[ad_1]

Up to date on June sixteenth, 2023 by Bob Ciura

Earnings traders are at all times on the hunt for high-quality dividend shares. There are lots of methods to measure high-quality shares. A technique for traders to seek out nice dividend shares is to deal with these with the longest histories of elevating dividends.

With this in thoughts, we created a downloadable record of all ~150 Dividend Champions.

You may obtain your free copy of the Dividend Champions record, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink beneath:

Traders are seemingly conversant in the Dividend Aristocrats, a bunch of 68 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

In the meantime, traders also needs to familiarize themselves with the Dividend Champions, which have additionally raised their dividends for not less than 25 years in a row.

Whereas their size of dividend will increase is identical, resulting in some overlap, there are additionally some essential variations between the Dividend Aristocrats and Dividend Champions.

In consequence, the Dividend Champions record is far more expansive. There are lots of high-quality Dividend Champions that aren’t included on the Dividend Aristocrats record.

This text will talk about the Dividend Champions, and an evaluation of our high 7 Dividend Champions, ranked in line with anticipated complete returns within the Positive Evaluation Analysis Database.

Desk of Contents

You may immediately soar to any particular part of the article by clicking on the hyperlinks beneath:

Overview of Dividend Champions

The requirement to change into a Dividend Champion is easy: 25+ years of consecutive annual dividend will increase. The Dividend Aristocrats have the identical requirement relating to variety of years, however with a number of extra necessities.

To be a Dividend Aristocrat, an organization should even be included within the S&P 500 Index, will need to have a float-adjusted market cap of not less than $3 billion, and will need to have a median each day worth traded of not less than $5 million. These added necessities preclude many corporations that possess a enough monitor document of annual dividend will increase, however don’t qualify primarily based on market cap or liquidity causes.

In consequence, whereas there’s some overlap between the Dividend Aristocrats and the Dividend Champions, there are additionally many Dividend Champions that aren’t Dividend Aristocrats. Earnings traders may need to think about these shares because of their spectacular histories of annual dividend will increase, so we now have compiled them within the downloadable spreadsheet above.

As well as, we now have ranked the highest 7 Dividend Champions in line with complete anticipated annual returns over the subsequent 5 years. Our high 7 Dividend Champions proper now are ranked beneath.

The Prime 7 Dividend Champions To Purchase Proper Now

The next 7 shares characterize Dividend Champions with not less than 25 consecutive years of dividend will increase, however additionally they have sturdy aggressive benefits, long-term development potential, and excessive anticipated complete returns.

Shares have been ranked by anticipated complete annual return over the subsequent 5 years, from lowest to highest.

Prime Dividend Champion #7: 3M Firm (MMM)

