[ad_1]

lindsay_imagery

Introduction

V.F. Company (NYSE:VFC), based in 1899, is a multinational firm specializing in attire and footwear. It’s thought-about one of many largest clothes conglomerates globally. The corporate boasts a various portfolio of fashionable manufacturers comparable to The North Face, Vans, Timberland, and Dickies.

Regardless of its well-established popularity, the corporate lately confronted vital challenges within the inventory market. Since Could 2021, its inventory has skilled a drastic decline of 80% with out substantial restoration intervals. Nonetheless, this title appears to be well liked by Wall Road and SA consultants. This divergent view from the market and analysts has piqued our curiosity.

Rankings (Searching for Alpha)

Upon cautious examination of V.F. Company’s financials and technique, we imagine a number of components contribute to the decline in its inventory worth.

Market seems cautious on the plan

After asserting one other long-term plan for the corporate in September 2022, the earlier CEO and chairman, Steven Rendle abruptly introduced his retirement in December 2022.

Benno Dorer, the present interim CEO and chairman, took over and can be conducting a seek for a brand new everlasting CEO.

Benno Dorer gave out the monetary outlook for FY2024 as follows:

Complete VF income flat to up barely in fixed {dollars}

EPS of $2.05 to $2.25

Free money move of about $900 million

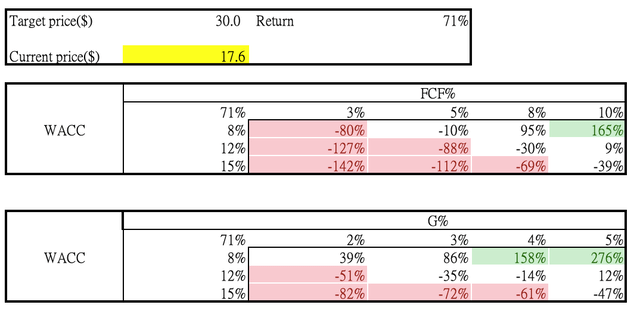

If we used the steerage as mannequin enter for FY2024 together with the next assumptions:

WACC: 8% Free money move margin: 8% Terminal progress fee: 3% Internet debt:5832 million (Q42023 information) Shares excellent: 388 million (This fall 2023 information)

It was estimated that the honest worth of the inventory could be 71% larger than the present worth.

Sensitivity evaluation (LEL Funding)

As well as, its valuation a number of appears low-cost. Its P/E ratio is decrease than the sector median and its 5-year common degree.

Valuation a number of (Searching for Alpha)

We’re of the opinion that the inventory is at the moment undervalued, primarily as a result of (1) the present interim administration lacks a confirmed monitor report, (2) the previous CEO failed to attain the unique targets, and (3) the present manufacturers are usually not well-positioned. Consequently, the market has maintained a cautious outlook on the inventory’s future prospects in our view.

Former CEO failed to attain the unique targets

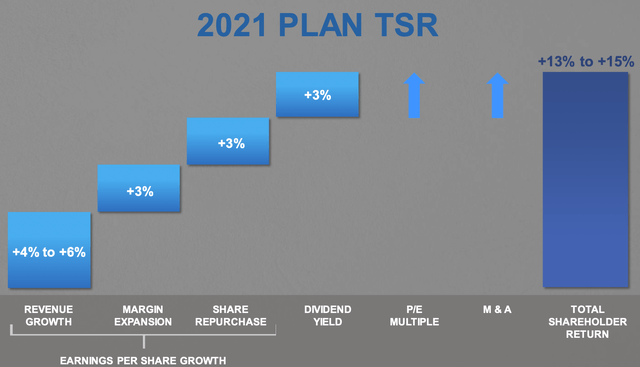

In 2017, Steven E. Rendle, the previous Chief Govt Officer, set bold targets of reaching a 13–15% annual shareholder return and a income progress CAGR of 4–6%.

