[ad_1]

ZU_09

With one of the crucial beneficial pure gasoline pipeline programs within the nation in Transco and a sexy valuation, Williams Corporations (NYSE:WMB) appear to be a sexy inventory at present ranges.

Firm Profile

WMB is a diversified midstream operator. It owns interstate pure gasoline pipelines; gathering, processing and treating belongings; NGL advertising providers, and crude oil transportation and manufacturing dealing with belongings.

The corporate operates in 4 segments. Its Transmission & Gulf of Mexico phase consists of its giant interstate pure gasoline pipelines Transco, Northwest Pipeline, and MountainWest, in addition to associated pure gasoline storage amenities. The phase additionally consists of pure gasoline gathering and processing and crude oil manufacturing dealing with and transportation belongings within the Gulf Coast area.

WMB’s Northeast G&P phase consists of its pure gasoline gathering, processing and fractionization belongings within the Marcellus and Utica shales. Its West phase, in the meantime, includes its pure gasoline gathering, processing and fractionization belongings within the western U.S. The phase operates within the Rocky Mountain area the Barnett Shale, the Eagle Ford Shale, the Haynesville Shale, and the Mid-Continent area, together with the Anadarko and Permian basins.

WMB lately closed the acquisition of MountainWest in February. The deal added about 8 Bcf/d of transmission capcity and 56 BcF of storage. The deal was finished at about an 8x a number of.

Alternatives & Dangers

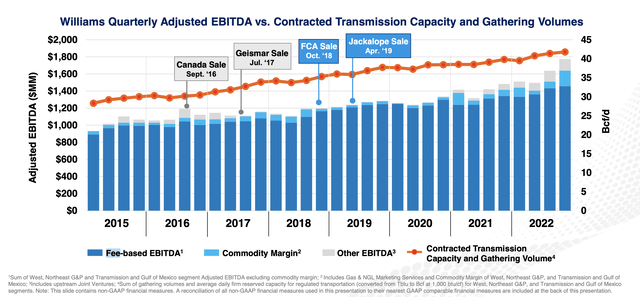

WMB is a big midstream operator that handles a few third of the pure gasoline manufacturing within the U.S. The corporate is predominately fee-based and the majority of its contracts come from demand-pull clients. So, whereas WMB does face some worth and quantity threat, these are the kind of contracts and buyer base a midstream firm would need for stability.

Firm Presentation

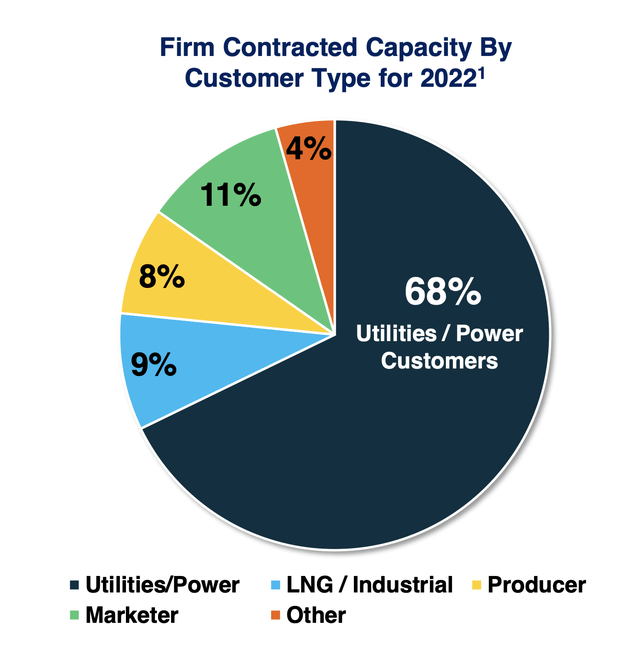

Over two-thirds of WMB’s clients are utility and energy firms, which is essentially the most secure buyer a pure gasoline transmission firm can have. Solely 8% of its contracted capability comes from producers.