5-year anticipated returns: 16.4%

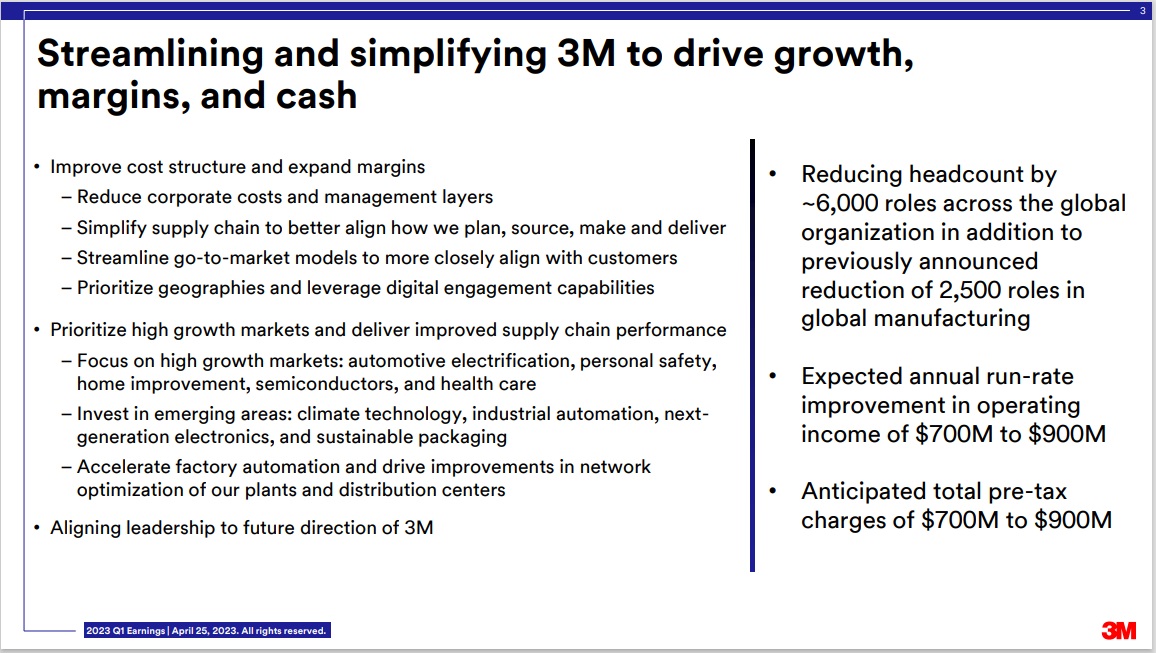

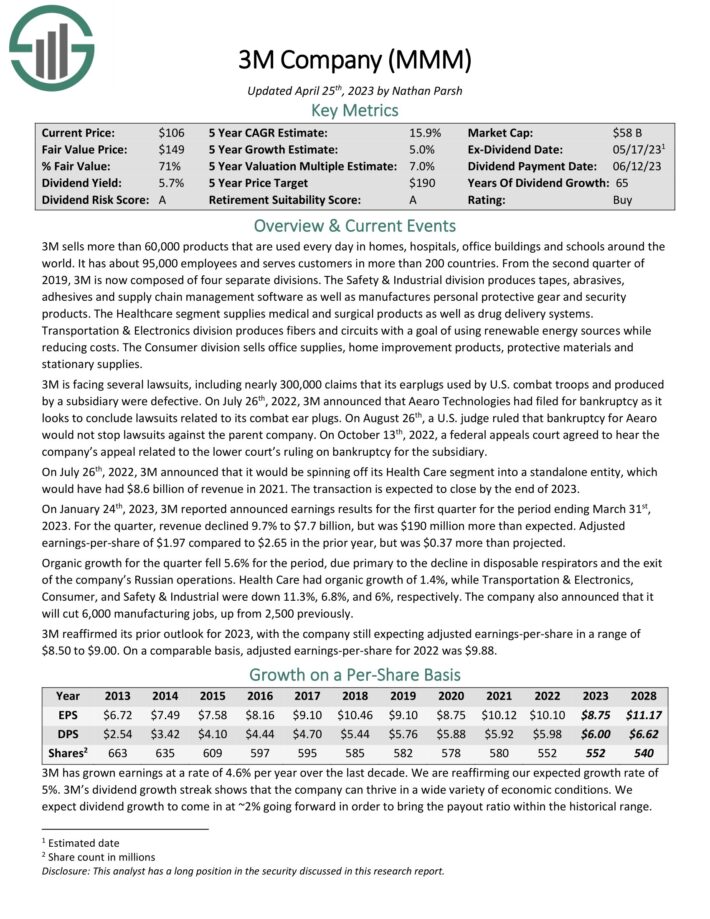

3M sells greater than 60,000 merchandise which can be used day by day in properties, hospitals, workplace buildings and colleges across the world. It has about 95,000 workers and serves clients in additional than 200 international locations.

3M is now composed of 4 separate divisions: Security & Industrial, Healthcare, Transportation & Electronics, and Shopper. The corporate additionally introduced that it could be spinning off its Well being Care phase right into a standalone entity, which might have had $8.6 billion of income in 2021. The transaction is anticipated to shut by the tip of 2023.

