[ad_1]

Editor’s be aware: In search of Alpha is proud to welcome The Moose Investor as a brand new contributor. It is simple to turn out to be a In search of Alpha contributor and earn cash to your greatest funding concepts. Energetic contributors additionally get free entry to SA Premium. Click on right here to search out out extra »

sankai

Interlude

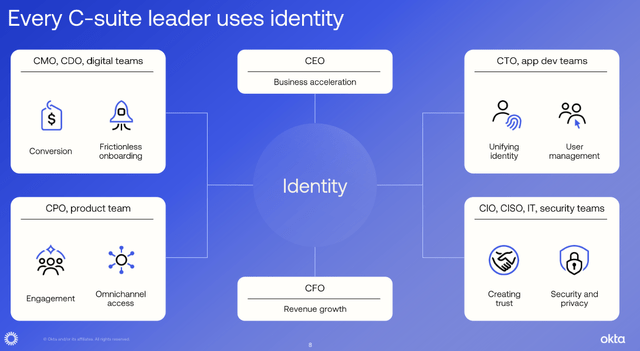

Okta Inc (NASDAQ:OKTA) has been in a position to develop revenues at a staggering 33% YoY as highlighted within the final earnings report. The corporate makes a speciality of offering id options for enterprises, but additionally small and medium companies, and primarily any group of the corporate that needs to raised infrastructure and higher the storage of consumer identities inside. ‘

The corporate has been in a position to collect up a really giant chunk of the identity-access market and sits at over 50% of the market share.

Firm Market (Investor Presentation)

I feel the corporate has been in a position to develop its enterprise very effectively and is nicely on its technique to reaching profitability. Development forward appears extremely sturdy and the cash invested will probably be for the long run. The market alternative is nice as the corporate itself states it to be round $80 billion in complete. If OKTA is ready to seize a good portion of that, the present valuation regardless of being excessive is a steal in 10 years forward and I consider it deserves a purchase score.

Development Alternative

As talked about to start with paragraph the full TAM for OKTA is huge at $80 billion in response to their very own presentation. The market of id entry appears it will likely be experiencing important development within the coming years. In an fascinating report by Fortune Enterprise Insights, the state of the trade may see a 14.5% CAGR between the years 2021 – 2028. I feel it is fairly believable the identical momentum will probably be seen for OKTA as they maintain over 50% of the market share. Among the tailwinds talked about are a rise in cloud-based options for firms that then will increase the necessity for safety options. As new applied sciences come to the market so do new rules for these and that’s an space which OKRA will help with.

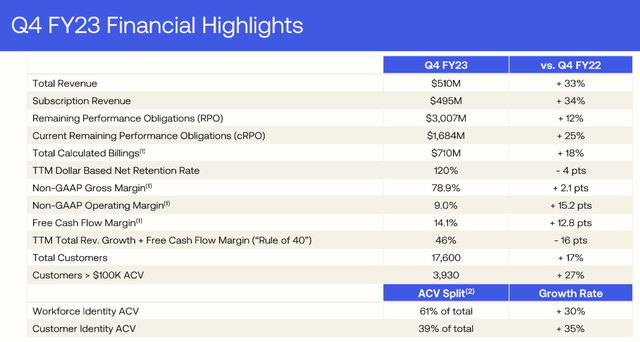

Monetary Highlights (Earnings Report)

Because the final earnings report additionally highlighted was the truth that OKTA nonetheless manages to assemble new clients, 17% of You to be precise, amounting to over 17 000. The place I see one other bonus for the corporate is the very fact they’re able to develop subscription revenues quicker than the general revenues. To me, this means the corporate is ready to go down prices effectively and is on its technique to reaching profitability. This was seen within the working margin which elevated by 15.2 pts YoY reaching 9% within the final quarter. As the corporate is reporting earnings on Might 31 I feel traders will probably be watching totally on this working margin persevering with its uptrend. What the corporate themselves expects from 2024 is a complete income improve of someplace between 16 – 17%. A shock within the subsequent report and a revision upwards might be a catalyst for the inventory worth and make it surge.

The Monetary State

It is fairly widespread for firms which can be new and upcoming to have a fairly harsh state of financials. However within the case of OKTA, I feel they’re in a fairly okay spot. The long-term debt proper now sits at round $2.2 billion, however with an enchancment within the money flows and margins, I do not see it as a serious concern or hindrance for the corporate. As said within the final report, the corporate has round 15% of its revenues as free money flows, a robust enchancment because the 12 months earlier than it was 4%. I feel this momentum may very nicely be saved up and will assist OKTA in managing its debt very effectively.

The liquidity within the firm stays extremely sturdy, at $2.58 billion with money, money equivalents, and short-term investments accounted for. This places them in a really sturdy place to proceed investing closely into themselves to additional development and produce worth to shareholders.

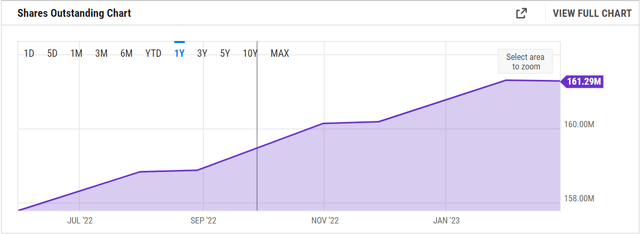

Shares Excellent (YCharts)

Thus far the shares have steadily been diluted through the years as the corporate wants to lift capital. However I feel it will cease fairly quickly because the margins are seeing nice enhancements. The necessity for elevating capital by means of dilution will probably be pointless and will end in a backlash from traders. However I feel that is additionally widespread seeing as the corporate remains to be in its infancy. What I wish to see extra of is a rise within the money place and a give attention to rising margins. That may assist flesh out the corporate much more and a extra clear future could be visualized for them for my part.

