[ad_1]

The Bitcoin Concern & Greed Index reveals that the sentiment across the asset has cooled off a bit not too long ago, one thing that would pave the best way for a rebound.

Bitcoin Concern & Greed Index Has Gone By means of Some Decline Lately

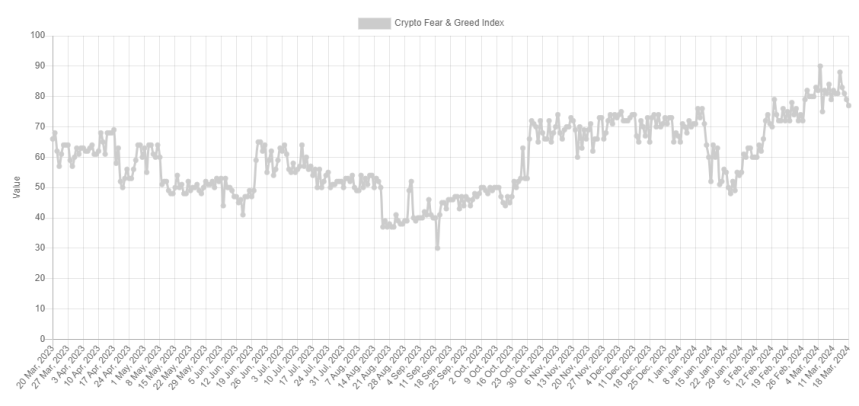

The “Concern & Greed Index” is an indicator created by Different that tells us concerning the common sentiment current among the many traders within the Bitcoin and wider cryptocurrency market

To find out the dealer mentality, the index takes into consideration for these 5 components: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Traits.

The metric makes use of a numeric scale that runs from zero to hundred for representing this sentiment. A rating of 46 or much less implies the presence of concern among the many traders, whereas that of 54 and above suggests greed available in the market.

The territory between these two (47 to 53) naturally corresponds to the impartial mentality. Moreover these three sentiments, there are additionally two excessive sentiments known as “excessive greed” and “excessive concern.”

The intense greed happens at values above 75, whereas the intense concern takes place beneath 25. Traditionally, these two sentiments have been fairly related for BTC’s trajectory.

Tops have usually tended to type when the traders have held the previous sentiment, whereas bottoms have been possible to occur when the market has been within the latter area.

At current, the merchants are holding a mentality of utmost greed, as the most recent information of the Bitcoin Concern & Greed Index reveals.

Seems to be like the worth of the metric is 77 in the mean time | Supply: Different

As is seen, the indicator’s worth is 77 proper now, that means that whereas it’s certainly inside excessive greed, it’s solely so simply. This can be a contemporary change from the way it has been not too long ago, because the chart beneath shows.

The worth of the indicator seems to have been happening not too long ago | Supply: Different

From the graph, it’s seen that the Bitcoin Concern & Greed Index has largely stayed deep inside the intense greed area not too long ago. On the 14th of this month, the indicator hit the 88 mark, and alongside this excessive, the BTC value registered its present all-time excessive of about $73,800.

Since this peak, although, the asset has plunged, and it seems that alongside it, so has the sentiment among the many merchants. As talked about earlier, tops have been extra prone to happen when the market has shared a mentality of utmost greed and this chance has usually solely gone up the extra excessive ranges the metric has hit.

This might maybe clarify why the current high occurred when it did. One other high this month, the one which passed off on the fifth, additionally coincided with excessive values within the Concern & Greed Index (a peak of 90 this time).

Shortly after this earlier peak and the plummet within the cryptocurrency that had adopted, the asset discovered its backside because the metric briefly exited the intense greed area.

Because the Bitcoin Concern & Greed Index is as soon as once more trying to dip outdoors this territory, it’s doable {that a} backside could also be close to for the worth this time as properly. It now stays to be seen if the sentiment would quiet down sufficient within the coming days in order to depart the intense area behind, at the very least briefly.

BTC Value

Bitcoin had plunged in direction of $64,500 throughout the weekend, nevertheless it appears the coin has made some restoration previously day because it’s now again at $68,000.

The worth of the coin appears to have gone via some volatility not too long ago | Supply: BTCUSD on TradingView

Featured picture from Yiğit Ali Atasoy on Unsplash.com, Different.me, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site completely at your individual threat.

[ad_2]

Source link