Supply: Investor Presentation

Click on right here to obtain our most up-to-date Positive Evaluation report on 3M (preview of web page 1 of three proven beneath):

Prime Dividend Champion #6: UGI Corp. (UGI)

5-year anticipated returns: 16.9%

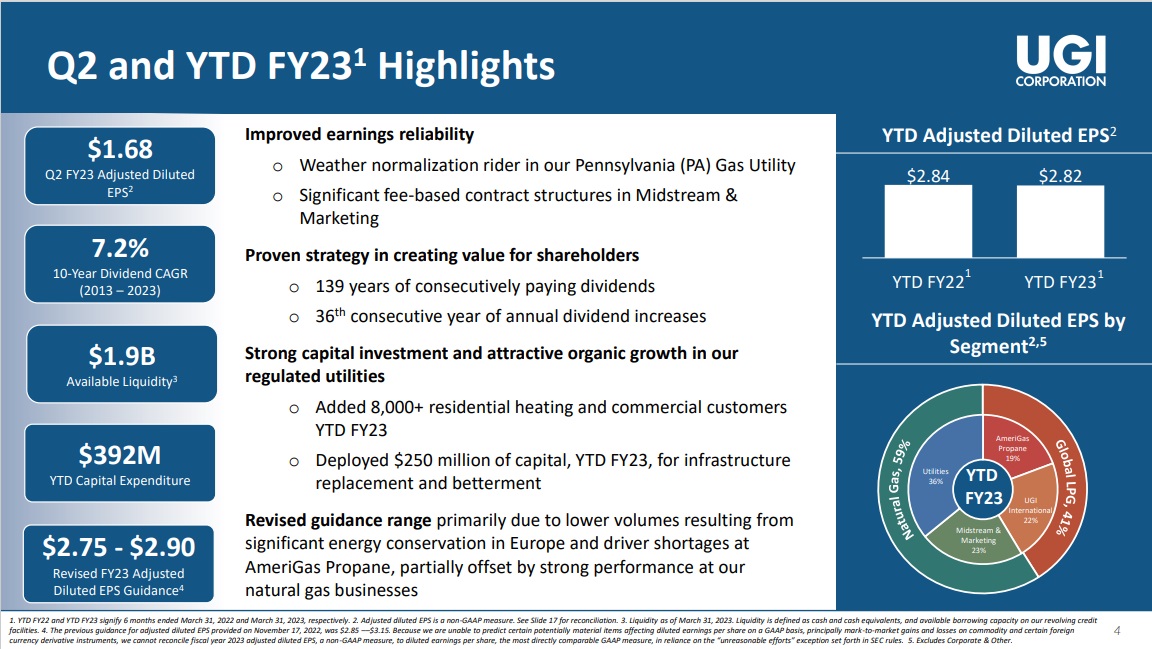

UGI Company is a fuel and electrical utility that operates in Pennsylvania, along with a big power distribution enterprise that serves all the US and different elements of the world. It was based in 1882 and has paid consecutive dividends since 1885.

The corporate operates in 4 reporting segments: AmeriGas, UGI Worldwide, Midstream & Advertising, and UGI Utilities.

Supply: Investor Presentation

On Could third, 2023 UGI reported Q2 outcomes. The corporate reported GAAP diluted earnings per share (EPS) of $0.51 and adjusted diluted EPS of $1.68, which had been decrease in comparison with the identical interval within the prior 12 months, the place GAAP diluted EPS was $4.32 and adjusted diluted EPS was $1.91. For the year-to-date interval, the corporate’s GAAP diluted EPS was $(4.02), whereas the adjusted diluted EPS was $2.82.

Click on right here to obtain our most up-to-date Positive Evaluation report on UGI (preview of web page 1 of three proven beneath):

