[ad_1]

Up to date on March seventeenth, 2022 by Bob Ciura

The Dividend Low cost Mannequin is a valuation method used to seek out the honest worth of a dividend inventory.

“All the pieces must be so simple as it may be, however not easier”– Attributed to Albert Einstein

The magnificence of the dividend low cost mannequin is its simplicity. The dividend low cost mannequin requires solely 3 inputs to seek out the honest worth of a dividend paying inventory.

1-year ahead dividend

Progress charge

Low cost charge

In case you favor studying by means of movies, you may watch a step-by-step tutorial on the right way to implement the dividend low cost mannequin under:

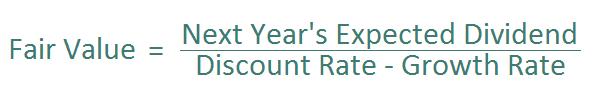

Dividend Low cost Mannequin Formulation

The method for the dividend low cost mannequin is:

The dividend low cost mannequin is calculated as follows. It’s subsequent yr’s anticipated dividend divided by an applicable low cost charge, much less the anticipated dividend development charge.

That is abbreviated as:

Alternate Names of the Dividend Low cost Mannequin

The dividend low cost mannequin is commonly referred to by 3 different names:

Dividend Progress Mannequin

Gordon Progress Mannequin

Dividend Valuation Mannequin

The Dividend Progress Mannequin, Gordon Progress Mannequin, and Dividend Valuation Mannequin all discuss with the Dividend Low cost Mannequin.

Myron Gordon and Eli Shapiro created the dividend low cost mannequin on the College of Toronto in 1956.

How The Dividend Low cost Mannequin Works

The dividend low cost mannequin works off the concept the honest worth of an asset is the sum of its future money flows discounted again to honest worth with an applicable low cost charge.

Dividends are future money flows for buyers.

Think about a enterprise paying $1.00 in dividends per yr, eternally. How a lot would you pay for this enterprise for those who needed to make 10% return in your funding yearly?

Notice: Right here’s a free funding calculator.

10% is your low cost charge. The honest worth of this enterprise in line with the dividend low cost mannequin is $10 ($1 divided by 10%).

We will see that is correct. A $10 funding that pays $1 yearly creates a return of 10% a yr – precisely what you required.

The dividend low cost mannequin tells us how a lot we must always pay for a inventory for a given required charge of return.

Estimating Required Return Utilizing the CAPM

CAPM stands for Capital Asset Pricing Mannequin. It’s a vital monetary idea to grasp. Click on right here to see 101 essential monetary ratios and metrics.

The capital asset pricing mannequin exhibits the inverse relationship between danger and return.

The required return for any given inventory in line with the CAPM is calculated with the method under:

The distinction between the market return and the danger free charge is called the market danger premium. What’s the present market danger premium?

The long-term, inflation-adjusted return of the inventory market not accounting for dividends is 2.4%. Inflation is predicted to be at 2.3% over the following decade. The present dividend yield on the S&P 500 is 1.7%. A good estimate of market return to make use of within the CAPM method is 6.4% (2.4% + 2.3% + 1.7%).

The present danger free charge is 4.4%. The danger-free charge is historically calculated because the yield on 3-month T-Payments. This leads to a market danger premium of two.0%.

All that’s left to calculate the required return on any inventory utilizing the CAPM is beta. Beta over a 10-year interval is calculated under for 3 Dividend Aristocrats:

These betas indicate a required return of:

Aflac has a required return of 6.28%

PepsiCo has a required return of 5.48%

Archer-Daniels-Midland has a required return of 5.98%

Inventory beta values have a big impact on the required returns of various shares. We used Yahoo Finance for beta values.

The Significance of The Dividend Progress Price

The dividend development charge is critically essential in figuring out the honest worth of a inventory with the dividend low cost mannequin.

The denominator of the dividend low cost mannequin is low cost charge minus development charge. The expansion charge have to be lower than the low cost charge for the dividend low cost mannequin to operate. If the expansion charge estimate is larger than the low cost charge the dividend low cost mannequin will return a detrimental worth.

