[ad_1]

Oskari Porkka/iStock through Getty Photos

I began writing about the most well-liked index and associated ETFs – S&P 500 (SPX) (SP500) (NYSEARCA:SPY) – in late October 2022. Initially, it was a comparability with the better-quality diversified, and extra steady [in my view] Cambria Shareholder Yield ETF (SYLD). Nonetheless, then I began SPY as a separate funding product and selected a impartial place in late January 2023, making an allowance for the accumulating macroeconomic situations at the moment that steered difficulties for the market’s prospect progress. I lastly turned bearish in late March, and since then I’ve continued to imagine that the SPY rally of current months is nothing greater than a bear market rally – the U.S. financial system, robust to this point, runs counter to what Powell’s Fed is attempting to attain, and the rising collapse of non-systemic banks is driving the market to unrealistic expectations, the extremely seemingly revision of which is about to set off a cascade of promoting, or at the very least restrict the expansion of the index. In as we speak’s article, I’ll attempt to clarify in additional element why I feel so and what could provoke these revisions within the foreseeable future. Allow us to dive in.

The Implications Of Jerome Powell’s Press Convention on Could 3, 2023

I do know I’m a little bit late to the celebration right here, however I need to suppose logically about what Jerome Powell’s final public look a number of days in the past meant for the market. Talking with varied skilled market members and in addition accessing a number of sources, I obtained the impression that the market has misinterpreted the employment and unemployment numbers launched since that convention. However let me begin so as.

Right here is how one of many merchants describes what occurred on the press convention by way of a dialog between Powell and the journalists. Jerome Powell tried to persuade us that all the pieces can be high quality, however he could not say when precisely. When requested what Fed’s plans had been, Powell replied that they had been ready for inflation and financial exercise to lower, which is already occurring, however it takes time. A journalist from the WSJ requested whether or not it was vital to lift rates of interest on Could third, on condition that the momentum wanted was already evident. Powell responded that the Fed was extra afraid of doing too little than an excessive amount of and believed there was stability between targets and dangers.

So what was this dialog presupposed to imply for the markets? Information dependency is the important thing driving power of the Fed, so the stronger the general financial system, the tighter Jerome Powell might be in his coverage selections. This implication ought to logically result in increased bond yields, each nominal and actual, and improve the worth of the greenback (DXY). It additionally ought to theoretically make traders extra fearful as the entire image is not favorable for the high-risk phase of the market. Conversely, if the scenario is reversed [weak economy], the consequence would be the reverse.

What was stated on Could third was truly useful as a result of it introduced the long-awaited “certainty” that everybody had been ready for – now we all know that “excellent news” is definitely “dangerous information” and vice versa. Now we’re extra seemingly approaching the Threat-Off mode of functioning of the inventory market once more, for my part. In conditions like the current, commodity costs, gold, and high-beta shares ought to theoretically fall; worth shares ought to dominate relative to progress shares.

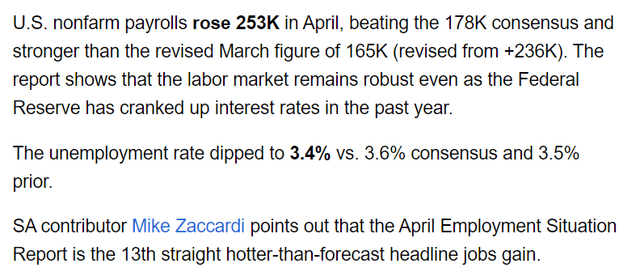

The whole lot above is concept. What will we see in actuality? U.S. financial system provides 253K [vs. the consensus of 178K] jobs in April, whereas the unemployment price drops to three.4% [vs. 3.6% consensus and 3.5% prior]. And markets rally.

SA Information, 5 Could 2023

SA Market knowledge, 5 Could 2023, writer’s notes

Robust knowledge from the U.S. financial system triggered a market rally reasonably than “good-news-selling” – that contradicts Jerome Powell’s current message, so far as I can see.

Sure, it was clear from his message that the Fed does not want to lift charges because it initially needed to – however the later knowledge on unemployment, which continues to fall, and non-farm payroll progress, which beat consensus by >42%, left nothing to do however proceed to strain the financial system till it offers up.

On the similar time, the Atlanta Fed’s Market Chance Tracker, which estimates the market-implied possibilities of varied ranges for the three-month common fed funds price, now costs a better chance that the Fed will minimize charges very quickly:

![Atlanta Fed [8 May 2023 data]](https://static.seekingalpha.com/uploads/2023/5/7/49513514-16835180047345347.png)

Atlanta Fed [8 May 2023 data]

For my part, the market’s habits – Friday’s inventory market rally and the best way forwarding feds charges are priced in as we speak – diverges sharply from the “knowledge dependence” I wrote about above, which Powell says the Fed itself follows in its selections.

