[ad_1]

JHVEPhoto

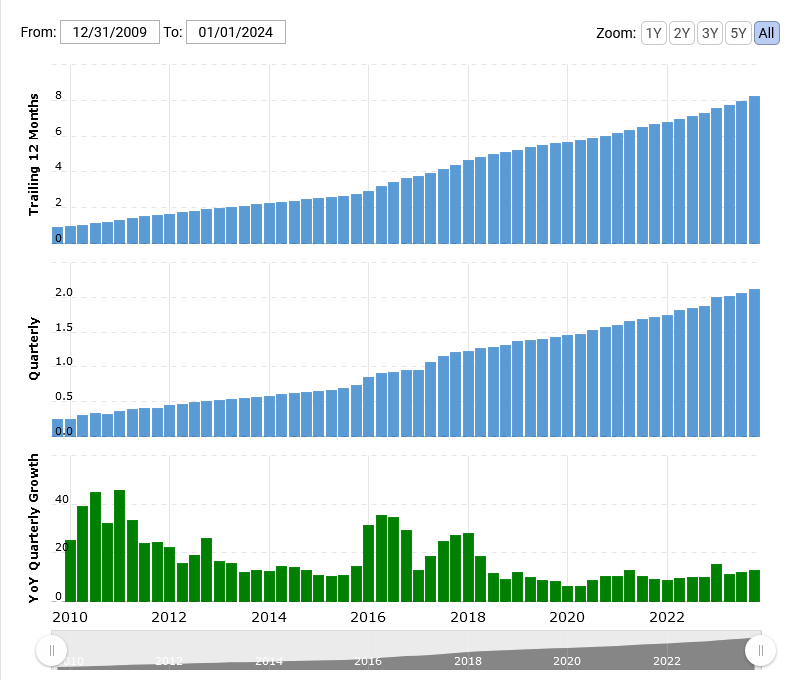

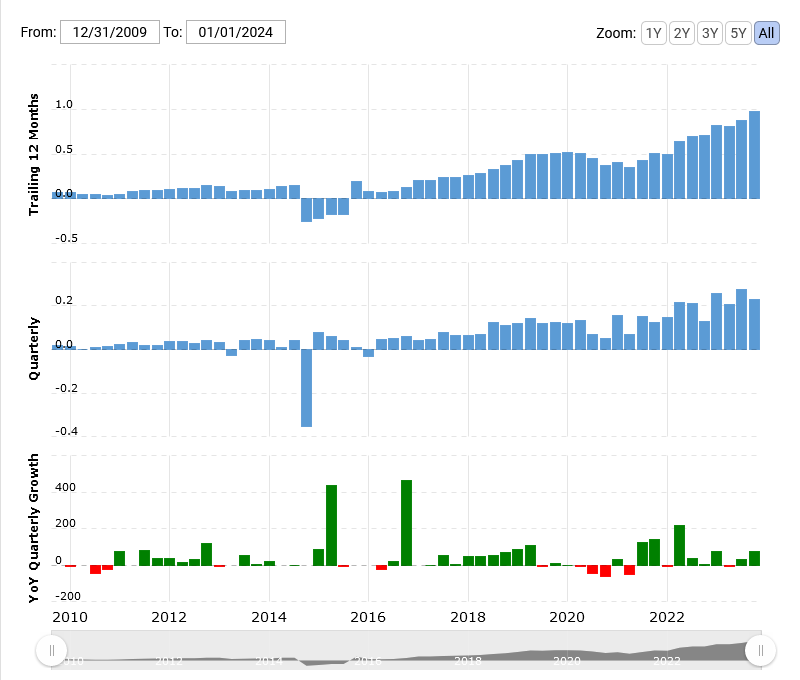

Final month, the world’s main information heart REIT, Equinix Inc. (NASDAQ:EQIX), reported fourth quarter and full-year outcomes for FY 2023. In a earlier article printed in Could, I identified that Equinix had managed to develop the top-line for 80+ uninterrupted quarters, the longest progress streak amongst S&P 500 firms. Fairly naturally, that was the primary line merchandise I used to be concerned with and, fortunately, it didn’t disappoint. Equinix reported This autumn income of $2.11B (+12.8% Y/Y), in-line with the Wall Road consensus, whereas This autumn FFO of $5.54 beat by $0.24. For the total 12 months, annual revenues elevated 13% year-over-year to $8.2 billion, which the corporate attributed to a ‘’…document 90 megawatts of xScale leasing within the fourth quarter, the results of elevated hyperscale demand to help synthetic intelligence and cloud deployments.’’ Equinix reported a surge in demand for hyperscale infrastructure to help AI and cloud initiatives. The corporate completed the 12 months with a complete xScale leasing capability of 300 megawatts globally.

Equinix issued what I take into account a wholesome however, quite conservative, FY 24 steering as follows:

Full-year income $8.793 and $8.893 billion, good for an 8.0% Y/Y enhance over the on an as-reported foundation

Adjusted EBITDA is anticipated to vary between $4.089 and $4.169 billion, good for an 11.5% Y/Y enhance on the mid-point

Adjusted EBITDA margin of 47%, good for a 200 basis-point enhance over the earlier 12 months

AFFO of $3.306 – $3.376 billion, representing 10% progress over the earlier 12 months on each an as-reported foundation

AFFO per Share of $34.58 – $35.31, representing a 9% Y/Y enhance.

The long-term outlook for Equinix and information heart firms usually stays constructive. Final 12 months offered a seismic shift in information heart buildouts with suppliers overwhelmingly shifting their infrastructure funding priorities from normal function computing and storage to AI and accelerated computing infrastructure. Consequently, AI workloads are projected to signify 25% of annual information heart capex by 2028. Morgan Stanley has picked Equinix as one of many firms that would profit as Europe upgrades its information facilities to deal with elevated AI workloads.