5-year anticipated returns: 16.9%

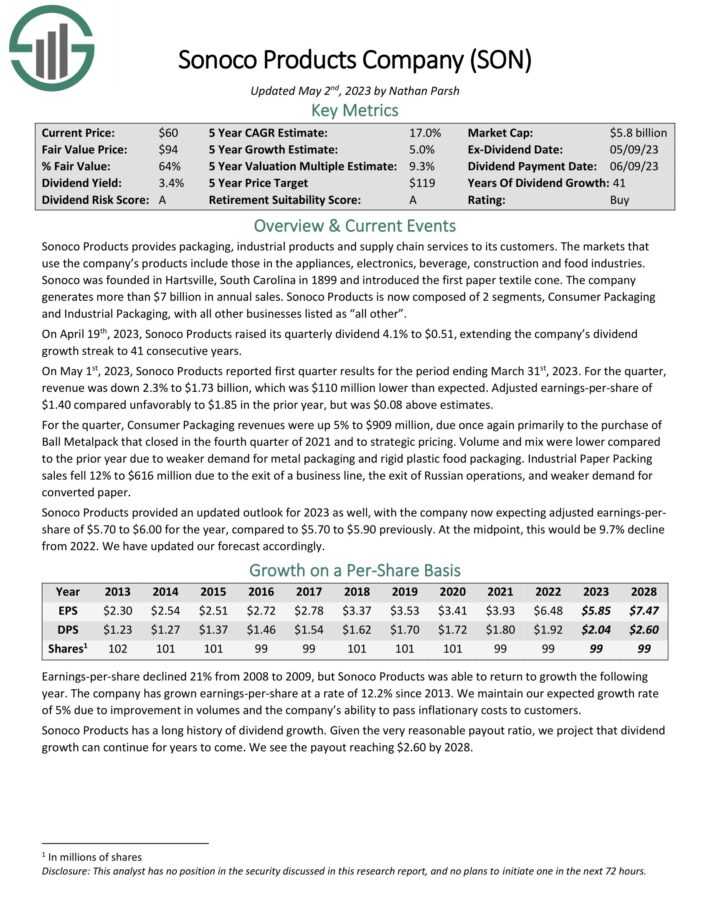

Sonoco Merchandise offers packaging, industrial merchandise and provide chain companies to its clients. The markets that use the corporate’s merchandise embrace these within the home equipment, electronics, beverage, development and meals industries. The corporate generates greater than $7 billion in annual gross sales.

Supply: Investor Presentation

On Could 1st, 2023, Sonoco Merchandise reported first quarter outcomes for the interval ending March thirty first, 2023. For the quarter, income was down 2.3% to $1.73 billion, which was $110 million decrease than anticipated. Adjusted earnings-per-share of $1.40 in contrast unfavorably to $1.85 within the prior 12 months, however was $0.08 above estimates.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sonoco (SON) (preview of web page 1 of three proven beneath):

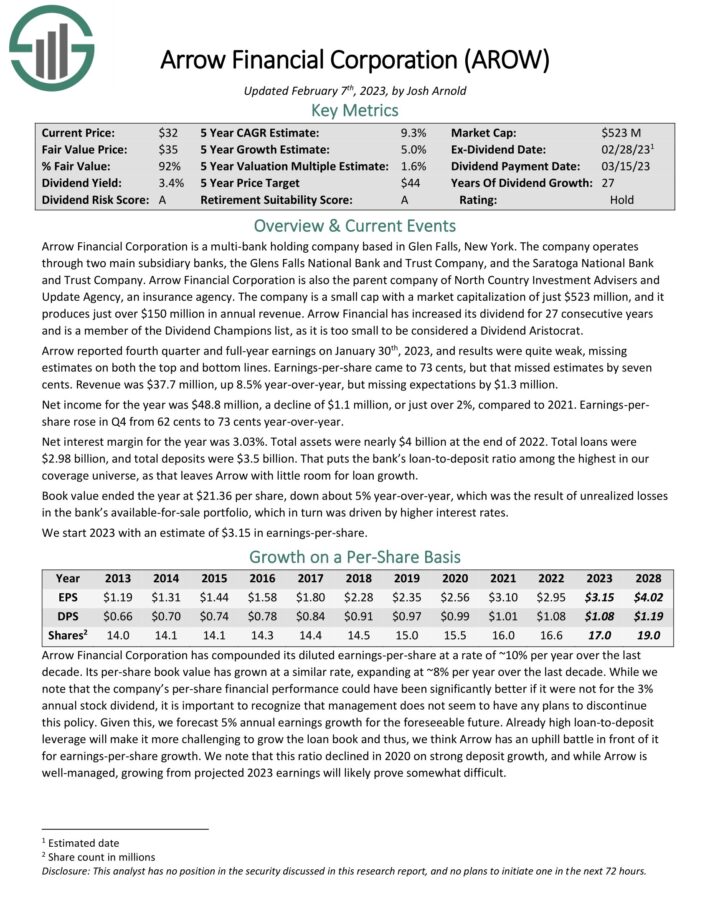

Prime Dividend Champion #4: Arrow Monetary (AROW)

5-year anticipated returns: 18.2%

Arrow Monetary Company is a multi-bank holding firm. The corporate operates by means of two foremost subsidiary banks, the Glens Falls Nationwide Financial institution and Belief Firm, and the Saratoga Nationwide Financial institution and Belief Firm. Arrow Monetary Company can be the mother or father firm of North Nation Funding Advisers and Replace Company, an insurance coverage company. The corporate produces simply over $150 million in annual income. Arrow Monetary has elevated its dividend for 27 consecutive years.

