[ad_1]

PM Pictures

Written by Nick Ackerman, co-produced by Stanford Chemist.

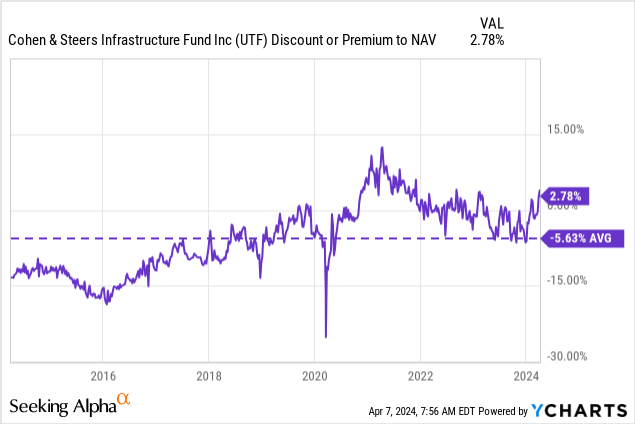

The final time we had been giving Cohen & Steers Infrastructure Fund (NYSE:UTF), it slipped to a gorgeous low cost stage relative to its internet asset worth per share. That made it look extra interesting for traders trying to decide up a place on this fund. Nonetheless, since then, the fund has seen its low cost slim considerably to the purpose the place the fund is buying and selling at a little bit of a premium now. On the identical time, the fund remains to be a stable play to realize some diversified infrastructure publicity and is value holding for the long run.

UTF Fundamentals

1-12 months Z-score: 2.16 Premium: 2.78% Distribution Yield: 7.98% Expense Ratio: 1.39% Leverage: 30.81% Managed Property: $3.08 billion Construction: Perpetual

UTF’s goal is

“whole return, with an emphasis on earnings by way of funding in securities issued by infrastructure firms.” They outline infrastructure firms as those who; “usually present the bodily framework that society requires to perform each day and are outlined as utilities, pipelines, toll roads, airports, railroads, marine ports and telecommunications firms.”

They don’t seem to be restricted to the place they’ll make investments globally or in what a part of an organization’s capital stack. That offers them each geographic publicity and asset class flexibility to take a position the place they see match. The fund additionally employs leverage, which provides to volatility and danger. Nonetheless, it will probably additionally add to the potential upside. When together with leverage bills, the fund’s whole expense ratio climbs to three.97%.

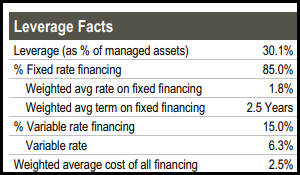

The upper price setting as a result of Fed elevating charges aggressively has negatively impacted leveraged funds that borrow primarily based on floating charges. Luckily, UTF’s administration hedged a majority of their borrowings with rate of interest swaps, primarily locking in mounted charges. The weighted common phrases nonetheless have round 2.5 years, offering a while for the fund when the Fed is anticipated to chop charges.

UTF Leverage Stats (Cohen & Steers)

Efficiency – Misplaced Interesting Valuation

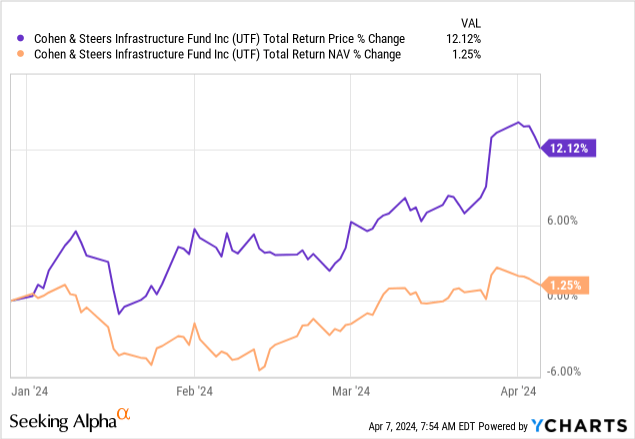

The final replace through which we highlighted the engaging low cost was posted proper at the beginning of the 2024 yr on January 1. Since then, the fund’s whole share worth returns have materially exceeded the fund’s underlying portfolio efficiency.