Firm Dangers

The funding thesis for the corporate depends fairly closely on that OKTA will have the ability to sustain the expansion they’ve had, which may assist justify the share dilution that has occurred over the previous couple of years.

If the expansion stops then I feel the share worth will collapse additional. Among the challenges that the corporate will probably be dealing with is managing bills. In early 2023 they already had been beginning to lower down on jobs. Most firms overhired in the previous couple of years as there was a increase within the tech sector. Fortunately it appears OKTA is taking the steps early on to assist maintain margins rising. However apart from the danger of earlier overspending, I feel competitors from different bigger and capital intense firms will show to be a serious problem. An organization like Amazon (AMZN) is already making steps into the cloud trade and producing a considerable quantity of income there. OKTA would not essentially have a place that protects them in opposition to the competitors, they work with a subscription mannequin, and if there are higher options offered to their clients the probability of them leaving is sort of excessive, particularly when information comes out of hacks into their methods.

Valuation

As the corporate is not anticipated to attain a worthwhile backside line by 2024 it’s totally arduous to make a purchase case on the present numbers as they’d counsel the corporate remains to be too immature to make an funding into. However I consider the potential lies forward for OKTA.

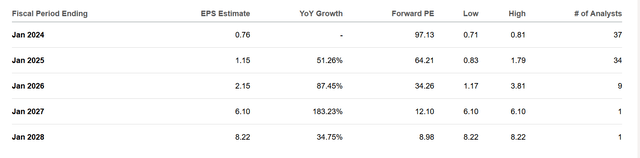

Future Estimates (In search of Alpha)

Though the analysts making estimates after 2026 are slim, I feel the momentum right here is highlighted fairly nicely. The p/e is dropping rapidly as the corporate ought to have the ability to improve its margins because it gathers extra clients and will increase the margins comprised of them. For an organization that might very nicely expertise 14% CAGR, the identical because the trade I do not suppose shopping for now’s unhealthy.

There are different firms on the market that additionally may supply publicity as cloud-based providers see nice demand. Cloudflare Inc (NET) can also be a highly regarded firm specializing in providing cloud providers to firms. However regardless that NET had an enormous run in 2021 their ahead p/e is even larger than OKTA at 136. It appears to be a standard pattern amongst tech firms that gross margins are straightforward to attain, however constructing a robust backside line is extremely tough. OKTA is a high-growth firm and with that, you need some type of reassurance of its high quality apart from simply excessive expectations, you want one thing to fall again on. I feel OKTA presents extra of that than NET. OKTA is seeing a quicker improve in margins and already has a robust FCF margin. It additionally appears NET is having a tough time remodeling its giant market share into continued development too.

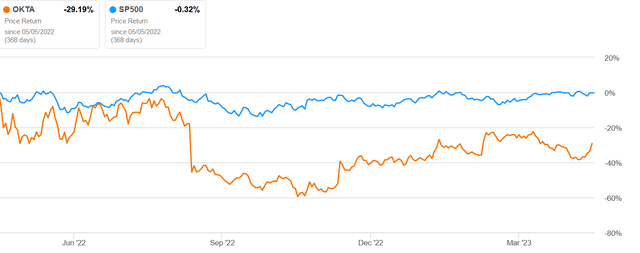

OKTA vs S&P 500 (In search of Alpha)

Wanting on the chart above, it would not look too good for OKTA, however over the long run, I anticipate an outperformance. You might be getting in early on an organization probably getting giant entry to an $80 billion TAM. You must issue this in when evaluating the corporate and I feel that is the rationale for the excessive p/e at present. 2021 was a wild 12 months for a lot of firms valuation and OKTA was no totally different. It has dropped considerably from the highs of near $300 per share. At these ranges the valuation was unreasonable, however the drop now does current a possibility. Wanting on the worth/money flows too, the corporate is dropping all the way down to a 56 a number of, which remains to be excessive, however a lot decrease than the TTM one in all 138. Free money flows will assist carry the corporate ahead and make it in a position to proceed closely investing in gaining new clients with out the danger of debt changing into a difficulty, as mentioned above.

Firm Takeaway

Okta Inc has a serious share of the market and the administration sees a big alternative that it will probably seize and assist gas additional development. The corporate noticed a rally within the share worth in 2021 however has since dropped closely from the highest. I feel the momentum will sustain and OKTA will have the ability to drive important appreciation for an funding, even at these multiples. The long-term outlook stays sturdy, the necessity for IAM options is there as increasingly firms are attempting to adapt to new rules and safety points internationally. The corporate has made some vital steps to hedge in opposition to points like this, by way of getting contracts with the federal government. One of many main ones just lately is FedRAMP Excessive Authorization which can assist federal businesses obtain their safety necessities. I feel it will assist get them a aggressive benefit within the trade because it additional establishes belief from the get-go when trying to tackle new clients. Authorities recognition will assist OKTA immensely for my part.

With a world presence, I feel OKTA is setting itself as much as be a serious winner on this market. Regardless of being an up-and-coming firm, the stability sheet truly seems very wholesome and I feel OKTA needs to be on most traders’ radar for the approaching years.

[ad_2]

Source link