[ad_1]

“Coronary heart Like a Truck” is a music recorded by American nation music singer Lainey Wilson. It was launched in Could 2022 because the lead single from her second studio album, Bell Backside Nation.

Lyrically, the music compares her coronary heart to a truck and is about acknowledging that it’s okay to expertise heartache and to recollect to maintain on going. In a press release accompanying the music’s launch, Wilson defined “This can be a music about discovering freedom in energy, and never being afraid of your scars and bruises. A truck that has hit a number of bumps and earned a number of scratches has proved itself and its tenacity… the shiny one on the lot can’t say that.”

The that means of this music clearly parallels the motion of the markets over the previous 1.5 years. The “bumps and scratches” the market skilled in 2022 created generational alternatives that our purchasers and plenty of of our podcast|videocast listeners have been in a position to and proceed to benefit from.

The music gained Feminine Video of the 12 months on the 2023 CMT Music Awards. (supply: Wikipedia)

I bought a coronary heart like a truckIt’s been drug by the mudRuns on goals and gasolineAnd that ole freeway holds the keyIt’s bought a lead foot down when it’s leaving…

Following alongside the theme of “vehicles” I joined Seana Smith and Akiko Fujita on Yahoo! Finance this Tuesday. Because of Taylor Clothier for having me on the present and Sydney Fried for the assist. We delivered our replace on Cooper Commonplace (which mentioned new automotive and TRUCK demand/incentives), BAC, VNO, Small Caps, Charges, Fed, earnings, outlook and extra. That is one to not be missed. There are fairly a number of surprises all through, however most significantly is that the actual cash won’t be made chasing the indices in 2H:

Watch in HD straight on Yahoo! Finance (Phase 1)

Watch in HD straight on Yahoo! Finance (Phase 2)

Full unedited model right here:

Right here had been a number of of my present notes forward of the section.

On Thursday night time I joined Mariko Oi on the BBC to debate financial institution earnings earlier than they began on Friday. Because of Joao da Silva for having me on. You may see the extent of skepticism that was prevalent going into banks earnings. It proved to be unfounded:

Sentiment

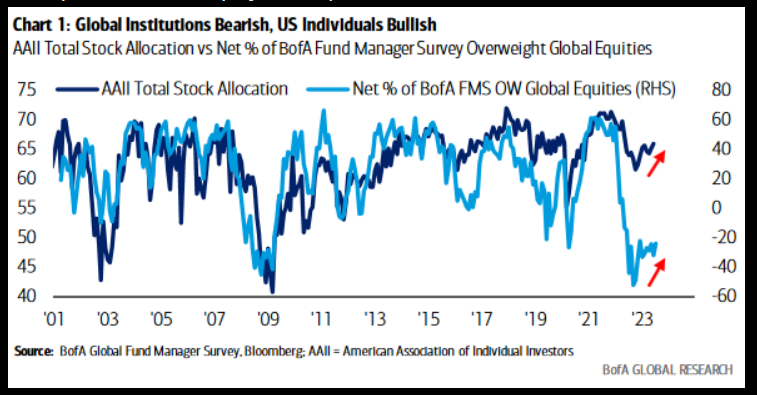

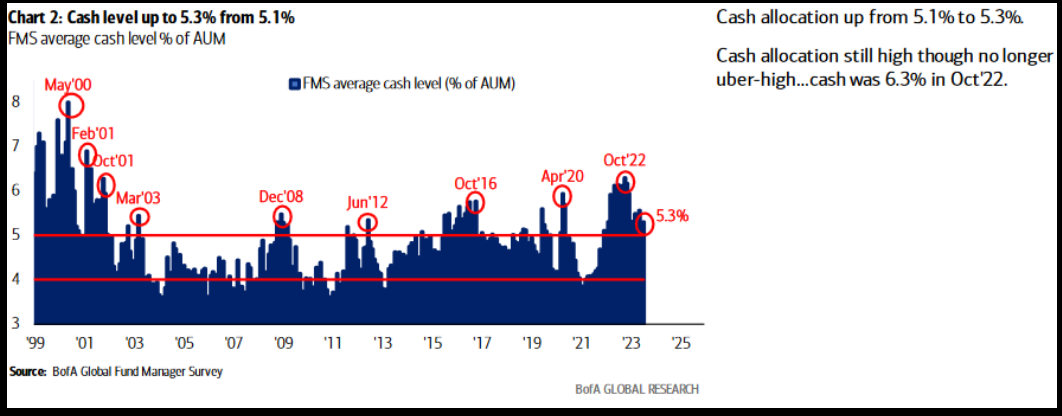

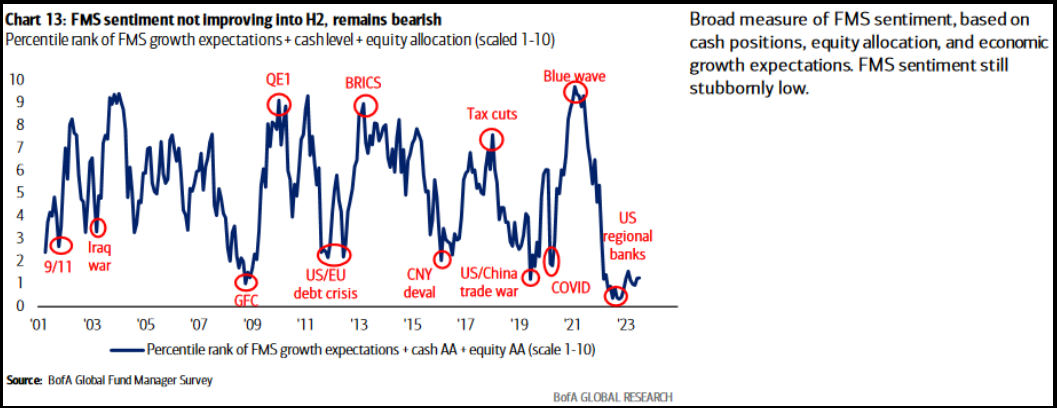

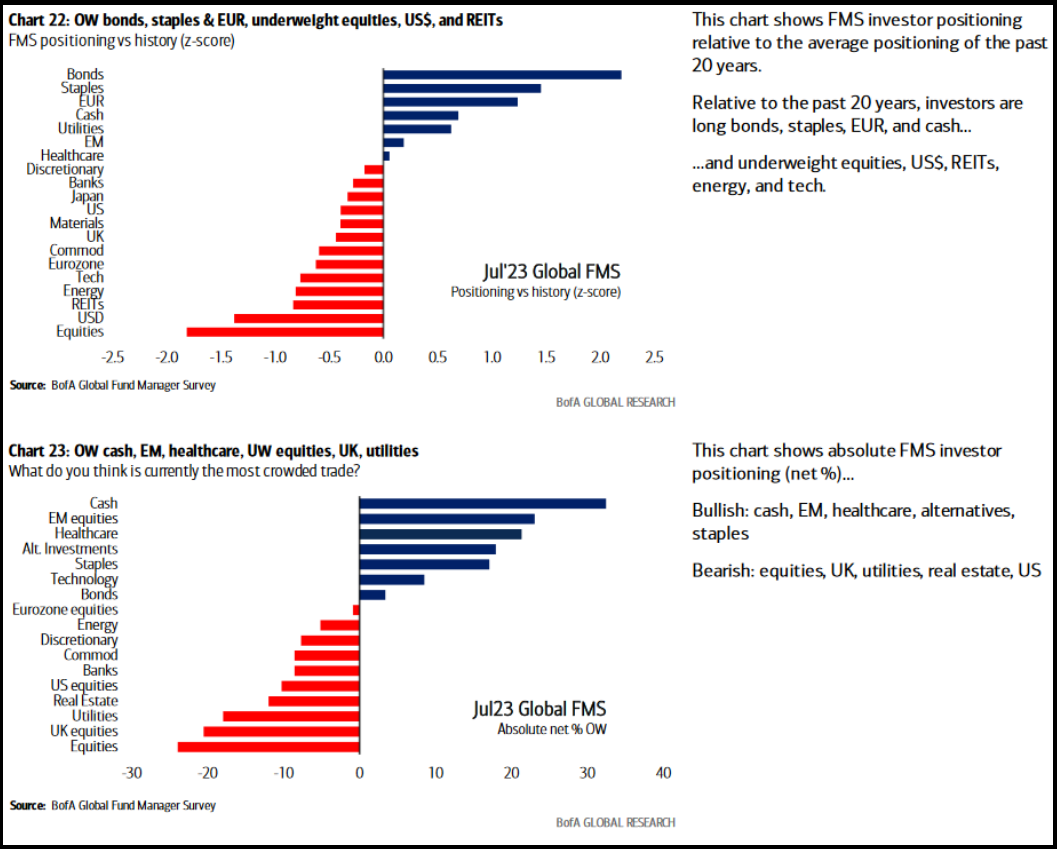

This Tuesday, Financial institution of America (NYSE:) printed its month-to-month “Fund Supervisor Survey.” I posted a abstract right here:

Right here had been the 5 key factors:

1. Much like COVID lows, “retail” bought it proper first, Establishments had been late to get again into equities and needed to play catch up.

2.Managers INCREASED their money positions this month. They are going to be pressured to purchase up an increasing number of. We’re seeing it already.

