[ad_1]

We Are

Fundamental Thesis & Background

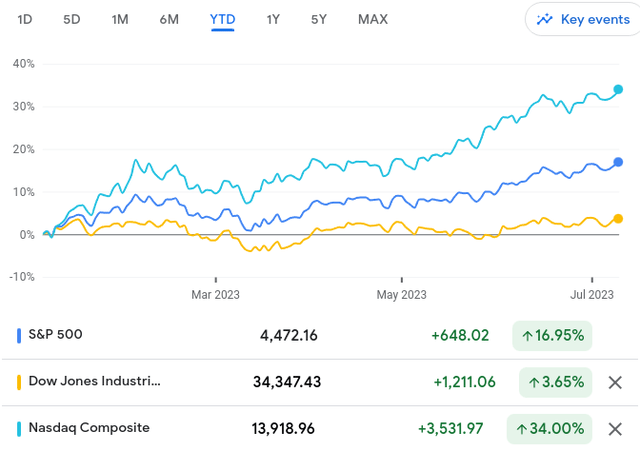

The aim of this text is to guage the broader funding panorama with a selected concentrate on equities. That is of heightened relevance to me proper now for quite a lot of causes. One, my portfolio is chubby equities so I’ve a eager curiosity in whether or not or not I would like to regulate my holdings. Two, the market has been on a formidable run within the short-term. This makes evaluating the potential future returns all of the extra mandatory:

YTD Efficiency (Google Finance)

Three, we now have to keep in mind that volatility has picked up over the previous eighteen months. Whereas volatility is low proper now – 2022 just isn’t as distinct of a reminiscence as one would really like. Markets tumbled final yr, solely to rise swiftly this yr, and that implies something could possibly be forward for the second half of 2023!

What I’m going to do for this overview is concentrate on some historic information factors, after which element why these could or is probably not probably the most applicable metrics for contemplating the place the market will go. We’re getting into a vastly totally different funding panorama than we now have been in over the past 10-15 years. So a extra ahead considering strategy is warranted. Nonetheless, we now have to be life like when it comes to historic norms and the way that would impression investor sentiment and the outlook for fairness indices. On this gentle, I’ll share my ideas as we transfer deeper into Q3.

Historic Lookbacks Solely One Piece Of The Puzzle

The primary level I need to contemplate is how helpful taking a look at previous valuations will be. This can be a widespread attribute buyers can contemplate when deciding if now could be a “good” value to buy-in. There is no such thing as a set method for when a inventory/sector/index is a real purchase or not. What is dear? It’s a subjective argument. And that’s the reason we see various costs for some corporations and sectors in comparison with others. There is no such thing as a one measurement matches all strategy. So averages and historical past can information us, however not essentially give a concrete reply.

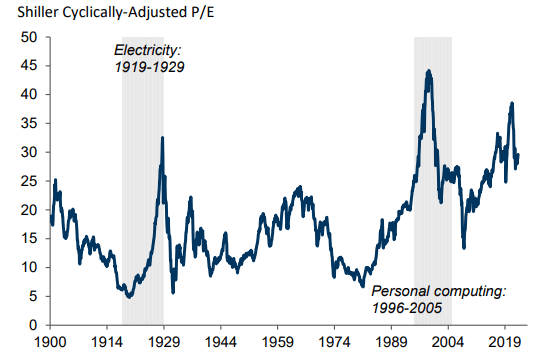

This will sound imprecise nevertheless it has relevance proper now. A standard benchmark for fairness buyers is the S&P 500. If we take a look at the present value to purchase the S&P 500, whether or not it’s costly or not likely depends upon one’s perspective. The present valuation is larger than the common for the previous 120 years, however within the shorter time period the valuation does not appear too outrageous:

Shiller P/E Ratio Over Time (For S&P 500) (Goldman Sachs)

Readers could also be asking – so what conclusion can I draw from this? Why is Dividend Seeker highlighting this data?

The easy cause is that it is necessary as a result of we could not have the ability to draw an easy conclusion from it. That’s basically my entire level. Whether or not shares are costly or not just isn’t clear right here. Are they based mostly on the previous 120 years? Sure. Are they based mostly on the final 5? No. So which timeframe do we have to use?

