[ad_1]

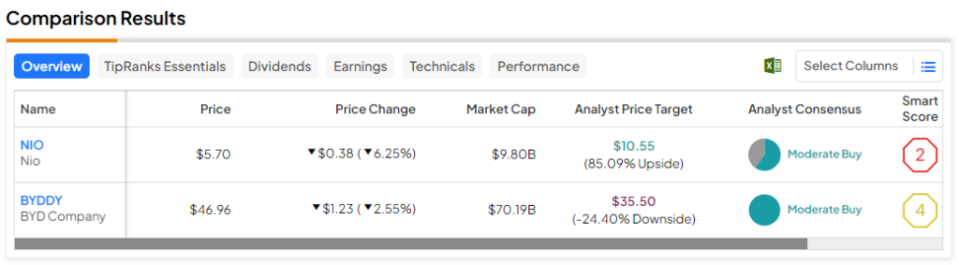

On this piece, I evaluated two EV shares, NIO (NYSE:NIO) and BYD (OTC:BYDDY), utilizing TipRanks’ comparability instrument to see which inventory is the higher purchase. A more in-depth look suggests a bearish view for NIO and a bullish view for BYD.

China-based NIO designs, manufactures, and sells electrical automobiles in China and Hong Kong, the U.S., the U.Okay., and Germany. In the meantime, BYD, additionally based mostly in China, manufactures and sells EVs, rechargeable batteries, and choose different electronics, together with elements for cellular gadgets.

Shares of NIO have plummeted 33% year-to-date, bringing their 12-month return to -41%. In the meantime, BYD inventory is down 14.8% year-to-date, and shares are down 22.7% over the past yr.

These steep year-to-date declines are according to the remainder of the EV business on account of considerations about weaker-than-expected demand for electrical automobiles and the continuing worth warfare. Consequently, even Tesla (NASDAQ:TSLA) is off 26% year-to-date, though the sector-wide drawdown may very well be providing up some buy-the-dip alternatives.

NIO is just not worthwhile, so we’ll examine its price-to-sales (P/S) ratio to that of BYD to gauge their valuations towards one another. For a separate comparable, we’ll use Tesla as a substitute of utilizing the broader auto market, which is skewed on account of excessive variations within the valuations of legacy automakers versus EV makers. Tesla is at present buying and selling at a price-to-earnings (P/E) ratio of 42.7 and a P/S of 6.8.

NIO (NYSE:NIO)

At a P/S of 1.4, the cash-burning NIO is buying and selling at the next valuation than the worthwhile BYD. With no signal that profitability is in sight and even no plan for attaining it anytime quickly, a bearish view seems to be acceptable for NIO, as there are many higher EV performs now with the sector’s latest pullback.

On the one hand, NIO grew its automobile deliveries by 18.2% year-over-year in January and exceeded its steering for fourth-quarter deliveries. Nevertheless, however, a cursory comparability of different EV makers reveals how a lot sooner most of them are rising in comparison with NIO. For instance, Li Auto (NASDAQ:LI) grew its automobile deliveries by 105.8% year-over-year in January, whereas XPeng (NYSE:XPEV) noticed its EV deliveries leap 58%.

Story continues

Then there’s the problem of profitability. Morningstar (NASDAQ:MORN) analyst Vincent Solar stated in September that NIO may turn out to be worthwhile in 2026, however the firm hasn’t supplied any official plan to succeed in profitability. A key situation for the automaker is its margins, that are being pressured by the continuing EV worth warfare.

NIO expects its automobile margins to succeed in roughly 15% by the fourth quarter, however its margin stood at 11% within the third quarter, down from 16.4% within the third quarter of 2022. Moreover, NIO’s web revenue margin has remained within the -30% to -40% vary for the final 4 years with no indicators of enchancment.

Its web revenue margin stood at -34.5% in 2020, improved to -29.3% in 2021, fell barely to -29.6% in 2022, and slipped again to -39.2% for the final 12 months, which suggests profitability may very well be far off. The truth that NIO holds solely a 2.1% sliver of the Chinese language new-energy-vehicle (NEV) market provides additional concern that it may very well be an extended street forward for the corporate — if it manages to outlive in any respect.