Firm Presentation

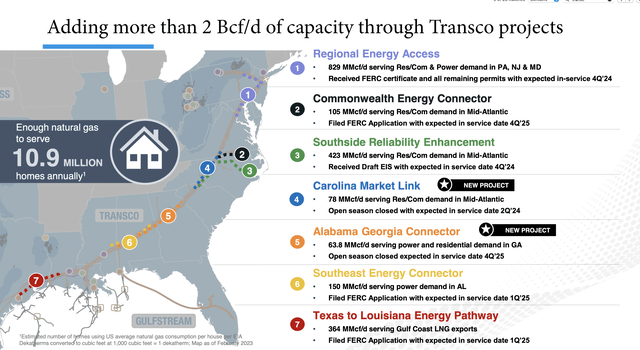

WMB’s Transco System is arguably essentially the most beneficial pure gasoline pipeline system within the U.S. In 2022, Transco accounted for a whopping 31% of WMB’s $6.4 billion in EBITDA. Between 2019-2022, the corporate was ready so as to add $380 million in fully-contracted fee-based income to the system by means of numerous initiatives. Even higher, the system continues to have a whole lot of development forward of it.

WMB at present has 7 Transco initiatives underway, which might add greater than 2 Bcf/d day of capability to the system. Anticipated in service dates are between Q2 2024 and This autumn 2025, so these initiatives shall be accretive in later years.

Firm Presentation

After all, developing interstate pipelines within the Northeast comes with dangers, simply ask Equitrans (ETRN) and the problems it has had making an attempt to get its Mountain Valley Pipeline up and operating. That pipeline started being constructed in 2018, however authorized and environmental points have saved the final 20 miles from being constructed on the 303-mile system. Nevertheless, WMB lately famous at its analyst day that FERC is altering the best way it evaluates initiatives and is requiring an environmental affect assertion, which bodes properly for the business.

Discussing its Transco alternatives at its analyst day, COO Michael Dunn stated:

“The Mid-Atlantic on Transco goes to be an amazing development engine for us. And if you concentrate on what occurred there throughout Winter Storm Elliott, the utilities had been actually shocked concerning the demand that occurred on the pure gasoline utility foundation there and the electrical era that was required. They’d a fairly vital margin of error there. It was about 10% miss on the electrical energy demand based mostly on the precise temperatures and wind that they noticed. That may be a vital miss while you’re excited about planning on your peak days. And I believe that is going to have a few of the utilities there rethinking their peak day eventualities and, as you heard Alan speak about, what they’re excited about from their capability margins that they need to have on the market and able to go and out there. In order that’s going to actually bode properly for us establishing new capability into that area. After which the LNG footprint within the Gulf Coast goes to be one other development engine for us on the Transco system.…

“We have now 7 there proper now or quickly to be 7 with the two new ones that you simply see right here on the listing. And so I am extremely assured in our workforce’s potential to execute initiatives. And I am even rather more assured now concerning the potential for us to obtain permits from the FERC with the place I’ve seen just a little little bit of a change in posture from the FERC. So very optimistic about these modifications. I am going to speak extra about REA right here in a second, however our 2 new initiatives, our Carolina Market Hyperlink and the Alabama Georgia Connector, these are initiatives serving residential, industrial and energy era within the Mid-Atlantic and Southeast. And as I stated, there are big alternatives for the Transco group. And I’m extremely excited concerning the alternatives that we’re taking a look at in our backlog in the present day.”