There are not any shares price any detrimental worth. The bottom worth a inventory can have is $0 (chapter with no sellable property).

Adjustments within the estimated development charge of a enterprise change its worth underneath the dividend low cost mannequin.

Within the instance under, subsequent yr’s dividend is predicted to be $1 multiplied by 1 + the expansion charge. The low cost charge is 10%:

$4.79 worth at -9% development charge

$5.88 worth at -6% development charge

$7.46 worth at -3% development charge

$10.00 worth at 0% development charge

$14.71 worth at 3% development charge

$26.50 worth at 6% development charge

$109.00 worth at 9% development charge

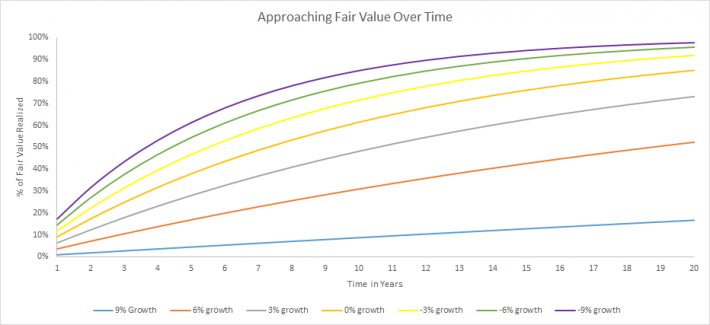

Longer Progress Charges Push Worth Out In Time

The nearer the expansion charge is to the low cost charge, the extra time it takes to method the current worth of discounted future money flows.

The chart under exhibits the proportion of honest worth reached by means of time for various development charges. A reduction charge of 10% and an anticipated dividend of $1 multiplied by $1 + the expansion charge is used.

Companies with a large hole between the low cost charge and the expansion charge converge on their honest worth quicker. There’s a hidden benefit right here. You don’t should be proper for as lengthy.

You probably have a required return of 10% and estimate dividend development at 0% a yr (no development) it will take 8 years for discounted money flows to achieve ~50% (53%, precisely) of honest worth.

With a 9% development charge, solely 7% of honest worth is reached after 8 years. The enterprise should develop at 9% for… 75 years to achieve 50% of its honest worth. Progress charges are troublesome to calculate over 1 yr. How anybody can push development charges out 50 or 75 years and have any confidence in them is past me.

It’s unimaginable to have any concept what a enterprise can be doing in 75 years, even in extraordinarily steady industries. At greatest, we are able to say a enterprise will most likely exist in 75 years. Saying it is going to nonetheless be rising at 9% a yr in 75 years is impractical.

Estimating The Dividend Progress Price

The dividend development charge should approximate the expansion charge of the enterprise over very long time intervals. If dividend development exceeded enterprise development for lengthy dividends can be greater than 100% of money flows. That is unimaginable over any significant size of time.

Lengthy-term earnings-per-share development approximates long-term dividend per share development.

Utilizing earnings-per-share development over dividend-per-share development has a definite benefit. Dividend development might be inaccurate because of 1 time will increase in payout ratio.

An organization can elevate its payout ratio from 35% to 70% and double its dividend. The corporate can’t repeat the identical trick over the following interval. The payout ratio can’t double once more from 70% to 140% (not less than, it might’t if it needs to remain in enterprise).

It’s simpler to estimate future development charges for established companies. A enterprise like PepsiCo will most likely develop across the identical charge over the following decade because it has over the past decade.

Quickly rising companies like Amazon (AMZN) can’t develop at 20% or extra yearly eternally. If Amazon grew its market cap at 20% a yr over the following 30 years it will be price greater than $300 trillion.

To place that into perspective, the worldwide GDP is at present round $85 trillion. Quickly rising companies’ development charges must be diminished to extra precisely mirror future development.

