[ad_1]

Ole_CNX/iStock through Getty Photographs

In a Feb. 15 Looking for Alpha article on the Sprott Uranium Miners ETF product (URNM), I wrote:

Uranium is a commodity traded within the bodily market. Sprott Uranium Miners ETF is a product that gives publicity to uranium in a world the place nuclear demand is rising.

URNM was buying and selling at $52.38 per share on Feb. 15. On March 5, the ETF had corrected 6.9% to the $48.76 per share degree. URNM’s high North American holding is Cameco Corp (CCJ), with greater than 13.50% publicity. Whereas CCJ is a senior uranium mining firm, Ur-Vitality Inc. (NYSE:URG) is a U.S. uranium firm that might have upside potential as curiosity within the uranium market will increase and the commodity’s value rises. URG is a small-cap inventory, and whereas its valuation stays problematic, it stays a beautiful speculative candidate to purchase on the present dip in the sector.

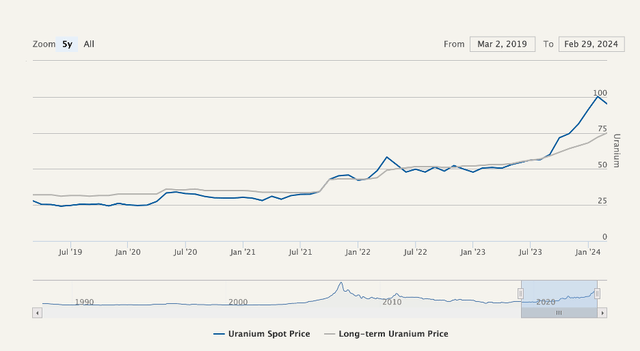

Uranium costs stay bullish

The bullish value pattern in uranium continued via February 2024

5-Yr Bodily Uranium Worth Chart (Cameco.com)

Because the chart reveals, whereas the spot uranium value fell barely from $100.25 on the finish of January 2024 to $95 per pound on the finish of February, the long-term uranium value rose from $72 to $75.

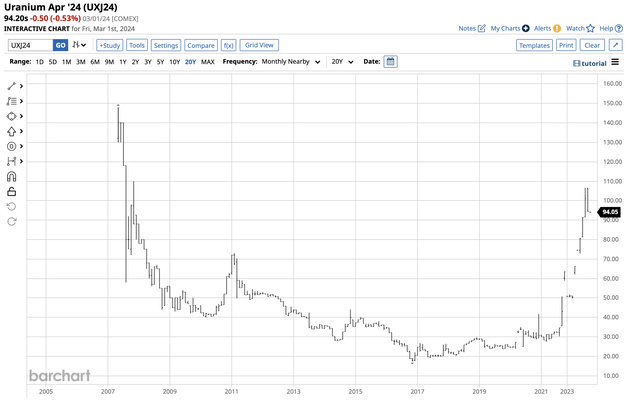

Whereas COMEX uranium futures are illiquid, they are a pricing benchmark.

Twenty-Yr Uranium Futures Chart (Barchart)

The 20-year chart highlights that uranium costs traded on both aspect of the $100 per pound degree in January and February. At $94.20 on March 4, the worth stays in a major bullish pattern.

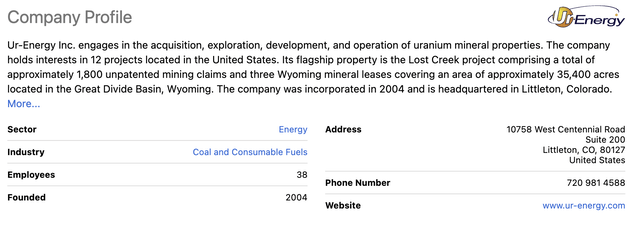

URG is a U.S. uranium mining firm

Ur-Vitality Inc. (URG) is a junior uranium miner. URG’s firm profile states:

URG Firm Profile (Looking for Alpha)

At $1.62 per share on March 4, URG had a $455.4 million market cap. A median of practically 3.1 million shares change palms each day. URG solely has 38 workers who handle the corporate’s mining claims. As an early-stage exploration firm, URG will doubtless promote any vital reserves within the U.S. to bigger senior uranium mining corporations. Nonetheless, it owns and operates the Misplaced Creek in-situ uranium facility in south-central Wyoming, which has produced round 2.7 million kilos of U3O8.

Whereas the corporate’s company workplace is in Littleton, Colo., its registered workplace is in Ottawa, Ontario, Canada.

Issue grades run the optimistic to adverse gamut

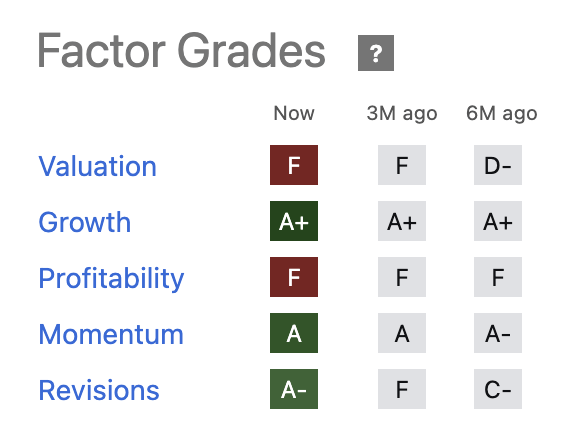

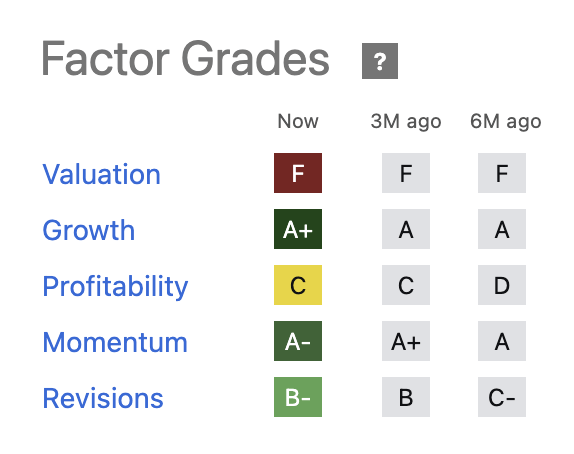

URG’s Looking for Alpha issue grades replicate the volatility and uncertainty of an exploration firm:

