[ad_1]

JHVEPhoto

Invesco (NYSE:IVZ) is a worldwide funding and asset administration agency with over 8,400 staff throughout 26 international locations.

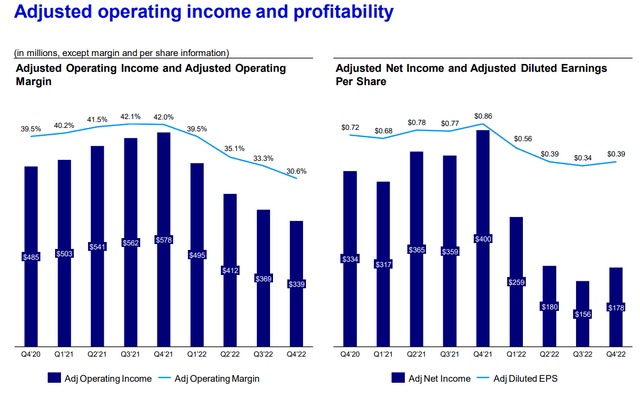

With over $1.4tn in AUM, the corporate recorded $5.92bn in 2022 revenues alongside $1.32bn in EBITDA at a 22% margin.

Introduction

At scale, Invesco principally derives earnings from charges; Funding Administration charges accounted for $4.36bn of working revenues; Service and Distribution charges accounted for $1.41bn; and Efficiency charges encompassed $68.2mn.

Invesco Annual Presentation

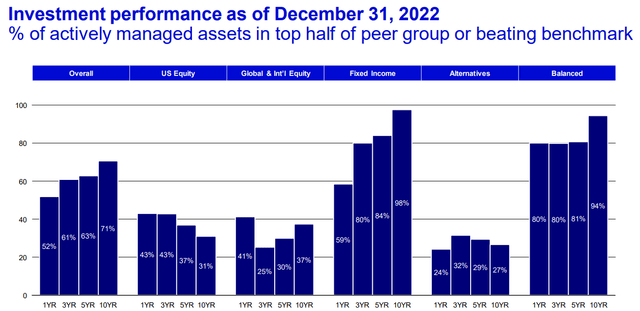

To assist guarantee buyers are given worth, Invesco has dedicated itself to a various asset combine and portfolio.

Valuation & Financials

Common Overview

As mentioned in abstract, Invesco’s 1Y development sharply contrasts that of the S&P500 (SPY) and the capital markets index.

Invesco (Darkish Blue) vs Opponents (TradingView)

Although this displays market sentiment on the power of capital markets, I consider Invesco has skilled an exaggerated worth decline, with the market neglecting Invesco’s potential to fight the eminent crises.

Comparable Firms

The asset administration business is pushed by actors with massive AUMs starting from the most important and institutionally oriented, BlackRock (NYSE: BLK), to friends like State Avenue (NYSE: STT) and Franklin Sources (NYSE: BEN), to banks resembling UBS (NYSE: UBS).

barchart.com

As demonstrated above, Invesco has trailed its friends in asset administration in current, 3-month worth efficiency. Manifesting what I consider is a steep undervaluation, Invesco sustains a mid-range ROA and revenue margin whereas sustaining the second-best worth, when evaluating P/E multiples.

Whereas Invesco does have a decrease revenue margin than friends, this solely serves to replicate Invesco’s concentrate on AUM development and the following charges hooked up to it. In distinction, unfavourable EPS development solely highlights the reliance on retail buyers for the corporate; since retail buyers are extra delicate to market swings than establishments, this places downward stress on Invesco’s earnings in my opinion.

Valuation

Based on my discounted money circulation mannequin, at its base case, Invesco’s honest worth is $19.92, up 21% from at present’s worth of $15.77. My mannequin assumes a reduction fee of 8%, much less intensive than the benchmark WACC of 10% owing to a stronger cap construction in addition to superior monetary place.

