[ad_1]

On this article

A typical query on the BiggerPockets boards goes one thing like this, “I’ve $50,000 and trying to spend money on actual property. How ought to I begin?”

In regular instances, my recommendation would 9 instances out of 10 be home hacking for a first-time investor, particularly given the markedly higher charges and phrases householders can get as in comparison with traders. Nevertheless, previously yr, that delta in mortgage phrases has compressed considerably, and so whereas home hacking remains to be an choice, it’s not head and shoulders above all the pieces else because it as soon as was. Though, home hacking has definitely held up higher than many different methods.

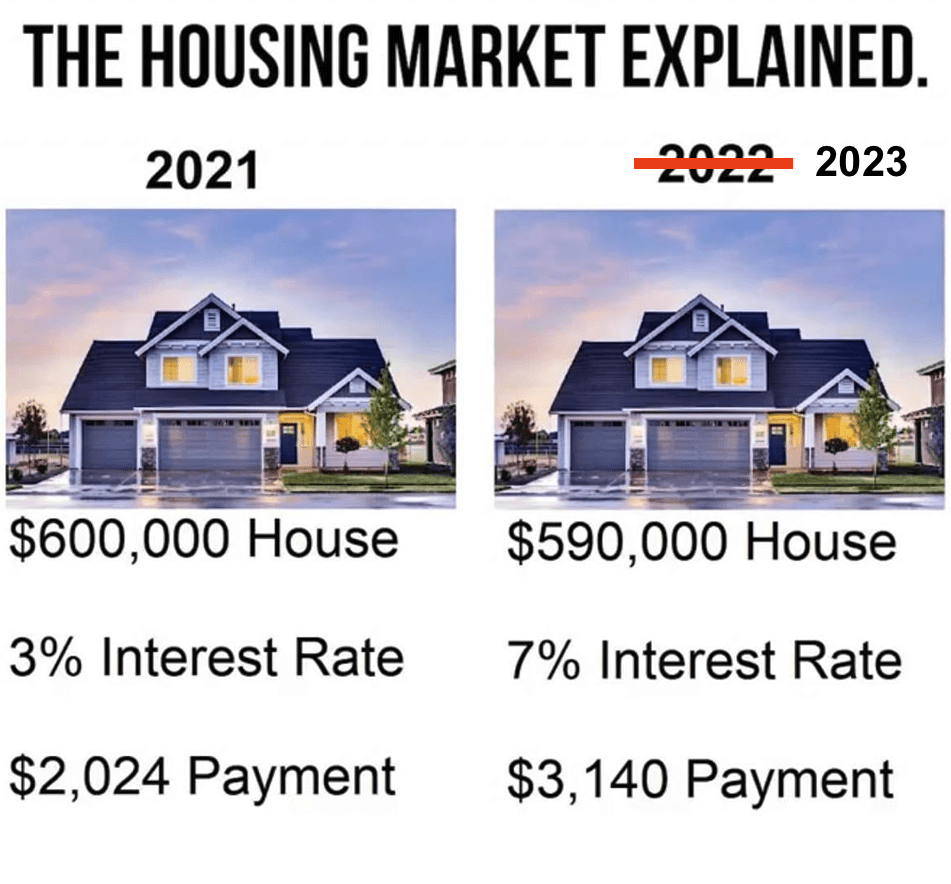

Certainly, if there ever was a difficult actual property market—notably for brand spanking new traders or these with $50,000 or so burning a gap of their pocket—this is able to be the one. This 2022 meme succinctly explains that problem as a lot as any essay might (up to date for 2023 audiences):

However sitting on the sidelines has its prices too. Suzanne Woolley at Bloomberg sums up the dilemma dealing with traders of all stripes, however most notably actual property traders on this present market,

“Within the brief time period, it could make extra sense to deal with preserving capital than discovering progress. However in the long term, inflation eats away at money and leaves savers with much less buying energy.”

So, given this predicament, what are the very best choices to pursue?

The BRRRR Technique: Largely No

Don’t get me fallacious, in the event you discover an important deal which you could purchase for 75% of its market worth and it money flows with present charges, then go for it. Sadly, for probably the most half, the BRRRR technique is useless (or hibernating, to be exact). That is robust for me to say as the BRRRR technique—particularly, in our case, shopping for with a personal mortgage, rehabbing, renting, after which refinancing with a financial institution—was our absolute favourite technique.