BofA Securities’ analysts have described the unfolding phenomenon as a “virtuous funding cycle” for the large names due to synthetic intelligence. World information heart capex is projected to develop at a sturdy 18% CAGR to $200 billion by 2028, of which hyperscalers together with Amazon Inc. (NASDAQ:AMZN), Microsoft Inc. (NASDAQ:MSFT), Alphabet Inc. (NASDAQ:GOOG) and Meta Platforms (NASDAQ:META) will signify practically half. The 4 firms are anticipated to spend $180B on capex in 2024, up 27% year-over-year.

That stated, one factor particularly in Equinix’s newest report caught my consideration: In This autumn, Equinix bought the corporate’s London 8 IBX information heart. Revenues from owned property elevated to 66% of recurring revenues, stepping up 2%, as the corporate continues to progress on possession and long-term management of property.

Lengthy-Time period Management Of Property

Majority of bearish theses on Equinix that I’ve come throughout give attention to the corporate’s lofty valuation, a difficulty I mentioned in my final Equinix piece. EQIX is in no way low-cost: P/ AFFO [FWD] of 25.55 is sort of double the sector’s median at 14.60; P/S of 10.78 vs. 4.40 and EV/EBITDA (TTM) of 34.85 vs. 16.63. In its protection, the valuation hole between Equinix and its friends has been narrowing, whereas its Money per Share studying of $22.18 is incomparable to the sector median at $0.78.

Nevertheless, analysts are inclined to overlook the chance posed by Equinix’s earlier mannequin of leasing a big share of its information heart house from a rising rival, Digital Realty (NYSE:DLR). After a wave of takeovers prior to now few years, Equinix, Digital Realty and Iron Mountain Inc. (NYSE:IRM) have been left standing as the one pure-play information heart firms.

Equinix operates a world community of 260 information facilities, together with 11 xScale builds representing practically 20,000 cupboards of retail and greater than 50 megawatts of xScale capability. Alternatively, Digital Realty manages a community of 314 information facilities, offering 2,352 megawatts of IT load capability in white house and practically 40 million web rentable sq. ft. Equinix leases giant areas from wholesale information heart operators, reminiscent of Digital Realty, then subdivides these into smaller, retail colocation companies to its clients by means of short-term licenses. This manner, the corporate gives the mandatory house, energy, cooling, bodily safety, and connectivity companies for its clients to function and interconnect their IT tools, thus considerably decreasing their prices and complexity.

