[ad_1]

By Chiranjivi Chakraborty & Ashutosh Joshi

Recession fears have pushed analysts to their most bearish on Indian information-technology sector bellwether Infosys Ltd. since uncertainties surrounding Brexit rocked the greater than $200 billion sector six years in the past.

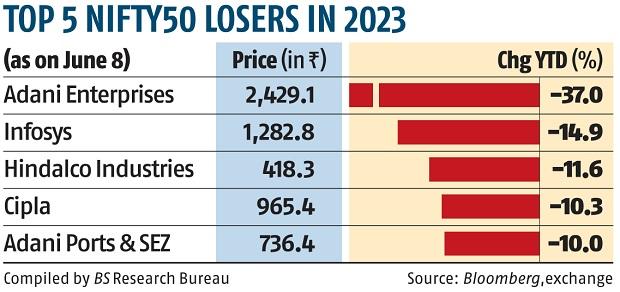

Round one-in-five analysts masking the corporate charge it a promote, the best proportion since September 2017, information compiled by Bloomberg present. The inventory is down 15 per cent up to now in 2023 on considerations over an earnings slowdown, making it the worst performer on the NSE Nifty 50 Index after Adani Enterprises Ltd.

At the least seven analysts downgraded the inventory to promote since mid-March amid considerations of decrease IT spending by US lenders attributable to considerations over regional financial institution well being. Infosys’s disappointing gross sales forecast for the present monetary 12 months added to the unfavourable newsflow.

“A doable sequential decline in 1Q and potential steering minimize down the road may weigh on the inventory close to time period,” JM Monetary Companies Ltd. analyst Abhishek Kumar, wrote in a notice Wednesday. Kumar warned that undertaking cancellations, which weighed on the agency’s fourth-quarter efficiency, may result in additional income decline for the Bengaluru-based firm.

Chirag Kachhadiya of Ashika Inventory Broking . sees restricted scope for higher return on funding for Infosys buyers given the possible lack of a share buyback for the following 12 months and the influence from headwinds within the US financial system.

That mentioned, cheaper valuations and up to date information factors within the US have stored nearly all of analysts bullish on the Indian IT agency. About 62 per cent of the 47 companies monitoring Infosys nonetheless have purchase rankings on the inventory.

First Revealed: Jun 08 2023 | 10:51 PM IST

[ad_2]

Source link

slotsfree creator solana token