[ad_1]

Monetary markets usually are not predictable, and merchants aren’t both! In day buying and selling, as in some other job, the human issue performs a big function. Let’s imagine that half of your success relies upon solely on you no matter profession you select.

Take group sports activities, resembling soccer or basketball, for instance. Your opponents are solely part of the elements at play. And even with absolutely the strongest group, with the unsuitable strategy, you’ll lose. The identical factor will be mentioned about motor sports activities, although.

In brief, you’re an lively participant with the potential to affect the end result, each positively and negatively.

Succeeding within the monetary market is just not all the time simple since your opponents are massive hedge funds and funding banks with a long time of expertise within the business. To a big extent, the success charge of most day merchants is often lower than 20%.

There’s a mistake many individuals make: beginning to commerce in monetary markets with out the correct quantity of data. Neither technical nor private.

As a result of understanding the markets, alone, is just not sufficient to develop into a profitable dealer. We additionally want to know ourselves, to keep away from being our personal worst enemies.

The character of buying and selling

In day buying and selling, individuals make predictions on the subsequent worth motion of an asset. They place a purchase commerce after they anticipate the monetary asset to rise after which brief it after they anticipate the worth to retreat.

There are millions of belongings that an individual can commerce. For instance, within the US, there are over 5,900 publicly traded firms listed by key exchanges just like the NYSE and Nasdaq. There are over 17,000 shares traded over-the-counter. Globally, the quantity is even larger.

Additional, there are tens of commodities you could commerce, together with gold, silver, aluminum, corn, and wheat. There are additionally key belongings like bonds, ETFs, and cryptocurrencies.

There are additionally quite a few methods {that a} dealer can use within the monetary market. A few of these methods embody trend-following, algorithmic buying and selling, quant buying and selling, information buying and selling, scalping, and arbitrage.

Some merchants are wonderful in simply one among these approaches whereas others make a fortune specializing in a number of of them.

The character of the dealer

The success of a dealer is just not solely decided by market situations or methods (market volatility, entry to funds, rates of interest, liquidity, and market sentiment).

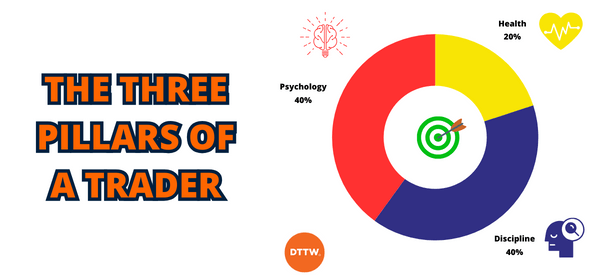

It’s a holistic interaction of assorted elements, collectively defining the character of the dealer. Understanding and mastering these components is essential for constant success within the unpredictable world of monetary markets.

These components embody each tangible and psychological points, shaping the dealer’s capability to navigate the unpredictable monetary markets.

Associated » Which is your buying and selling type?

Well being Issues

Past the screens and charts, a dealer’s bodily well-being is a cornerstone of their success. Optimum well being isn’t just a private concern however a strategic benefit, as a result of it immediately influences a dealer’s efficiency.

When a dealer is in good well being, they possess the resilience wanted to climate sudden challenges. Even within the face of illnesses such because the flu, a strong dealer can adapt and proceed executing well-informed choices.

The bodily state of a dealer is just not merely a private matter; it’s an asset that may be leveraged to safe a aggressive edge within the ever-changing panorama of monetary markets.

Focus and Self-discipline

Within the dynamic and infrequently chaotic realm of buying and selling, day-after-day is a brand new battle. The flexibility to remain targeted and disciplined amidst the fixed flux of data and market actions is the unsung hero of a dealer’s journey.

Consistency in strategy, no matter market situations, turns into the bedrock for long-term success. It’s not nearly making the best choices (as a result of, at instances, you possibly can fail); it’s about making them constantly.

The dealer’s focus is the compass guiding them by way of market complexities, and self-discipline is the power making certain they keep the course even when confronted with adversity.

These qualities elevate a dealer from mere participation to mastery within the risky world of monetary markets.

The Psychological Panorama

The psychological side of buying and selling transcends charts and analytics. Confronting biases and managing feelings is a pivotal talent set that distinguishes profitable merchants from the remaining.

Navigating the intricate net of 1’s personal thoughts, particularly throughout risky market situations, is an artwork that profitable merchants grasp. It entails recognizing and mitigating cognitive biases, understanding the emotional toll of wins and losses, and sustaining a resilient mindset within the face of uncertainty.

The dealer’s capability to navigate this psychological panorama isn’t just a complementary talent; it’s a defining trait that transforms them from a market participant to a real maestro of monetary markets!

On this planet of buying and selling, the place numbers meet feelings, mastering the psychological panorama is the important thing to sustained success.