2017-2021 Plan (VFC)

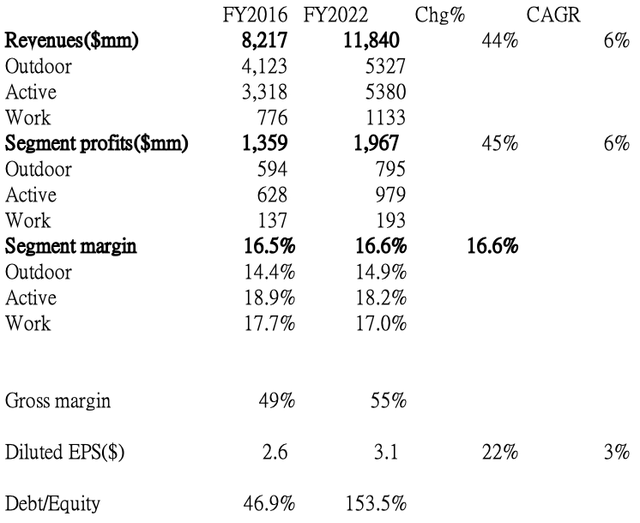

Nonetheless, the corporate’s diluted EPS progress CAGR from FY2016 to FY2022 was solely 3%. This was far beneath the expectation of EPS progress of 12%, indicating a failure to satisfy the goal.

Financials by phase (VFC)

The corporate’s This fall FY2023 earnings report, which was launched on Could 23, offered extra proof of the state of affairs’s deterioration. The corporate had one other goodwill impairment at Supreme. In FY2023, the corporate reported a complete of $735 million in goodwill impairment, with $394 million attributed to Supreme. The acquisition of Supreme in FY2021 incurred $1.25 billion in goodwill, additional burdening the corporate’s debt degree, which rose to 228% in FY2023 from 49% in FY2016. Sadly, Supreme’s efficiency in FY2023 was disappointing, with income and working revenue declining by 7% and 22%, respectively.

Western Coalition Failure because the Results of Poor Execution

The corporate confronted challenges in growing its non-U.S. income from 45% to the focused 52%, as promised by the previous CEO. In FY2023, non-U.S. revenues accounted for less than 42% of complete revenues. This shortfall was primarily because of underperformance within the APAC area, stemming from the corporate’s sturdy stance on provide chain initiatives, such because the boycott of cotton sourced from Xinjiang. This led to a big boycott by Chinese language customers, impacting the corporate’s presence within the area.

The corporate pursued an aggressive method to enhancing provide chain effectivity by actively collaborating in worldwide organizations just like the Higher Cotton Initiative (“BCI”) and the Worldwide Fur-Free Alliance. These initiatives have been geared toward growing the corporate’s bargaining energy with materials suppliers. Nonetheless, the technique had a unfavorable affect on APAC revenues, as Chinese language manufacturers like Anta and Li Ning benefited from the boycott and aggressively gained market share. Anta and Li Ning reported progress of 8% and 13%, respectively, in 2022, with Anta anticipated to surpass Nike, Inc., (NKE) in revenues in China, altering the aggressive panorama.

Within the U.S., the corporate confronted stiff competitors from different manufacturers. Its wholesale revenues declined by 2% in FY2023, whereas Nike and Skechers skilled a big enhance of 26% in wholesale gross sales in 2022. Adidas additionally reported double-digit progress within the U.S. market throughout the identical interval. Moreover, revenues from the highest 10 largest clients for V.F. Corp. decreased by 14% in FY2023.

