[ad_1]

Day buying and selling is a apply that’s changing into extremely frequent amongst individuals from world wide.

Whereas demand for day buying and selling has at all times been rising, the pattern jumped throughout the Covid pandemic as shares and cryptocurrency costs jumped.

A quite common query about this enterprise is: “How lengthy a day ought to I commerce?”. Not all companies are the identical, and day buying and selling offers you lots of flexibility. Each by way of belongings and within the period of time to speculate.

Let’s undergo how a lot time per day you’ll need to spend on these numerous market approaches.

Day dealer workday

In a previous article, we wrote concerning the typical workday of a day dealer. In it, we wrote that day merchants spend completely different quantities of time every single day. Some individuals open tens of trades per day, which means that they work even for greater than eight hours.

Alternatively, there are those that spend lower than an hour buying and selling. They do that by opening a couple of trades every single day and letting them run.

This method is generally frequent amongst merchants who do it on a part-time foundation. These merchants sometimes set their positions within the morning after which wait for his or her consequence throughout the day.

The good thing about day buying and selling is its flexibility. Which means individuals can commerce as a lot as they need or as little as they need. Additionally, at instances, individuals who commerce the least are likely to outperform those that commerce for extra hours per day.

What determines the buying and selling time?

There are a number of elements that decide the everyday workday of a dealer. Allow us to have a look at a few of these elements.

Property you might be buying and selling

First, it relies on the belongings that they concentrate on. The preferred belongings out there are:

StocksCommoditiesExchange-traded funds (ETF)CryptocurrenciesForex.

Shares are sometimes open each Monday to Friday for a couple of hours. The foreign exchange market, alternatively, is open each Monday to Friday for twenty-four hours. Additional, cryptocurrencies are open on a 24/7 foundation.

Subsequently, as a day dealer, your typical workday will rely upon the asset that you’re buying and selling. For the foreign exchange market, it’s attainable to commerce for greater than ten hours per day.

Alternatively, if you’re a inventory dealer, you may solely commerce for a shorter interval every single day (6.5 hoursiIf you base your buying and selling within the U.S., from 9.30 AM to 4 PM).

Cryptocurrency merchants have an extended buying and selling window since they will open trades for a vast interval.

Buying and selling technique

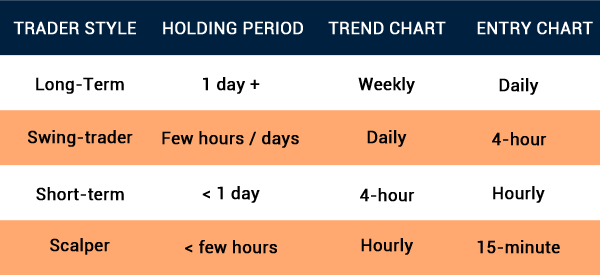

Second, it relies on your general buying and selling technique out there. A few of the hottest buying and selling methods out there are scalping, swing buying and selling, algorithmic buying and selling, and duplicate buying and selling amongst others.

These methods demand completely different timelines. For instance, scalpers will sometimes spend extra time buying and selling since they concentrate on opening and shutting tons of of trades every single day inside a really brief time-frame. These merchants can keep out there for greater than eight hours per day,

Swing merchants, alternatively, sometimes open trades and maintain them for a couple of days. As such, these merchants can open a couple of trades in per week and spend only a few hours.

Lengthy-term traders, alternatively, don’t must open trades every single day. Some traders like Warren Buffett open a couple of investments yearly.

The place you’re employed

One other factor that impacts the time is the place you’re employed. When you commerce in your retail account, it means that you could commerce as you would like since you may have extra flexibility.

Alternatively, if you’re employed, the time you spend buying and selling will rely upon the administration. On this case, your schedule will rely in your contract.

Market circumstances

At instances, the underlying market circumstances will decide the instances you spend buying and selling.

Simply to present an instance, when the market is trending, it’s attainable to commerce for extra hours. Alternatively, when the market is in a consolidation part, spending extra time buying and selling will not be splendid.

Property accessible

Additional, the dealer you might be utilizing shall be vital in figuring out the time you’ll be utilizing. For instance, at DTTW, our merchants have extra belongings since our platform has shares from world wide.

On this case, they will commerce shares from Asia, Europe, after which the US. In case your dealer has solely American shares, you might be restricted to the shares that you could commerce.

Common time utilized by most merchants

The common time that many full-time merchants spend is between 5 to 6 hours. On this time, they’ll do their evaluation and allocate their assets accordingly. Analysis may be divided into technical and basic evaluation.

Technical evaluation is the place they determine indicators like shifting averages and the Relative Power Index (RSI). Basic evaluation, alternatively, entails key points like information and financial knowledge when buying and selling.

On the similar time, within the US, merchants have entry to commerce shares for extra time due to prolonged hours. After-hours is a interval that occurs after the common session closes. In lots of circumstances, firms are likely to publish their earnings throughout this era.

The pre-market session begins very early within the morning earlier than the common periods. This session often units the tone out there.

Additionally, merchants do a number of issues once they full their buying and selling day. First, they take time to have a look at their buying and selling journal. A journal is a doc the place they write all of the happenings out there.

Second, they have a look at the financial and earnings calendar to find out the important thing occasions to anticipate the next day. A few of the prime occasions to look at are rate of interest selections, inflation, and employment.

Additionally, figuring out the businesses that may publish their outcomes the following day will assist you understand what to anticipate.

Abstract

Day buying and selling is without doubt one of the finest methods of earning money out there. For one, profitable merchants are judged by their efficiency and never the time they spend buying and selling.

Some highly-successful merchants solely spend a couple of hours per day working. What is required is an effective buying and selling technique, consistency, and good time administration.

[ad_2]

Source link