[ad_1]

Commerce Concepts Evaluate

Options

Charts

Ease of Use

Scanners

Alerts

Platform Differentiation

Abstract

Commerce Concepts is a standalone inventory scanning instrument that gives distinctive market scanners, superior evaluation instruments, and synthetic intelligence. Commerce Concepts is arguably one of many prime scanning instruments accessible available on the market proper now.

About Commerce Concepts

Commerce Concepts is an extremely highly effective instrument for anybody on the lookout for a nonstop pipeline of commerce concepts all through the buying and selling day. The platform offers tons of built-in scans that discover distinctive buying and selling alternatives in real-time. It’s additionally versatile sufficient for customers to create their very own scanning methods with out ever needing to study a coding language.

Commerce Concepts used to have a popularity for having a steep studying curve, but it surely’s turn out to be way more user-friendly through the years. Now, customers can step proper into it with out an excessive amount of rationalization or benefit from a one-on-one coaching session with a Commerce Concepts coach. There are additionally a ton of movies and tutorials that will help you get began with the platform.

So, what does Commerce Concepts supply, and might it enhance your buying and selling? Let’s take a better have a look at this platform in our Commerce Concepts evaluate.

Commerce Concepts Historical past

Shaped in 2002, Commerce Concepts has advanced from being only a market scanner right into a full-fledged thought era platform. It serves greater than 50,000 merchants throughout 19 nations and screens the US and Canadian fairness markets. The platform leverages synthetic intelligence to determine what methods work within the present market and generate concepts that greatest match predictive outcomes.

Commerce Concepts has a reside neighborhood chatroom with moderators and a bustling neighborhood of lively merchants. Co-founder Dan Mirkin is an lively day dealer who often posts trades on Twitter and understands the wants of merchants.

In contrast to a whole lot of different scanners that tie up huge assets scanning on the person’s pc, Commerce Concepts handles all of the processing at its information facilities after which pushes the filtered inventory concepts to the end-user. That is an environment friendly and streamlined mannequin that leads to faster and extra correct scans. It’s actually spectacular how briskly Commerce Concepts can crunch information about 1000’s of shares on a typical laptop computer.

Commerce Concepts is being actively developed and often rolls out new options. We did our preliminary Commerce Concepts evaluate again in 2019 and have up to date it a number of occasions since.

How A lot Does Commerce Concepts Price?

Commerce Concepts pricing is simple. Subscriptions are $84 monthly (or $999 for a pay as you go 12 months) for the Commonplace plan or $167 monthly (or $1,999 for a pay as you go 12 months) for the Premium package deal.

The Commonplace plan comes with all the essential scanning instruments, together with the Channel bar and built-in indicators that may be custom-made along with your most well-liked settings. In addition they embody charts, alerts, and prime lists. All real-time information is included as nicely.

The Premium plan contains every thing you get with the Commonplace package deal in addition to:

Entry/Exit Indicators

AI Buying and selling Instruments

Technique Backtesting

Autotrading with Brokerage Plus

EXCLUSIVE DISCOUNT

Save $340 on Commerce Concepts

Use code DTR15 for 15% off Any Subscription

Commerce Concepts Platform Options

Commerce Concepts is filled with highly effective options and merchants ought to count on a little bit of a studying curve once you first open the platform. That stated, there are many help assets and tutorials in the event you need assistance getting acclimated to the software program. Most skilled merchants ought to be capable to begin figuring issues out inside an hour or two.

So, let’s get to it.

We’re going to check out a few of the strongest options within the Commerce Concepts platform, together with:

Charting

Scanners

Brokerage Plus

Channels

Racing

AI Buying and selling

And extra

Platforms

Let’s begin by discussing the software program itself.

Commerce Concepts affords desktop and net platforms. The desktop platform is Home windows-only, however the web-based platform can be utilized on any working system in any browser. Mac customers can run the platform utilizing a Home windows digital atmosphere instrument like BootCamp or Parallels.

