[ad_1]

JacobH

There’s no query that 2022 was a great 12 months for Denison Mines Corp. (NYSE:DNN). The corporate made significant progress in testing in-situ restoration (“ISR”) processes within the Athabaskan soil, and, within the course of, considerably de-risked its Phoenix Venture. Administration additionally just lately introduced that buyers ought to anticipate to see the discharge of Denison’s Feasibility Examine (‘FS’) within the first half of 2023.

That occasion shall be key as it should present a lot wanted price and timeline updates to Denison’s 2018 PFS targets, a few of which administration has already indicated won’t be met. This can be one of many the reason why, utilizing some measures, Denison shares at the moment commerce at a deeper low cost than different builders within the Basin. On this article, we’ll talk about how the FS could impression Denison’s share value.

Firm Background

As mentioned in a earlier article, Denison is at the moment targeted on creating its Wheeler River property. The venture is slated to return on-line in two phases with the primary, named Phoenix, using the lower-cost ISR technique to be adopted by the second section, named Gryphon, which can use standard underground mining strategies.

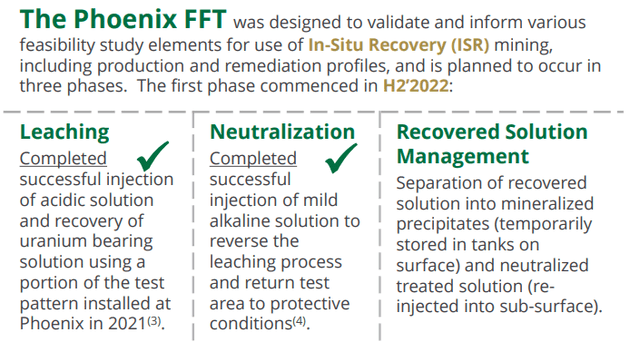

The corporate intends to be the primary uranium miner to make use of ISR on Canadian soil, and within the Fall of final 12 months introduced that it had efficiently accomplished two out of the three steps mandatory to take action. It’s at the moment engaged on the third step, outlined under, which needs to be accomplished by mid-year.

Steps within the ISR Course of (Investor Presentation)

Valuation

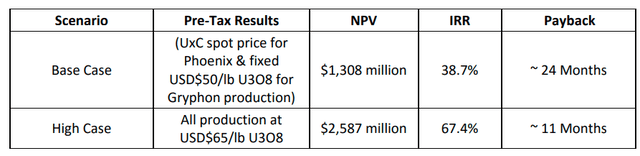

The mixed two phases of the venture are anticipated to provide 109.4Mlbs of U3O8 over a 14-year mine life, and the 2018 PFS listed the venture’s Base Case pre-tax IRR at 38.7% with a CAD$1.3 billion NPV8% (~US$956 million utilizing a 1.36 USDCAD trade price). Now granted, that may be a pretty modest sum which doesn’t present a lot upside when in comparison with Denison’s present enterprise worth of $771 million.

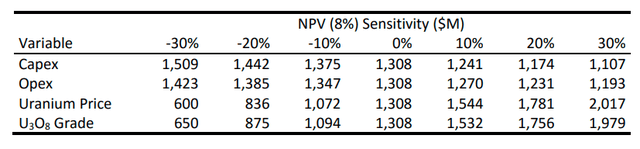

Nonetheless, it needs to be famous that the bottom case makes use of a $43.92/lb common value for its uranium. And provided that U3O8 at the moment trades within the $50/lb vary and yellowcake’s value has not traded under $45/lb for over a 12 months, that value assumption is starting to look considerably conservative. The PFS additionally included the next sensitivity evaluation which might lead buyers to deduce that at present costs Denison’s NPV8% can be just under CAD$1.7 billion, or about US$1.25 billion, enhancing its valuation to 0.62 NPV.

Prefeasibility Examine

However that is the place one’s view of present and future uranium costs comes into play. That’s as a result of Denison’s PFS additionally lists a “Excessive Case” situation utilizing a $65/lb value during which case the NPV8% is available in at CAD$2.6 billion, or about US$1.9 billion, giving the inventory a present valuation of about 0.4 NPV.

Denison Prefeasibility Examine

On a relative foundation, Denison’s valuation additionally appears like it could have some upside. Granted, its Enterprise Worth per Pound (‘EV/lb’) of $6.15 is priced considerably greater than that of third-tier participant Uranium Vitality Corp. (UEC), which boasts a really low-cost EV/lb of $4.98. Generally although, issues are low-cost for a motive.

But when as an alternative we evaluate Denison to a top-tier developer equivalent to NexGen Vitality Ltd. (NXE), which has an EV/lb of $6.73, then Denison’s inventory begins to appear like considerably of a cut price. As a way to current a extra conservative image, these numbers use solely the Measured and Indicated Sources and, within the case of Denison, use solely the Wheeler River numbers, excluding its different small properties.

The distinction between the 2 grows even bigger after we contemplate their Whole Acquisition Value per Pound (‘TAC/lb’). Right here, Denison costs considerably decrease than NexGen with a TAC/lb of $18.12 relative to NexGen’s a lot greater $21.89.

However therein lies the danger.

Danger

The Whole Acquisition Value is calculated by including the Enterprise Worth, projected Capex price, and All-In Sustaining Prices (‘AISC’). That quantity is then divided by the Reserve dimension to get the per pound quantity. And each Denison’s Capex and AISC numbers are beginning to be lengthy within the tooth as these projections have been made as a part of its 2018 PFS. For sure, a lot has modified on the planet over the last 5 years.

It due to this fact is smart that the market can be discounting the inventory till it will get better readability with reference to the venture’s prices. Capex and AISC are nearly sure to extend when the Feasibility Examine is launched, however the query is by how a lot? Given the elevated inflation charges of the previous few years, the market could tolerate a 20% or 30% enhance in projected prices however could also be much less forgiving of numbers considerably above that.

Nonetheless, there is no such thing as a manner of actually realizing, and this uncertainty is more likely to overhang the inventory till the FS is launched.

Takeaway

I proceed to consider that Denison’s inventory has robust potential, however I lower my ranking from Sturdy Purchase to Purchase as I anticipate better price and timeline readability from the Feasibility Examine. And whereas I do not suppose it very seemingly that uranium costs will surge to $100/lb anytime quickly, I can positively see costs rising to the $65/lb vary by the center a part of this decade, and for these causes I proceed to carry the inventory.

[ad_2]

Source link