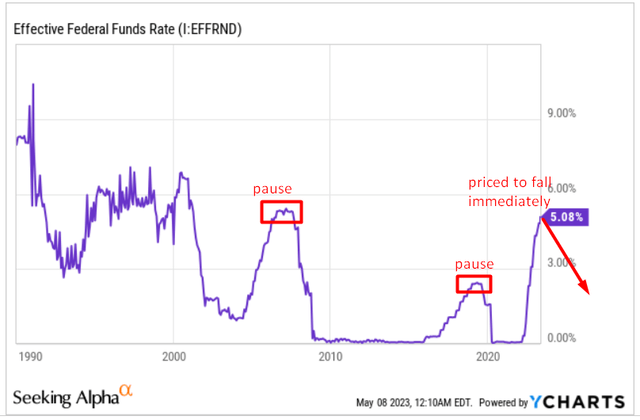

In response to the CME FedWatch Software, there may be presently solely a 9.6% likelihood of a price hike in June and a 38.1% likelihood of a price minimize as early as July. For September, there may be solely a 23.3% likelihood that charges will stay at as we speak’s ranges. That is too daring a market assumption, for my part, as a result of there’s a lag between the speed hike and when it truly impacts the financial system – which is why the speed minimize often does not occur instantly, however after a pause. Proper now, there is no such thing as a pause anticipated:

YCharts, writer’s notes

So, what do we have now within the backside line right here?

Powell has made it clear that the Fed could not have to lift charges an excessive amount of. It’s going to be guided by the out there knowledge. 2 days after that speech, the most recent financial knowledge made it clear that the job is much from executed – now the Fed must keep tight longer than Powell hinted to. For some motive, rate of interest expectations have determined to not regulate to the not too long ago launched robust knowledge as an apparent counter sign.

For the revealed contradiction to be resolved, a brand new catalyst must emerge that shouts to the market that the Fed is not executed but – that might be an actual sport changer for the inventory market.

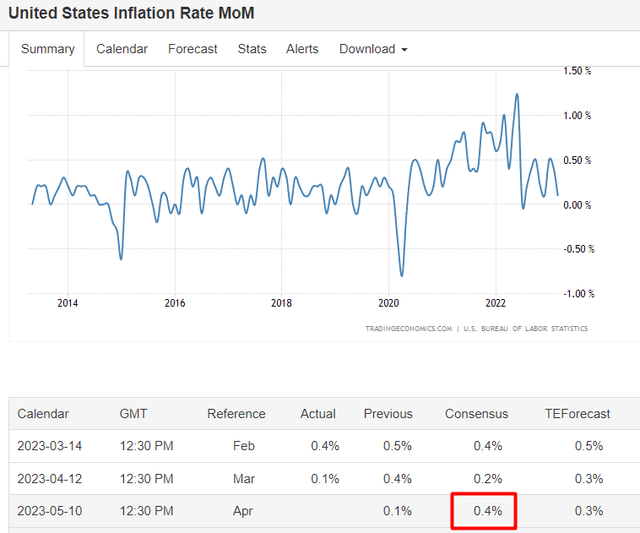

CPI Could Right The Emerged Discrepancy

The brand new week out there might be really wealthy in new knowledge that may flip all the pieces the other way up. Most essential, for my part, would be the knowledge on inflation [CPI], which might be revealed on Could 10. The market believes that CPI elevated by 0.4% in April:

TradingEconomics, writer’s notes

And this 0.4% projection appears to be too optimistic. Goldman Sachs predicts that the April headline CPI (MoM) will improve by 0.5% pushed by increased meals and power costs [proprietary source], which might end in a year-on-year price of 5.59%, remaining unchanged. Their forecast is predicated on a 4% surge in used automobile costs attributable to robust public sale costs in Q1 and a 0.8% improve in attire costs due to a rebound in clothes spending and favorable residual seasonality. The financial institution additionally anticipates one other improve within the automobile insurance coverage class as carriers proceed to counteract increased restore and alternative prices. Sure, a lower in journey classes reminiscent of airfares (-2%) and lodge lodging (-1%) attributable to weak webfares and unfavorable residual seasonality ought to strain CPI a little bit. GS additionally believes that the March slowdown in shelter classes was real and displays a decline within the enhance from post-pandemic lease renewals. However general, the analysts count on related month-to-month readings in April, with an estimated 0.50% rise in lease and a 0.52% rise in homeowners’ equal lease of residence [OER]. Additionally they estimate a 0.47% improve in core CPI – approach increased than the consensus of 0.3%.

If the CPI headline for April actually seems to be what GS expects, it ought to enormously cool the fervor of the present market rally and return it to its well-deserved “bear market rally” standing. You would possibly ask me – the financial system is so robust, why cannot this rally be referred to as a “new bull market” it doesn’t matter what the Fed does?

