[ad_1]

JennaWagner/E+ by way of Getty Photos

The Federal Reserve paused charge hikes eventually week’s coverage assembly, however Fed Chairman Jerome Powell advised the Home Monetary Providers Committee on Wednesday that extra will increase have been seemingly.

“Inflation has moderated considerably for the reason that center of final 12 months,” he mentioned, however “inflation pressures proceed to run excessive, and the method of getting inflation again right down to 2% has an extended option to go.” He added: “Practically all FOMC contributors anticipate that it will likely be applicable to boost rates of interest considerably additional by the top of the 12 months.”

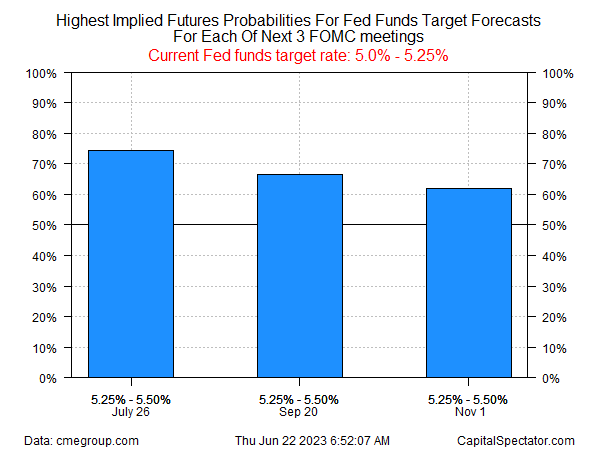

In the meantime, Fed funds futures proceed to lean towards a one-and-done situation, based mostly on the very best estimated chance estimates for the subsequent three Fed conferences. After a 25-basis level improve on the July assembly, the group assumes the Fed funds goal charge will peak at 5.25%-5.50%.

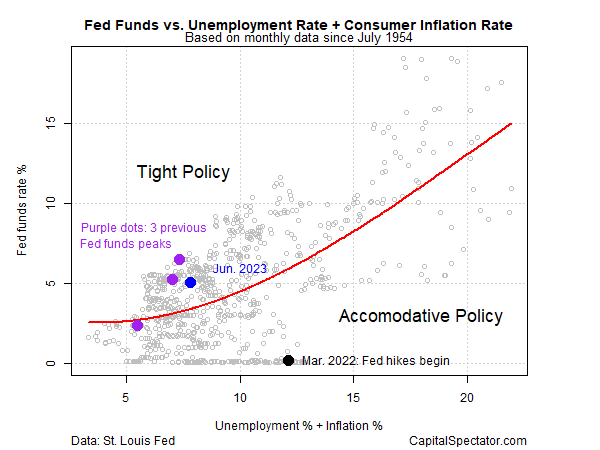

A easy mannequin utilizing unemployment and client costs to profile Fed coverage suggests {that a} reasonably tight profile prevails. That is a believable, if nonetheless unproven, situation for anticipating that charge hikes might quickly finish.

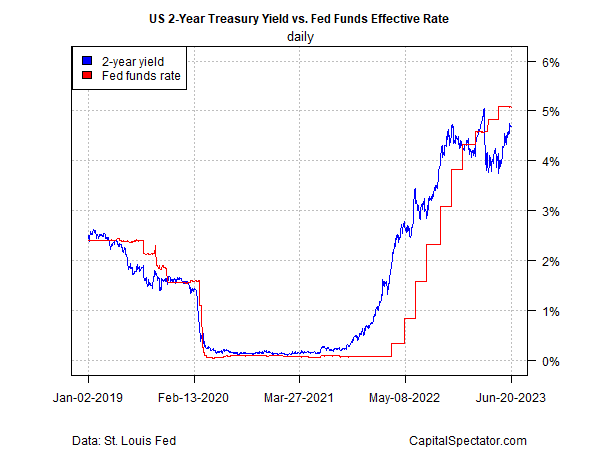

The two-year US Treasury yield can also be priced in anticipation that the Fed funds goal charge is at or close to a peak. The policy-sensitive 2-year yield was unchanged yesterday at 4.68% (June 21). Though this key Treasury yield is up a pointy 90 foundation factors over the previous month, the truth that it stays under the Fed funds charge displays the market’s view that charge hikes are near peaking.

