ended up “profitable” the Turkey of the Yr this yr, that was Lion Electrical (LEV/WS), however one other can also be on this top-20 record in BigBear.ai (BBAI/WS) — the inventory is basically unchanged since she touted it in late August, however, helped by an enormous spike after she advisable it, the warrants are nonetheless up fairly properly (from about 25 cents to the 42-cent vary for the time being). Nonetheless strikes me as foolish leverage for a inventory that must go up 500% or extra earlier than the warrants come into play, and her pitch was awfully deceptive in calling this warrant a “26-cent microcap AI inventory”, however math is math, and it’s on the record.

There are a couple of oddballs within the record that weren’t simply using together with the AI craze, too — Porter Stansberry made me grouchy together with his pitch of Dream Finders Properties (DFH) again within the Spring, and it has labored out exceptionally nicely… and the Motley Idiot’s microcap Canadian lending tech firm Propel hits the record as nicely, type of a North-of-the-border model of Upstart Holdings (UPST), I suppose, so in fact that’s yet one more choose that’s AI-fueled. That can also be the latest winner on this record, it was teased about six weeks in the past… but it surely was additionally a part of a multi-stock AI pitch for Motley Idiot Canada, which included Docebo (DCBO) and Alphabet (GOOG, GOOGL), and people two bigger corporations have just about simply tracked the S&P 500 throughout that point interval.