Arrow reported fourth quarter and full-year earnings on January thirtieth, 2023, and outcomes had been fairly weak, lacking estimates on each the highest and backside strains. Earnings-per-share got here to 73 cents, however that missed estimates by seven cents. Income was $37.7 million, up 8.5% year-over-year, however lacking expectations by $1.3 million.

Internet earnings for the 12 months was $48.8 million, a decline of $1.1 million, or simply over 2%, in comparison with 2021. Earnings-per-share rose in This fall from 62 cents to 73 cents year-over-year. Internet curiosity margin for the 12 months was 3.03%. Complete property had been practically $4 billion on the finish of 2022. Complete loans had been $2.98 billion, and complete deposits had been $3.5 billion.

That places the financial institution’s loan-to-deposit ratio among the many highest in our protection universe, as that leaves Arrow with little room for mortgage development. E-book worth ended the 12 months at $21.36 per share, down about 5% year-over-year, which was the results of unrealized losses within the financial institution’s available-for-sale portfolio, which in flip was pushed by larger rates of interest.

Click on right here to obtain our most up-to-date Positive Evaluation report on AROW (preview of web page 1 of three proven beneath):

5-year anticipated returns: 18.2%

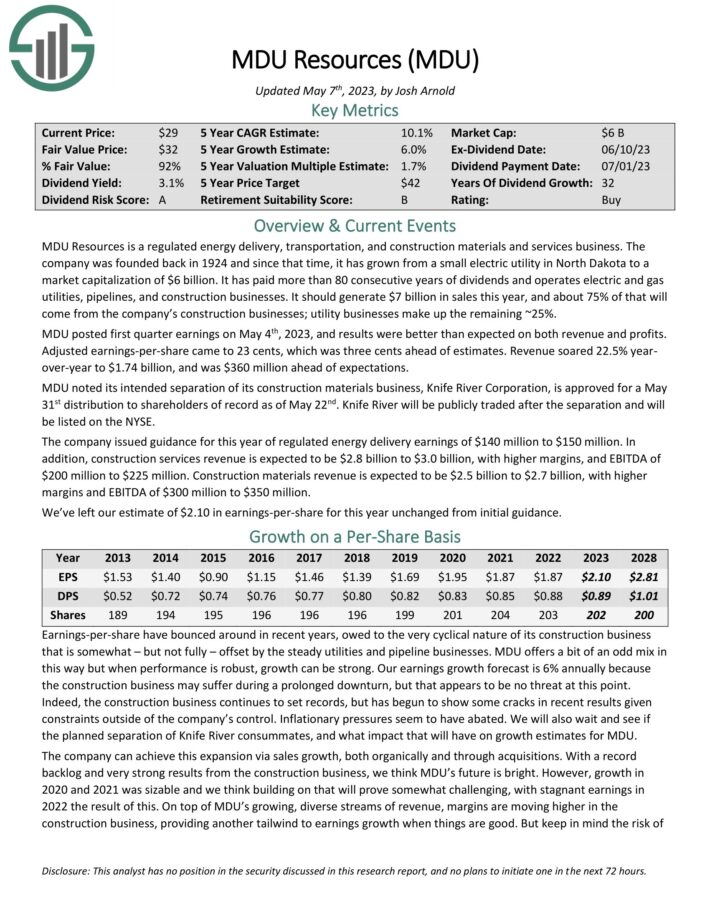

MDU Sources is a regulated power supply, transportation, and development supplies and companies enterprise. It has paid greater than 80 consecutive years of dividends and operates electrical and fuel utilities, pipelines, and development companies. It ought to generate $7 billion in gross sales this 12 months, and about 75% of that may come from the corporate’s development companies; utility companies make up the remaining ~25%.