My reply to that’s maybe none. What actually issues just isn’t previous valuations however whether or not or not U.S. firms are going to be making more cash within the months and years forward. If earnings go up, or the macro-environment is favorable, or the financial system is increasing, then P/E will care for itself. So evaluating how favorable situations are going to be for the subsequent few quarters is way more vital than making an attempt to determine if shares are at present costly based mostly on historic norms. That’s the main message I need to convey right here.

Costly Shares Are Driving Index Beneficial properties

However trying forward does imply contemplating the place we at the moment are. How life like are extra good points on this market? With inflation easing, a chance for much less Fed tightening, and a recession that is still “delayed” (it’s doable it will not even occur this yr in any respect), the macro-outlook is not horrible. In truth, the labor market is powerful, client spending stays supportive, and geo-political tensions with Russia and China have moved away from alarmist headlines. That is all excellent news for equities as a complete.

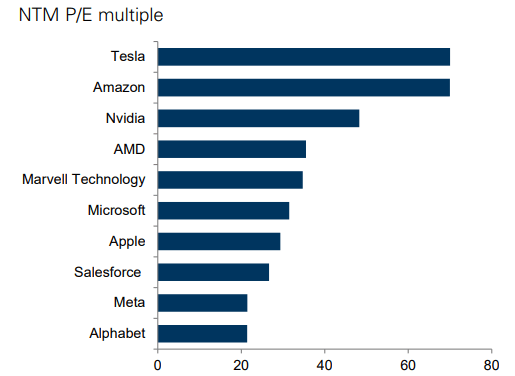

However we now have to pay attention to what has been driving the market already in 2023 to know if extra good points are actually sustainable. Whereas the “market” is up huge – that is truly being pushed by a handful of names – and people are principally Tech names liable for the good points. This is the reason the NASDAQ is up by a lot greater than the DOW and the S&P 500 as I illustrated within the opening paragraph.

With this in thoughts, I need to emphasis that these names are nowhere close to low cost. The P/E ranges are very excessive for some, and reasonably excessive for others, however none of them are in discount territory:

High Market Drivers – P/E Ratios (FactSet)

I takeaway two issues from this. One, for indices to go up, these corporations must develop their earnings robustly in an effort to hold P/E ratios in verify. There’s a restrict to what buyers pays, even for the likes to Tesla and Amazon. Two, if the primary level does not occur, then we’d like the opposite 475+ shares within the S&P 500 to step up. This has not been a broad market rally and that issues me that it is not actually supported. As soon as we see broader participation, I can see confidence on a go-forward foundation. Till then, the longer term outlook must be cautious in my view.

U.S. Giant-Caps Profit From A Falling Greenback

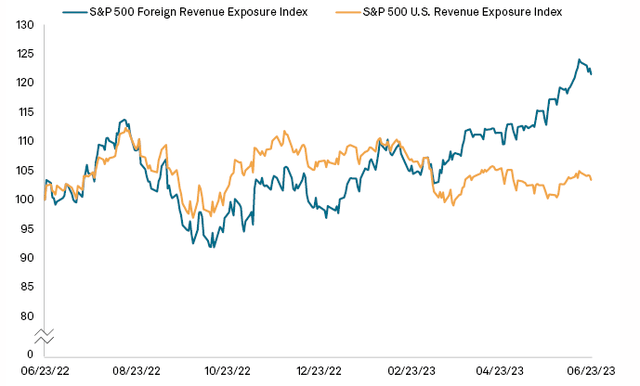

I’ll now study a cause why shares can go larger. And after I consult with “shares” on this case I imply the S&P 500. I’m trying on the large-cap U.S. fairness market as a result of that may be a main benchmark and can be the majority of my private publicity. So I take a look at the market from the angle of: can U.S. corporates carry out nicely each domestically and abroad. Giant U.S. firms usually have a good deal of overseas income publicity, so evaluating the worldwide atmosphere is vital to U.S. large-cap centric buyers (like myself).

One metric to take a look at to know that is the worth of the U.S. greenback. Regardless of a common rising price atmosphere domestically, the U.S. greenback has been falling in opposition to quite a lot of world currencies. This has occurred since inflation started to ease in America and expectations for a Fed “pause” started to rise. This has led to a boon for home corporations with plenty of overseas publicity as a result of these foreign currency echange, when transformed to US {dollars}, turn into value extra. In consequence, large-cap corporations within the S&P 500 with extra overseas income have been out-performing their domestic-oriented friends:

Inventory Divergence Based mostly on Origination of Income (S&P World)

I do need to handle expectations a bit right here. If I’m being trustworthy, I’m shocked on the drop within the U.S. greenback at a time when rates of interest are rising, however that ties again to my title of “trying ahead, not again” thesis.

