[ad_1]

Up to date on January nineteenth, 2024 by Bob CiuraSpreadsheet information up to date day by day

On the earth of investing, volatility issues. Traders are reminded of this each time there’s a downturn within the broader market and particular person shares which can be extra unstable than others expertise monumental swings in worth in each instructions. That volatility can improve the danger in a person’s inventory portfolio relative to the broader market.

The volatility of a safety or portfolio towards a benchmark – is known as Beta. In brief, Beta is measured by way of a system that calculates the worth danger of a safety or portfolio towards a benchmark, which is usually the broader market as measured by the S&P 500 Index.

When inventory markets are rising, high-beta shares might outperform. With that in thoughts, we created a listing of S&P 500 shares with the best beta values.

You possibly can obtain your free Excessive Beta shares checklist (together with related monetary metrics similar to dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

It’s useful in understanding the general worth danger stage for buyers throughout market downturns particularly.

Excessive Beta shares will not be a positive guess throughout bull markets to outperform, so buyers must be considered when including excessive Beta shares to a portfolio, as the burden of the proof suggests they’re extra prone to under-perform during times of market weak point.

Nevertheless, for these buyers keen on including a bit extra danger to their portfolio, we’ve put collectively a listing to assist buyers discover one of the best excessive beta shares.

This text will present an summary of Beta. As well as, we’ll talk about learn how to calculate Beta, incorporating Beta into the Capital Asset Pricing Mannequin, and supply evaluation on the highest 5 highest-Beta dividend shares in our protection database.

The desk of contents beneath gives for simple navigation:

Desk of Contents

Excessive Beta Shares Versus Low Beta

Right here’s learn how to learn inventory betas:

A beta of 1.0 means the inventory strikes equally with the S&P 500

A beta of two.0 means the inventory strikes twice as a lot because the S&P 500

A beta of 0.0 means the shares strikes don’t correlate with the S&P 500

A beta of -1.0 means the inventory strikes exactly reverse the S&P 500

The upper the Beta worth, the extra volatility the inventory or portfolio ought to exhibit towards the benchmark. This may be helpful for these buyers that want to take a bit extra danger available in the market as shares which can be extra unstable – that’s, these with greater Beta values – ought to outperform the benchmark (in idea) throughout bull markets.

Nevertheless, Beta works each methods and may actually result in bigger draw-downs during times of market weak point. Importantly, Beta merely measures the dimensions of the strikes a safety makes.

Intuitively, it might make sense that prime Beta shares would outperform throughout bull markets. In any case, these shares must be attaining greater than the benchmark’s returns given their excessive Beta values. Whereas this may be true over quick durations of time – significantly the strongest elements of the bull market – the excessive Beta names are usually the primary to be bought closely by buyers.

One potential idea for this, is that buyers are in a position to make use of leverage to bid up momentum names with excessive Beta values and thus, on common, these shares have decrease potential returns at any given time. As well as, leveraged positions are among the many first to be bought by buyers throughout weak durations due to margin necessities or different financing issues that come up throughout bear markets.

In different phrases, whereas excessive Beta names could outperform whereas the market is powerful, as indicators of weak point start to indicate, excessive Beta names are the primary to be bought and customarily, rather more strongly than the benchmark.

Certainly, proof suggests that in good years for the market, excessive Beta names seize 138% of the market’s complete returns. In different phrases, if the market returned 10% in a yr, excessive Beta names would, on common, produce 13.8% returns. Nevertheless, throughout down years, excessive Beta names seize 243% of the market’s returns.

In an identical instance, if the market misplaced 10% throughout a yr, the group of excessive Beta names would have returned -24.3%. Given this comparatively small outperformance throughout good instances and huge underperformance throughout weak durations, it’s straightforward to see why we want low Beta shares.

Associated: The S&P 500 Shares With Unfavorable Beta.

Whereas low Beta shares aren’t a vaccine towards downturns available in the market, it’s a lot simpler to make the case over the long term for low Beta shares versus excessive Beta given how every group performs throughout bull and bear markets.

