[ad_1]

TERADAT SANTIVIVUT

No person can predict if the cycle of acrimonious recriminations between Israel and Iran will cease this week – after the Iranian retaliation for the destroyed Damascus consulate – or whether or not it retains spiraling uncontrolled, which may preserve this market correction going.

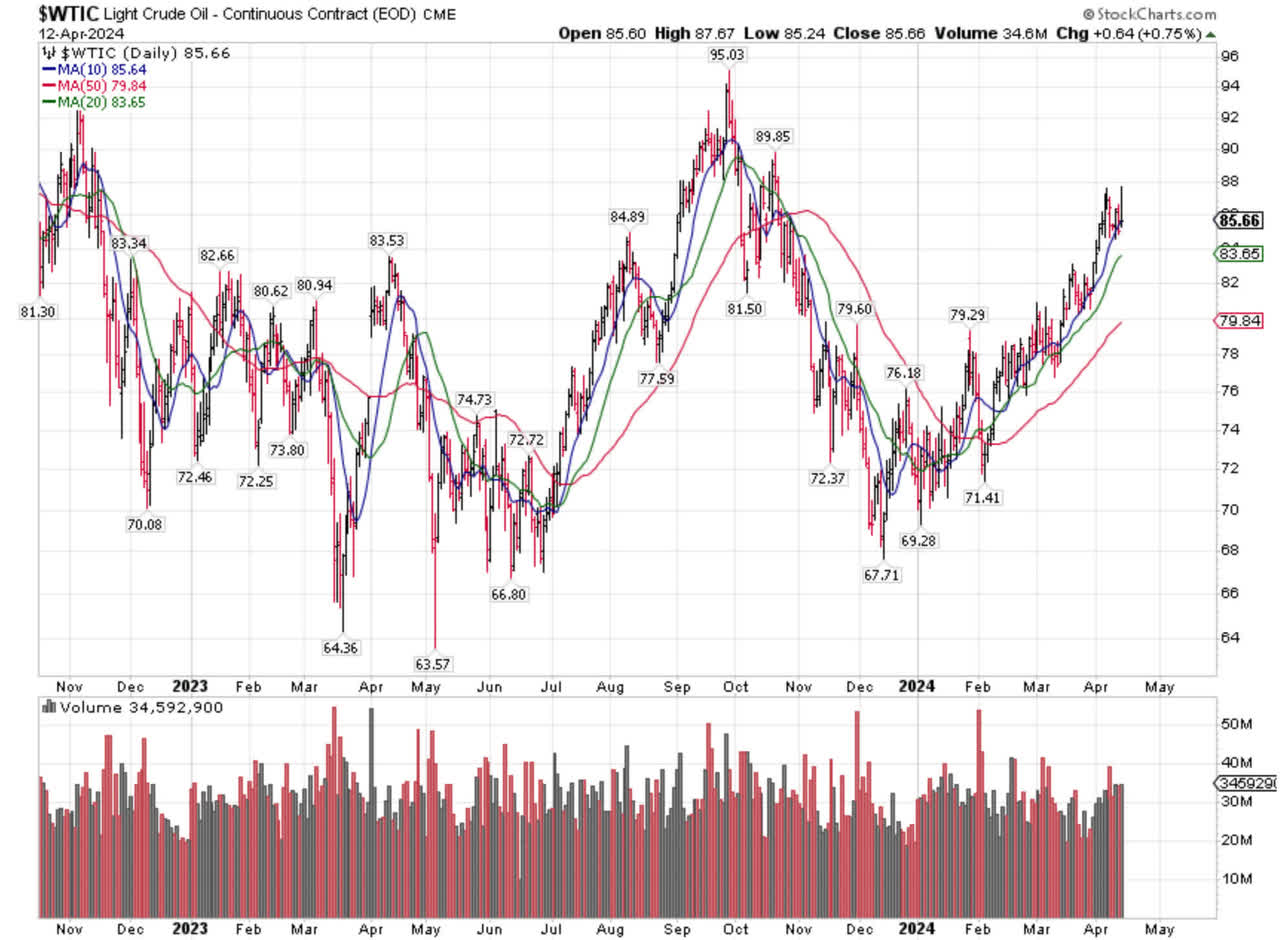

Additional hostilities between Iran and Israel may additionally trigger a spike within the worth of oil that’s certain to rattle world markets. Iran may simply engineer an oil worth spike as a weapon, as they’ve substantial management of the Strait of Hormuz, and I don’t assume any Western authorities, significantly the U.S. in an election yr, needs to see crude oil costs hovering.

Graphs are for illustrative and dialogue functions solely. Please learn vital disclosures on the finish of this commentary.

There’s a seasonality for oil costs, as consumption tends to rise from March to September, since superior economies are concentrated within the Northern Hemisphere, the place spring and summer season months enable extra journey.

Hotter climate also can facilitate an escalation of the conflict in Ukraine, reminiscent of a Russian offensive in Ukraine aiming to capitalize on the Ukrainian ammunition and troop scarcity.

Whereas there’s a probability that the Israel-Iran battle could de-escalate this week, I severely doubt that the conflict in Ukraine will settle down, and two wars escalating will likely be a bit a lot for the worldwide vitality markets.

