[ad_1]

North Carolina Consultant Wiley Nickel, joined by Senator Cynthia Lummis and Consultant Mike Flood, has put forth a Congressional Overview Act (CRA) decision that could possibly be of crucial significance to the US Bitcoin and crypto business. This important legislative effort goals to overturn the Securities and Change Fee’s (SEC) directive requiring banks to incorporate buyer cryptocurrency property on their stability sheets, probably clearing a serious hurdle for the institutional adoption of Bitcoin and different digital property.

The CRA decision targets the SEC’s Employees Accounting Bulletin (SAB) 121, issued in March 2022. This controversial bulletin demanded that monetary establishments replicate an equal legal responsibility on their stability sheets for every digital asset held. The digital asset sector broadly criticized this requirement for its potential to undermine the operational viability of digital asset custodians.

SAB 121 Is Essential For Institutional Bitcoin Adoption

Perianne Boring, the CEO of the Chamber of Digital Commerce, strongly commented on the problem, emphasizing the significance of this legislative transfer: “AB 121 has been one of many largest impediments to institutional adoption of Bitcoin and cryptocurrency. We’re breaking down this barrier to make digital property extra accessible to People.”

In a complete assertion, the Chamber of Digital Commerce applauded the bipartisan initiative of Senator Lummis, Consultant Flood, and Consultant Nickel. “At this time’s bipartisan decision represents a decisive motion to make sure the SEC operates inside its designated rulemaking authority,” the assertion learn. It additional criticized the SEC for bypassing established procedures with SAB 121, thereby “compromising the integrity of the regulatory framework and violating ideas of clear and inclusive governance.”

The SEC’s SAB 121 has been a degree of rivalry inside the digital asset group. The Chamber of Digital Commerce’s Token Alliance has been on the forefront of difficult this rule, advocating for its rescission and fascinating with varied governmental our bodies, together with the GAO. Of their assertion, the Chamber highlighted their in depth efforts: “The workstream has submitted eight letters to Congress regarding digital asset custody issues, engaged with the SEC’s Workplace of the Chief Accountant, and urged the GAO to overview the rule.”

The Initiative Has Bi-Partisan Help

Reflecting on the significance of this decision, US Republican Mike Flood remarked: “Chair Gary Gensler’s SAB 121 has nearly blocked banks from serving as custodians of digital property. At this time, Rep Wiley Nickel, Senator Lummis, and I launched resolutions to repeal SEC’s horrible bulletin. SAB 121’s days are numbered – it’s time for it to go!”

Patrick McHenry, chairman of the Monetary Companies GOP, additionally shared his view, emphasizing the bipartisan nature of the opposition to SAB 121: “There may be bipartisan settlement SAB 121 undermines shopper safety and leaves prospects’ digital property weak. I look ahead to getting this measure throughout the end line to overturn it. Due to Mike Flood, Wiley Nickel, and Senator Lummis in your management.”

The introduction of the CRA decision marks a big second within the evolving relationship between digital asset markets and regulatory frameworks in the USA. The result of this legislative effort has the potential to drastically affect the institutional adoption of Bitcoin and different cryptocurrencies.

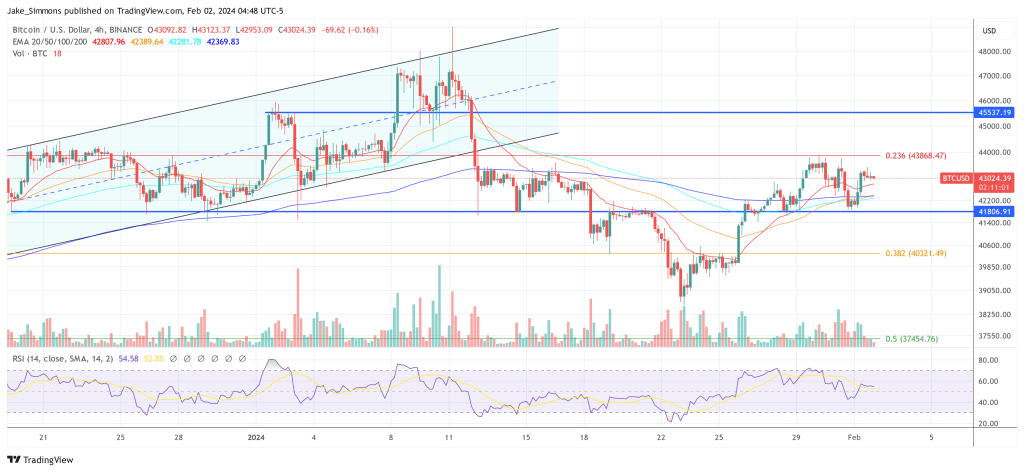

At press time, Bitcoin traded at $43,024.

Featured picture created with DALL·E, chart from TradingView.com

[ad_2]

Source link