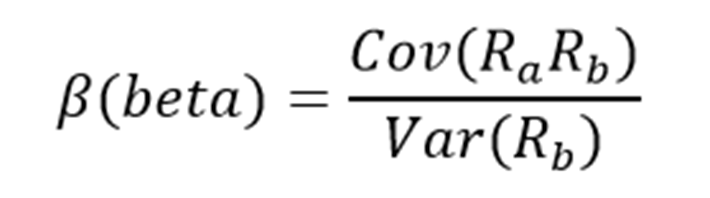

How To Calculate Beta

The system to calculate a safety’s Beta is pretty easy. The outcome, expressed as a quantity, exhibits the safety’s tendency to maneuver with the benchmark.

In different phrases, a Beta worth of 1.00 signifies that the safety in query ought to transfer just about in lockstep with the benchmark (as mentioned briefly within the introduction of this text). A Beta of two.00 means strikes must be twice as massive in magnitude whereas a damaging Beta signifies that returns within the safety and benchmark are negatively correlated; these securities have a tendency to maneuver in the other way from the benchmark.

This kind of safety can be useful to mitigate broad market weak point in a single’s portfolio as negatively correlated returns would recommend the safety in query would rise whereas the market falls.

For these buyers searching for excessive Beta, shares with values in extra of 1.3 can be those to hunt out. These securities would supply buyers at the very least 1.3X the market’s returns for any given interval.

Right here’s a take a look at the system to compute Beta:

The numerator is the covariance of the asset in query whereas the denominator is the variance of the market. These complicated-sounding variables aren’t really that tough to compute.

Right here’s an instance of the info you’ll have to calculate Beta:

Danger-free charge (usually Treasuries at the very least two years out)

Your asset’s charge of return over some interval (usually one yr to 5 years)

Your benchmark’s charge of return over the identical interval because the asset

To point out learn how to use these variables to do the calculation of Beta, we’ll assume a risk-free charge of two%, our inventory’s charge of return of 14% and the benchmark’s charge of return of 8%.

You begin by subtracting the risk-free charge of return from each the safety in query and the benchmark. On this case, our asset’s charge of return internet of the risk-free charge can be 12% (14% – 2%). The identical calculation for the benchmark would yield 6% (8% – 2%).

These two numbers – 12% and 6%, respectively – are the numerator and denominator for the Beta system. Twelve divided by six yields a price of two.00, and that’s the Beta for this hypothetical safety. On common, we’d anticipate an asset with this Beta worth to be 200% as unstable because the benchmark.

Desirous about it one other method, this asset must be about twice as unstable because the benchmark whereas nonetheless having its anticipated returns correlated in the identical route. That’s, returns can be correlated with the market’s total route, however would return double what the market did in the course of the interval. This is able to be an instance of a really excessive Beta inventory and would supply a considerably greater danger profile than a mean or low Beta inventory.

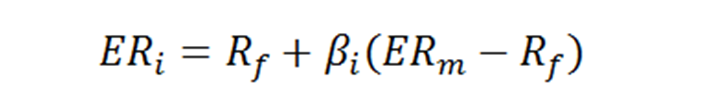

Beta & The Capital Asset Pricing Mannequin

The Capital Asset Pricing Mannequin, or CAPM, is a typical investing system that makes use of the Beta calculation to account for the time worth of cash in addition to the risk-adjusted returns anticipated for a specific asset. Beta is an integral part of the CAPM as a result of with out it, riskier securities would seem extra favorable to potential buyers. Their danger wouldn’t be accounted for within the calculation.

The CAPM system is as follows:

The variables are outlined as:

ERi = Anticipated return of funding

Rf = Danger-free charge

βi = Beta of the funding

ERm = Anticipated return of market

The chance-free charge is identical as within the Beta system, whereas the Beta that you simply’ve already calculated is just positioned into the CAPM system. The anticipated return of the market (or benchmark) is positioned into the parentheses with the market danger premium, which can also be from the Beta system. That is the anticipated benchmark’s return minus the risk-free charge.

To proceed our instance, right here is how the CAPM really works:

ER = 2% + 2.00(8% – 2%)

On this case, our safety has an anticipated return of 14% towards an anticipated benchmark return of 8%. In idea, this safety ought to vastly outperform the market to the upside however understand that throughout downturns, the safety would undergo considerably bigger losses than the benchmark. Certainly, if we modified the anticipated return of the market to -8% as an alternative of +8%, the identical equation yields anticipated returns for our hypothetical safety of -18%.