Ycharts

Thus, the fund has gone from a gorgeous low cost to a stage the place we would not think about including aggressively. The fund could also be a stable long-term funding, however we typically get many higher alternatives so as to add extra aggressively. Actually, in our final replace, the fund’s 1-year z-score was flipped. It was round -2 and is now at 2.16 on the time of writing. The fund has traditionally traded at a reduction, however extra not too long ago, the low cost/premium of this fund has appeared to be extra risky during the last yr or so.

Ycharts

In the end, because of this, we might return right down to a ‘Maintain’ ranking as a substitute of a ‘Purchase.’

On the identical time, the fund’s underlying portfolio might nonetheless carry out nicely with significant publicity to utilities. This sector was slammed by the higher-rate setting, which is why UTF has been struggling to maintain NAV from trending decrease over the previous couple of years. This sector might see the tailwind of decrease charges play out with appreciation. UTF additionally has a smaller sleeve of fixed-income and most well-liked that would additionally see a carry.

It’s extremely anticipated that we’re seeing peak Fed price targets for this cycle, although when the cuts are coming is to be decided. With sizzling inflation and financial knowledge persevering with to return in, these lower expectations and the variety of cuts have continued to be pushed again.

After all, it might play out both method. Ought to inflation begin to run uncontrolled once more and we’d like greater charges, that may put detrimental stress again on this fund. Additional, if charges are lower aggressively, it is doubtless on account of a a lot weaker-than-anticipated economic system. In order that’s the place the “tender touchdown” can be probably the most splendid. If inflation moderates whereas the economic system holds up pretty respectably, we are going to get gradual and measured price cuts. That may actually be the seemingly splendid state of affairs not just for UTF however for many investments on the whole.

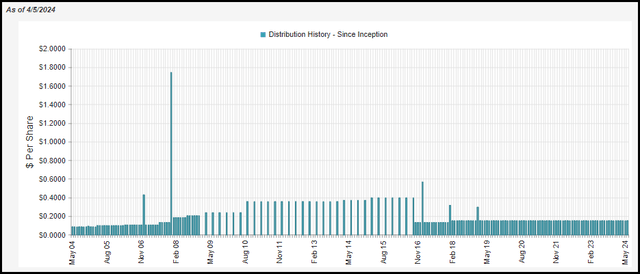

Distribution – Month-to-month Pay

One of many interesting traits of most closed-end funds is the upper distributions that they’ll pay out. For UTF, we’re seeing a distribution of almost 8% for shareholders, however the NAV price is a contact greater as a result of slight premium of 8.18%. On this case, the fund has to earn a bit greater than what shareholders even obtain.

UTF Distribution Historical past (Cohen & Steers)

That may be one other helpful motive to select up a fund at a big low cost as a result of shareholders’ payout can be even greater relative to what the underlying portfolio has to provide.

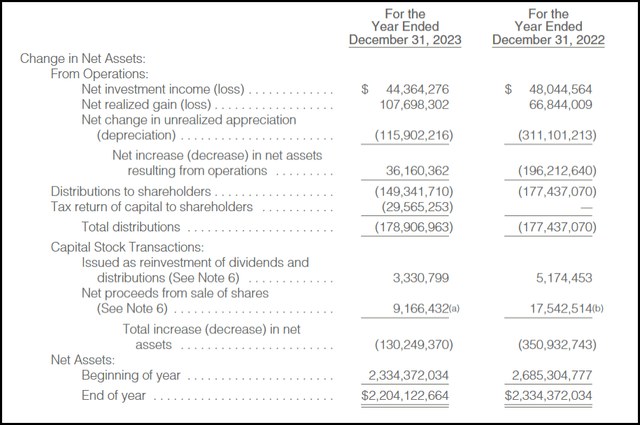

Like most CEFs with heavy fairness publicity, UTF might want to produce capital features to fund most of its distribution. Internet funding earnings coated slightly below 25% of the fund’s distribution in 2023, down some from 27% in 2022.

