[ad_1]

AmnajKhetsamtip

Introduction

GSK plc (NYSE:GSK) is a London-based international healthcare large, identified for producing an array of prescription drugs, vaccines, and client healthcare merchandise. The corporate’s portfolio consists of famend medicine reminiscent of Advair for bronchial asthma, Trelegy Ellipta for COPD, and Shingrix, a number one shingles vaccine. With an emphasis on respiratory illnesses, HIV, oncology, and immuno-inflammation, GSK’s strategic focus ensures a gradual pipeline of progressive choices.

In a latest improvement, GSK reached a settlement regarding a lawsuit tied to Zantac, a product which was taken off the cabinets resulting from its hyperlink to most cancers. The following article will study GSK’s funding potential within the aftermath of this latest information.

Q1 2023 Earnings

Let’s first evaluation financials. In Q1 2023, GSK reported decreased COVID-19 answer gross sales in comparison with Q1 2022, however noticed a sturdy 10% progress when excluding these options, owing to robust showings in Vaccines, Specialty and Basic Medicines divisions. Key progress contributors have been Shingrix, meningitis vaccines, HIV medicines, Benlysta, Nucala and Trelegy. Working revenue and EPS suffered as a result of distinctive earnings benefit from the Gilead (GILD) settlement in Q1, 2022 and diminished Xevudy gross sales. Adjusted working revenue stayed constant, whereas EPS elevated 7% resulting from fewer non-controlling pursuits, a decrease tax charge, and vigorous gross sales progress. Money generated from operations was $364.59 million; free money outflow ($875.3 million) was decrease than Q1 2022 as a result of timing of Gilead settlement and revenue share funds. The corporate reaffirmed its full-year 2023 steerage and declared a $0.18 dividend for Q1, 2023.

GSK Inventory Evaluation

As of the most recent information per In search of Alpha, GSK has a formidable valuation, with a ahead non-GAAP P/E ratio of 9.47, which is kind of modest, suggesting the inventory is perhaps undervalued given the earnings potential. Its GAAP P/E ratio for trailing twelve months [TTM] is 12.90, displaying cheap valuation. The corporate’s price-to-book ratio stands at 4.81, indicating that it is perhaps barely overvalued relative to its web belongings.

By way of progress, GSK presents a combined bag. Whereas its year-over-year (YoY) income and diluted EPS have grown by 8.81% and 10.03% respectively, it has seen a decline in its three-year income progress [CAGR] at -6.15%. Its three-year EPS progress, nevertheless, is strong at 38.84%. The destructive levered free money move [FCF] progress YoY of -37.36% suggests potential monetary strains.

GSK boasts robust profitability metrics, with a gross revenue margin of 70.35% and an EBIT margin of 25%. Its excessive web earnings margin of fifty.35%, return on fairness (ROE) of 28.17%, and return on belongings (ROA) of 6.13% sign efficient administration and promising profitability.

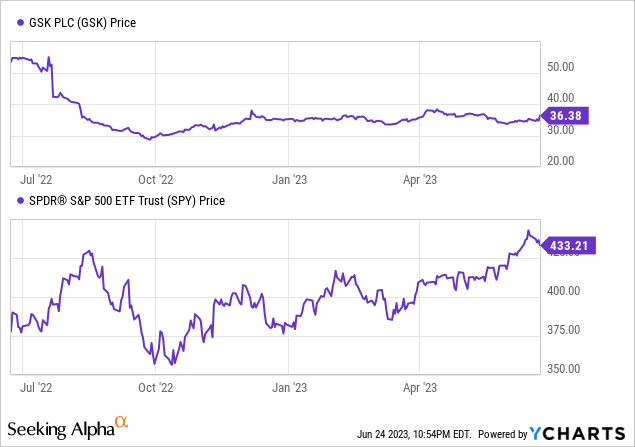

Nonetheless, its momentum has been considerably lackluster. Over the previous yr, GSK’s inventory value has underperformed relative to the broader market, with a destructive return of -33.90% in comparison with the S&P 500’s constructive return of 16.54%.

GSK’s market cap stands at $70.19 billion, with complete debt at $25.79 billion and money holdings of $8.60 billion. This leaves it with an enterprise worth of $87.30 billion. Given these financials, GSK appears to supply worth, however buyers could must brace for some volatility given its combined progress and momentum indicators.