This safety would theoretically obtain stronger returns to the upside however actually a lot bigger losses on the draw back, highlighting the danger of excessive Beta names throughout something however sturdy bull markets. Whereas the CAPM actually isn’t good, it’s comparatively straightforward to calculate and offers buyers a method of comparability between two funding options.

Evaluation On The 5 Highest-Beta Dividend Shares

Now, we’ll check out the 5 dividend shares with the best Beta scores (in ascending order from lowest to highest).

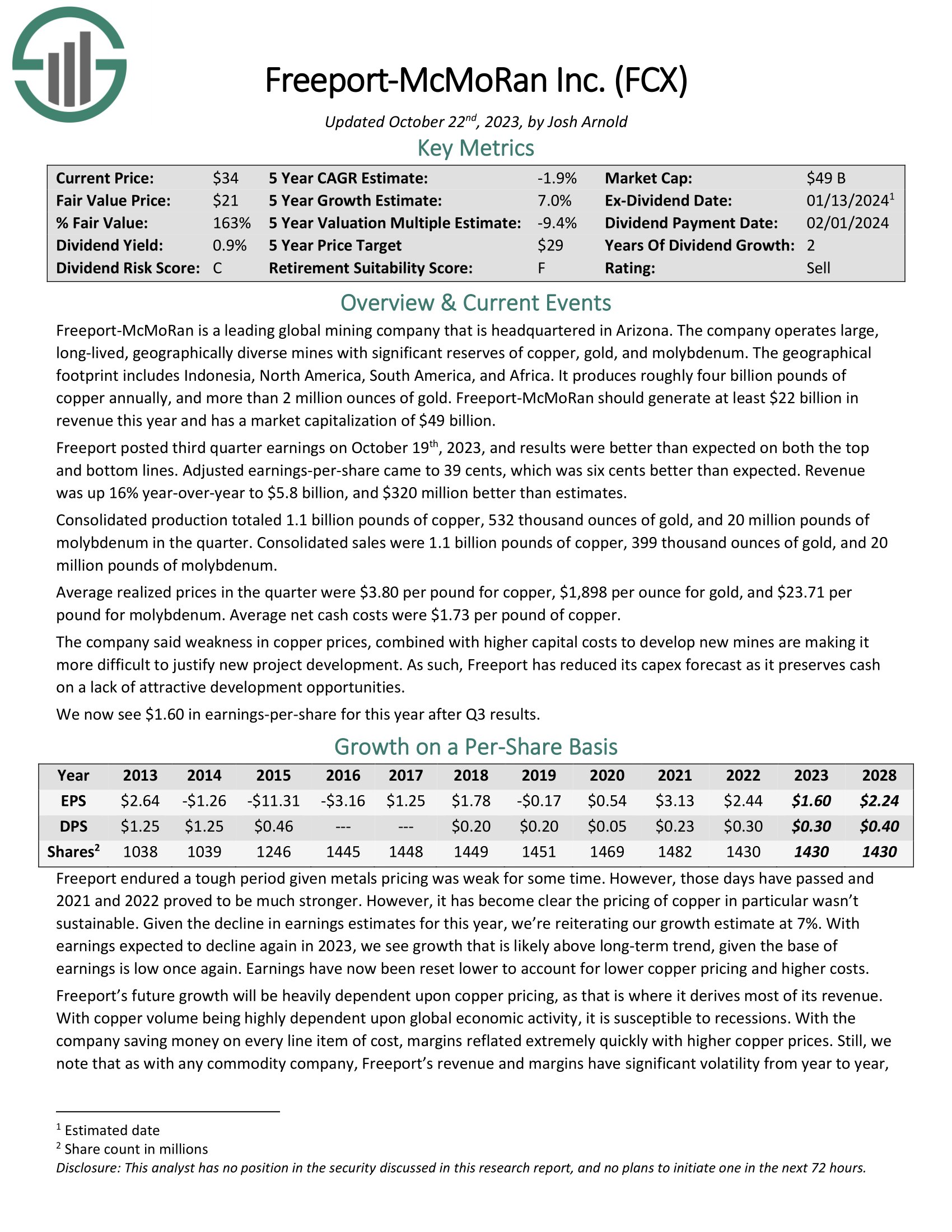

#5: Freeport McMoRan (FCX)

Freeport-McMoRan is a number one international mining firm that’s headquartered in Arizona. The corporate operates massive, long-lived, geographically numerous mines with vital reserves of copper, gold, and molybdenum. The geographical footprint consists of Indonesia, North America, South America, and Africa. It produces roughly 4 billion kilos of copper yearly, and greater than 2 million ounces of gold.