The software program itself is quick and dependable. As we famous above, Commerce Concepts processes information within the cloud after which pushes the outcomes to customers. This protects your pc from being overloaded.

For the sake of our evaluate, we shall be specializing in the desktop platform, as that’s what most merchants will use. It is usually the extra highly effective choice of the 2 platforms. Whereas the web-based platform is handy, most lively merchants will choose the ability and effectivity of the desktop platform.

Channels

Commerce Concepts Channels are one of many distinctive options that enable merchants to dive proper into this platform with minimal setup.

“Channels” are basically pre-built scans centered round a theme. For instance, there are channels for:

Uncommon Quantity

Uncommon Choices

Quick Squeezes

Swing Buying and selling Shares

Pre-Market Movers

After-Hours Movers

And extra

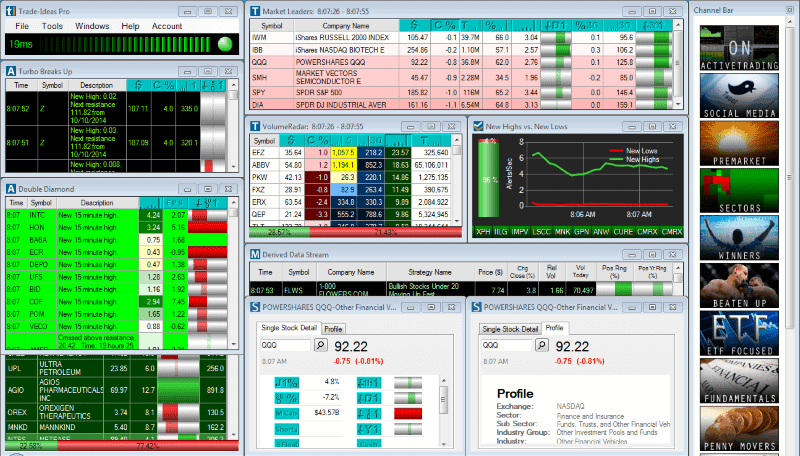

Right here’s a have a look at the channel window:

Once you click on on one of many channels, you’ll find the shares that meet the standards for the scan of that channel. There are just a few handy scans in-built. For instance, in the event you click on on the “After Hours” channel, you’ll find essentially the most unstable shares, quantity leaders, and real-time alerts.

There are many channels to select from, so new customers ought to discover all of them to see which of them shall be most helpful for day by day buying and selling.

Charts & Information

Earlier than we transfer on to a few of the different scanning options, let’s take a fast have a look at a few of the determination help instruments that Commerce Concepts affords. For many merchants, a scan alert is simply a place to begin. It alerts you to important worth motion, after which you’ll be able to observe up with your personal analysis.

Each Commerce Concepts scan is linked to determination help instruments. When you double-click on a scan end result, you’ll be able to see the inventory charts, fundamentals, information, and extra.

Commerce Concepts charts have come a great distance through the years. When the platform first launched, the charts had been very primary. Now, they embody a lot of the superior options you’d count on from a buying and selling platform.

Key options embody:

Candlestick Charting

A number of Timeframes (Minutes, Hours, Days, Weeks, and Months)

Technical Indicators (Transferring Averages, RSI, MACD, VWAP, and extra)

Annotation Instruments

Charts are up to date in real-time and embody information from pre-market and after-hours buying and selling classes as nicely.

You may arrange a number of chart home windows if you wish to use totally different chart settings or test shares throughout a number of timeframes.

Current information headlines can be found from a wide range of retailers, together with In search of Alpha, Motley Idiot, Benzinga, newswires, and extra. Clicking on a information headline will take you out of the platform to learn the complete article within the browser. Commerce Concepts isn’t a information scanner, however it’s handy to see current headlines to find out why a inventory could also be transferring.

Technique Scanners

Commerce Concepts has built-in methods and inventory screeners, that are kinds of pre-configured scans. These may be accessed by way of the platform’s Alert Window.

You should use the scans as they’re, customise them, or construct your personal from scratch.