UTF Annual Report (Cohen & Steers)

That is truly fairly constructive as a result of NII has been materially decrease within the case of another funds primarily based on the rising prices of borrowings.

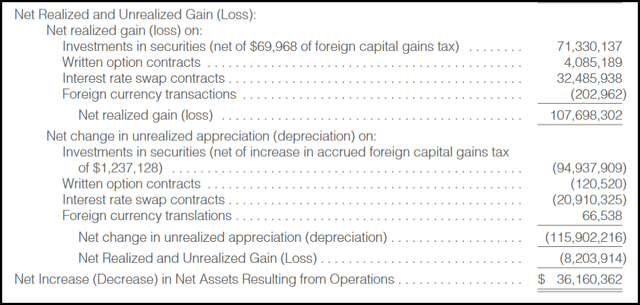

The fund is hedged with rate of interest swaps, however these come within the type of realized/unrealized features/losses. We will see a big $32.486 million was realized from their rate of interest swap contracts.

UTF Realized/Unrealized Positive factors/Losses (Cohen & Steers)

So, with the borrowing prices rising, a fund would typically nonetheless see a fabric decline in NII. Curiosity bills for 2023 for the fund got here to $56.861 million versus the $27.344 million final yr. That is a 107% enhance year-over-year with a distinction of $29.517 million. For UTF, the fund was in a position to largely offset this with greater dividend and curiosity earnings that the fund earned as whole funding earnings rose from $108.527 million to $131.791 million.

One other supply of distribution protection is from writing choices, which can also produce capital features for the fund. That generated one other $4 million in realized features for the fund.

We will additionally see that the fund was in a position to subject some new shares by way of its dividend reinvestment plan and at-the-market providing. For the DRIP, traders obtain as much as a 5% low cost or reinvest at NAV, whichever is greater. This may be carried out when the fund is buying and selling at a premium and might be impartial if shares are offered at NAV or accretive to the fund if offered at a premium.

Distribution – Tax Classifications

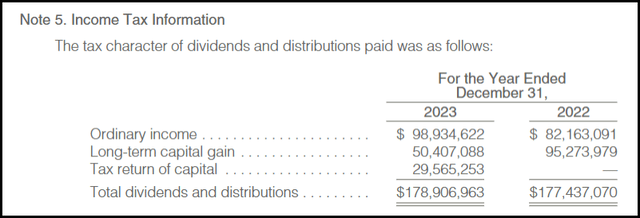

For tax functions, the distribution noticed some return of capital distribution in 2023, however traditionally, the fund has seen largely long-term capital features.

UTF Distribution Tax Character (Cohen & Steers)

Technically talking, the fund’s ROC distributions would have been thought-about harmful for final yr. Nonetheless, on the identical time, the fund had unrealized appreciation embedded within the portfolio, which it might have offered off to create a state of affairs with out ROC distributions. Actually, it was sitting on over $480 million in unrealized appreciation on the finish of final yr.

Nonetheless, typically, it is best to let your winners proceed to run greater and promote your losers, making a state of affairs the place ROC distributions can present up. With vitality firms, MLPs, and a few REIT publicity, ROC distributions may also present up primarily based on these payouts as nicely.

Of the quantity listed as extraordinary earnings, in 2023, all the quantity was thought-about certified dividends.

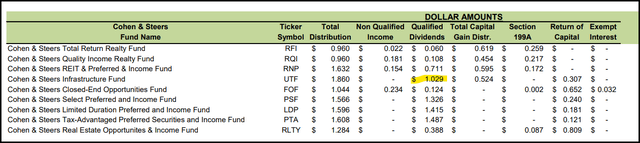

CNS CEF Distribution Tax Breakdown (Cohen & Steers (highlights from creator))

Between the ROC, LTCG, and QDs, it is a slightly, comparatively talking, tax-friendly fund that may very well be acceptable for a taxable account.