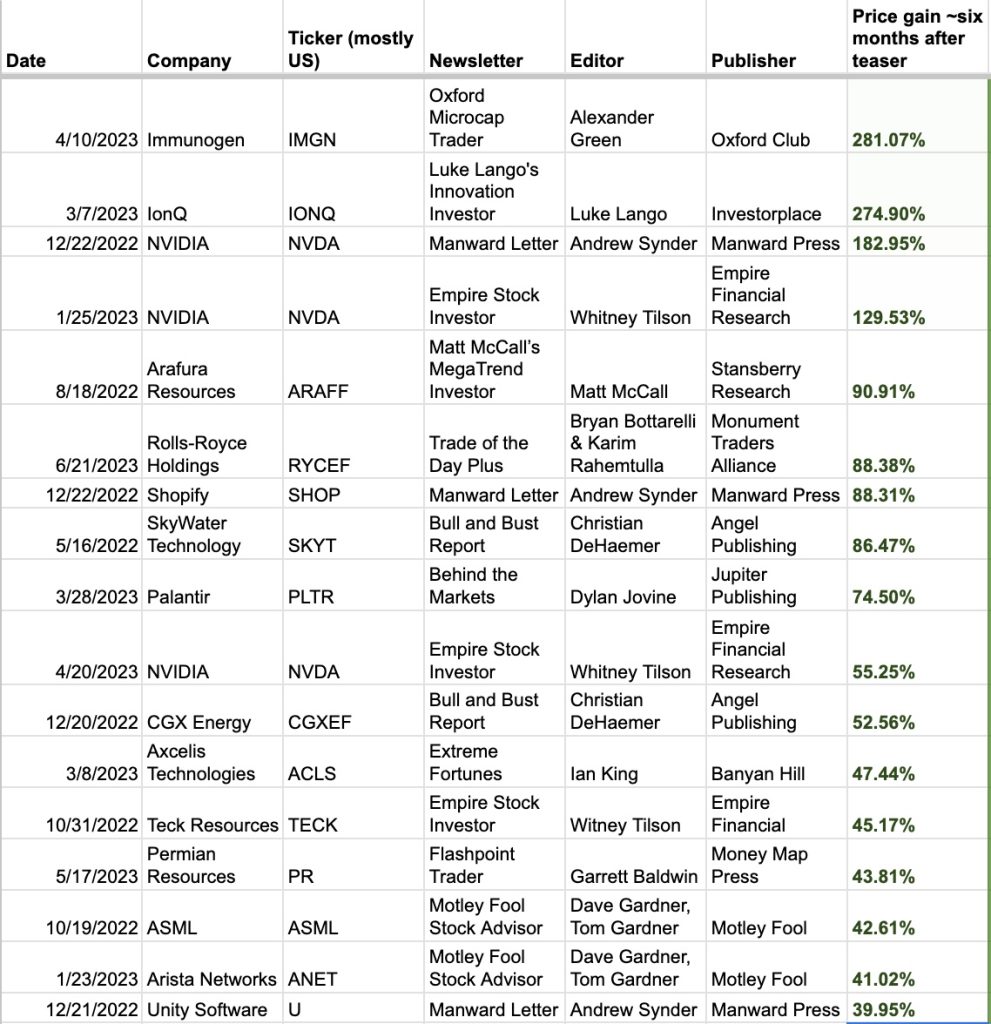

What’s the influence of the calendar on these picks? Properly, we do additionally monitor these shares 10 days, one month, six months and one yr after they had been teased… so if we need to be a bit extra scientific, and return additional (I don’t normally do that, however I’ve obtained spreadsheets on the mind), then the highest picks six months from their advice/teaser date over the previous yr and a half or so, would give us a considerably completely different record. Right here’s what the highest of that “six-months after it was picked” record would seems like, you possibly can see that a couple of picks soared properly, principally due to a quick-moving development, however didn’t keep among the many leaders lengthy sufficient to make our record — like SkyWater (SKYT) when uranium shares had been hovering, or CGX Vitality (CGXEF) earlier than Venezuela began speaking about taking up Guyana and its offshore oil fields:

Not so say six months is the appropriate timeframe — we additionally monitor these shares over shorter and longer durations, out to a few years… I gained’t overwhelm you with but extra lists, however you possibly can dig into these teaser monitoring sheets from the previous 16 years and see what you discover. Tell us if there are any surprises (together with unhealthy ones — a number of the knowledge is likely to be off if we missed a inventory cut up or a chapter from some many-moons-ago picks).

And eventually, expensive buddies, we all the time need to take into consideration the large image — did the funding publication teaser pitches assist or damage in the course of the previous yr, on common?

Teaser shares are nearly all the time beneath common, as a gaggle — should you purchased each inventory on the day it was teased, you’d have carried out worse than should you had purchased the S&P 500 on these days — however typically it’s fairly shut. Sometimes, over the previous 15 years, we’ve seen that lower than a 3rd of the teased shares beat the market, greater than half do worse than the market, and there’s a giant chunk within the center that’s fairly shut.

This yr? Properly, the pundits all mentioned it was a superb yr for stock-pickers — and it actually was! The common teased inventory went up about 8.3%, and should you had as a substitute purchased the S&P 500 on those self same days your return would have averaged 10.6%… so the teaser shares solely did about 2.3 share factors worse than the proverbial “monkeys throwing darts,” which is healthier than we’ve usually seen.

We’ve coated 218 teaser picks to date in 2023, and 100 of them are beating the S&P 500… which is fairly good, and higher but, 50 of them are outperforming the S&P 500 by greater than 10%, and 27 of them by greater than 25%. About half a dozen shares have doubled this yr out of 218, which can also be greater than standard… even when it’s a little bit miserable that there are solely six “doubles”, since that tends to be the minimal form of positive aspects these publication teaser adverts promise. Solely about forty of those teaser picks have misplaced greater than a 3rd of their worth, relative to the S&P 500, and — drum roll please — NONE have gone bankrupt! We regularly have one or two 100% losses from a chapter or fraud of some variety, however not this yr. But, at the very least. (It’s possible that the Farfetch (FTCH) shares picked final December by Alex Inexperienced will in all probability go to zero, because the working enterprise is offered to Coupang and the press launch says that “Upon consummation of the Sale, Farfetch Restricted expects that holders of its Class A and B extraordinary shares and its convertible notes won’t get better any of their excellent investments in Farfetch. Farfetch Restricted can also be anticipated to be delisted from the NYSE and to be liquidated”…. but it surely’s the season of miracles, and that hasn’t occurred but).

Whew. What a yr.

Benefit from the break, everybody, Inventory Gumshoe will probably be closed till January 2, and we want you a really completely satisfied week and a Completely satisfied New Yr. Thanks for becoming a member of us on these adventures in teaser-revealing and teaser-tracking as we attempt to assist buyers assume for themselves, and please be happy to chime in beneath should you assume any of the perfect pundit picks of the previous yr deserve some extra consideration — or should you assume we missed someone.

Disclosure: Of the businesses talked about above, I personal shares of and/or choices on Alphabet, NVIDIA, Shopify, Unity Software program, Dream Finders Properties,

[ad_2]

Source link