MDU posted first quarter earnings on Could 4th, 2023, and outcomes had been higher than anticipated on each income and earnings. Adjusted earnings-per-share got here to 23 cents, which was three cents forward of estimates. Income soared 22.5% yearover-year to $1.74 billion, and was $360 million forward of expectations.

Click on right here to obtain our most up-to-date Positive Evaluation report on MDU Sources (preview of web page 1 of three proven beneath):

Prime Dividend Champion #2: Albemarle Company (ALB)

5-year anticipated returns: 18.7%

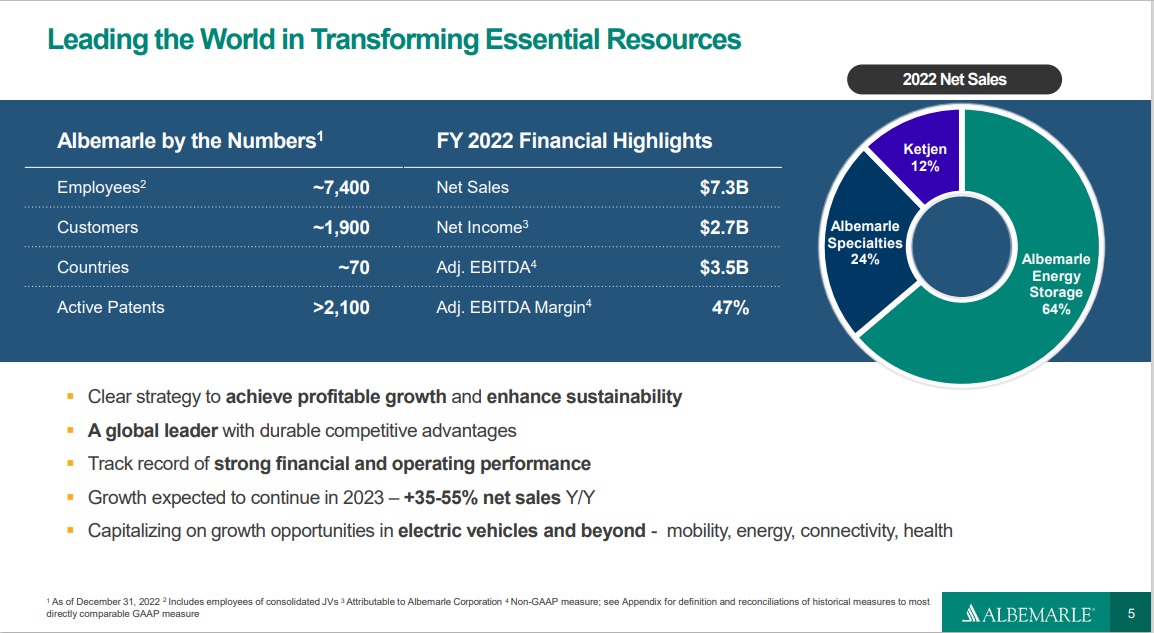

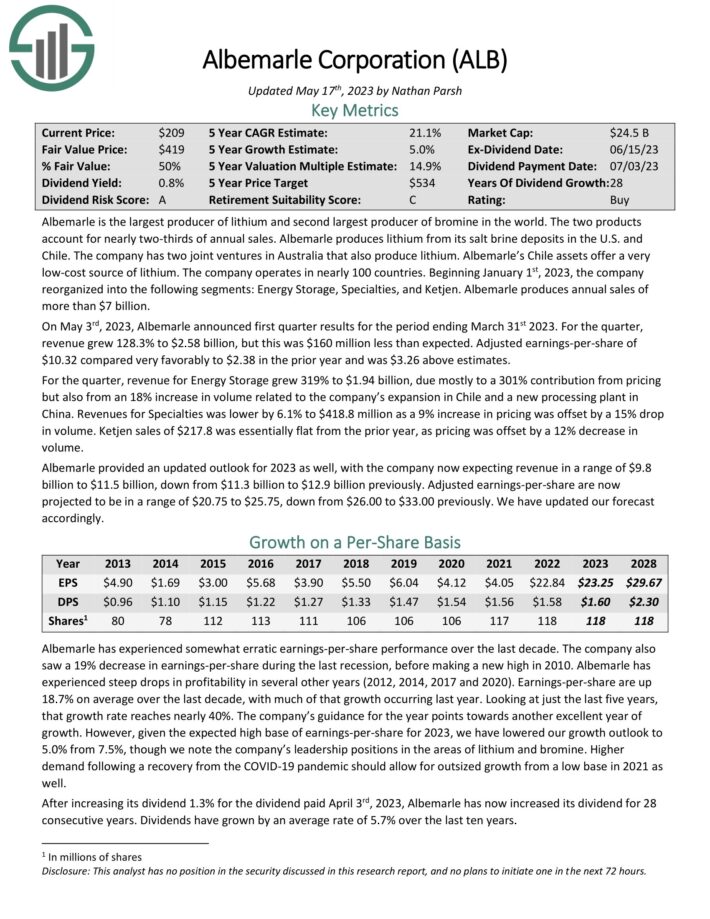

Albemarle is the biggest producer of lithium and second largest producer of bromine on the earth. The 2 merchandise account for practically two-thirds of annual gross