These scanners are actually the celebrities of the Commerce Concepts software program and the rationale why so many day merchants use Commerce Concepts. Throughout our Commerce Concepts evaluate, we examined out just a few pre-configured Commerce Concepts scans and constructed just a few customized scans of our personal. The pliability and energy of those scans go approach past what you are able to do with a typical inventory screener. Commerce Concepts lets you create customized alerts for a wide range of totally different buying and selling methods. Alerts are color-coded, which makes it straightforward for day merchants to identify the alerts you’re on the lookout for.

You’ll positively must spend a while taking part in round with the totally different settings as a result of there are a whole lot of choices. You may set lots of of various kinds of alerts. Listed here are just some:

You too can filter the scan outcomes even additional with standards like:

Intraday Quantity

Change from Shut

Relative Quantity

Change (i.e. NYSE, NASDAQ, and so forth.)

Customized Watch Lists

As we talked about, it takes time to arrange your scans. It may be useful to begin with a pre-built technique and customise it to your liking. You’ve gotten loads of choices to work with. Commerce Concepts is extremely customizable and affords filters and alerts that ought to go well with any buying and selling model.

When you arrange your scanner, outcomes will begin displaying up in real-time. You may arrange a number of scanners to be alerted to various kinds of strikes. The alerts home windows are color-coded and embody descriptions for the alert sort, making it straightforward to watch a number of scans directly.

You too can customise the columns within the scan outcomes to incorporate no matter information factors are related to your buying and selling technique.

Market Explorer

Market Explorer is without doubt one of the latest instruments in Commerce Concepts. This instrument options handmade scans from the crew behind Commerce Concepts. The scans are distinctive in that they search for particular setups that will in any other case be troublesome to determine with quantitative standards.

When you’ve got ever tried to scan for a selected chart sample, you may have in all probability run into this problem. For instance, how precisely do you create quantitative scan filters for a chart sample corresponding to a bull flag or a spot fill?

Market Explorer solves this problem by offering pre-built scans for a wide range of setups. Listed here are just some:

Bull Flags and Bear Flags

Hole Fills

Hole and Pullback

Sturdy Shares Pulling Again

Closing Vary Breakouts

Transferring Common Crossovers

The outcomes are spectacular. For instance, listed here are the outcomes from a closing vary breakout scan:

Once I pull up the chart for these outcomes, it’s a match.

The power to scan based mostly on qualitative standards (i.e. chart patterns) is an thrilling characteristic for Commerce Concepts subscribers.

Actual-Time Inventory Races

Actual-time inventory races are one other current characteristic added to Commerce Concepts. That is positively one of the crucial distinctive options we have now ever seen in a scanning platform.

Once we first noticed this characteristic, we thought it was a gimmick. The inventory racing window options shares “racing” (racecar graphics and all).

After testing this characteristic additional, we realized that it truly offers a singular worth. The racing characteristic provides context to a scan. It exhibits how shares carry out over time relative to a sure metric and to one another.

A inventory race may be arrange from any prime record window. Right here’s the way it works.

Begin by selecting your prime record window. High lists may be arrange for a wide range of standards, together with:

Each day Gainers

Each day Losers

Quantity Leaders

Gappers

And extra

Primarily, High Lists are just like the technique scanners we mentioned above, however in additional of a “sorted desk” format than a “real-time alert” format.

When you select your prime record, you’ll be able to arrange a inventory race and set the standards for the race. Listed here are the choices:

The principle settings for a time-based race embody:

Lanes – Variety of shares to race

Minutes – Size of the race

Based mostly On – The metric for profitable the race (e.g. quantity, % chg)

Type On – How shares needs to be sorted

Substitute Vehicles – Substitute shares within the race

This may occasionally appear complicated at first, so let’s put it into primary phrases.

Assume it’s 10:00AM EST and you’re looking on the record of the highest gainers for the day. Proportion change isn’t insightful sufficient as a result of a inventory may hole up after which fade. You need to see which shares are performing greatest in real-time. So, you arrange a 10-minute race to see which shares carry out the most effective in real-time. This helps you slender down an inventory of the 100 prime movers all the way down to the 5-10 greatest intraday alternatives.