3. Sentiment is on the identical pessimistic stage you see at market lows (not highs):

4. Managers nonetheless obese money and bonds. Underweight equities. You already know what to do!

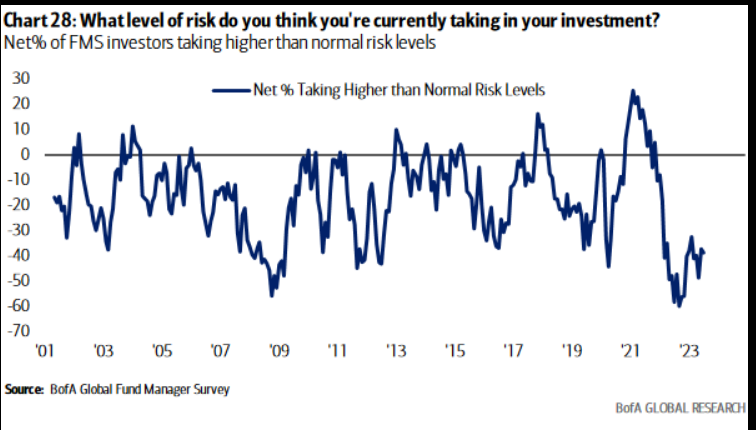

5. Traders taking the least danger since 2009 lows.

All the time keep in mind…

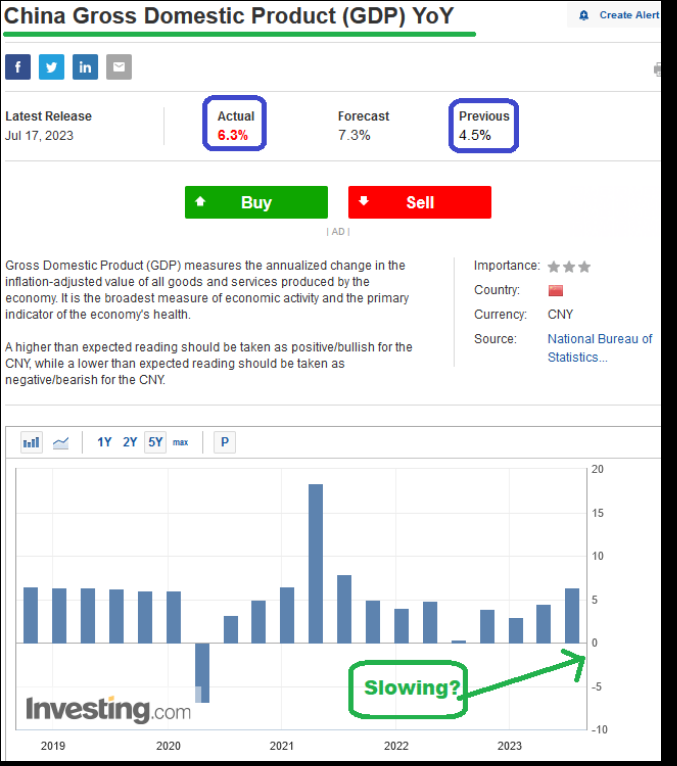

China Updates

Now onto the shorter time period view for the Basic Market:

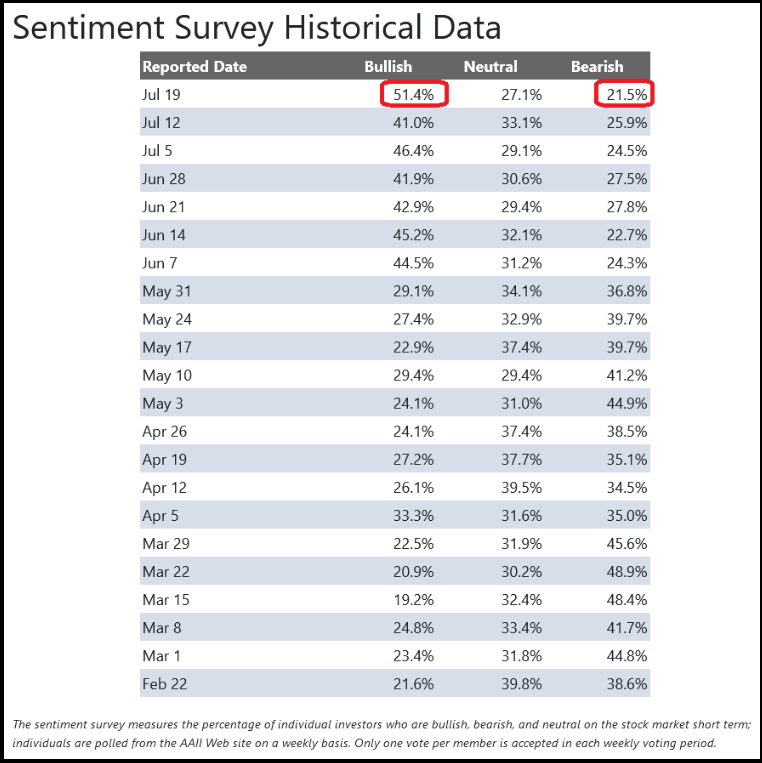

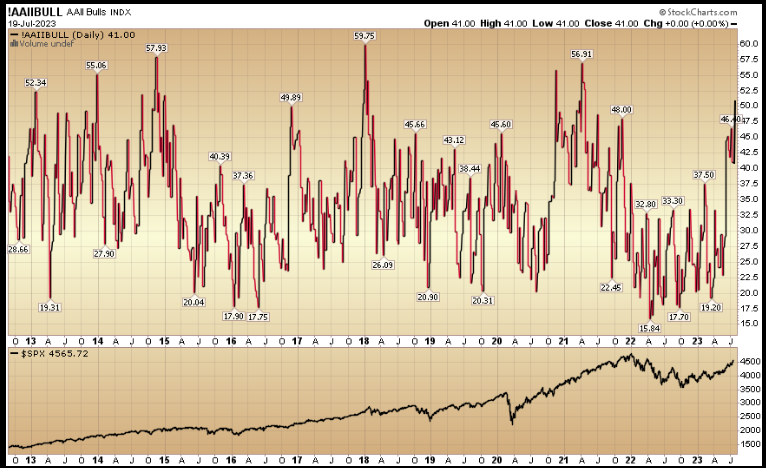

On this week’s AAII Sentiment Survey consequence, Bullish % (Video Clarification) jumped to 51.4% from 41% the earlier week. Bearish % dropped to 21.5% from 25.9%. The retail investor could be very optimistic. This will keep elevated for a while based mostly on positioning coming into these ranges, however it could not shock us to see slightly give-back in coming weeks (even when we had been to push a bit increased first). Take note, institutional buyers are nowhere close to totally invested but, so there might be a persistent bid on any bumpy pullbacks by year-end.

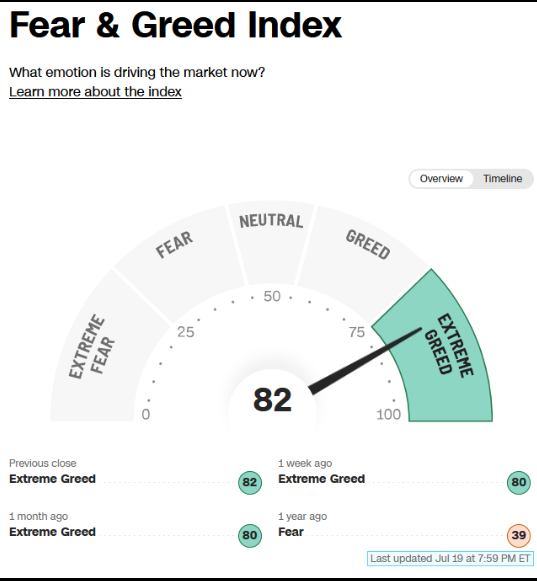

The CNN “Worry and Greed” ticked up from 80 final week to 82 this week. Sentiment is scorching and has remained pinned for a number of weeks. You may learn the way this indicator is calculated and the way it works right here: (Video Clarification)

Worry & Greed Index

US – CNN Worry and Greed Index

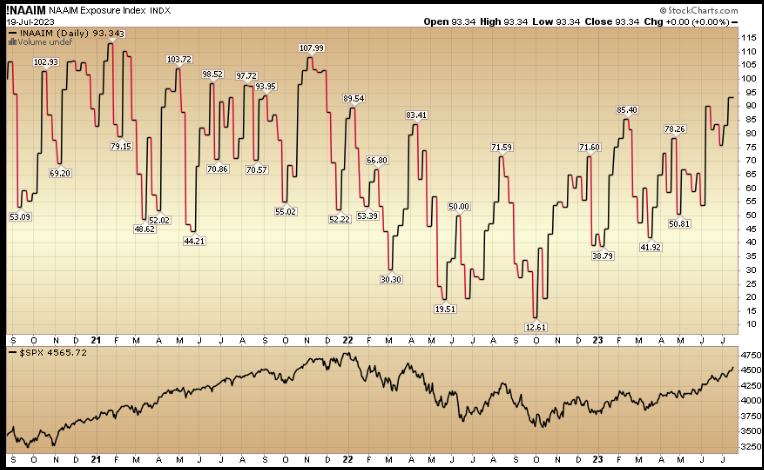

And at last, the NAAIM (Nationwide Affiliation of Energetic Funding Managers Index) (Video Clarification) moved as much as 93.34% this week from 83.11% fairness publicity final week. Managers have been chasing the rally.

This content material was initially printed on Hedgefundtips.com

[ad_2]

Source link