[ad_1]

Monty Rakusen

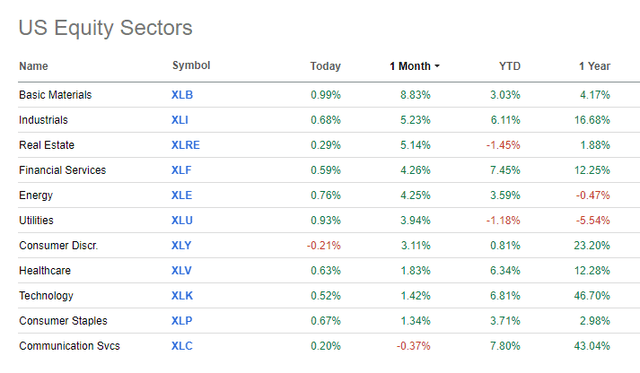

Fast – reply me this: What’s the top-performing S&P 500 sector over the previous month? Perhaps the ETF titling of the article gave it away. Sure, the Supplies Choose Sector SPDR® Fund ETF (NYSEARCA:XLB) garners the highest spot since early February. The ETF which includes large-cap resources-focused firms has been on a heater amid continued sturdy financial development numbers and a waning US Greenback Index. Fears of rates of interest that can be ‘increased for longer’ simply don’t appear to have the identical bearish impression they did at instances in 2023. For XLB and the Supplies area, I assert that this recent bout of momentum augers properly for the month forward.

Thus, I’m upgrading the ETF from a maintain to a purchase.

US Fairness Sector Efficiency: Supplies Leads M/M

Searching for Alpha

For background and in accordance with SSGA Funds, XLB seeks to supply exact publicity to firms within the chemical, development materials, containers and packaging, metals and mining, and paper and forest merchandise industries. Monitoring the S&P 500 Supplies sector index, the fund permits buyers to take strategic or tactical positions at a extra focused degree than conventional style-based investing.

I final wrote about XLB again close to the market lows in March 2023. Whereas the ETF is up 17% whole return since then, it has sharply underperformed the S&P 500, which is increased by 30% (worth solely) over the previous 12 months. Because it stands, XLB is a big fund with greater than $5 billion in belongings underneath administration as of March 5, 2024. Share-price momentum has improved markedly in comparison with simply three months in the past whereas its low 0.09% annual expense ratio needs to be seen favorably by long-term buyers.

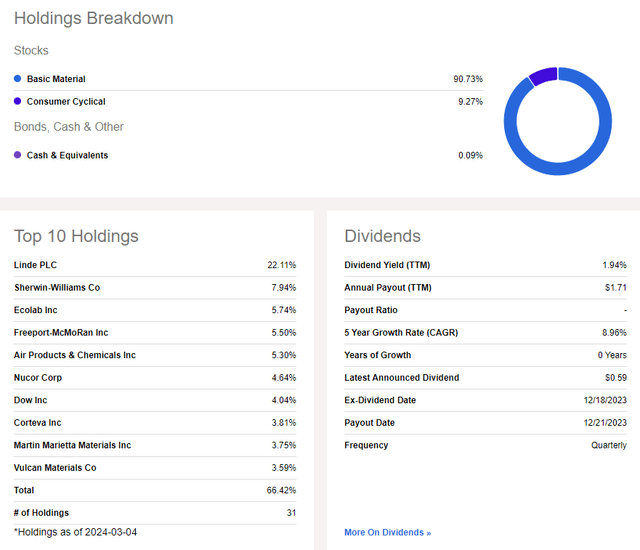

Dividends, in the meantime, should not all that top with the allocation as a complete, however the 1.94% distribution fee is about half a proportion level above that of the SPX. Danger rankings are weak, although, given this cyclical ETF’s risky historical past and a concentrated portfolio. Lastly, liquidity metrics are strong contemplating its excessive common day by day quantity of greater than 900,000 shares and a median 30-day bid/ask unfold of only a single foundation level.

