[ad_1]

By Graham Summers, MBA

A serious financial institution simply went underneath… contagion is dragging down different comparable companies… the Fed is introducing emergency measures to bailout the system.

Is it 2008 over again?

Sure and no.

“Sure” within the sense that the Fed created a large bubble in danger property. Additionally “sure” within the sense that banks made silly choices, violating central tenets of danger administration by lending cash to purchasers that would by no means pay it again (this time tech startups as a substitute of excessive danger mortgage debtors). And eventually “sure” within the sense that the responsible gamers get bailed out by the tax-payer and the rich are made “complete” with preferential remedy as a consequence of their connections to DC.

Nonetheless, that’s the place the similarities finish… as a result of the problems the monetary system faces as we speak are far higher and systemic that those it confronted in 2008.

The 2008 disaster was triggered by a disaster in housing… which grew to become a banking disaster courtesy of Wall Avenue’s poisonous derivatives trades,

This disaster (2023) is a disaster in Treasuries… that are the bedrock of our present monetary system, the senior-most asset class in existences. And as soon as once more Wall Avenue has gone bananas with derivatives based mostly on an asset class.

In 2008, the derivatives had been “credit score default swaps” and the marketplace for them was roughly $50-$60 trillion in measurement.

As we speak, the derivatives are based mostly on “rates of interest/ bond yields” and the marketplace for them is $500+ trillion. And as we simply found with Silicon Valley Financial institution and Signature Financial institution… the banks weren’t significantly intelligent in how they managed their dangers this time both.

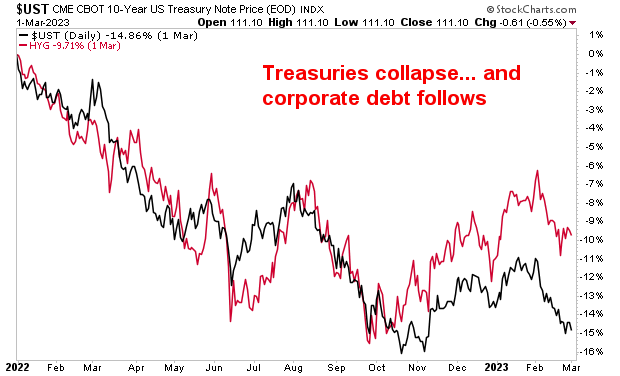

Over the past 12 months because the Fed raised rates of interest from 0.25% to 4.75%, the Treasury market has collapsed. Bear in mind, when bond yields RISE, bond costs FALL.

Different debt securities adopted go well with together with mortgage-backed securities, company bonds and the like. As a result of keep in mind, the yield on Treasuries represents the “danger free” charge of return in opposition to which all danger property are priced. So when Treasuries fell, ALL different debt devices needed to be repriced accordingly.

On account of this, U.S. banks are presently sitting on $640 BILLION in unrealized losses on their longer length bond/debt portfolios. That is what precipitated the collapse of Silicon Valley Financial institution… and when you assume that’s the final shoe to fall on this mess, I’ve received a bridge to promote you in Brooklyn.

So benefit from the bounce we’re seeing in danger property now. It gained’t final… simply because the market rally triggered by Bear Stearns’ shotgun wedding ceremony to JP Morgan in March 2008 didn’t final both.

Certainly, from a BIG PICTURE perspective my proprietary Crash Set off is now on the primary confirmed “Promote” sign since 2008.

This sign has solely registered THREE occasions within the final 25 years: in 2000, 2008 and as we speak.

In case you’ve but to take steps to organize for what’s coming, we simply printed a brand new unique particular report The right way to Make investments Throughout This Bear Market.

It particulars the #1 funding to personal in the course of the bear market in addition to make investments to probably generate life altering wealth when it ends.

To choose up your FREE copy, swing by:

phoenixcapitalmarketing.com/BM.html

PS. Our new investing podcast Bulls, Bears & BS is formally reside and obtainable on each main podcast software (Apple, Spotify, and so on.)

To obtain or pay attention, swing by:

bullsbearsandbs.buzzsprout.com/

[ad_2]

Source link