After we look forward, the actual fact is the Federal Reserve has probably already enacted its largest will increase to benchmark rates of interest. That is true even with future price hikes anticipated later this yr. The massive strikes are accomplished, and buyers are trying ahead. Sooner or later, other than the fast subsequent few months, rates of interest are prone to be decrease. On the finish of 2023 and in to 2024, the U.S. greenback will stay beneath strain because the market begins to cost in cuts. Whether or not these occur or not will stay to be see, however it’ll impression the fairness market on a constant foundation regardless.

From that perspective, large-cap U.S. corporations with plenty of overseas publicity will in all probability out-perform as they’ve been. This makes me comfy proudly owning a disproportionate quantity of funds like SPDR Dow Jones Industrial Common ETF (DIA), Vanguard S&P 500 ETF (VOO) and the Invesco QQQ ETF (QQQ).

Developed World Is Going To Have To Make Structural Modifications

My ultimate thought takes a take a look at debt ranges. That is truly forward-looking regardless of the info being real-time. What I imply is – debt ranges are excessive and since I count on an elevated price atmosphere to persist by means of the rest of 2023, this has an out-sized financial impression.

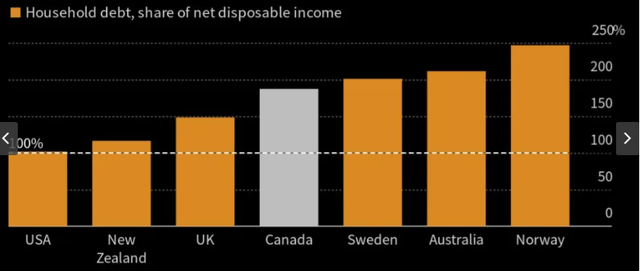

To be clear, this isn’t distinctive to the U.S. as different developed international locations have the identical problem. Central banks world wide have upped borrowing prices and shoppers and households have felt the pinch. Inflation is pushing costs up and better rates of interest make borrowing to pay these larger costs much more tough to handle. The importance of this on the truth of the world right this moment is proven fairly clearly within the following graphic:

Family Debt (Yahoo Finance)

What I draw from that is that change goes to be wanted sooner or later. This isn’t a sustainable course. Developed names are going to should discover a strategy to carry down inflation, decrease borrowing prices, pump out extra stimulus, or another strategy to ease the burden to shoppers. Developed world households can not ship consumption progress with this backdrop. They’ve been residing on prior stimulus, amplified financial savings charges, and a perception that “sooner or later” costs will come down. Stimulus has dried up, saving charges are depressed as households dip into prior financial savings to make ends meet, and central banks are usually not displaying any indication of slicing charges (on common).

For a consumption-driven financial system to thrive, this isn’t a great backdrop. This tells me that I needs to be monitoring retail/client discretionary publicity very carefully within the months forward as a result of – with out change – one thing goes to interrupt.

Backside-line

The world of investing requires an understanding of the previous, however an knowledgeable opinion on what the longer term holds. The long run is what is going to drive returns, so understanding what’s going on now that can form how the world seems over the subsequent few quarters (and years) is of important significance. On this regard, I see a situation the place inventory valuations come beneath strain, however large-caps who’re chubby with overseas income publicity maintain up higher than others. This is because of my perception that the USD has in all probability peaked and overseas revenues will assist drive income going ahead.

Moreover, yields are additionally close to their peak, though the Fed might transfer one or two extra instances on charges. However as inflation eases, there’ll in all probability be a lag earlier than treasury yields observe swimsuit. We are likely to see the Fed, and by extension the treasury yield curve, be reactionary quite than proactive. Which means whereas inflation has already began to ease decisively, treasury yields will take longer to return down:

CPI vs. Treasury Yield (Bloomberg)

The impression of that is that buyers (and companies) will favor larger borrowing prices for the rest of the yr, if not longer. This places strain on extra discretionary names and in addition on corporations which have much less value elasticity with their items and companies. The secret might be on high quality holdings, selectivity, and amplifying publicity to these names that may profit from each a falling USD but in addition who are usually not priced for perfection (i.e. Tesla). On this approach I really feel comfy sufficient in my long-only fairness portfolio, regardless of the rising market and more difficult financial image.

[ad_2]

Source link