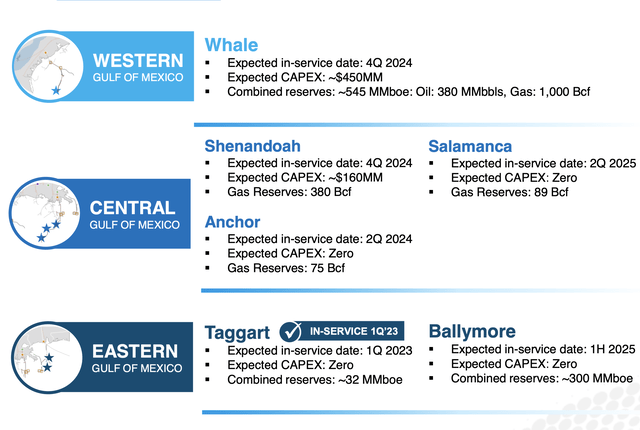

Outdoors of Transco, the corporate is concentrating on the Gulf of Mexico as a development driver. It at present has 6 deepwater GOM initiatives underway, lots of which require no preliminary CapEx from WMB. It’s anticipating its GOM adjusted EBITDA to double because of these initiatives by 2025.

Firm Presentation

General, WMB has proven an important return on its development initiatives. From 2019-2022 it has a 17.5% return of invested capital. That has helped improve its adjusted EBITDA by practically $1.6 billion from 2019 to 2023 (estimated).

Regardless of the variety of development initiatives WMB is engaged on, like many midstream firms, WMB’s main focus has been on strengthening its stability sheet over development. The corporate has taken its leverage from 4.8x in 2018 down to three.55x on the finish of 2022. Over the identical time interval, its grown its dividend from $1.36 to $1.70. In the meantime, its dividend protection ratio was a strong 2.37x for 2022. WMB is trying to develop its dividend by over 5% in 2023.

General, these metrics present a disciplined midstream operator that is ready to pursue enticing development initiatives, hold its stability sheet sturdy, and develop its dividend. That’s usually what income-oriented buyers wish to see in these firms.

Valuation

Turning to valuation, WMB trades at 8.6x the 2023 EBITDA consensus of $6.58 billion. Primarily based on the 2024 EBITDA consensus of $6.72 billion, it’s valued at 8.4x. In case you alter for the MountainWest acquisition, it might increase the a number of to about 8.8x and eight.6x, respectively.

The inventory has a sexy free money stream yield of about 11.8% based mostly on my 2023 projections calling for $4.25 billion in FCF. The inventory has a yield of about 6%. As such, the dividend could be very properly lined and has loads of room to develop.

WMB trades in the midst of the place different giant midstream operates are at present buying and selling.

WMB Valuation Vs Friends (FinBox)

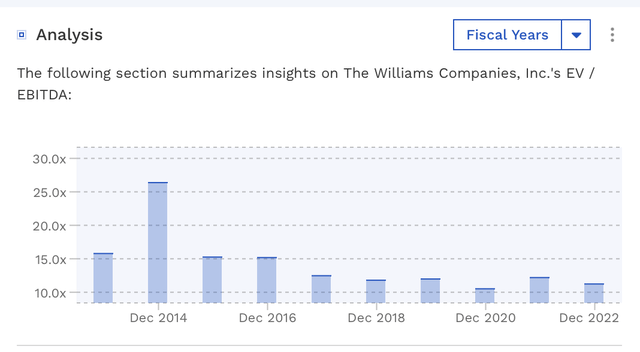

It trades at a a lot decrease a number of than it did pre-pandemic.

WMB Historic Valuation (FinBox)

Conclusion

WMB gives a pleasant mixture of development, stability, a strong stability sheet, and dividend development. The corporate, in the meantime, has arguably crucial and beneficial pure gasoline pipeline system within the U.S. in Transco. Whereas the corporate could have some commodity-price headwinds in 2023, its fee-based contracts and demand-pull clients are extraordinarily enticing and defensive in nature.

Buying and selling at underneath 9x EV/EBITDA with some good initiatives that may hit within the 2024 by means of 2025 timeframe, the inventory seems to be like a “Purchase.” I see upside to $42, which is an underneath 11x a number of based mostly on the 2024 consensus.

[ad_2]

Source link