[ad_1]

Leonhard Simon

NIO (NYSE:NIO) has underperformed towards the broader market since late September when my newest article on the corporate was revealed, and I do not see any main catalysts that might assist the corporate enhance its operations and assist the inventory to aggressively admire in the long term. On the similar time, there are causes to consider that NIO will proceed to underperform and burn money since there isn’t any indication that the enterprise would be capable to thrive within the present aggressive surroundings within the EV business.

Main Challenges Forward

Earlier this month, NIO reported its Q3 earnings outcomes, which confirmed that its revenues elevated by 46.6% Y/Y to $2.61 billion, however have been under the estimates by $50 million. On the similar time, whereas the corporate expects to ship between 47,000 to 49,000 autos in This fall, which might lead to ~150,000 deliveries in FY23, it will not meet the preliminary goal of delivering 250,000 autos that was introduced earlier this yr.

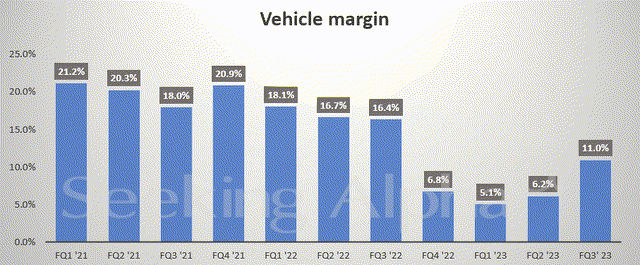

One other main subject that must be talked about is that NIO is probably going going to stay unprofitable within the following years as a result of ongoing worth conflict inside the EV business that has been suppressing the margins. In Q3, NIO’s car margin was 11%, up Q/Q, however down from 16.4% a yr in the past.

NIO’s Automobile Margin (Searching for Alpha)

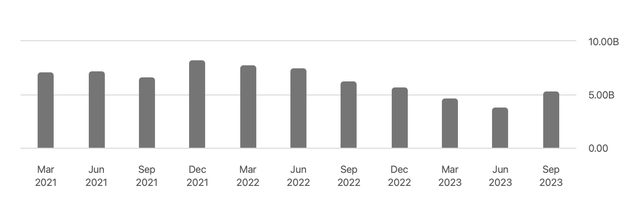

The decline in margins has already resulted in an unsustainable money burn charge for NIO. The corporate continues to burn over half a billion {dollars} every quarter and the one purpose why it managed to keep away from a liquidity disaster is as a result of pricing of a secondary providing under the market costs on the expense of present shareholders. The rise in money reserves in Q3 has come not from operations however from the extra injection of liquidity because of the secondary providing, which I’ve talked about in my newest article on the corporate.

NIO’s Money Reserves (Searching for Alpha)

What’s extra is that yesterday, NIO closed a $2.2 billion strategic fairness funding from the Abu Dhabi-based fund CYVN Holdings. Below the deal, NIO has issued near 300,000 new peculiar shares on the worth of $7.50 per share, which is under the present market worth, to CYVN which now has a ~20% stake within the firm.

Whereas the extra liquidity would definitely prolong NIO’s lifeline and provides its administration extra time to determine learn how to develop into worthwhile, the injection of liquidity additionally comes at a serious value to peculiar shareholders. NIO’s share depend has been regularly rising every quarter on account of such secondary choices and on the finish of Q3, its share depend stood at 1.74 billion, up by ~5% Q/Q. Such offers under the market costs are diluting peculiar shareholders and making their investments within the firm much less engaging as a result of rising share depend.

One other factor that must be talked about is that there isn’t any assure that the injection of extra funds will assist the corporate develop into worthwhile and even drastically enhance car margins anytime quickly. In any case, regardless of pricing secondary choices and diluting its present shareholders up to now, NIO didn’t drastically enhance its operations and keep away from elevating new funds. What’s extra is that regardless of delivering ~122,000 autos in 2022, its market share in China accounted for lower than 1%. With ~150,000 deliveries anticipated this yr, it is laborious to see how NIO would be capable to drastically enhance its efficiency and mitigate the draw back brought on by the continuing worth conflict inside the EV business.

Contemplating all of this, it will be protected to say that NIO’s upside is at the moment restricted. Most of its margins are destructive, it has obtained dozens of draw back revisions in current months, and its shares commerce at over 2 occasions the corporate’s gross sales with no indicators of profitability in sight. With such knowledge, it is nearly unimaginable to make a correct valuation mannequin to determine what’s the firm’s truthful worth within the present surroundings. Regardless that the road expects NIO to develop into worthwhile someplace in 2026, there isn’t any assure that that is going to be the case, particularly if the value conflict inside the EV business will not be over by that point. What’s extra is that on the present money burn charge, it is most probably that the corporate can be required to lift extra cash and dilute its shareholders much more, even though it not too long ago obtained extra liquidity.

Geopolitical Dangers To Think about

What’s additionally necessary to grasp is that NIO has been actively in search of methods to develop its presence in different markets so as to mitigate the draw back brought on by the value conflict and the weaker development of the Chinese language financial system. Nonetheless, in contrast to Tesla (TSLA), NIO expands at a time when globalization slowly unraveling, and it turns into a lot tougher to get entry to different markets. Whereas NIO nonetheless targets a launch in the US sooner or later, the worsening of Sino-American relations and the implementation of protectionism insurance policies are more likely to forestall it from efficiently increasing its presence within the American continent anytime quickly.

What’s extra, is that it appears that evidently NIO may even be unable to shortly develop its presence in Europe as properly. The corporate is at the moment promoting lower than 1000 autos per quarter in Europe and the potential commerce conflict between China and the European Union might undermine any development efforts of NIO within the outdated continent.

Is There Any Upside Left?

There’s one factor that might undermine my bearish thesis, and that is the aggressive ramp-up of deliveries that might develop NIO’s market share inside the Chinese language EV business. By shifting to the OEM mannequin, NIO might exceed the car supply expectations for subsequent yr and make shareholders put money into the corporate’s development story, which might preserve the momentum going for longer and push the shares larger within the close to time period.

Whereas the potential ramp-up of deliveries is unlikely to enhance the corporate’s bottom-line efficiency as a result of suppression of margins brought on by exterior components, it might however enhance the general sentiment and make the basics much less related for some time. Aside from that, it is laborious to see any positives of investing in NIO for the long term till the money burn subject is mounted.

The Backside Line

Whereas NIO’s shares gained momentum on account of discovering a technical help degree and having a profitable automobile occasion, they possible will not be capable to considerably admire in the long term as a result of fixed dilution and an unsustainable money burn charge. Regardless that it is a good factor that the corporate will not face a liquidity crunch anytime quickly because of the current injection of liquidity, it is nonetheless laborious to see how NIO would be capable to drastically enhance its bottom-line efficiency given the suppression of margins and an absence of main development catalysts.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link