sales. Albemarle produces lithium from its salt brine deposits within the U.S. and Chile. The corporate has two joint ventures in Australia that additionally produce lithium.

Associated: 2023 Lithium Shares Listing

Supply: Investor Presentation

On Could third, 2023, Albemarle introduced first quarter outcomes. For the quarter, income grew 128.3% to $2.58 billion, however this was $160 million lower than anticipated. Adjusted earnings-per-share of $10.32 in contrast very favorably to $2.38 within the prior 12 months and was $3.26 above estimates.

Click on right here to obtain our most up-to-date Positive Evaluation report on Albemarle (preview of web page 1 of three proven beneath):

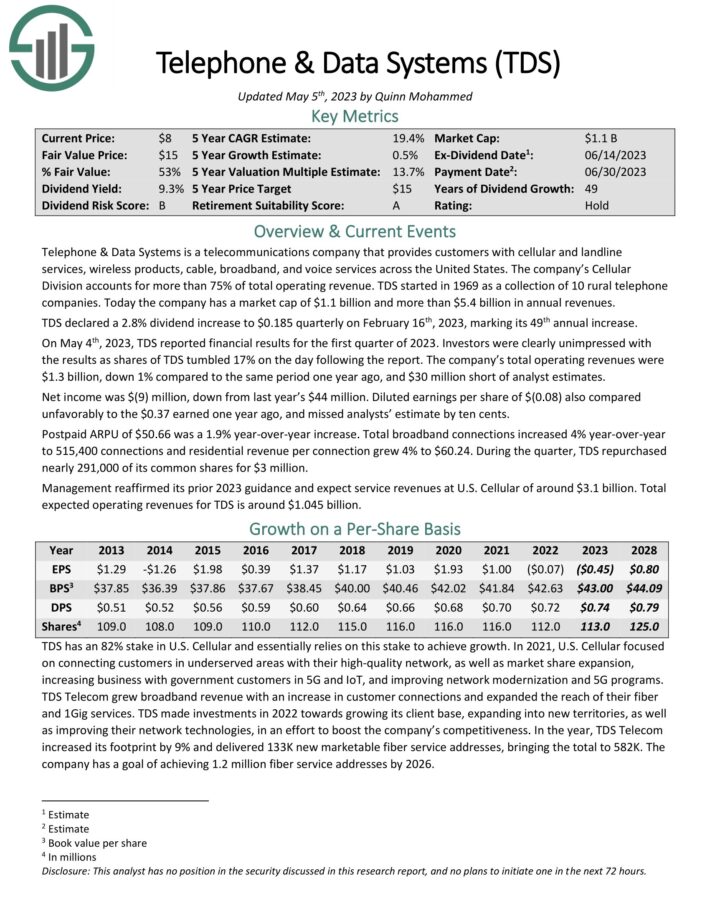

Prime Dividend Champion #1: Phone & Information Methods (TDS)