The one distinctive factor about NIO is its battery-swapping expertise, but it surely’s too early to say whether or not it would result in success for your complete firm.

What Is the Worth Goal for NIO Inventory?

NIO has a Reasonable Purchase consensus ranking based mostly on six Buys, 4 Holds, and nil Promote scores assigned over the past three months. At $10.55, the common NIO inventory worth goal implies upside potential of 85.1%.

BYD (OTC:BYDDY)

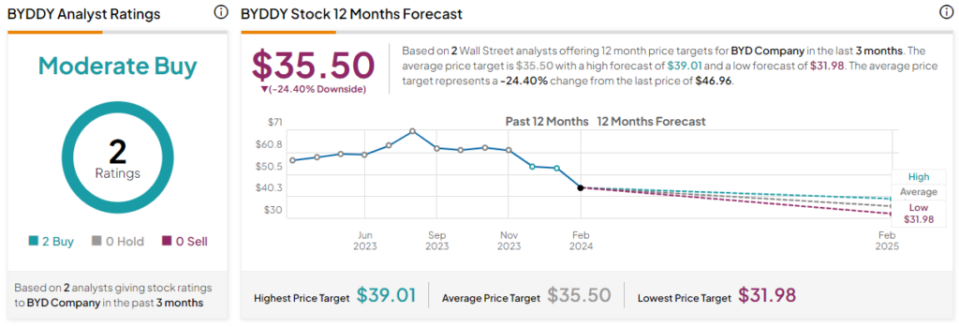

At a P/E of 34.8 and a P/S of 0.9, BYD is buying and selling at a steep low cost to Tesla — though it unseated Elon Musk’s wildly profitable EV maker because the world’s largest vendor of electrical automobiles by supply rely. Thus, a bullish view appears acceptable for BYD, particularly contemplating that the corporate is undervalued with out even contemplating the non-EV elements of its enterprise.

In 2023, BYD noticed its retail gross sales of new-energy automobiles in China leap 50% year-over-year to 2.7 million items, giving it a 35% share of the Chinese language NEV market. In the meantime, Tesla holds solely a 7.8% share of the Chinese language market, though its automobile gross sales in China grew a wonderfully respectable 37.4% year-over-year to greater than 600,000 items.

BYD additionally has its sights set on worldwide markets, because it delivered a document 36,174 automobiles outdoors China in January. After all, all of those gross sales traits are optimistic for BYD, even when the inventory takes a breather briefly.

One final thing to notice about BYD is that this firm has been round for a few years, having developed into an EV firm that additionally makes different electronics. As such, BYD has loved some stellar long-term features in its inventory worth, which is up 284% over the past 5 years and 358% over the past 10, making it a horny buy-and-hold place for the long run.

What Is the Worth Goal for BYDDY Inventory?

BYD has a Reasonable Purchase consensus ranking based mostly on two Buys and no Maintain or Promote scores assigned over the past three months. At $35.50, the common BYD inventory worth goal implies draw back potential of 24.4%.

Conclusion: Bearish on NIO, Bullish on BYDDY

It’s no secret that traders are anxious concerning the state of the EV market. Excessive rates of interest hit EV gross sales exhausting, but it surely’s beginning to seem like charges may begin coming down sooner or later this yr. Moreover, any dependence on near-term gross sales traits for EVs is just short-sighted. Though the transition might take longer than beforehand anticipated, the latest pullback within the inventory costs of some EV makers presents a horny buy-the-dip alternative.

Nevertheless, when evaluating BYD and NIO, it’s clear that BYD is a Chinese language juggernaut that’s too low cost to disregard, whereas NIO seems to be like a cash-burning, ultra-risky speculative play on battery-swapping expertise. If NIO even survives, it may very well be fairly a while earlier than we begin to see indicators of success peering across the nook.

Disclosure

[ad_2]

Source link