[ad_1]

Quantity is a crucial a part of the monetary market because it determines the power of a transfer within the monetary market.

In most intervals, market strikes which are supported by quantity are simpler than these with restricted ones. Subsequently, day merchants use quantity indicators when making choices to determine whether or not an asset is liquid or not.

On this article, we are going to delve into considered one of these indicators, the Damaging Quantity Index (NVI), transferring on to grasp how we will use it for our profit when buying and selling within the markets.

What’s the Damaging Quantity Index (NVI)?

The NVI is a little-known technical indicator that was created by Paul Dysart within the Nineteen Thirties. Over time, a number of iterations of his unique objectives have been advised. The idea behind this software is that it seems to be on the change in quantity to resolve when the sensible cash is lively.

Good cash out there refers to funds allotted by extremely skilled individuals, together with these in hedge funds and funding banks. These entities are believed to be extremely realized and that they’ll affect the broader market.

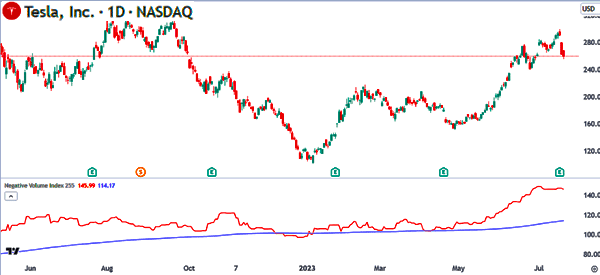

A key a part of the Damaging Quantity Index is that it assumes that the sensible cash is extra lively in intervals of low quantity and vice versa. The chart under reveals the NVI line in pink and the EMA line proven in blue.

How the NVI index is calculated

Studying how technical indicators are derived is an effective factor however it’s not all that obligatory since buying and selling platforms like TradingView and MetaTrader present them.

The Damaging Quantity indicator is calculated by including the online advances. Web advances is outlined as a interval when the online quantity dropped from one interval to the subsequent one.

In consequence, the cumulative NVI line is often unchanged when the quantity will increase from one interval to the opposite.

There are completely different iterations of this indicator. First, as proven above, the NVI indicator has added the exponential transferring common (EMA).

This EMA is good because it reveals the power of the NVI line. First, it’s doable to substitute the share worth change for web advances. So, that is the way you calculate the indicator:

First, set the beginning of the cumulative determine: It may begin at 100 or 1000.Subsequent, add the share worth change to the cumulative NVI when the quantity retreats.Lastly, add a sure EMA line for alerts. In most intervals, individuals add a 255-day EMA.

The method for the Damaging Quantity Index indicator is proven under:

NVIt = (Pt – P (t – 1) / P t-1 X NVI t-1

On this case NVIt is the detrimental quantity index at time t and Pt is the value or the index degree at time t.

The aim of the Damaging Quantity Index is to take a look at the quantity actions in an asset. These belongings embrace shares, cryptocurrencies, commodities, and bonds.

How NVI indicator works

As talked about above, this indicator works in a comparatively easy manner the place it seems to be on the quantity of an asset. Its aim is to see the developments of the sensible cash out there.

On this case, the indicator seems to be on the every day buying and selling quantity, making it much less best for day merchants. As an alternative, it’s principally utilized by swing merchants and long-term traders.

The interpretation of the software is equally easy. Specialists imagine {that a} bull market tends to occur extra when the NVI indicator strikes above the 255-moving common. Different consultants imagine {that a} bear market occurs when the indicator is under the transferring common.

Buying and selling the NVI indicator and instance

The NVI indicator works by its interactions with the 255-day transferring common. Subsequently, due to its long-term nature, day merchants don’t use it usually. As an alternative, they principally use it when conducting a multi-timeframe evaluation out there.

Multi-timeframe evaluation is a course of the place a dealer seems to be at a number of time frames in a aim of figuring out developments out there. You’ll be able to transfer from a every day chart then to a four-hour chart, adopted by the hourly and 15-minute chart.

A great instance of the toll at work is proven within the Tesla inventory under. For a long-term investor, the perfect time to have purchased the inventory was on June ninth when the NVI indicator moved above the transferring common.

Methods for utilizing the NVI indicator

As talked about, the NVI indicator will not be all that best for day merchants. That’s as a result of day merchants use extraordinarily short-term charts like one minute and 5 minutes. On this case, it might be laborious for them to make use of it out there.

Swing merchants and long-term traders use the Damaging Quantity Index indicator by its interplay with the exponential transferring common (EMA). As talked about above, they provoke a purchase commerce when it strikes above the transferring common and vice versa.

One other strategy is to mix it with different indicators. Typically, merchants use pattern indicators and oscillators to verify developments. The most well-liked indicators you should use the NVI with are transferring averages and Relative Energy Index (RSI).

Within the chart under, we see that the NVI moved above the 255-day transferring common when the inventory moved above the 2 transferring averages.

Abstract

On this article, we’ve got appeared on the necessary indicator often known as the Damaging Quantity Index (NVI).

We now have seen that the index seems to be at quantity out there and the way it impacts key belongings like shares. Nevertheless, most day merchants won’t discover it helpful. As an alternative, it’s extra helpful to traders and swing merchants.

Exterior helpful sources

[ad_2]

Source link