[ad_1]

The query of the day is easy. Are traders coping with one other banking disaster, which poses what is known as “systemic” danger (I.E. Dangers that threaten your entire banking system) or what my colleague Jeff Pietsch, CFA phrases “idiosyncratic” danger – that means dangers which can be particular to every entity concerned.

To make certain, there are some systemic points right here. The dangerous information is that we really feel the first downside that triggered Silicon Valley Bancorp to go below – the truth that SVB did not need to mark-to-market the losses on US Treasury securities – is definitely widespread throughout smaller banks all around the nation.

The excellent news is that this solely turns into an enormous downside (you recognize, the sort of downside the place the federal government must experience in on their white horses) when a financial institution is compelled to promote these securities. In SVB’s case, it was depositors taking their cash out of the financial institution in rapid-fire vogue (the report I learn mentioned that $42 billion in deposits have been withdrawn in a single day!) that prompted them to promote. This, in fact, created capital points. The financial institution then tried to lift capital to cowl. However, shock, shock, nobody was keen to place up the cash. So, bam, similar to that, the financial institution was taken over by California regulators.

Additionally in the excellent news column is the brand new lending program the Fed introduced the Monday after the SVB blowup. Principally, the Fed is making money obtainable to all banks for a interval of a pair years. So… Which means that banks have entry to capital when/in the event that they want it. And in flip, which means troubled banks will not need to promote their securities at a loss and repeat the cycle SVB went by. No, they’ll simply head over to the Fed and borrow the cash.

However… You knew that was coming, proper? Financial institution clients aren’t silly. If a financial institution begins to point out indicators of issues, depositors are nonetheless more likely to pull their money out. And an excessive amount of of this conduct is a nasty factor. Which is why Janet Yellen is making headlines this morning speaking about defending financial institution depositors. In a speech right now, the Treasury Secretary and former Fed Chair says, “Our intervention was vital to guard the broader US banking system, and comparable actions could possibly be warranted if smaller establishments undergo deposit runs that pose the danger of contagion.”

So, if depositors aren’t prone to dropping their cash on accounts over the FDIC insured stage of $250K, then there will not be a purpose for people to drag their cash out en masse. And if there is not a “run” on the financial institution, then it may be argued there is not an instantaneous downside. At the least from the bulls’ perspective, anyway.

The opposite excellent news right here is that the Fed, the federal government, and the regulators have all seen this film earlier than – greater than as soon as! As such, the play e-book is already in place to attempt to “make a cease” and make sure the safety of the banking system.

Nonetheless, on the opposite aspect of the ledger is the concept a banking disaster – irrespective of how giant – is more likely to influence each company and shopper sentiment. As in, all people takes a breath and goes simple on the spending/hiring plans for some time. Oh, and there is additionally the concept one of these mess causes the possibilities of recession enhance right here.

The excellent news is the anticipated slowdown in financial exercise can be disinflationary. Which helps the Fed big-time of their combat towards the evils of inflation. Will the Fed acknowledge this at their assembly right now/tomorrow? We will see. However one factor is for certain, emergency measures to make sure the safety of banks definitely complicates issues for Jay Powell’s merry band of central bankers.

So, as you possibly can most likely inform by now, I see that is an “on the one hand, but alternatively” sort of state of affairs. From my perch, the secret’s to have the ability to perceive each the issues and the way the markets react to the ebb and circulate of the associated information. To this point not less than, my take is that we do not have a “large” systemic downside (suppose S&L disaster and/or the Nice Monetary Disaster of 2008) on our palms.

However with the Ate up faucet tomorrow, it is going to be VERY fascinating to listen to their tackle all of this. Keep tuned, this can absolutely be fascinating!

Now let’s evaluation the “state of the market” by the lens of our market fashions…

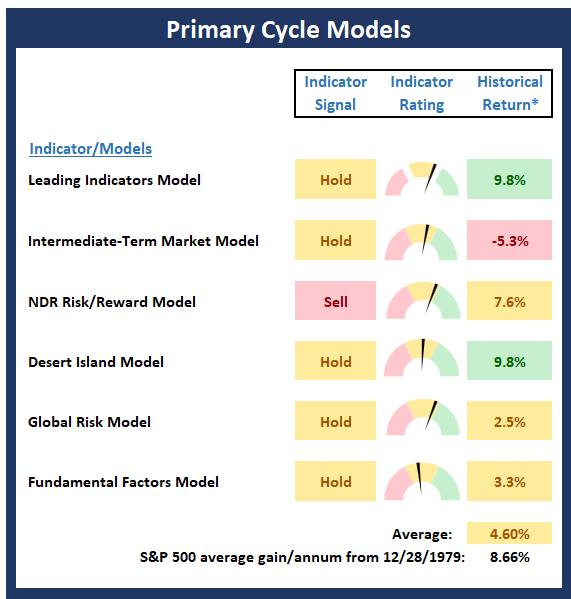

Major Cycle Fashions

Beneath is a bunch of big-picture market fashions, every of which is designed to determine the first pattern of the general “state of the inventory market.”

