[ad_1]

Niall/iStock through Getty Pictures

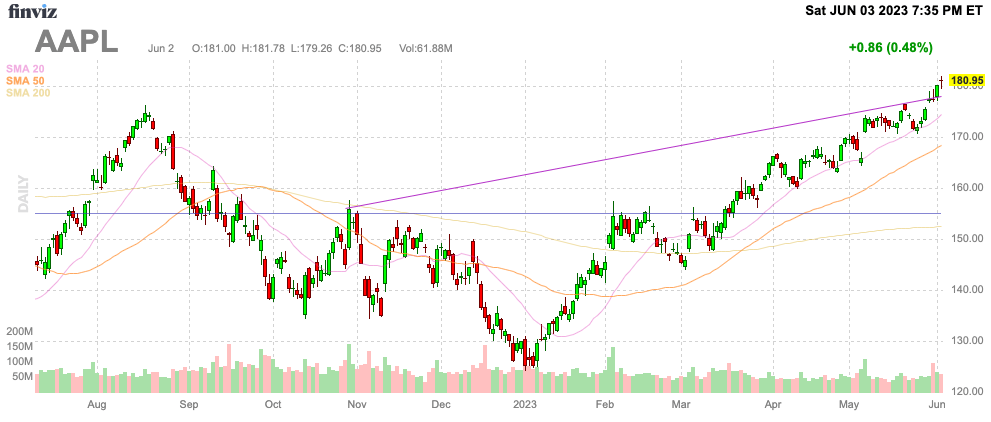

Apple (NASDAQ:AAPL) is heading to in direction of an enormous second of fact occasion with the anticipated launch of an AR/VR system on the WWDC. Meta Platforms (META) simply introduced one other headset whereas Apple buyers are ready on the official entry into the class within the signal of how a lot the tech large is battling new product growth. My funding thesis stays extremely Bearish on Apple with the inventory buying and selling at all-time highs whereas all indicators level in direction of a significant flop right here.

Supply: Finviz

Headset Wars

Meta simply introduced a 3rd era product within the Meta Quest 3. The VR/MR headset is about to be launched within the fall with a $500 price ticket and extra particulars on the Meta Join occasion on September 27.

The headset presents a 40% slimmer kind issue and as much as 200% greater decision with the brand new Snapdragon chipset from Qualcomm (QCOM). Meta already has over 500 apps that can work with the Quest 3.

The issue going through Apple is that the corporate would not have a product, a lot much less an ecosystem, to make the most of any AR/VR system with a $3,000 worth level. Apple is anticipated to launch the system on the Worldwide Builders Convention (“WWDC”) on June 5. The excellent news is that Meta nonetheless hasn’t created the holy grail of good glasses that permits for a really immersive expertise with out lugging round a tool strapped to 1’s head.

Supply: Meta Platforms

Regardless, Meta continues to continuously launch new merchandise with enhancements to prior generations. Customers can have consolation that Meta is investing in product upgrades and rising the app platform.

Notice, Apple will not have a shopper system to compete with Meta within the subsequent 12 months and probably years into the longer term. Apple is anticipated to launch a $3K system for builders with a wire connected for the battery. Nothing in regards to the Apple system speaks of breakthrough expertise.

As CNBC highlights, the Apple headset is the primary main system because the Apple Watch in 2014. The Watch took 8 years to start out delivering 50 million items with revenues reaching as much as $18 billion now.

Supply: BusinessofApps

The mixture with AirPods and different Residence units solely generated a mixed $41 billion in gross sales for FY22. The vast majority of gross sales had been from the Watch and AirPods, but the entire merchandise within the Wearable/Residence/Equipment class hardly generates 10% of gross sales.

Contemplating the AR/VR system is probably the most significant new product in almost a decade, a failure could have a profound impression on Apple. The corporate would not have one other product on the radar to spice up gross sales.

Tim Prepare dinner took over as CEO in 2011 and the manager in all probability will get an excessive amount of credit score for product growth throughout this era. The overwhelming majority of gross sales development has occurred because of the iPhone success in rising quarterly revenues from the $10 to $20 billion vary to now $40 to $70 billion ranges.

As CEO, Prepare dinner has been impeccable at rising gross sales through enhancements to current merchandise and increasing into providers. Attributable to Covid pull forwards, Apple not has a product tailwind and actually faces extra of a headwind resulting in the a number of quarters of gross sales declines.

Throughout this era, iPad income has stalled and Mac income is now displaying indicators of returning to base income ranges just like pre-Covid numbers. In plenty of methods, Prepare dinner has boosted iPhone gross sales and grown providers for iPhone customers with little to no enhancements in every other class throughout this era.

In essence, buyers should not have any cause to anticipate a significant success of the AR/VR system class. Customers have proven little interest in paying up for a $3K Professional system and Meta is promoting the patron AR/VR system at a worth level just like the Apple Watch and would not anticipate annual gross sales to even high the ten million stage.

Apple hasn’t performed something to make the system seem headed for achievement and influential analyst Ming-Chi Kuo would not even forecast 1 million items offered within the first 12 months. The income goal is barely within the $3 billion vary and Kuo truly seems bullish on the system suggesting some folks anticipate Apple to fail to succeed in this goal.

Too A lot Confidence

Regardless of the entire logic pointing to Apple below Tim Prepare dinner failing to launch any materials new product, buyers are nonetheless prepared to pay all-time excessive costs for the inventory. The foremost danger right here is {that a} product failure reinforces the ineffectiveness of Prepare dinner since Steve Jobs handed away.

Any AR/VR headset failure will instantly cut back any premium valuation within the inventory for a future Apple Automotive product. The distinction now could be that the smartphone market wasn’t close to totally saturated again in 2011 permitting Prepare dinner to make the most of operational excellence to drive development whereas Apple now wants an enormous product hit to drive development with annual gross sales reaching $400 billion.

As highlighted in prior analysis and ignored by the market, analysts forecast restricted development within the years forward. These numbers ought to truly consider revenues for the AR/VR system contemplating the expectations for a launch this 12 months, but Apple seems set to disappoint.

Supply: In search of Alpha

After gross sales dip in FY23, the consensus estimates have Apple rising gross sales sub-7% for the subsequent couple of years. An AR/VR system failure couple journey a number of billion off these gross sales targets and additional cut back the expansion charges.

The one justification for the inventory buying and selling above 30x FY23 EPS targets is a big hit on the AR/VR system being launched on the WWDC on Monday.

Takeaway

The important thing investor takeaway is that Apple is priced for enormous new product hits to drive development for years into the longer term and this does not seem grounded in actuality. The tech large is anticipated to disappoint the market with a brand new AR/VR headset and the inventory ought to dump subsequent week.

[ad_2]

Source link