Key to success

Your capability to generate earnings hinges on the harmonious interaction of those three basic entities. Take into account them because the pillars supporting your success within the intricate world of buying and selling. Even when one falters, the optimistic sum of well being, focus, and psychological resilience can nonetheless pave the best way to profitability.

For example, think about a situation the place your well being is just not at its peak, maybe because of sickness. Regardless of this setback, a dealer geared up with self-discipline and a pointy focus can nonetheless make knowledgeable choices, albeit with some efficiency compromise.

Equally, on days when feelings threaten to disrupt your focus, a disciplined strategy can mitigate the impression, making certain you stay heading in the right direction.

After all, the perfect situation is to optimize every entity for peak efficiency. Nonetheless, the fact of buying and selling acknowledges that challenges could come up. What issues most is the collective energy of those entities, making certain that even in suboptimal situations, you stay resilient and able to making strategic choices.

The true problem arises when the sum of those entities turns unfavorable. It’s at this level that the fragile stability ideas, and challenges intensify.

Recognizing and rectifying this imbalance turns into paramount. The unfavorable sum not solely jeopardizes your profitability but additionally locations the very basis of your buying and selling endeavors in danger

Why you possibly can be your worst enemy when buying and selling

At instances, as a dealer, you will be your personal worst enemy whereas shifting within the monetary markets. For instance, if you find yourself not wholesome, there are probabilities that you’ll not be as environment friendly as if you find yourself advantageous. Although, as we mentioned, this alone is just not a consider figuring out the failure of your transactions.

In case you begin to lose your self-discipline, and your psychological management, the actual troubles will begin to come. Your evaluation will start to worsen and bias to have an effect on your decisions.

Your feelings

One of the crucial vital traits within the monetary market is your feelings. You will be a wonderful dealer and find yourself shedding cash merely since you didn’t handle your feelings nicely.

Emotional points occur in good and unhealthy instances. If you make substantial earnings, you may wish to proceed buying and selling with out doing loads of evaluation. For instance, when your purchase commerce rises, you is perhaps tempted to open the identical commerce once more. Most often, doing this will result in substantial losses.

In addition they work if you make substantial losses available in the market. You possibly can open a separate commerce to recuperate your losses. On this scenario, you’ll be able to open an even bigger commerce to speed up your restoration.

Different emotional points that may impression your buying and selling outcomes are panic promoting, revenge buying and selling, and being extraordinarily grasping.

Evaluation paralysis

The opposite manner you could be your personal worst enemy is called evaluation paralysis. This can be a scenario that’s characterised by overanalyzing data, working in direction of perfectionism, feeling overwhelmed, and procrastination.

One of many fashionable approaches that this occurs is if you use tens of technical indicators within the monetary market. Most often, this doesn’t work out nicely. As a substitute, it is best to concentrate on utilizing two or three indicators as a substitute of so many.

Overconfidence

You can too be your personal worst enemy due to being overconfident. When you find yourself so overconfident, likelihood is that you’ll overlook key points in your decision-making.

You possibly can overlook doing sentimental and technical evaluation earlier than you open a commerce. Most often, this overconfidence can result in larger losses.

No danger administration

Danger administration is without doubt one of the most vital issues within the monetary market. It refers back to the means of limiting losses whereas maximizing returns.

A few of the prime danger administration methods available in the market are having a stop-loss and a take-profit, doing correct place sizing, and avoiding an excessive amount of leverage.

In some instances, danger administration can stop a dealer from making some huge cash. For instance, take-profit and small lot sizes and leverage can restrict your upside potential.

Subsequently, some merchants keep away from utilizing these danger administration methods and expose themselves to substantial losses.

Not following your guidelines

As a day dealer, you could have guidelines. A few of these guidelines embody not leaving your trades open in a single day, utilizing a small leverage, and buying and selling sure belongings like shares and currencies. If you don’t comply with your guidelines, there are indicators that you’ll lose cash in the long run.

There are different methods the place you will be your personal worst enemy within the monetary market, together with: not utilizing a buying and selling journal, having concern and greed available in the market, or shopping for monetary belongings with out doing any analysis.

Abstract

In navigating the intricate panorama of monetary markets, the essence of “The Nature of the Dealer” extends past a mere understanding—it calls for lively self-assessment.

Recognizing the intricate dance between well being, focus, and psychological resilience isn’t just a theoretical train; it’s a name to motion. Merchants should have interaction in steady self-reflection, evaluating the concord inside these three pillars.

Assessing one’s well being, sustaining unwavering focus, and mastering the psychological intricacies usually are not simply parts of a profitable technique; they’re the very essence of buying and selling mastery.

Aspiring and seasoned merchants alike should heed this crucial—common self-assessment is the compass that ensures they continue to be on the trail to sustained success within the dynamic world of monetary markets.

Exterior helpful sources

7 Questions to your buying and selling self evaluation – High Step

[ad_2]

Source link