UTF’s Portfolio

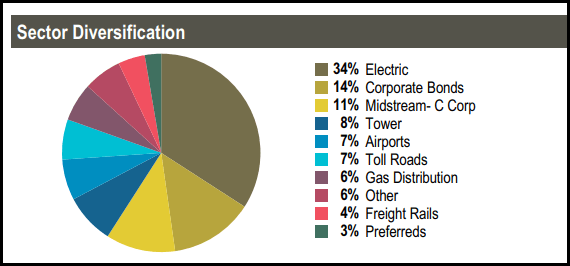

Turnover for the portfolio got here in at 40% for the final yr. UTF carries an total portfolio cut up of 84% allotted to widespread and most well-liked/fixed-income at an allocation of 16%. It is a slight shift from the nearer to twenty% that the fund had been carrying beforehand within the fixed-income sleeve. Although is not a seemingly materials shift given the comparatively smaller sleeve of their fixed-income publicity anyway.

UTF High Sector Weightings (Cohen & Steers)

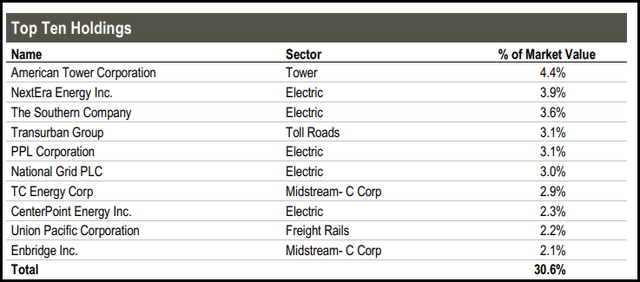

Electrical utilities nonetheless have probably the most vital publicity to the fund, adopted by that fixed-income sleeve. Then, we now have midstream c-corps as a significant weight, with firms similar to TC Power (TRP) and Enbridge (ENB) because the fund’s largest holdings.

Over half of the tower allocation is allotted to that weight due to American Tower Corp (AMT), which is now the biggest holding of the fund. Beforehand, it was the second largest and customarily persistently had a bigger holding for this fund.

UTF High Ten Holdings (Cohen & Steers)

On condition that AMT is hardly projecting any dividend progress for the subsequent yr, will probably be attention-grabbing to see in the event that they maintain holding this place or scale back publicity. That they had beforehand offered an replace that they had been going to hit their dividend progress goal of ~10%, which they’d beforehand acknowledged as their aim in 2023. Nonetheless, the dividend can be lowered heading into 2024 from the earlier quarterly dividend quantity—going from $1.70 again right down to $1.62.

They’re nonetheless hoping to carry it regular in 2024, which might imply a slight enhance from 2023 when wanting on the whole yr. $1.62 annualized comes out to $6.48, which might, the truth is, be greater than the $6.45 paid in 2023. Nonetheless, this REIT was in a position to beforehand maintain a document of elevating nearly each quarter. It is a direct results of the now greater price setting and their want to give attention to preserving a wholesome stability sheet, and we have seen that with internet leverage heading decrease.

I think that they may have simply held the $1.70 by way of 2024, because the projected AFFO payout ratio can be round 65.8%. That may have precipitated a bit much less confusion for traders, and even simply have forgotten about making an attempt to hit the ~10% goal for 2023 and maintain it at $1.62. Both method, I plan to proceed my very own private place in AMT and would even think about including additional. I am additionally not fearful about holding AMT by way of quite a lot of totally different CEFs that I maintain; I feel they may have executed that change a bit higher. Maybe, as I maintain quite a lot of CEFs, I’m nicely conscious of and count on the necessity for “changes” in distributions. Nonetheless, for particular person firms and REITs, something that may seem like a “lower” ought to in all probability be averted.

Conclusion

UTF supplies international publicity to a diversified basket of infrastructure firms. The fund is leveraged, and better charges have meant greater borrowing prices. Fortunately, the fund has been hedged with rate of interest swaps on a majority of its borrowings, which means that the detrimental impression on this fund was considerably minimized. Whereas the fund looks like a stable long-term infrastructure play, I might chorus from including aggressively primarily based on the present premium to the fund’s NAV.

[ad_2]

Source link