[ad_1]

Buying and selling could be difficult at instances, particularly for a lot of new and inexperienced day merchants. For a lot of struggling merchants, there’s normally no simple approach out as a result of operating a profitable account requires expertise and experience.

On this article, we’ll take a look at among the high buying and selling methods that many struggling trades (even some execs) can use to reboot their careers.

Utilizing transferring averages

One of many best buying and selling methods that anybody can grasp is utilizing transferring averages. A transferring common is an indicator that appears on the common worth of an asset in a sure interval. The fundamental transferring common is calculated by including the asset costs after which dividing by the variety of intervals.

The straightforward transferring common (SMA) has some challenges because it takes all intervals equally. For instance, in a 200-day transferring common, the determine for at this time is normally the identical for 200 days earlier than. Subsequently, there are a number of transferring averages that clear up this case.

Examples of those averages are:

All these transferring averages are used the identical approach in day buying and selling.

Development Following

There are a number of methods for utilizing the transferring common indicator. First, you should use the transferring common in trend-following. That is the place you determine to purchase an asset when the worth is above a transferring common or quick it when the worth is beneath the MA.

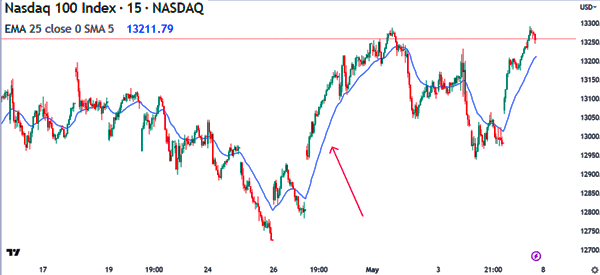

The purpose is that an asset will proceed rising so long as it’s above the MA and vice versa. A superb instance of that is proven within the chart beneath. As you possibly can see, the Nasdaq 100 index remained above the 25-period transferring common for some time.

Subsequently, a easy technique is to seek out an asset that’s trending, apply a transferring common, after which place a bullish commerce. It’s best to then exit the commerce when the asset strikes beneath the transferring common.

Crossover

The opposite easy technique for utilizing the transferring common is to easily look ahead to a crossover. This course of works in a comparatively easy approach. The concept is to use a transferring common on a chart after which look ahead to the asset to cross it.

If it crosses it on the high, it is a signal that bears are prevailing. Alternatively, if it crosses it at a decrease aspect, it is a signal that the worth will proceed rising within the close to time period.

What to think about when utilizing transferring averages

Utilizing transferring averages on this strategy is a comparatively simple course of. There are a number of issues that you are able to do to enhance your end result when utilizing the transferring common technique. First, all the time incorporate quantity in your buying and selling charts.

The concept behind quantity is straightforward. If an asset rises above the transferring common in a high-volume atmosphere, there’s a probability that the worth will proceed rising for some time. Alternatively, if the amount is restricted, the beneficial properties won’t have legs.

The opposite vital factor to notice about transferring averages is that the interval or the size issues. In most intervals. As proven above, We used the 25-period transferring common in trend-following. Some folks use a unique determine, with some utilizing the 10-period and others utilizing the 7-period transferring common.

Lastly, it’s best to take into account the kind of transferring common that you’ll use. Among the hottest kinds of transferring averages are exponential, smoothed, volume-weighted, and least squares amongst others.

Utilizing the VWAP technique

Along with utilizing transferring averages in day buying and selling, the opposite technique that you should use properly is the Quantity Weighted Common Worth (VWAP). Whereas some consider that the VWAP is much like transferring averages, there’s a large distinction.

The VWAP merely appears to be like on the common worth of an asset in a sure interval when adjusted with quantity. Subsequently, the indicator can solely be utilized in intraday charts equivalent to 5-minute and 15-minute. It can’t work in longer charts like day by day and weekly.

The idea of utilizing the VWAP is similar because the transferring common. In most intervals, merchants enter a bullish commerce each time the worth is above the VWAP indicator. Equally, they enter a bearish commerce when the worth strikes beneath the VWAP indicator.

For instance, within the chart beneath, we see that Microsoft shares have been in a robust bullish development up to now few days. The shares are above the VWAP indicator which means that merchants ought to keep a bullish trades so long as it’s above the indicator.

The opposite various is the place a dealer decides to attend for the chart to proceed dropping and hit the VWAP. If it strikes beneath the VWAP, it’s a signal to begin a bearish commerce. Alternatively, you possibly can place a purchase commerce if it rejects transferring beneath the VWAP indicator.

Threat administration

Shifting averages and VWAP will not be all the time excellent. Subsequently, you will need to use a number of threat administration methods to guard your draw back.

Among the hottest threat administration methods embrace having a stop-loss for all of your trades, training these methods in a demo account earlier than transferring to a stay account, lowering the quantity of leverage, and doing correct place sizing.

Threat administration will assist you to to guard your account in case your trades don’t go proper.

Abstract

On this article, we’ve regarded on the two hottest buying and selling methods for people who find themselves struggling within the business.

When you can grasp the idea of transferring common and VWAP and threat administration, you possibly can be capable to commerce in all market situations efficiently.

[ad_2]

Source link