5-year anticipated returns: 19.8%

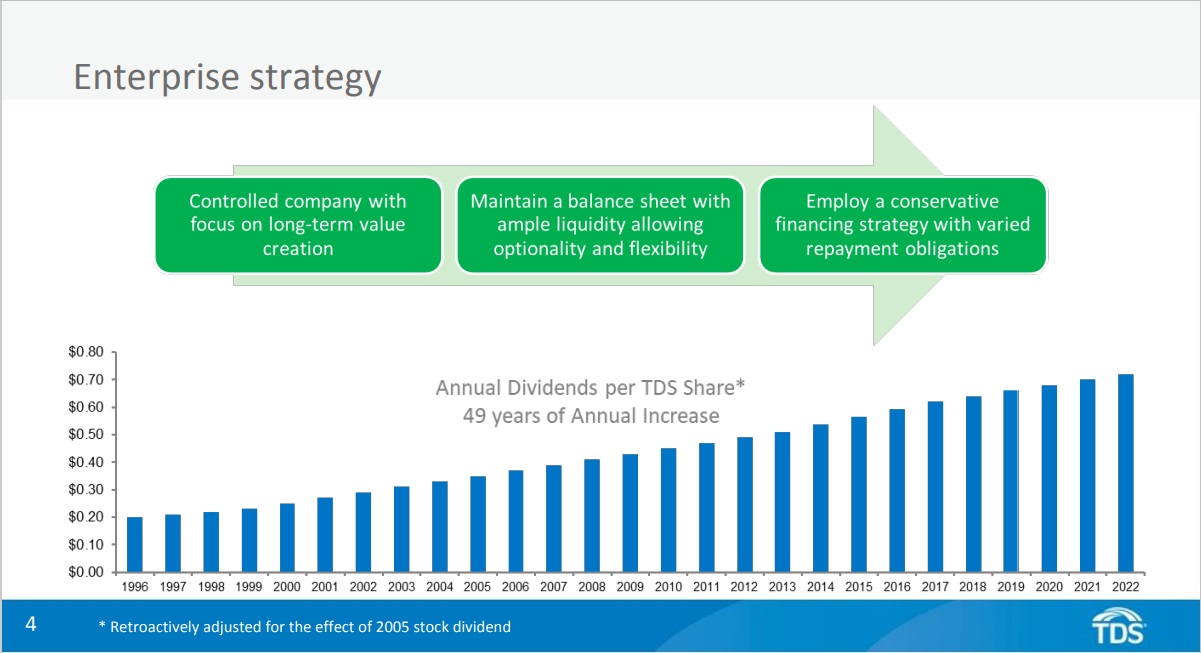

Phone & Information Methods is a telecommunications firm that gives clients with mobile and landline companies, wi-fi merchandise, cable, broadband, and voice companies throughout the U.S. The Mobile Division accounts for greater than 75% of complete working income.

Phone & Information Methods has an 82% stake in U.S. Mobile and primarily depends on this stake to attain development. The sturdy dependence of Phone & Information Methods on U.S. Mobile ends in an especially risky and unreliable efficiency. The corporate has grown quick in some years however it has enormously decelerated within the final two years. It incurred losses final 12 months and is poised to incur additional losses this 12 months.

Earnings don’t cowl its dividend, as the corporate is poised to incur losses this 12 months. Given additionally its inconsistent enterprise efficiency, the dividend sustainability is questionable.

Click on right here to obtain our most up-to-date Positive Evaluation report on Phone & Information Methods (TDS) (preview of web page 1 of three proven beneath):

Remaining Ideas

The varied lists of shares by size of dividend historical past are an excellent useful resource for traders who deal with high-quality dividend shares.

To ensure that an organization to lift its dividend for not less than 25 years, it will need to have sturdy aggressive benefits, extremely worthwhile companies, and management positions of their respective industries.

Additionally they have long-term development potential and the power to navigate recessions whereas persevering with to lift their dividends.

The highest 7 Dividend Champions introduced on this article have lengthy histories of dividend development, and the mixture of excessive dividend yields, low valuations, and future earnings development potential make them enticing buys proper now.

The Dividend Champions record isn’t the one option to rapidly display screen for shares that repeatedly pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].

[ad_2]

Source link