There’s little doubt that there’s a studying curve when utilizing this characteristic for the reason that idea itself is model new. That stated, there are a whole lot of sensible functions. In a approach, it replaces a display with dozens of charts. As an alternative of monitoring efficiency on charts, you’ll be able to monitor them with a race and discover profitable shares on autopilot.

For instance, this after-hours inventory race helped us discover essentially the most unstable after-hours shares in real-time.

Since inventory races are new, you will want to see in the event that they slot in your buying and selling workflow, however we positively suggest taking part in round with them.

Backtesting

To date, we’ve lined the scanning instruments accessible within the Commerce Concepts platform. Let’s proceed our evaluate by taking a look at a few of the different distinctive buying and selling instruments.

One of many cool issues about Commerce Concepts is that it brings quant buying and selling options to common merchants. We’ll focus on just a few of those superior information instruments, beginning with backtesting.

Commerce Concepts permits customers to backtest any technique. The objective of a backtest is to see how efficient it could be to commerce the shares within the scan outcomes.

Keep in mind the customized scans we mentioned above? Commerce Concepts permits you to check the effectiveness of those scans with an easy-to-use backtesting instrument. Merely right-click on the alerts window to tug up the backtesting choices.

Once you arrange a backtest, you enter just a few standards for the way you propose to commerce the inventory and the expertise will present you ways efficient that technique could be. Settings embody:

Entry Time (Based mostly on time of day)

Exit Time (Based mostly on time of day, minutes after entry, or at market shut/open)

Threat settings (cease loss and revenue goal)

Testing timeframe

When you enter the standards on your technique, Commerce Concepts will present you efficient that technique could be. Key metrics embody:

Common Acquire

Common Loss

Shopping for Energy Required

Win Fee

Common Return

And extra

The backtesting instrument is a handy option to gauge the effectiveness of a scanner. Whereas it could be troublesome to enter your precise technique, you will get shut sufficient to extract significant information. For instance, in the event you plan to purchase shares for high-of-day breakouts with a 1:3 danger/reward, you can see how efficient that might be over the long term utilizing the backtester.

Whereas we don’t suggest utilizing the backtester for each scan, it may be actually helpful when testing new scan concepts. The backtester appears at information from the previous couple of months to see if a scan is sustainable. This provides a brand new degree of perception to the scan creation course of.

For instance, a scan might carry out nicely at present if the broader market is bullish, however that doesn’t imply it will likely be efficient in the long term. Backtesting permits you to time-test your scanning methods for effectiveness.

Synthetic Intelligence (AI) – Holly

Commerce Concepts makes use of AI in a approach that we haven’t seen from every other buying and selling software program. Holly is an AI engine that implements 35 lengthy and quick methods to seek out methods which have a historic success fee of 60% and a pair of:1 revenue issue to commerce.’Holly is an AI engine that implements 35 lengthy and quick methods to seek out methods which have a historic success fee of 60% and a pair of:1 revenue issue to commerce.

The AI engine actively stalks the market to execute these trades, full with entries, exits, the rationale for exits, and sort of technique executed. The outcomes are up to date in real-time so customers can piggyback on the trades or simply watch and see how they play out. You may analyze the entry and exit factors to see how the synthetic intelligence engine works, or you’ll be able to merely analyze the trades to see which shares hit Holly’s radar.

Trades are reviewed in an end-of-day video weblog from Commerce Thought’s Stay Buying and selling Room recap. In a single day, Holly will run multiple million simulated trades utilizing greater than 45 totally different methods to generate essentially the most viable methods to make the most of the subsequent morning. Holly offers a morning watchlist of the popular methods and shares she’s going to commerce for the day. You may monitor these within the AI Methods window. Holly outperformed the S&P 500 index five-fold with a 52% return versus 10% in 2016.

Order Entry/Suitable Brokers

Commerce Concepts integrates with E*Commerce and Interactive Brokers for in-platform order entry and automatic buying and selling.