URG Issue Grades (Looking for Alpha)

The F valuation rating is a operate of a sizzling speculative uranium market over the previous months versus the speculative nature of an exploration mining firm. The F score in profitability is unsurprising, as exploration corporations make investments vital capital in lots of drill holes with out yield or outcomes. Nonetheless, one success pays for the numerous unsuccessful makes an attempt.

In the meantime, the expansion, momentum, and revisions scores make URG a beautiful however speculative funding alternative.

A speculative inventory with upside within the present surroundings

Uranium is a sizzling market lately. After an over 100% value rise in 2023, Bloomberg lately identified uranium companies have revived “forgotten mines.” With capital flowing into the uranium sector, URG shares have been in a bullish pattern.

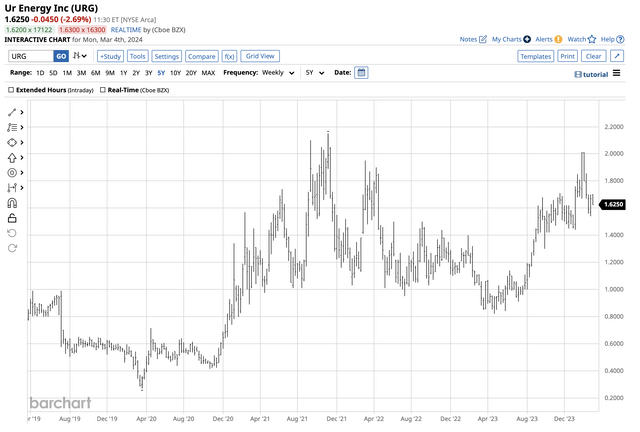

5-Yr Chart of URG Share Worth (Barchart)

The five-year chart highlights after falling to a pandemic-inspired 27.10 cents per share in March 2020, URG shares surged to a $2.15 excessive in November 2021. The shares corrected to an 82.01 cents low in April 2023 and have made greater lows and better highs over the previous months, reaching the $1.62 degree on March 4 after flirting with $2 per share in early February.

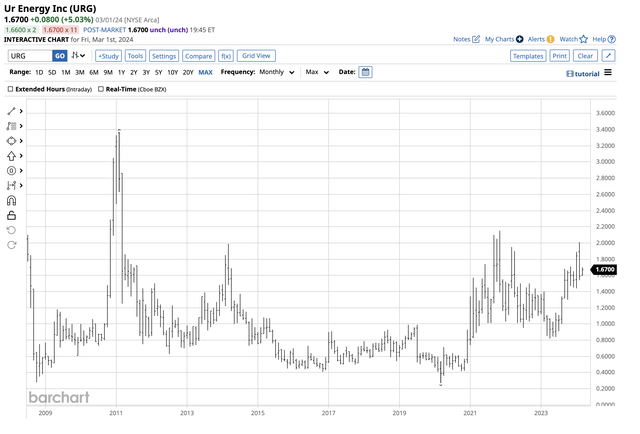

Lengthy-Time period URG Worth Chart (Barchart)

The long-term chart courting again to 2008 reveals URG reached a file $3.37 per share excessive in February 2011. The speculative nature of this exploration firm might trigger a rally to problem the 2011 highs if the uranium market stays on bullish hearth over the approaching months.

Evaluating URG to CCJ – A junior to established senior comparability and suggestion for these lengthy CCJ

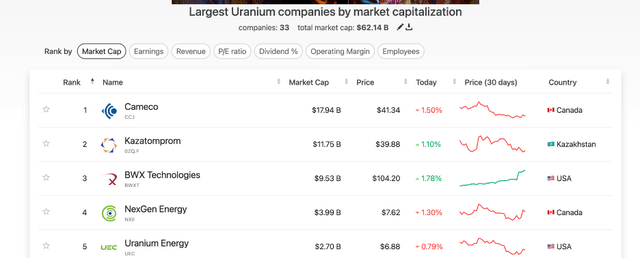

Cameco (CCJ) is the 800-pound gorilla within the sector, because the Canadian uranium mining large is the second-leading worldwide producer with the highest market cap.

Main Uranium Firms by Market Cap (companiesmarketcap.com)

URG’s market cap makes the corporate 18th on the record. In the meantime, evaluating URG’s issue grades to CCJ’s is revealing.

Cameco Issue Grades (Looking for Alpha)

Whereas URG and CCJ obtain an F in valuation, CCJ’s established manufacturing yields a C in profitability. In distinction, URG receives an F. Each corporations obtain the very best A+ grade in progress, whereas URG edges out CCJ in momentum and revisions.

CCJ was buying and selling at just under $41.50 per share on March 4, whereas URG was on the $1.62 degree. URG’s leverage in a market the place uranium stays a sizzling commodity might imply there’s extra upside potential on a share foundation in URG than CCJ shares over the approaching weeks and months.

Leverage is a double-edged sword because it implies that any draw back value motion in uranium might trigger URG to fall additional on a share foundation than CCJ. Nonetheless, because the pattern is at all times your greatest buddy till it bends, I favor URG’s upside potential within the present surroundings.

[ad_2]

Source link