[ad_1]

Michail_Petrov-96

Technique

PIMCO Intermediate Municipal Bond Lively Change-Traded Fund ETF (NYSEARCA:MUNI) is an actively managed municipal bond fund launched on 11/30/2009. It has 441 holdings, a trailing 12-month distribution yield of two.80%, an estimated yield to maturity of three.68% and an expense ratio of 0.35%. Distributions are paid month-to-month.

As described within the prospectus by PIMCO, the fund’s aims are present earnings and long-term capital appreciation. It seeks…

to take care of a reasonably constant degree of dividend earnings, topic to market circumstances, by investing in a broad array of fastened earnings sectors and using earnings environment friendly implementation methods. Lengthy-term capital appreciation sought by the Fund typically arises from decreases in rates of interest or bettering credit score fundamentals for a selected sector or safety (…) PIMCO will make the most of a backside up strategy to hunt to determine asset lessons and securities which are undervalued.

The fund invests primarily in funding grade bonds, however can also spend money on:

Spinoff devices, akin to choices, futures, swaps, mortgage- or asset-backed securities. Excessive yield securities (“junk bonds”), as much as 30% of belongings. Securities denominated in foreign exchange, as much as 15%. Devices tied to rising nations, as much as 15%. Most popular and convertible securities, as much as 10%.

In the newest fiscal yr, the portfolio turnover charge was 352%, which may be very excessive. On this article, I’ll take as a benchmark the biggest municipal bond ETF: iShares Nationwide Muni Bond ETF (MUB).

Portfolio

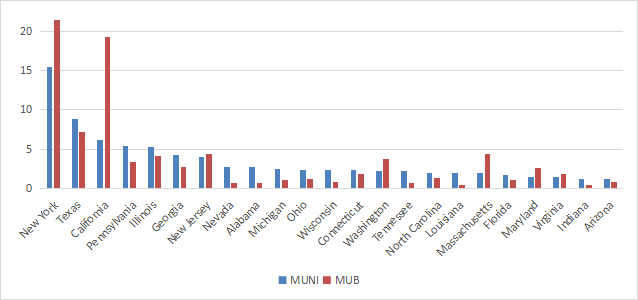

The subsequent chart lists the states the place MUNI has greater than 1% of belongings. They symbolize an mixture weight of 82%, and 87% for MUB. In comparison with the benchmark, MUNI underweights New York, California, and is extra diversified geographically.

Geographical allocation in % of belongings (Chart: creator; knowledge: PIMCO, iShares)

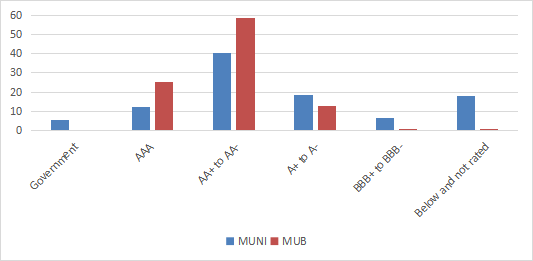

MUNI has 17.87% of belongings invested in securities under funding grade (rated under BBB- or not rated), whereas MUB has lower than 0.1% on this class.

Credit standing profile in % of belongings (Chart: creator; knowledge: PIMCO, iShares)

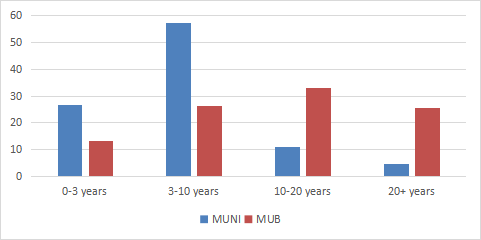

About 84% of the fund’s belongings has a maturity of 10 years or much less, vs. 39% for MUB.