Freeport posted third quarter earnings on October nineteenth, 2023, and outcomes had been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to 39 cents, which was six cents higher than anticipated. Income was up 16% year-over-year to $5.8 billion, and $320 million higher than estimates.

FCX has a Beta worth of two.07.

Click on right here to obtain our most up-to-date Certain Evaluation report on FCX (preview of web page 1 of three proven beneath):

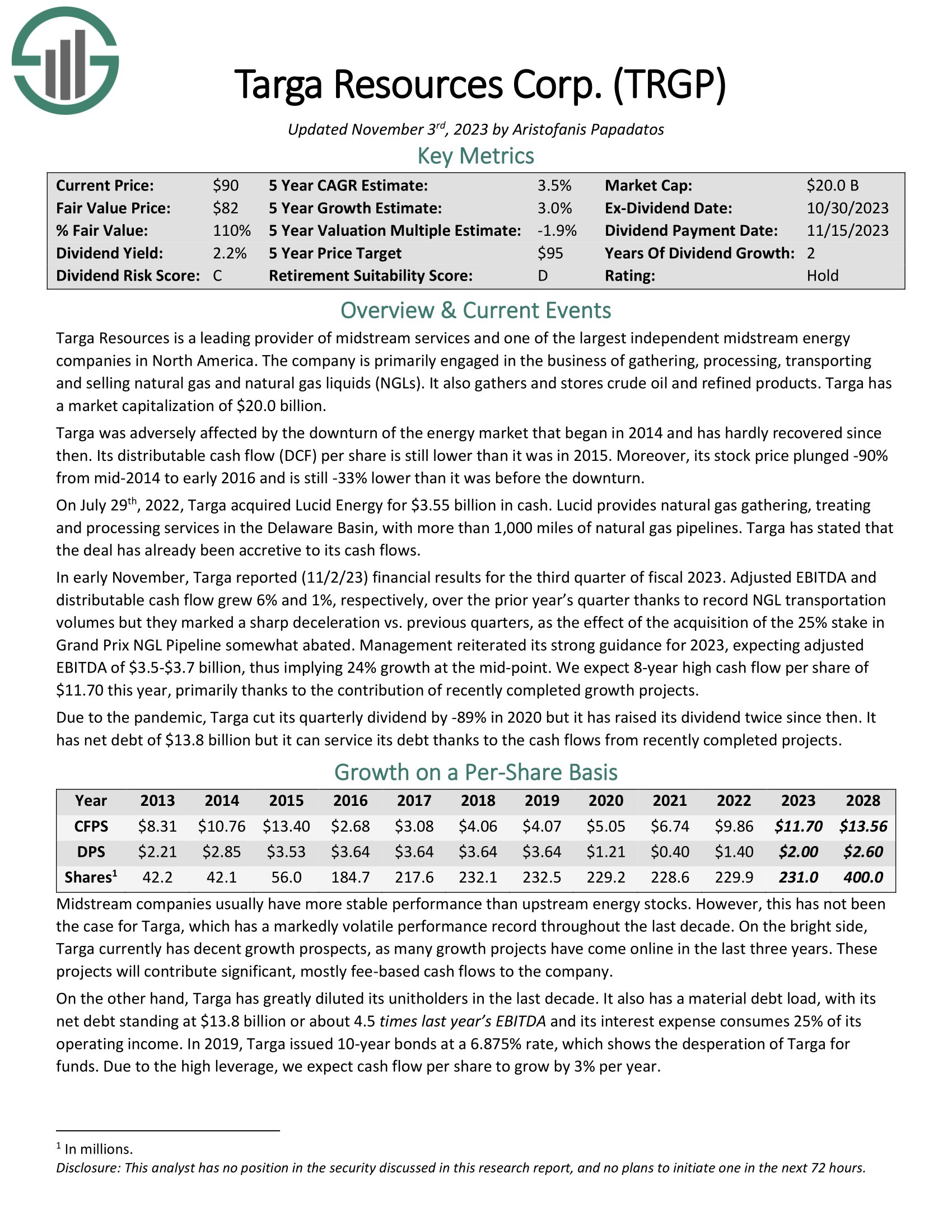

#4: Targa Assets Corp. (TRGP)

Targa Assets is a number one supplier of midstream companies and one of many largest unbiased midstream energycompanies in North America. The corporate is primarily engaged within the enterprise of gathering, processing, transportingand promoting pure fuel and pure fuel liquids (NGLs). It additionally gathers and shops crude oil and refined merchandise.