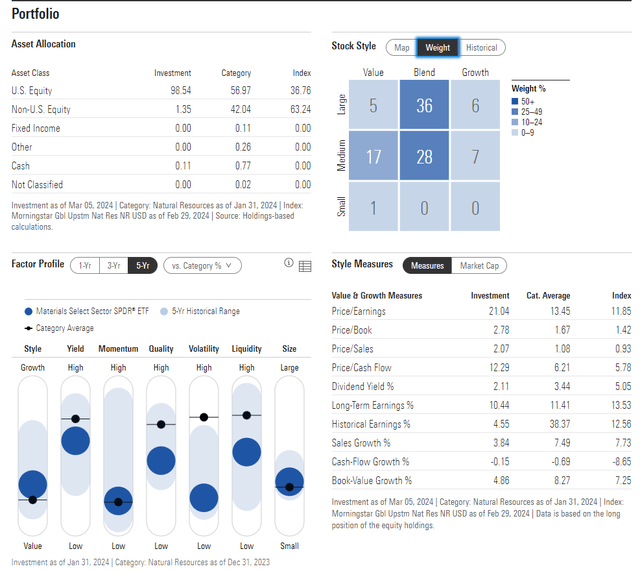

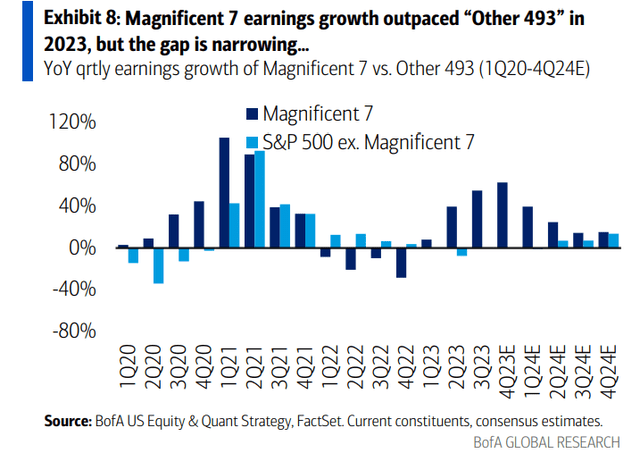

Digging into the portfolio, the 5-star, Bronze-rated fund by Morningstar provides surprisingly excessive diversification throughout the fashion field. Absolutely half of the ETF is taken into account mid-cap with about a good mixture of worth and development, although there’s a slight bent towards the worth fashion. With a ahead price-to-earnings ratio of 21, it doesn’t look like a steal of a deal, however the earnings development within the S&P 500 ought to start to favor areas away from the Magnificent Seven shares, in accordance with strategists at BofA World Analysis.

XLB: Portfolio & Issue Profiles

Morningstar

S&P 500 EPS Development Seen Favoring Shares Away from the Magazine 7 Quickly

BofA World Analysis

What makes XLB riskier than different sector funds is that there’s a greater than one-fifth weighting in a single inventory. Linde plc (LIN) instructions a excessive 22% of XLB. Furthermore, that firm has international headquarters (PLC denotes a UK agency). In all, the highest 10 belongings make up a excessive 66% of the ETF.

XLB: Holdings & Dividend Data

Searching for Alpha

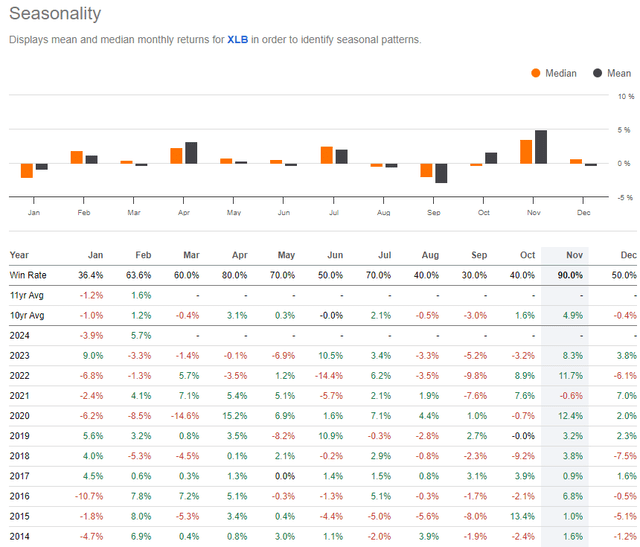

Seasonally, XLB tends to see about flat returns in March, however April is among the many strongest months of the 12 months, in accordance with Searching for Alpha’s Seasonality software. Beneficial properties have traditionally been prevalent from Could via July, too. So, now could possibly be an opportune time to get lengthy shares.

XLB: Bullish Seasonality Forward

Searching for Alpha

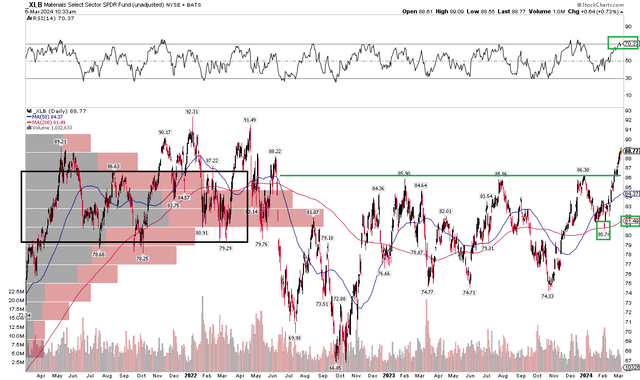

The Technical Take

What nudges me to improve XLB to a purchase is its sturdy momentum as we method the top of the primary quarter. Discover within the chart beneath that the ETF lately broke out from main resistance within the space of $86. The fund had met promoting strain on a trio of events from early final 12 months via the flip of the 12 months. Help was seen simply above $74, making a, name it, $12 buying and selling vary. Given the breakout, we will arrive at an upside measure transfer worth goal utilizing the peak of that sample. Add $12 onto the previous resistance at $86, and the chart would recommend that $98 is within the playing cards.

I feel that’s doable provided that the RSI momentum oscillator on the prime of the graph has confirmed the brand new excessive in worth. What’s extra, check out the long-term 200-day shifting common – XLB held that development indicator line like a champ on a pullback only a few weeks in the past, additional underscoring that the bulls are in cost. Lastly, with a excessive quantity of quantity by worth now beneath the newest share worth, there needs to be ample assist on pullbacks.

Total, I see assist at $86 and have an upside goal of $98 on XLB.

XLB: Bullish Upside Breakout, Focusing on $96

Stockcharts.com

The Backside Line

I’m upgrading XLB from a maintain to a purchase. After months lengthy underperformance, the Supplies slice of the S&P 500 is main equities to the upside.

[ad_2]

Source link