[ad_1]

grandriver

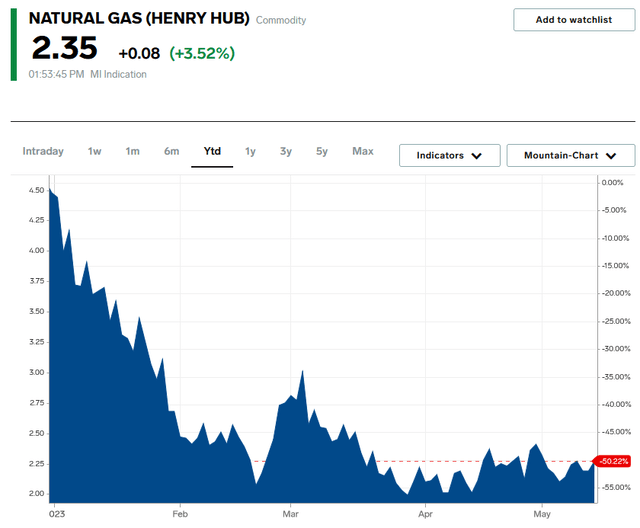

Comstock Assets, Inc. (NYSE:CRK) is an unbiased exploration and manufacturing firm that produces pure fuel within the Haynesville shale. This isn’t a basin that we hear about fairly often, however it’s the third-largest supply of pure fuel in the US. Sadly, Comstock Assets’ concentrate on pure fuel has not benefited it very a lot this 12 months as pure fuel costs have been extremely weak for the reason that begin of the 12 months. In truth, pure fuel at Henry Hub has declined 50.22% year-to-date:

Enterprise Insider

This was principally as a result of a provide glut that was brought on by an unusually heat winter that diminished home demand considerably. Nonetheless, the long-term fundamentals for pure fuel are fairly optimistic because the compound is more likely to see vital demand development as a complement to renewable sources of power. Whereas this can definitely work to Comstock Assets’ profit over the long-term, the corporate will seemingly proceed to battle for the close to future as there are indicators that the US will quickly fall right into a recession as there isn’t a fast supply of demand to offset the present supply of oversupply. Thankfully, the corporate does have a fairly engaging valuation on the present value and an affordable dividend yield, so buyers are paid whereas the long-term thesis performs out.

About Comstock Assets

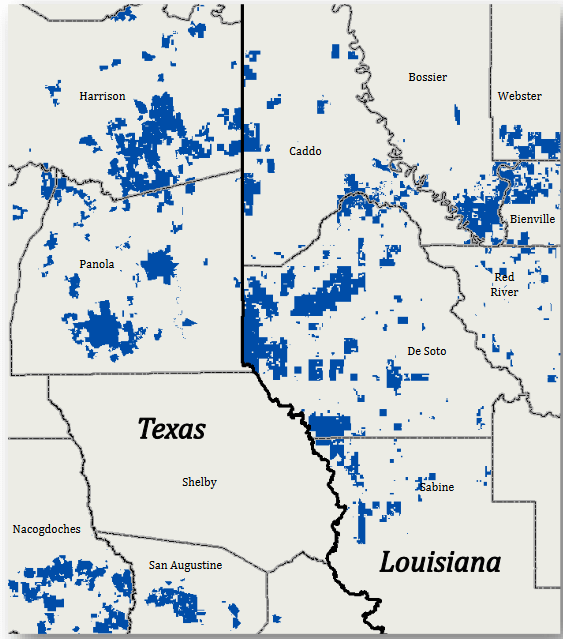

As said within the introduction, Comstock Assets is an unbiased exploration and manufacturing firm that primarily operates within the pure gas-rich Haynesville Shale. The corporate controls roughly 470,000 web acres in each the Texas and Louisiana parts of the useful resource play:

Comstock Assets

The Haynesville Shale shouldn’t be a area that we hear a lot about within the media, however as was already talked about, it’s the third-largest pure fuel play in the US. In keeping with the U.S. Power Data Administration, the Haynesville shale has proved assets of 56.2 trillion cubic toes of pure fuel as of 2021. That’s greater than some other basin within the nation apart from the Marcellus and the Permian Basins.