In early November, Targa reported (11/2/23) monetary outcomes for the third quarter of fiscal 2023. Adjusted EBITDA and distributable money movement grew 6% and 1%, respectively, over the prior yr’s quarter because of document NGL transportation volumes however they marked a pointy deceleration vs. earlier quarters, because the impact of the acquisition of the 25% stake in Grand Prix NGL Pipeline considerably abated.

TRGP has a Beta worth of two.17.

Click on right here to obtain our most up-to-date Certain Evaluation report on TRGP (preview of web page 1 of three proven beneath):

#3: Devon Vitality (DVN)

Devon Vitality Company (DVN) is an unbiased vitality firm engaged primarily within the exploration, growth and manufacturing of oil, pure fuel and NGLs. On January seventh, 2021, Devon and WPX Vitality accomplished an all-stock merger of equals. The mixed $29 billion market cap firm advantages from enhanced scale, improved margins, greater free money movement, and the monetary power to speed up the return of money to shareholders by means of a “mounted plus variable” dividend technique.

Devon reported Q3 2023 earnings on November seventh, 2023. For the quarter, earnings per share equalled $1.42 in comparison with the $2.88 per share reported in the identical interval final yr. According to its fixed-plus-variable dividend payout, Devon declared a $0.77 quarterly dividend, a rise over the earlier quarter.

DVN has a Beta worth of two.23.

Click on right here to obtain our most up-to-date Certain Evaluation report on DVN (preview of web page 1 of three proven beneath):

#2: Marathon Oil (MRO)

Marathon Oil Company operates as an unbiased exploration and manufacturing firm in the USA and internationally. The corporate engages within the exploration, manufacturing, and advertising and marketing of crude oil and condensate, pure fuel liquids, and pure fuel. It additionally owns and operates central gathering and treating services, and the Sugarloaf gathering system.

MRO has a Beta worth of two.23.

#1: APA Company (APA)

APA explores and produces crude oil, pure fuel and pure fuel liquids (NGLs) within the U.S., Egypt and the North Sea. In 2022, APA produced about 318,000 barrels of oil equal per day (excluding non-controlling curiosity). On this interval, oil, pure fuel, and NGLs comprised 74%, 17% and 9% of the whole income of the corporate, respectively.

In early November, APA reported (11/1/23) monetary outcomes for the third quarter of fiscal 2023. It grew its manufacturing 20% over the prior yr’s quarter however its common realized costs of oil and fuel corrected from abnormally excessive ranges in final yr’s interval. In consequence, earnings-per-share decreased -32%, from $1.97 to $1.33, although they exceeded the analysts’ consensus by $0.27. APA has overwhelmed the analysts’ estimates for six quarters in a row.

APA has a Beta worth of three.33.

Click on right here to obtain our most up-to-date Certain Evaluation report on APA (preview of web page 1 of three proven beneath):

Last Ideas

Traders should take danger under consideration when choosing potential investments. In any case, if two securities are in any other case comparable by way of anticipated returns however one affords a a lot decrease Beta, the investor would do effectively to pick the low Beta safety as it might supply higher risk-adjusted returns.

Utilizing Beta will help buyers decide which securities will produce extra volatility than the broader market, similar to those listed right here. The 5 shares we’ve checked out supply buyers excessive Beta scores together with very sturdy potential returns. For buyers who need to take some extra danger of their portfolio, these names and others like them in our checklist of the 100 greatest excessive Beta shares will help decide what to search for when choosing a excessive Beta inventory to purchase.

At Certain Dividend, we frequently advocate for investing in firms with a excessive chance of accelerating their dividends every yr.

If that technique appeals to you, it could be helpful to flick thru the next databases of dividend progress shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link