The principle drawback is that just about each lender goes to anticipate a property to have a 1.2 debt service protection ratio (DSCR) or higher. Specifically, your internet working revenue (gross revenue minus bills) will have to be 1.2 instances the mortgage funds. Even in excessive money move markets, it’s very laborious to get even a 75% mortgage with rates of interest within the 6s and 7s and costs the place they’re at.

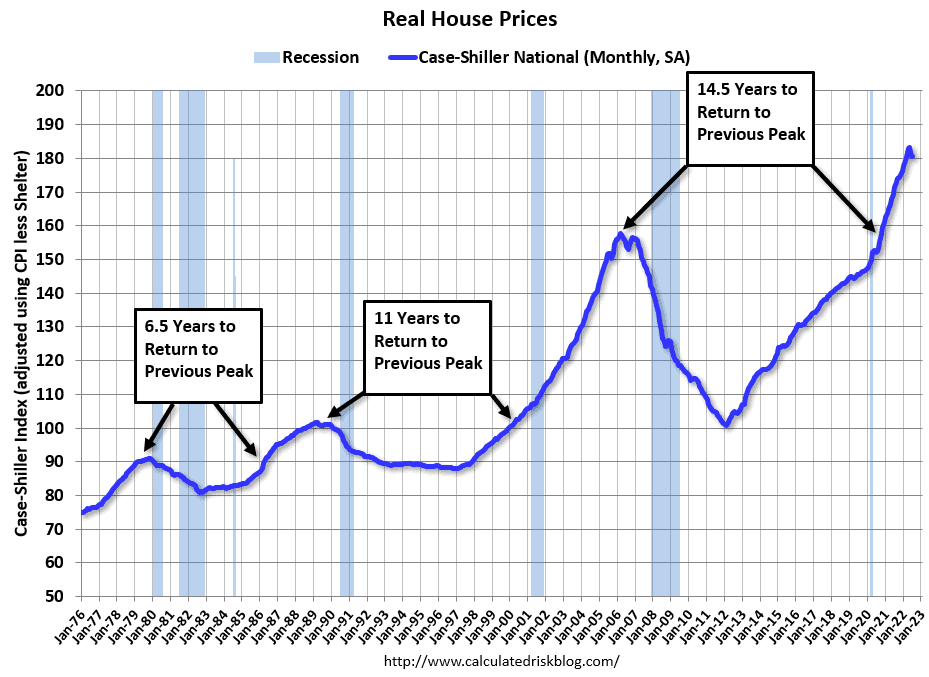

Moreover, actual property costs have began to fall. Positive, they haven’t fallen a lot (see meme above), however after skyrocketing, they’re starting to chill off. A crash may be very unlikely, however so is substantial appreciation within the close to future. As Invoice McBride has proven, the time between one peak for CPI-adjusted actual property costs to once more equal that very same worth after a decline has been between 6.5 and 15 years for the final three cycles.

McBride predicts that, in whole, costs will fall 10% nominally and 25% in actual phrases (adjusted for inflation) from their mid-2022 peak. Opinions on this, in fact, differ extensively. However the overall consensus is that actual property costs will probably fall, are most unlikely to go up greater than a marginal quantity, and even when they do go up, they may nearly definitely path inflation.

McBride, for his half, believes actual property costs will probably be “in purgatory” for seven years. I are inclined to agree.

Due to this fact, you’ll in all probability want to depart some huge cash in a property and are unlikely to see plenty of appreciation within the subsequent few years. When you have quantity of capital or companions with money keen to go in with you, that’s one factor. And sure, in the event you discover an important deal, pull the set off.

However for probably the most half, the BRRRR technique isn’t ideally suited within the present market.