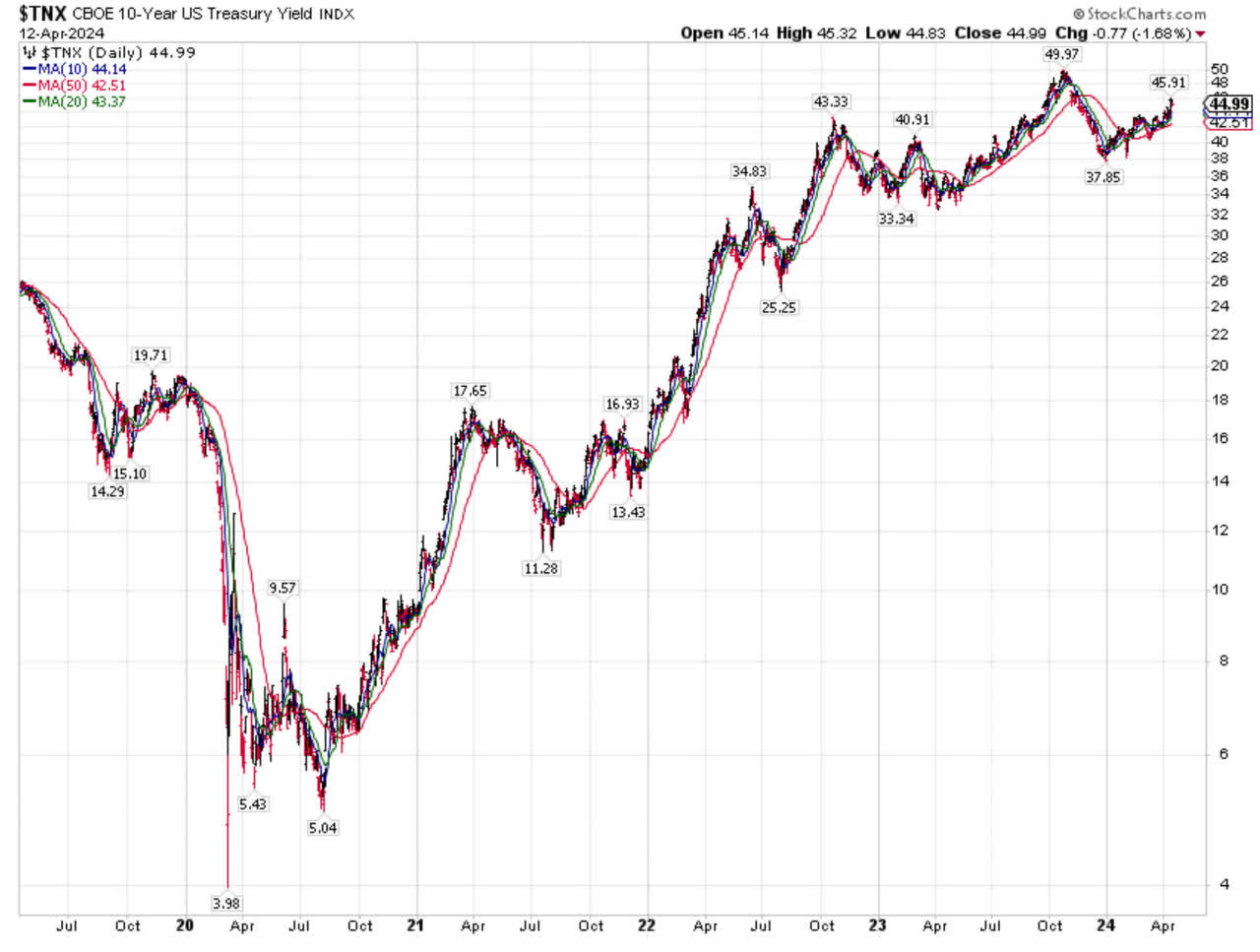

Then now we have Treasury yields, that are approach too agency for a Fed that’s about to chop charges. By the tip of final week, fee reduce chances had decreased dramatically as a consequence of increased inflation reviews.

The issue is that an excessive amount of deficit spending could assist the financial system, however excessive rates of interest choke it off. A ten-year Treasury yield close to 5% won’t be cheered by the market, the identical approach it was unwelcome final October:

Graphs are for illustrative and dialogue functions solely. Please learn vital disclosures on the finish of this commentary.

Final October, a well-known hedge fund supervisor who is thought to be an skilled in futures proclaimed that the Fed had misplaced management of the bond market and, with Treasury yields then close to 5%, the U.S. financial system was more likely to enter a recession in 2024.

However then, Treasury yields backed off, and we had one heck of a “gentle touchdown” market rally and no recession up to now in 2024. Nonetheless, I don’t consider that any rise above 5% on the 10-year Treasury yield will likely be taken in stride by both the financial system or the inventory market.

If one had been to take a look at the chart of the 10-year Treasury yield (above) and never give attention to the file price range deficits – of which there’s a precedent on the finish of World Battle II, when measured as proportion of GDP – one will see a collection of rising lows and rising highs, a traditional uptrend.

An additional examination of this chart would present that the 10-year Treasury yield made a climactic COVID low in 2020, after which it broke out of a pleasant head-and-shoulders backside formation in 2022.

Since then, a cycle of upper lows and better highs is nearly uninterrupted. Any transfer above 5% makes the well-known hedge fund supervisor’s considerations very related, whereas a transfer beneath 3.78% alerts that this cycle of upper lows and better highs is over.

I’m not certain proper now which one will come first.

Disclaimer: Please click on right here for vital disclosures positioned within the “About” part of the Navellier & Associates profile that accompany this text.

Disclosure: *Navellier could maintain securities in a number of funding methods provided to its purchasers.

Authentic Publish

Editor’s Notice: The abstract bullets for this text had been chosen by Searching for Alpha editors.

[ad_2]

Source link