The connection between Equinix and Digital Realty stretches again a long time, with Equinix at occasions leasing greater than two dozen information heart places from Digital Realty. Sadly, their as soon as symbiotic relationship began exhibiting critical cracks ever since Digital Realty acquired Telx for ~$1.9 billion in October 2015, as digital infrastructure agency Dgtl Infra has famous. Telx offered retail colocation companies similar to these of Equinix, basically positioning Digital Realty as a direct competitor to Equinix. Relations between the 2 firms got here to a head after Equinix filed a lawsuit towards Digital Realty in 2019 over an occupational dispute relating to a 1.1 million-square-foot, 9-story, extremely interconnected information heart situated at 350 East Cermak Highway within the South Loop near Chicago, Illinois. Lengthy story quick: Equinix needed to increase its lease on one of the vital necessary “service accommodations” in all the U.S. primarily based on a Proper of First Provide (ROFO) clause of their settlement, whereas Digital Realty needed to make use of it to develop its rising colocation enterprise. Though the feud was litigated in Digital Realty’s favor in April 2023, it underscores the chance of the 2 firms doing enterprise throughout quite a few information facilities, encompassing commitments totaling over $500 million in lease.

Fortunately, Equinix has been slicing its reliance on Digital Realty, with the corporate at the moment leasing 15 information heart places from Digital Realty, down from 26 in 2020. In the meantime, Equinix has seen a steady lower in its weighted common remaining lease time period (WALT), from ~11 years in 2020 to ~7.5 years at the moment. This sample has a number of explanations:

Digital Realty is forcing Equinix to signal shorter-term leases. Equinix is not concerned with signing longer-term leases.

Both approach, Equinix is more and more relying by itself properties. In its newest report, Equinix revealed that 66% of its recurring income now comes from owned property, up 2 percentage-points Q-on-Q. This minimizes the chance of shedding beneficial house to opponents.

Aside from a average (and considerably anticipated) slowdown in top-line progress, most of Equinix’s key progress metrics stay wholesome. I reiterate my Purchase advice for EQIX.

Equinix Income Development (MacroTrends)

Equinix Web Revenue (MacroTrends)

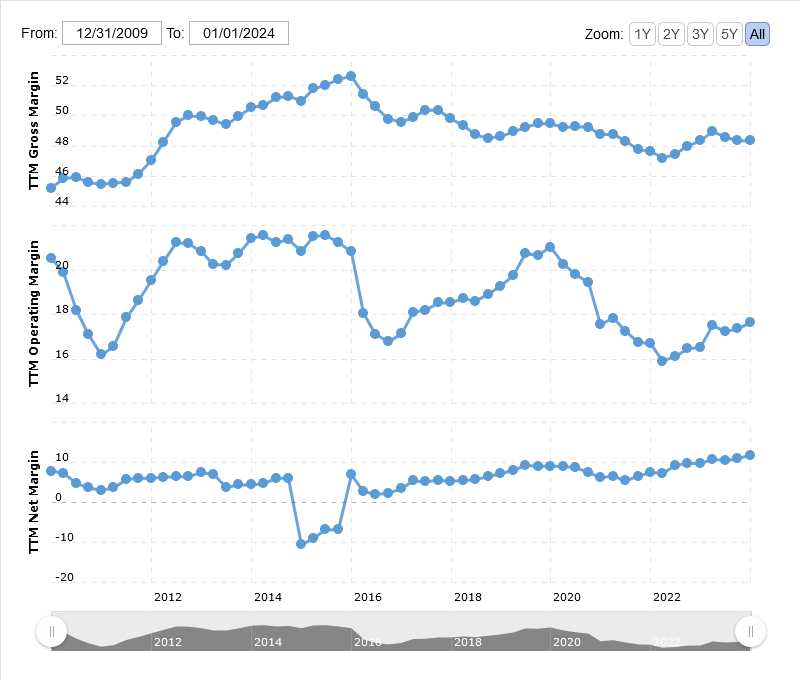

Equinix Revenue Margin (MacroTrends)

[ad_2]

Source link