Sponsored

Home Hacking: Possibly

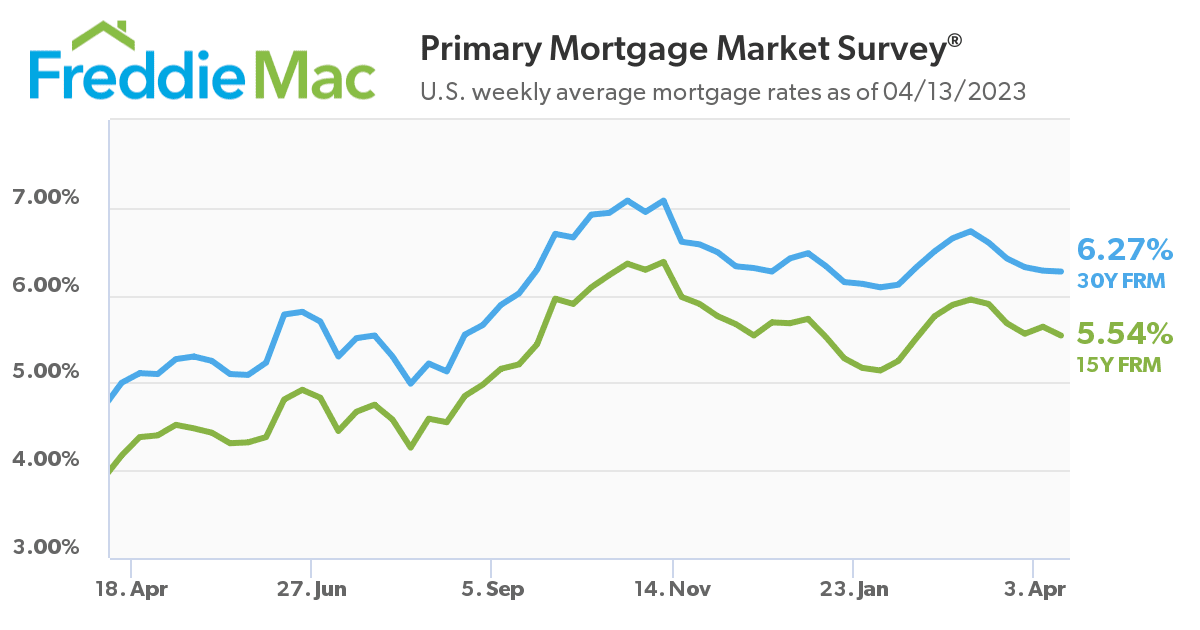

I purchased my private residence in mid-2021 and bought a 3% mortgage fastened for 30 years. I’ve heard of many individuals getting mortgages within the 2s. (I feel Mark Zuckerberg set the document on this regard with a 1.05% mortgage). Sadly, such charges are a factor of the previous.

At the moment, mortgage charges are within the mid-6s. Though that’s higher than the low 7s they had been at throughout the starting of the yr. At the least we will all be glad about small mercies.

Whereas charges are larger than regular, it’s nonetheless factor to get your foot in the true property investing door. And with FHA loans, you are able to do so with solely 3.5% down, which $50,000 will cowl in nearly any market. Moreover, you should purchase as much as a fourplex with an FHA mortgage, dwell in a single unit and hire out the opposite three, getting a spot to dwell and changing into an investor on the identical time.

Even many banks will provide conventional financing as much as 95% of the acquisition worth for householders.

Nevertheless, for the primary time in my investing profession, I can’t unequivocally endorse home hacking for brand spanking new traders or these trying to place $50,000 or so. But it surely’s nonetheless positively an choice to think about.

Earlier than shifting on, I ought to word that inflation has been cooling, so there may be motive to imagine that rates of interest will come down later this yr or early subsequent. So, whereas I’m usually an enormous fan of fixed-rate mortgages, this is able to be a time to consider adjustable-rate mortgages. (Though it’s best to stress check your monetary capability in case charges do go up, you’ll be able to simply by no means know with such issues.)

Artistic Financing: Sure

On this regard, I’m principally speaking about subject-to offers. With such offers, the property is purchased “subject-to” the prevailing mortgage. So, the deed is transferred to you, however the vendor stays on the mortgage.

There’s a large alternative right here on this market as most householders have nice loans, and but the market has slowed, so it’s more durable and may take longer to promote (though costs have solely dropped a bit as a result of only a few persons are motivated to promote). And as I put in a earlier article, “The benefits to the customer, on this case, are apparent. Should you can ‘assume’ a mortgage at 2.85% on a property, how a lot does the acquisition worth even matter?”