AlphaSpread

Moreover, Alpha-Unfold’s multiples-based valuation instrument helps the thesis of basic market underpricing, with Invesco presupposed to be undervalued by 50% and a good worth of $31.79. This hyper-undervaluation underscores Invesco’s superior multiples with regard to P/OCF, EV/FCFF, and EV/EBIT.

Thus, taking a imply of my DCF and AlphaSpread’s relative valuation, Invesco has a base upside of 35.5%, with a good worth of $23.78.

Underlying Strengths and Underpricing Help Progress

Regardless of macro headwinds, Invesco has managed to keep up optimistic web inflows in its portfolio. That is owing to a excessive diploma of AUM diversification – in reference to geographic, channel, and asset lessons – along with the flexibility to successfully allocate given capital.

Invesco Annual Presentation

Furthermore, the final company technique of the agency – to develop AUM and consequently help fee-related profitability – has been efficiently and persistently pursued; Invesco has skilled a 7.8% CAGR throughout their whole AUM since 2016.

Invesco Annual Presentation

Whereas the elevated prominence of the wealth impact and retail investing crowd in recent times has jettisoned Invesco’s ETF-heavy product combine, it has additionally led to the market relating Invesco’s worth motion to retail investor sentiment; as such, Invesco has skilled worse worth declines relative to friends. Nevertheless, the corporate’s monetary outcomes rebuke this principle of retail dependency, and whereas there was a cloth unfavourable influence from decreased retail investor exercise, I consider the market has overreacted and thus, total, underpriced Invesco.

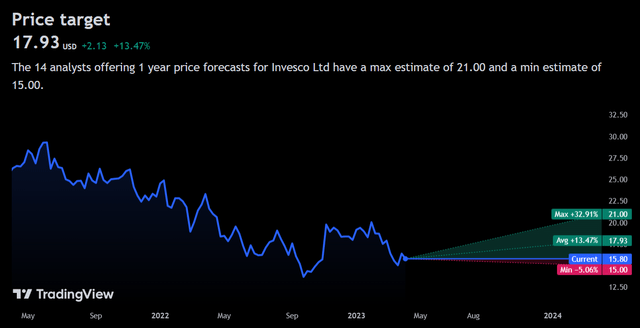

Wall Avenue Consensus

Institutional analysts seem to largely echo my optimistic view of the corporate; at its base case, Invesco is projected to expertise a 1Y worth enhance of 13.87% to $17.93.

TradingView

And regardless of the turbulence monetary establishments particularly face these days, analysts largely consider that the worst has blown over for Invesco and its worth has largely bottomed out, projected a minimal worth lower of -5.06%, with comparatively low implied volatility to the earlier 12 months.

Dangers

Retail Sentiment Represents a ‘Double-Whammy’

Though, as aforementioned, retail investor sentiment doesn’t adequately and completely signify Invesco’s total monetary outcomes, it has so far within the eyes of a lot of Invesco’s shareholders. In consequence, past the loss from decreased retail exercise, poorer retail investor sentiment could result in unfavourable share-price motion as properly.

Third-Social gathering Threat is Paramount

As a monetary establishment foremost, Invesco is uncovered to shifts in each capital provisions in addition to asset high quality. Due to this fact, the asset supervisor depends on a bunch of companions and downstream and upstream events to help its enterprise. Macroeconomic impacts, regulatory shifts, and many others. affecting both can have materials penalties for Invesco.

Margin Compression Might Speed up

Principally, Invesco depends on an reasonably priced and accessible product combine to drive client engagement. This has, nevertheless, led to decrease margins relative to friends. And in an surroundings whereby affordability is vital and with larger-scale rivals, Invesco could also be pressured to additional scale back charges so as to meet competitors. In the end this could result in diminishing profitability.

Conclusion

Within the quick time period, I anticipate that Invesco’s basic undervaluation will likely be alleviated and a reversion to the imply multiple-based inventory worth goal of the business will happen.

In the long run, particularly as macro situations enhance, I anticipate Invesco’s mass-market technique to proceed to yield rewards and allow future margin growth.

[ad_2]

Source link