Maturity profile in % of belongings (Chart: creator; knowledge: PIMCO, iShares)

Efficiency

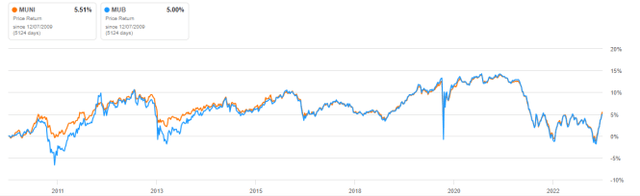

Since its inception in November 2009, MUNI has underperformed MUB by 34 bps in annualized return (together with distributions). Nevertheless, it exhibits a touch higher risk-adjusted efficiency (Sharpe ratio within the subsequent desk) due to a decrease volatility

Complete Return

Annual Return

Drawdown

Sharpe ratio

Volatility

MUNI

44.71%

2.66%

-11.15%

0.42

3.97%

MUB

51.54%

3.00%

-13.68%

0.4

5.05%

Click on to enlarge

For each funds, the capital appreciation has been about 5% in 14 years, as reported by the chart under (worth return, excluding distributions). In the identical time, the cumulative inflation has been about 42%, primarily based on CPI. This represents a big loss in inflation-adjusted worth for shareholders.

MUNI vs. MUB, worth return since MUNI inception (In search of Alpha)

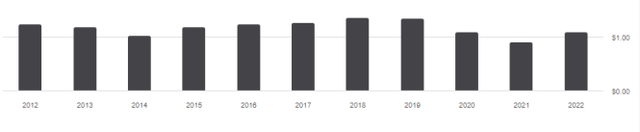

The annual sum of distributions has gone barely down within the final 10 years, from $1.23 to $1.10 per share (-10.6%). As soon as once more, this represents a big lack of earnings stream for shareholders relative to a cumulative inflation about 29%.

MUNI distribution historical past (In search of Alpha)

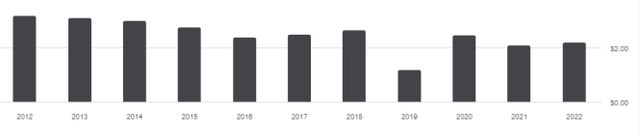

It’s even worse for MUB, which has suffered a lower in distributions of 30.3% (from $3.20 to $2.23 per share).

MUB distribution historical past (In search of Alpha)

MUNI vs rivals

The subsequent desk compares traits of MUNI, MUB, and 4 of the preferred Muni bond ETFs:

Vanguard Tax-Exempt Bond ETF (VTEB) iShares Brief-Time period Nationwide Muni Bond ETF (SUB) SPDR Nuveen Bloomberg Municipal Bond ETF (TFI) First Belief Managed Municipal ETF (FMB).

MUNI

MUB

VTEB

SUB

TFI

FMB

Inception

11/30/2009

9/7/2007

8/21/2015

11/5/2008

9/11/2007

5/13/2014

Expense Ratio

0.35%

0.05%

0.05%

0.07%

0.23%

0.65%

AUM

$1.36B

$38.08B

$33.41B

$9.09B

$3.79B

$1.94B

Avg Each day Quantity

$15.34M

$663.78M

$468.71M

$74.91M

$61.33M

$14.95M

Yield TTM

2.80%

2.65%

2.80%

1.73%

2.41%

2.99%

Click on to enlarge

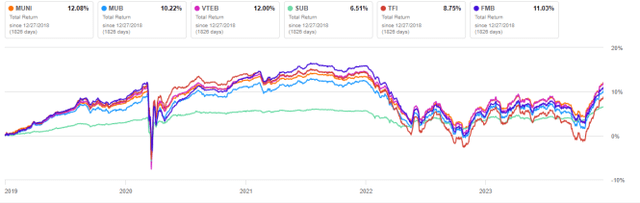

MUNI is the smallest fund on this group concerning belongings underneath administration, or AUM. It has the second most costly charge behind one other actively managed fund: FMB. Within the final 5 years, MUNI has been the perfect performer by a brief margin:

MUNI vs. Rivals, 5-year whole return (In search of Alpha)

Takeaway

PIMCO Intermediate Municipal Bond Lively Change-Traded Fund ETF is an actively managed fund in municipal bonds with a versatile technique and a excessive turnover. In comparison with iShares Nationwide Muni Bond ETF, it exhibits a better threat in credit standing, however a decrease threat concerning maturity. The technique has resulted in a barely decrease historic volatility since inception and a greater preservation of distributions within the final 10 years. Regardless of a excessive expense ratio, it has been among the many greatest performers in its fund class within the final 5 years. Nonetheless, losses in inflation-adjusted worth and earnings stream do not make MUNI actually engaging as a long-term funding. The Muni bond asset class is extra helpful as a element of a tactical allocation technique switching between bond classes, however on this case a extra liquid ETF like MUB is preferable.

[ad_2]

Source link