There are some disadvantages to subject-to. For instance, the financial institution has the appropriate to name the mortgage due, though they hardly ever do such a factor. One other is that the customer can’t borrow any of the cash for rehab. And if there’s a large discrepancy between the gross sales costs and the mortgage, there’s no approach to bridge that hole with out getting a second mortgage.

However for an investor with about $50,000 to spend, that can fairly often do the trick and fill that hole.

It also needs to be identified that vendor financing is an alternative choice that consumers ought to take into account on this market. It presents related challenges and related alternatives, aside from the apparent indisputable fact that just about no house owner goes to lend to you at 3% curiosity to purchase their home from them.

Syndications: Largely No

Actual property syndications are normally completed on bigger offers the place a principal celebration finds, negotiates, and arranges a deal and brings in traders to cowl the down fee and repairs. Often, the principal will maintain about 15-35% of the fairness, and the passive traders get the remainder.

Through the previous few years, traders in syndications have made a killing as actual property costs have skyrocketed. However now, returns are decrease as a result of rates of interest are larger, and (no less than as of now) costs haven’t come down a lot to assuage that diminished money move. And as famous above, there isn’t any motive to assume actual property costs will go up a lot, if in any respect, within the close to future. And they’ll nearly definitely not maintain tempo with inflation. So, a lot of the benefits that actual property syndications provide are now not there, notably for passive traders.

After all, as with BRRRR, there are nonetheless good offers round. And if the market does get messier, there could also be extra motivated sellers and, thereby, extra alternatives for actually good offers, which will probably be price it no matter rate of interest or potential appreciation. However that has not but come to go.

Personal Lending: Possibly

Personal lenders usually lend at 8-12% curiosity. Laborious cash lenders (sometimes companies set as much as lend non-public cash to flippers) normally lend at 12-15% with three to 5 factors.

$50,000 is mostly not sufficient to lend to somebody shopping for a home to flip or maintain, however when you have nearer to $100,000 or extra, there ought to be alternatives on the market.

And certainly, with rates of interest within the mid-6s, a ten% non-public mortgage doesn’t sound practically as unhealthy to an investor because it did a yr in the past. If that type of return meets your targets, non-public lending is one thing to think about.

The Sidelines: Possibly

One other first for me is even contemplating the opportunity of recommending these with $50,000 who wish to begin in actual property to as a substitute sit on the sidelines in the intervening time. Time out there beats timing the market—or no less than it normally does.

This market is without doubt one of the few instances I’d say that it isn’t that unhealthy of a factor to sit down on the sidelines for some time. For our half, we’re centered on ending our rehabs, growing our occupancy, and optimizing our techniques. We’re not trying to buy a lot this yr. Though, that’s partly as a result of we had an enormous yr in 2022 and are enjoying a little bit of catch-up.

As of this writing, the one-month U.S. treasury bond has a 4% yield, and the six-month gives a 5% return. These had been within the ones final yr. So, sitting on the sideline isn’t the de facto equal of stuffing cash beneath your mattress because it was not way back.

Whereas these returns are nonetheless beneath inflation and fairly paltry in comparison with what actual property traders are inclined to purpose for, they’re much higher than shopping for a mediocre cope with a excessive rate of interest mortgage in a risky and sure declining market.

In the end, my advice wouldn’t be to sit down on the sidelines. However I’d be way more snug holding on for a extremely whole lot and ready rather a lot longer than I’d have been final yr and extra so nonetheless than, say, 5 years in the past.

On this economic system, specifically, you don’t want to power something.

Conclusion

That is probably the most complicated and difficult actual property market I’ve seen in my lifetime. I definitely don’t envy somebody trying to begin now. It’s necessary to method the market cautiously and never attempt to power a deal to occur. There will probably be time for that, and the economic system will, eventually, grow to be extra advantageous for actual property traders.

Even nonetheless, there are alternatives in actual property on the market for somebody with $50,000 or so, even on this market. You simply have to be a bit extra cautious and much more affected person.

Artistic financing strategies to do extra offers, extra usually

Is your lack of money holding you again out of your actual property goals? Irrespective of how a lot cash you have got in your checking account, there may be all the time actual property you’ll be able to’t afford. Don’t let the contents of your pockets outline your future! This e-book gives quite a few methods for leveraging different folks’s cash for wonderful returns in your preliminary funding.

Word By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.

[ad_2]

Source link