Coaching

All new subscribers have the choice to schedule a free one-on-one coaching session with a Commerce Concepts employees member. We suggest benefiting from this after spending just a few hours taking part in round within the software program by yourself.

As well as, Commerce Concepts has a ton of academic movies accessible on its YouTube channel together with tutorials on the web site. The platform has a studying curve, but it surely’s not too arduous to determine when you dive into it. Customers can learn by way of the definitions of every sort of technique to get an thought of what’s underneath the hood pretty rapidly.

Commerce Concepts Brokerage Plus

Commerce Concepts launched Brokerage Plus in early 2019 as a part of the corporate’s initiative to deliver AI-powered buying and selling to retail merchants. This characteristic was not included in our preliminary Commerce Concepts evaluate, however we had been so enthusiastic about it that we got here again for an replace.

EXCLUSIVE DISCOUNT

Save $340 on Commerce Concepts

Use code DTR15 for 15% off Any Subscription

Brokerage Plus was initially launched as an add-on characteristic priced at $1,100. It’s now included with a Commerce Concepts Premium subscription

Brokerage Plus permits merchants to create, check, and automate day buying and selling methods. Whereas many buying and selling platforms supply backtesting, that is the primary time we’ve seen full automation in an easy-to-use platform for retail merchants. In fact, automating your buying and selling technique isn’t easy, however Brokerage Plus can get you began.

Right here’s the way it works:

Step 1: Connect with Your Dealer

Brokerage Plus connects on to your brokerage account, which lets you place actual trades based mostly in your automated technique. Presently, Brokerage Plus solely connects to Interactive Brokers, however the firm plans to create extra integrations within the coming 12 months.

Step 2: Create Your Scan

Step one in direction of automating your technique is making a scan. This scan shall be used to seek out the shares that shall be traded utilizing your technique within the subsequent step. You should use the built-in Commerce Concepts scanners or construct a customized scan inside the platform.

Step 3: Construct Your Technique

Brokerage Plus goals to bridge the hole between scanning for shares and day buying and selling.

Stick to us right here, as the method isn’t easy. But it surely’s essential to know earlier than you think about auto-trading.

When you’re accustomed to backtesting, you realize that you could create a scan, outline your entry/exit standards, and backtest the profitability of your technique. For instance, you can create a scan for shares breaking above their 52-week highs, outline hypothetical entries of 100 shares on the breakout worth, and set your exit worth to five% above the entry level. A backtest would check the profitability of this technique utilizing historic information. The outcomes might present that this technique yields a 5% revenue 70% of the time and a 2% loss 30% of the time. This leads to web profitability of two.9% ((70% x 5%) – (30% x 2%)).

Merchants who use backtesting may run these simulations and select to commerce the technique manually. Brokerage Plus takes this to the subsequent degree by providing automated buying and selling. You may create an entry/exit technique utilizing the next standards:

Lengthy/Quick – Select whether or not you need to open lengthy or quick trades.

Entry Time – Select the market hours once you’d prefer to run your technique (e.g. 9:30 AM – 12 PM)

Place Sizing – Select your place measurement utilizing a set quantity of shares or a flat fee (e.g. 1000 shares OR $5,000 place)

Entry Order – Select what sort of order you’d like to make use of to open a place and enter further standards for opening positions (e.g. Open restrict order at $0.05 above the final worth for 60 seconds following the alert)

Cease Loss – Select from a wide range of filters to create an automated cease loss (e.g. fastened worth, share, trailing cease or indicator)

Goal – Set your revenue goal utilizing a wide range of filters ((e.g. fastened worth, share, or indicator)

Timed Exits – You may refine your exit plan additional by planning time-based exits (e.g. exit 60 minutes after entry, exit at market shut, and so forth.)

The success of this automation depends closely on the technique itself. The concept of earning money on autopilot is engaging however shouldn’t be mistaken for simple cash. Thankfully, Commerce Concepts offers three ranges of automation that will help you construct a profitable technique. It’s usually in a dealer’s greatest curiosity to maneuver by way of these ranges sequentially.