GSK Settles Zantac Lawsuit, Faces Ongoing Authorized Battle

GSK has achieved a landmark settlement within the U.S., successfully circumventing the Goetz case, a lawsuit regarding its former heartburn drug, Zantac, which has been linked to most cancers dangers. Whereas sustaining its innocence, GSK pledges a staunch protection in opposition to the remaining Zantac lawsuits. The drug, also referred to as ranitidine, was faraway from the U.S. market in 2020 resulting from doable carcinogenic results.

This settlement is paying homage to Bayer’s (OTCPK:BAYZF) ongoing litigation regarding Roundup, a weedkiller alleged to trigger most cancers, leading to billions in settlement prices. The severity of the scenario for GSK hinges on the variety of comparable lawsuits and their outcomes. Dealing with a mess of lawsuits might impose a big monetary burden, probably even catastrophic, regardless of GSK’s intention to vigorously contest the remaining instances. Moreover, reputational harm could happen, impacting the corporate’s valuation and investor confidence.

Avoiding a court docket trial within the Goetz case has the twin advantage of lowering publicity surrounding the difficulty and probably deterring additional lawsuits. When a case goes to court docket, it inherently attracts extra public consideration. Media studies would possible recount the main points of the alleged dangerous results of Zantac, probably additional damaging GSK’s popularity. By settling out of court docket, GSK can management the narrative surrounding the difficulty to some extent and mitigate potential reputational hurt. Moreover, a court docket trial might encourage different customers of Zantac to return ahead with their very own lawsuits, notably if the plaintiff wins or receives a considerable settlement. By avoiding a court docket trial, GSK could forestall such a snowball impact from occurring.

Nonetheless, the court docket ruling in March 2023, admitting the plaintiff’s skilled causation opinions within the Goetz case for jury evaluation, provides a layer of credibility to the plaintiff’s allegations and complicates GSK’s authorized panorama. It is vital to notice that this ruling solely applies to the Goetz case and doesn’t suggest settlement with the plaintiff’s scientific conclusions.

Moreover, the scheduling of two further trials for 2024 underlines the continuing authorized problem. These upcoming trials, alongside GSK’s proactive protection stance, recommend that this litigation might prolong over a number of years and probably incur substantial prices. This case might considerably affect GSK’s financials and popularity, signaling a probably tumultuous interval for the corporate and its shareholders.

Regardless, for now, plainly buyers have reacted positively to GSK’s try and restrict authorized publicity and potential reputational hurt ensuing from the settlement within the Goetz case.

My Evaluation & Suggestion

In gentle of GSK’s latest settlement regarding Zantac and a crucial evaluation of the corporate’s financials, the longer term for this pharmaceutical titan is considerably veiled in uncertainty. Whereas the out-of-court settlement has successfully diminished quick reputational dangers and potential monetary liabilities, the continuing authorized battles and the looming presence of future lawsuits stay a transparent concern for the corporate. The settlement may very well be seen as a method to suppress the magnitude of the difficulty, but it is a ticking time bomb that might probably lead to heavy monetary burdens and extreme reputational harm.

Regardless of the stormy authorized atmosphere, GSK’s monetary well being stays robust. With a sturdy gross revenue margin, a ahead non-GAAP P/E ratio that means potential undervaluation, and an honest EPS progress, the corporate reveals resilience and monetary stability. These elements, coupled with a formidable product portfolio and constant funding in R&D, recommend that GSK has the flexibility to climate the storms forward.

Nonetheless, the momentum of the inventory is one thing buyers must scrutinize, given the latest underperformance in comparison with the broader market. It is important to look at how the authorized challenges affect the corporate’s inventory value and market place within the close to time period. Moreover, the upcoming trials in 2024 are more likely to function essential turning factors that might considerably affect investor sentiment and the corporate’s total monetary well being.

Taking all of this into consideration, my suggestion for GSK could be a cautious ‘Maintain’. This suggestion is derived from the assumption that the corporate’s robust monetary place and progressive product pipeline steadiness out the potential destructive impacts of the continuing authorized points. That stated, the maintain suggestion comes with a powerful urge for present and potential buyers to maintain a detailed eye on the unfolding authorized situation and its affect on the corporate’s monetary and operational efficiency.

[ad_2]

Source link