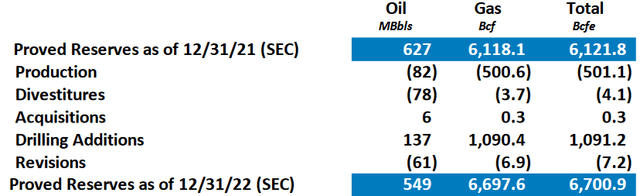

This unimaginable useful resource wealth is mirrored in Comstock Assets’ reserves. Many buyers overlook an power firm’s reserves, which is a mistake as they’re critically essential. It is because the manufacturing of crude oil and pure fuel is by its very nature an extractive course of. In spite of everything, useful resource producers actually receive the merchandise that they promote by pulling them out of reservoirs within the floor. As these reservoirs solely comprise a finite amount of assets, a useful resource producer should regularly uncover or purchase new sources of assets, or it’s going to ultimately run out of merchandise to promote. As an organization’s success in these endeavors is not at all assured, its reserves dictate how lengthy it will probably proceed to supply earlier than it finally runs out of assets. As of January 1, 2023, Comstock Assets had complete proved reserves of 6.7 trillion cubic toes of pure fuel equal. The corporate was producing a mean of 1.4 billion cubic toes of pure fuel equal per day as of that date, so its reserves had been adequate to final for simply over 13 years. That may be a very affordable reserve life that’s truly higher than lots of the supermajor power corporations possess. As such, Comstock Assets seems to be fairly effectively positioned right here and may be capable to function for fairly some time even when it fails to find new assets for a short while.

With that stated Comstock Assets does have a historical past of rising its reserves, which is not less than partly as a result of the growing effectivity of drilling operations has been rendering extra assets economically viable. As we are able to see right here, the corporate’s reserves went from 6.1218 trillion cubic toes of pure fuel equal to six.7009 trillion cubic toes of pure fuel equal final 12 months:

Comstock Assets

That is although the corporate was extracting pure fuel out of the bottom all final 12 months. It is a good signal, significantly ought to it proceed, because it ensures the long-term viability of the corporate. Sadly, as Comstock Assets solely releases estimates of its reserves yearly, we have no idea what has occurred over the primary a number of months of this 12 months so far as this goes. Nonetheless, the purpose is made as the corporate is extremely rich by way of the assets that it has within the floor. That is one factor that we very very similar to to see with an organization reminiscent of this.

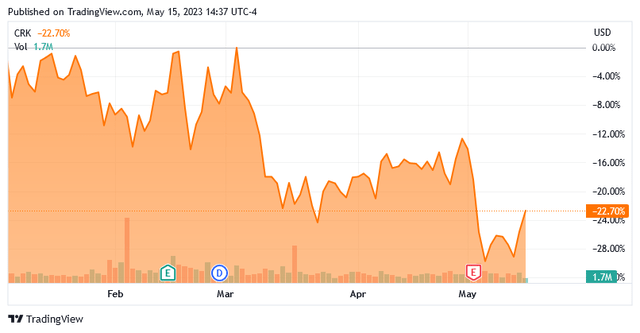

As already talked about, pure fuel has carried out somewhat poorly this 12 months. This is because of an oversupply of pure fuel in the US after a hearth shut down a significant pure fuel export facility and an unusually heat winter brought on pure fuel consumption to be decrease than regular. This has had a adverse affect on Comstock Assets’ inventory value, as is perhaps anticipated. The corporate’s inventory is down 22.70% year-to-date, so it has luckily held up higher than pure fuel costs have:

Searching for Alpha

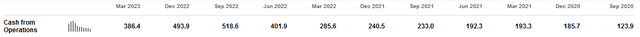

That is fully anticipated in such an atmosphere, nevertheless. As anybody that has been following the power business for an prolonged time period is effectively conscious, inventory costs of power corporations are inclined to correlate with crude oil and pure fuel costs. That is partly as a result of the truth that the monetary efficiency of those corporations is considerably depending on useful resource costs. We will see this by taking a look at Comstock Assets’ working money flows. Right here they’re:

Searching for Alpha

As we are able to see, the corporate typically did higher during times by which useful resource costs had been larger, though it isn’t an ideal correlation. One of many causes for that is that the corporate makes use of hedging to handle its publicity to commodity costs. Mainly, it’s utilizing futures, ahead contracts, choices, and different spinoff contracts to primarily lock in a value for the pure fuel that it sells. Within the first quarter of 2023, Comstock Assets realized a mean promoting value of $3.07 per thousand cubic toes of pure fuel equal although the common market value was $2.98 per thousand cubic toes of pure fuel equal throughout that quarter. The corporate was capable of accomplish this as a result of it bought the spinoff contracts upfront, effectively earlier than the worth of pure fuel began declining in earnest across the begin of this 12 months. That is the way it can assist clean out the corporate’s income and by extension revenue and money movement. The corporate’s promoting value within the first quarter of 2022 averaged $3.53 per thousand cubic toes of pure fuel equal regardless of the common value throughout that quarter being $4.55 per thousand cubic toes of pure fuel equal. Thus, the hedging program allowed the corporate to take pleasure in extra monetary stability than it in any other case would have skilled. Nonetheless, as not all the firm’s manufacturing is hedged, it does nonetheless have some publicity to pure fuel costs in both path. Thus, it appears seemingly that its efficiency over the remainder of this 12 months will likely be worse than the corporate managed to ship over the course of final 12 months, barring a considerable enchancment in pure fuel costs, which appears unlikely.

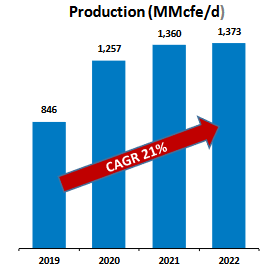

Comstock Assets, together with a couple of different producers, is taking steps to scale back the present oversupply of pure fuel. A latest report from Baker Hughes pointed this out, as exploration and manufacturing corporations pulled sixteen drilling rigs from productive obligation final week. That brings the overall variety of rigs in operation nationwide right down to 141, which is the biggest weekly decline since February 2016. As some readers could recall, 2016 was the tail finish of one in all a somewhat nasty bear marketplace for the power business brought on by the Saudis trying to bankrupt the U.S. shale business. The truth that final week was the biggest since that occasion definitely says one thing! Comstock Assets itself said that will probably be decreasing drilling exercise within the Louisiana portion of the Haynesville Shale. Relying on how this performs out over the remainder of the 12 months, it might characterize a reversal from the corporate’s latest historical past of delivering pretty aggressive manufacturing development:

Comstock Assets

Nonetheless, it’s in all probability greatest for the corporate to scale back manufacturing till pure fuel costs recuperate. As I’ve identified in varied previous articles, power value modifications are often extra essential for an organization’s backside line outcomes than uncooked manufacturing. It can additionally improve its revenue margin if costs go up, which is very unlikely to occur so long as the provision glut persists.