The actual fact is that the market is a forward-looking mechanism. It is one of many quickest main indicators within the macroeconomist’s arsenal. It costs in all the information upfront, thrives on expectations, and the adjustment to actuality is not all the time fast and never all the time environment friendly. Sure, as I write these strains, the overall financial system appears to be like robust – and that is good TODAY. However already TOMORROW it might probably result in utterly reverse conclusions. Take unemployment, for instance. Its low stage towards a background of robust financial progress and low inflation is the last word dream. However a really low unemployment price signifies that demand for labor is rising and, consequently, wages are rising – that is dangerous for preventing inflation. The Fed must cool that progress to attain its objective of cracking down on inflation – that is a detrimental outlook for shares. And as we speak there are a number of such situations ignored by the market.

Along with the upside danger to CPI, we additionally see a disaster in regional banks and the movement of capital into the know-how sector, which I do not suppose is logical. Sure, FANGMAN firms have largely exceeded earnings expectations, which have been revised down many occasions in current months. However the absolute progress simply cannot justify their inventory worth ranges.

![Crescat Capital [May 5, 2023]](https://static.seekingalpha.com/uploads/2023/5/8/49513514-16835231791711097.png)

Crescat Capital [May 5, 2023]

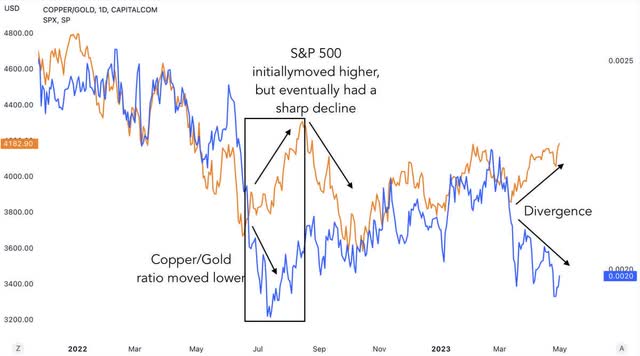

The dynamics of the power and commodity markets additionally recommend that world demand is falling. Even the copper-gold ratio is more and more diverging from the dynamics at SPY. The copper-gold ratio, historically used to evaluate the enterprise cycle, displays the relative energy of copper, an industrial steel related to financial progress, versus gold, a valuable steel that will increase in worth during times of financial instability. Throughout a downturn, gold tends to do higher, reducing the copper-to-gold ratio – precisely what we’re seeing as we speak. And SPY is not following go well with.

Shared on Twitter by @GameofTrades_

This discrepancy should disappear in some unspecified time in the future – I feel it won’t be in favor of SPY/SPX.

The Backside Line

After all, my thesis carries a lot of dangers that put my whole conclusion in danger. First, if CPI comes out under the anticipated 0.4% [MoM, headline], this is able to be a totally reverse sign to the market – the chance of an excellent dovish Fed would instantly turn into even increased and the rally is prone to proceed. Second, hedge funds are too pessimistic in the intervening time – their quick positions are resulting in a protecting that helps the index. Once more, the extra quick positions, the extra seemingly that SPY might be artificially sustained by the protecting for longer than I count on.

However regardless of the upside dangers, I nonetheless anticipate that the sensible cash will begin to take earnings someplace in Could/June. It is because the bull market has deviated considerably from its fundamentals and valuation. Nonetheless, timing will not be all the time on my facet. All of the worry could have already been mirrored within the index’s momentum in 2022, indicating that the market has already bottomed out – one other danger to my thesis to remember earlier than making any funding selections primarily based on the data offered on this article.

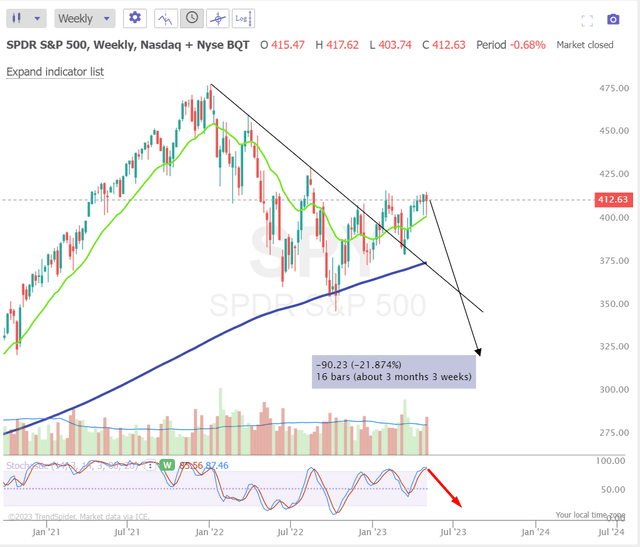

My bearish stance assumes that if the US experiences a recession, the honest P/E a number of must be roughly 15-16x. Bearing in mind a potential 1.5% downward EPS revision, the implied SPY worth can be considerably decrease than its present ranges. To calculate the honest worth, we multiply the FY23 P/E by the EPS adjusted for the downward revision, which ends up in $3222.23. This worth is 21.9% decrease than the present worth on the time of writing, and I keep my tactical “Promote” score on SPY/SPX.

TrendSpider Software program, writer’s notes

As all the time, your feedback are welcomed! Thanks for studying!

[ad_2]

Source link