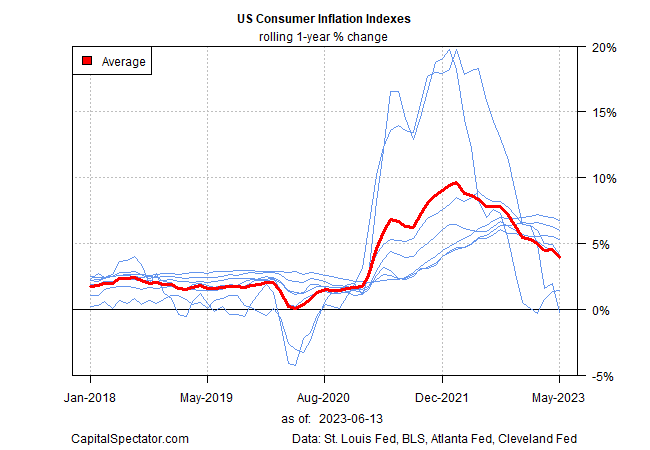

The ultimate arbiter on what occurs subsequent will nearly actually be the incoming inflation numbers. There may be concern that whereas inflation has peaked, the easing of pricing pressures has been slower and fewer persistent than the Fed prefers. The excellent news is that the draw back bias appears set to persist, based mostly on the common change within the 1-year tempo of seven inflation measures (for a listing, see web page 3 right here).

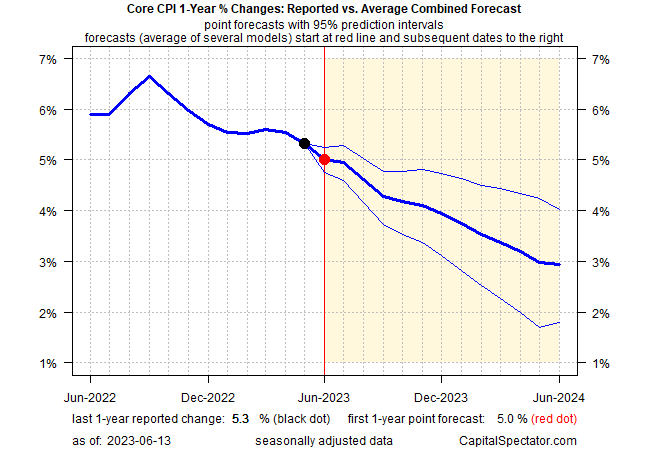

CapitalSpectator.com’s ensemble forecasting mannequin for core CPI additionally factors to softer pricing stress within the months forward, albeit at a sluggish tempo, which helps the view that greater than charge hike is feasible and maybe seemingly.

The acid take a look at, as all the time, is the precise information. The subsequent key actuality examine is the June CPI report, due in just a few weeks. For the second, a cautiously optimistic outlook prevails {that a} “lengthy option to go” could also be a shorter street than the hawks assume.

But when the doves are leaping the gun, once more, the supply for disappointment appears prone to come from a resilient economic system, advises Tim Duy, chief US economist at SGH Macro Advisors. In a word despatched to shoppers final week, after the Fed introduced a pause, he defined:

The tightening cycle continues. We should not low cost the latest SEP and its projection of one other 50bp of charge hikes. The economic system merely has not cracked as anticipated. As now we have written, exercise is extra resilient than economists are inclined to anticipate. It is constructed with an inner bias for progress and is at the moment benefiting from fiscal and demographic help. The longer this continues, the extra market contributors, and the Fed, will suspect that the impartial charge has risen.

To reprise and revise a well-known line from the period of the Clinton administration, “It is [still] the economic system, silly.” In flip, the essential query: Will the economic system keep resilient?

Unique Publish

Editor’s Be aware: The abstract bullets for this text have been chosen by Looking for Alpha editors.

[ad_2]

Source link