Handbook/Backtesting – That is much like the backtesting instance we mentioned above. You may create a method, backtest it, and place trades manually.

Semi-Automated – Semi-automatic is the subsequent step up. Semi-automatic buying and selling permits you to execute automated methods, however that you must be the one to tug the set off on the commerce. For instance, if Inventory $XYZ hits the scan, you can manually set off your “Purchase 5000 Shares” technique.

Absolutely Automated – Absolutely automated buying and selling is strictly what it seems like. You create your technique, and Brokerage Plus will place trades mechanically. You continue to have the choice to change trades (e.g. by tightening a cease order). Nonetheless, even with out your interference, the technique will execute mechanically.

Total, Brokerage Plus is without doubt one of the most fun improvements for retail merchants. We sit up for seeing the evolution of this characteristic and can report on future updates. This characteristic may revolutionize the best way merchants use Commerce Concepts and assist make it simpler for retail merchants to automate their methods.

Platform Differentiators

Commerce Concepts is the most effective inventory scanner available on the market proper now. Different platforms can’t even come near the kind of distinctive intra-day scans or supply the pliability of mixing scans so simply as Commerce Concepts does. Many of the built-in brokerage platform scanners are primary and clunky. Commerce Concepts affords an countless number of pre-built scanners and customization choices.

The pre-built scanners are the star of the platform. Whereas many scanners supply customization and some primary pre-built scans, Commerce Concepts affords a collection of well-crafted pre-built scans that enable merchants to begin utilizing the platform with minimal setup.

Most significantly, Commerce-Concepts does all of the processing on its servers and pushes the inventory candidates to you somewhat than utilizing your personal pc, which ties up assets and slows down efficiency.

Commerce Concepts additionally affords an internet model in case that you must entry the platform from a pc the place you don’t have the platform put in. The online platform isn’t as highly effective because the Home windows desktop platform, however there’s positively worth to it.

What Kind of Dealer is Commerce Concepts Finest For?

This inventory scanner is right for intraday merchants who commerce pre-market, regular market, and post-market hours. Swing merchants might also discover some good concepts for short-term swings in the event that they set the timeframe parameters to longer time frames.

Momentum and chart-based merchants could have their palms full with the nonstop circulation of concepts. In truth, the most important drawback isn’t spreading oneself too skinny and hopping on too many alerts. This is applicable to all scanners. It helps to have a stable buying and selling methodology in place and use the scanner as a pure thought generator to contemplate adopting the concepts that suit your model.

If you’re an lively momentum dealer, Commerce Concepts is unquestionably price trying out.

Execs

The very best real-time strategy-based inventory screener available on the market

Synthetic intelligence built-in technique commerce efficiency is superb

Continuous concepts generated from pre-market by way of post-market

Free moderated reside chatroom offers further concepts

Plenty of coaching movies and tutorials

Customizable methods with drag and drop integration and backtesting

Auto-trading availability

Cons

Straightforward to overtrade too many concepts directly

Charts may use some extra indicators

Desktop model isn’t accessible for Mac

EXCLUSIVE DISCOUNT

Save $340 on Commerce Concepts

Use code DTR15 for 15% off Any Subscription

Commerce Concepts Options

Commerce Concepts is difficult to beat by way of general scanning energy and high quality. However the worth and complexity of this platform means it gained’t be proper for each dealer.

When you’re extra targeted on charting and alerts, and don’t want as many scanning capabilities, you may need to try TradingView. It is a extremely customizable charting platform that gives a script editor that will help you construct customized buying and selling methods. It affords a free model, with paid plans beginning at solely $14.95 monthly.

Another choice is FinViz, which is straightforward to make use of and affords a really huge collection of technical and elementary metrics for inventory scanning. Scan outcomes are up to date in real-time all through the day. There’s a free plan accessible, however most merchants will need to improve to FinViz Elite for $39.50 monthly.

[ad_2]

Source link