Major Cycle Fashions

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

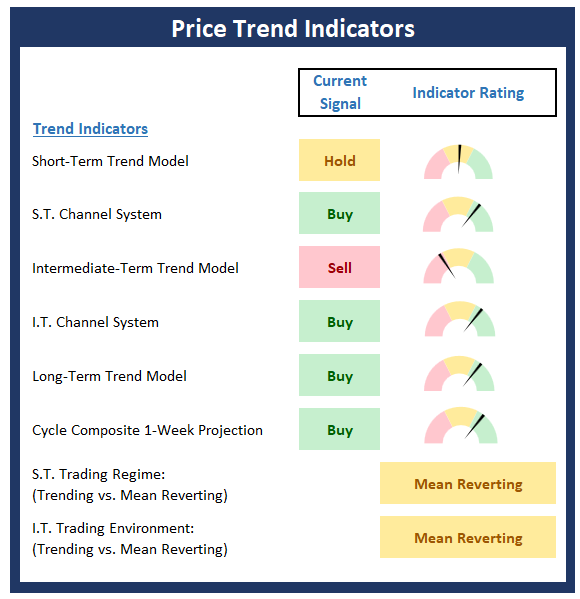

Pattern Evaluation

Beneath are the scores of key worth pattern indicators. This board of indicators is designed to inform us concerning the general technical well being of the market’s pattern.

Value Pattern Indicators

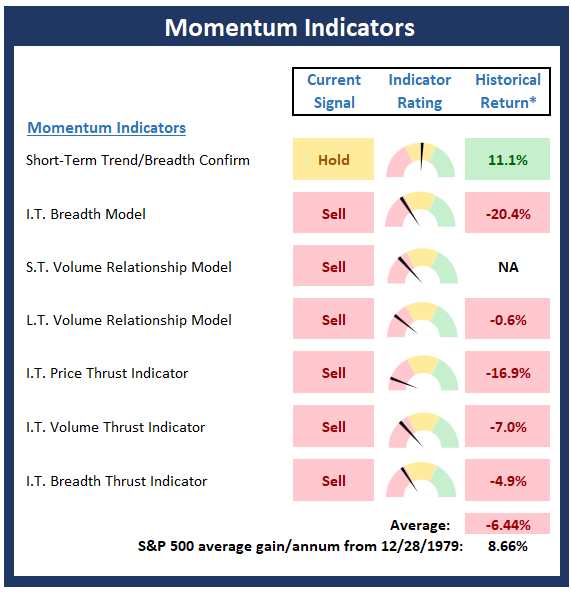

Market Momentum Indicators

Beneath is a abstract of key inside momentum indicators, which assist decide if there’s any “oomph” behind a transfer out there.

Momentum Indicators

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

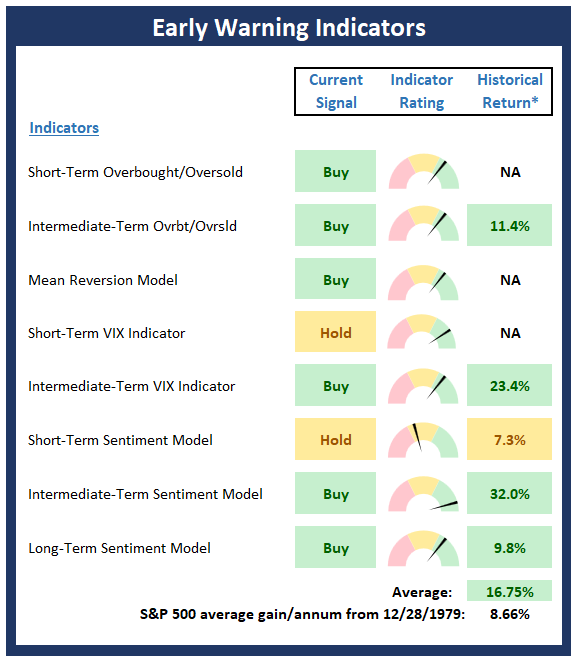

Early Warning Indicators

Beneath is a abstract of key early warning indicators, that are designed to recommend when the market could also be ripe for a reversal on a short-term foundation.

Early Warning Indicators

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

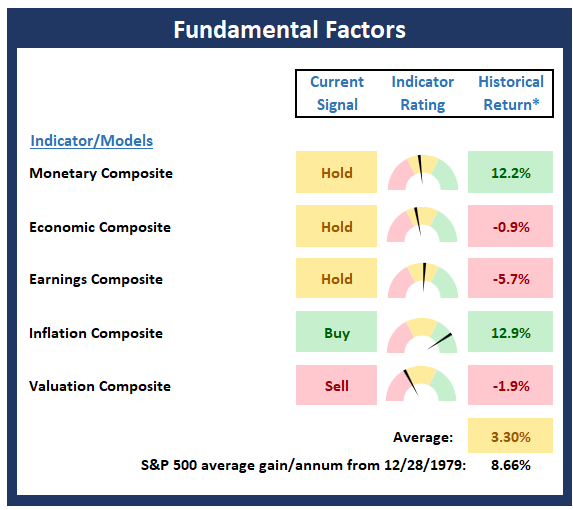

Elementary Issue Indicators

Beneath is a abstract of key exterior components which have been recognized to drive inventory costs on a long-term foundation.

Elementary Elements

* Supply: Ned Davis Analysis (NDR) as of the date of publication. Historic returns are hypothetical common annual performances calculated by NDR.

Thought for the Day:

When robust winds blow, do not construct partitions, however slightly windmills -Nassim Taleb

Wishing you inexperienced screens and all one of the best for an important day,

***

Disclosures: On the time of publication, Mr. Moenning held lengthy positions within the following securities talked about: none – Word that positions could change at any time.

[ad_2]

Source link