Vans and Timberland’s Growth Challenges

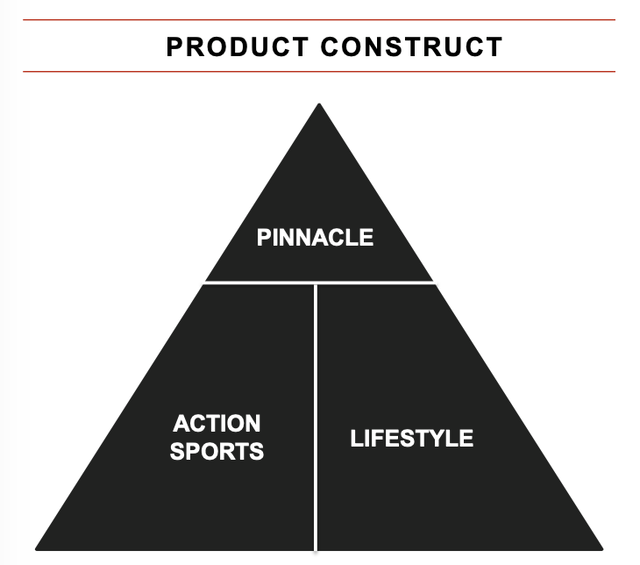

In an effort to adapt to the post-COVID athleisure pattern, Vans launched new merchandise that targeted on consolation and efficiency, such because the Van Ultrarange and MTE. Whereas the administration thought-about the efficiency of Ultrarange and MTE constructive, we imagine this shift signifies a lack of concentrate on their core choices. Regardless of Ultrarange and MTE experiencing progress of 51% and 34%, respectively, Vans’ total model gross sales declined by 8% for the yr, whereas its competitor Converse noticed an 8% enhance. The administration’s curiosity in increasing Vans by way of an prolonged product providing, referred to as the top technique, would possibly hinder the model’s efficiency until it introduces modern breakthrough merchandise.

Pinnacle technique (VFC)

In an try and develop past streetwear, Vans ventured into the realm of maximum sports activities comparable to browsing and snowboarding. Whereas the idea could seem interesting, the acute sports activities market already boasts a number of formidable gamers. Established surf manufacturers like Quiksilver, Billabong, and Rip Curl have earned recognition for his or her performance-oriented choices. Equally, snow manufacturers comparable to Burton, Salomon, and Columbia are strong opponents when it comes to efficiency gear. With out modern breakthrough merchandise, it’s unlikely that Vans’ technique will yield vital leads to these extremely aggressive markets. Moreover, Vans’ Ultrarange and MET face sturdy competitors from business giants like Nike and Adidas, additional intensifying the problem. To reach these domains, Vans might want to ship distinctive and compelling choices that differentiate the model from its opponents.

Timberland, doubtless recognizing the specter of athleisure pattern to its place, endeavored to raise its model picture. In 2018, the corporate divided its Timberland enterprise into Timberland and Timberland PRO, aiming to develop its presence within the out of doors and trend sectors. An bold transfer included a collaboration with Jimmy Choo to focus on the ladies’s market. Timberland’s mountain merchandise have been designed to showcase the model’s authentic strengths of sturdiness, waterproofing, and premium leather-based. Nonetheless, the mountain shoe and trend segments are extremely aggressive arenas. Mountain footwear necessitates not solely sturdiness but additionally consolation and correct design to accommodate the difficult mountain atmosphere. Notably, outstanding efficiency manufacturers like The North Face, Patagonia, and Mammut dominate this area.

Our take

In our view, the administration pursued aggressive monetization methods by increasing into non-core classes, profiting from the macro tailwind in FY2022. Nonetheless, these endeavors have been fraught with danger and lacked a stable basis of long-term planning. As macroeconomic circumstances weakened in FY2023, the corporate encountered a decline in revenues and an extreme accumulation of stock. The previous CEO might have benefited from report leads to FY2022, however the inventory worth then fell by 80% on account of anxiousness concerning the firm’s future. Merely altering the administration might not be adequate to revive market confidence in our opinion, as stock ranges have to be decreased to a extra snug degree. Its stock remained 62% larger in comparison with the earlier fiscal year-end. We imagine that the corporate just isn’t well-positioned in opposition to the competitors.

In the course of the This fall earnings name, the administration highlighted their plans to lower the SKU depend by 30% by the top of FY2024. For Timberland, the corporate intends to leverage core icons for constant progress and emphasize its heritage and authenticity in out of doors and work merchandise. Concerning Vans, the main target will probably be on preserving the model’s heritage, which is deeply rooted in motion sports activities tradition.

Whereas the return to core for the manufacturers is considered positively, warning is warranted as a result of administration’s poor monitor report in reaching their targets. The seek for a brand new CEO is anticipated to be accomplished inside six months. The interim CEO seems targeted on defensive techniques at the moment. Nonetheless, within the fiercely aggressive shoe and attire sector, taking part in protection is harmful in our view. We imagine that the corporate will proceed to lose market share to rivals in america and China. As Timberland, Vans, and Supreme account for greater than 50% of complete revenues and have confronted headwinds, we imagine that the corporate would possibly nonetheless be experiencing difficulties till new administration and a brand new technique are in place.

Subsequently, we predict the optimum time to buy this inventory could be as soon as the brand new CEO takes over. Even when the worth is favorable proper now, further draw back may be on the horizon. We fee the inventory as “Impartial”.

[ad_2]

Source link