Monetary Concerns

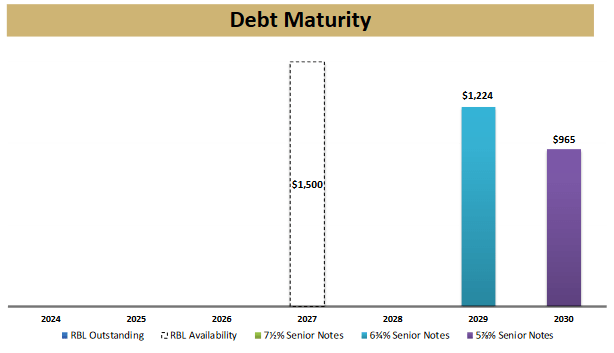

It’s all the time essential to have a look at the best way that an organization funds its operations earlier than contemplating an funding in its shares. It is because debt is a riskier strategy to finance an organization than fairness as a result of debt should be repaid at maturity. That’s often completed by issuing new debt and utilizing the proceeds to repay the maturing debt. This will trigger an organization’s curiosity bills to extend following the rollover, relying on the situations available in the market. After we take into account that rates of interest are on the highest ranges that now we have seen since 2007, that could be a very actual concern proper now. Along with this danger, an organization should make common funds on its debt whether it is to stay solvent. As such, an occasion that causes an organization’s money movement to say no might push it into insolvency if it has an excessive amount of debt. That is additionally a danger that we must always not ignore in Comstock Assets’ case as a result of volatility and weak spot in pure fuel costs proper now.

One metric that we are able to use to measure the debt degree of an exploration and manufacturing firm like Comstock Assets is the leverage ratio. This ratio is also called the online debt-to-EBITDAX ratio, and it primarily tells us how lengthy (in years) it will take the corporate to fully repay its debt if it had been to dedicate all its pre-tax money movement to that process. We explicitly exclude exploration prices right here because it offers a greater image of the corporate’s precise money movement as it will probably capitalize prices related to exploration. As of March 31, 2023, Comstock Assets had a leverage ratio of 1.1x based mostly on its trailing twelve-month EBITDAX. I’ll admit that I would like to see this ratio under 1.0x, however the present ratio shouldn’t be too dangerous since Comstock Assets doesn’t have any debt due till 2027:

Comstock Assets

Thus, Comstock Assets, Inc. has loads of time for pure fuel costs to recuperate earlier than it wants to fret an excessive amount of about its debt. As there are a number of pure fuel liquefaction vegetation coming on-line by that point that can function a supply of latest demand, it appears seemingly that will probably be capable of understand larger costs by that point and presumably even pay down its debt considerably earlier than it must roll it over.

Valuation

It’s all the time vital that we don’t overpay for any asset in our portfolios. It is because overpaying for any asset is a surefire strategy to earn a suboptimal return on that asset. Within the case of an unbiased exploration and manufacturing firm like Comstock Assets, we are able to worth it by wanting on the inventory’s ahead price-to-earnings ratio. This ratio principally tells us how a lot now we have to pay at the moment for every greenback of earnings that the corporate is predicted to generate over the subsequent 12 months. As I identified lately although, just about all the things within the power sector is considerably undervalued at the moment. Thus, it’s best to match Comstock Assets to a few of its friends as a way to see which inventory at present affords essentially the most engaging relative valuation.

In keeping with Zacks Funding Analysis, Comstock Assets has a ahead price-to-earnings ratio of 8.48 on the present value based mostly on its present 12 months estimate of $1.16 per share. That is considerably lower than the 18.17 ratio of the S&P 500 Index (SP500). Right here is how Comstock Assets’ ratio compares to a few of its friends:

Firm

Ahead P/E Ratio

Comstock Assets

8.48

Vary Assets (RRC)

11.08

Antero Assets (AR)

12.89

EQT Company (EQT)

12.49

Chesapeake Power (CHK)

15.96

Click on to enlarge

As we are able to clearly see, all of those corporations are valued considerably extra cheaply than the market in combination proper now. Nonetheless, Comstock Assets is by far the most affordable of the group. This might definitely enchantment to worth buyers, though it does appear seemingly that the inventory will battle for some time as a result of low pure fuel costs.

Conclusion

In conclusion, Comstock Assets, Inc. has definitely taken some punishment as a result of very low pure fuel value atmosphere. The corporate’s hedges are serving to it considerably, however it does appear very seemingly that its monetary efficiency this 12 months will likely be a lot worse than what the corporate managed to realize in 2022. It’s actively working to scale back its pure fuel manufacturing although, which might be a good suggestion till the provision glut abates. The long-term story that now we have established for Comstock Assets, Inc. in earlier articles stays intact and it’s in all probability price it for long-term buyers keen to be affected person, however it is crucial to not count on something unimaginable within the close to time period.

[ad_2]

Source link