Dividend Low cost Mannequin Excel Spreadsheet Calculator

Obtain a free Excel Spreadsheet dividend low cost mannequin calculator on the hyperlink under:

Dividend Low cost Mannequin Excel Spreadsheet Calculator

The calculator has detailed instruction contained in the spreadsheet on the right way to use it.

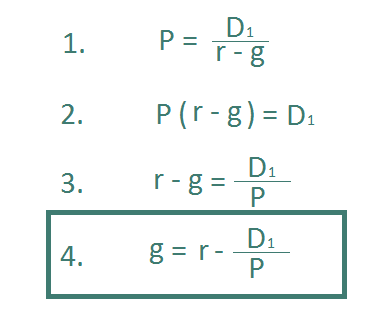

The Implied Dividend Progress Price

The dividend low cost mannequin can inform us the implied dividend development charge of a enterprise utilizing:

Present market worth

Beta

Cheap estimate of subsequent yr’s dividend.

To take action we want solely rearrange the dividend low cost mannequin method to resolve for development fairly than worth.

Let’s use Walmart (WMT) for instance:

Share worth of $138

Estimated dividend subsequent yr of $2.32 per share

Beta worth of 0.49

Utilizing the Beta above with our previously-calculated 6.4% anticipated market return and 4.4% risk-free charge offers us a CAPM required return of 5.38% to make use of for our low cost charge.

Plugging these numbers into the implied dividend development method offers an implied dividend development charge for Walmart of three.80%.

Evaluating the implied development charge to affordable development expectations can flip up probably undervalued securities.

Walmart is a high-quality dividend inventory, because of its lengthy monitor report of development, and above common dividend yield.

Click on the hyperlink under to obtain an implied development charge dividend low cost mannequin calculator:

Implied Progress Price Excel Spreadsheet Calculator

Shortcomings of the Dividend Low cost Mannequin

Whereas the dividend low cost mannequin is a really helpful train to worth dividend development shares, as with every mannequin, there are a number of shortcomings that buyers ought to take into account.

First, the dividend low cost mannequin values a inventory in perpetuity. The truth is that no enterprise exists eternally. The mannequin ascribes a constructive worth (albeit negligible) to dividends paid 100+ years from now.

I’m a agency believer within the efficacy of long-term investing. Making 100+ yr forecasts is silly, even for the longest of long-term buyers.

Moreover, the dividend low cost mannequin doesn’t work on companies that don’t pay dividends. Alphabet (GOOG) (GOOGL) definitely has a constructive worth, though it doesn’t at present pay dividends.

This shortcoming makes the dividend low cost mannequin a useful gizmo just for dividend paying shares (because the title implies).

The dividend low cost mannequin says the honest worth of a enterprise is the sum of its future money flows discounted to current worth.

One other potential shortcoming is that the dividend low cost mannequin fails to account for money flows from promoting your shares. Utilizing Alphabet once more for instance, the corporate invests its money flows into development, not paying dividends to shareholders.

If the corporate can develop earnings-per-share at 15% a yr, its inventory worth ought to (in concept) develop at 15% a yr as effectively. When buyers promote the inventory they are going to generate a really actual money movement. The dividend low cost mannequin doesn’t account for this.

The mannequin additionally doesn’t bear in mind altering payout ratios. Some companies might elevate or decrease their goal payout ratio. This meaningfully impacts the honest worth calculation of the dividend low cost mannequin.

Lastly, calculating the ‘honest’ low cost charge can also be a severe disadvantage to the dividend low cost mannequin. You may know your anticipated return, however not what the general anticipated return of the market must be. The CAPM does a poor job of arising with actual world low cost charges.

Last Ideas

The dividend low cost mannequin has severe flaws; however so does each different valuation metric. Investing is an artwork, not a science. There isn’t a one excellent strategy to make investments.

The dividend low cost mannequin is a useful gizmo to gauge assumptions a couple of dividend inventory. It’s not the ultimate phrase on valuation, however it does present a special method to take a look at and worth dividend shares.

This text accommodates spreadsheet downloads for the implied development charge and for the dividend low cost mannequin. They’re listed under:

Further Studying

If you’re interested by discovering high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases can be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link