[ad_1]

koto_feja

On this two-part article collection, I will evaluate two biotech investments, each concentrating on irritation within the context of neurology. Irritation is more and more understood as a serious driver of a variety of persistent and progressive illnesses and even some acute situations, and as such, the decision of irritation is a “new therapeutic frontier” in response to a current Nature evaluate. INmune Bio (INMB) and Coya Therapeutics (NASDAQ:COYA) are growing two totally different therapeutic approaches (mechanisms of motion) to the identical common end result: diminished irritation within the central nervous system, however specializing in totally different indications as core applications. They accomplish diminished neuroinflammation by way of two totally different paths: in Coya’s case, enhancing the suppressive exercise of T regulatory (Treg) cells, and in INmune’s case, eliminating the damaging facet of the well-known key inflammatory cytokine, TNF. I imagine each shares are considerably undervalued, albeit for various causes, and each are closely insider-owned and pretty well-funded. On this article, I will concentrate on Coya and its core program. I imagine Coya is undervalued as a consequence of its very promising ALS therapy and platform know-how facet.

Neuroinflammation in Power Illness

Irritation is a key driver of persistent illness. The questions are in regard to the easiest way to change irritation since it will possibly have restorative and damaging properties. In acute harm or throughout an infection, elevated irritation or proinflammatory responses are essential to wash up particles and destroy international materials. Subsequently and ideally, a restorative part then begins the place tissue is regrown or healed. Dysregulation within the immune system may result, in an extreme proinflammatory response, and tissue injury can happen. This in some illnesses is accompanied by persistent makes an attempt to heal, which may end up in antagonistic outcomes like vital scar tissue build-up over time.

The catch is that the immune system may be very complicated and in some respects redundant, and easily “turning down” common irritation with conventional and never adequately particular strategies just isn’t at all times useful or useful. As an example, for this reason NSAID use (e.g., ibuprofen) will not deal with ALS or Alzheimer’s successfully. Scientific trials with NSAIDs for Alzheimer’s fail to point out advantages. Thus biotech and pharma firms are aiming to seek out higher methods to affect irritation.

With particular regard to neuroinflammation, next-generation medication supply the potential to deal with quite a lot of illnesses – let’s use ALS and Alzheimer’s as examples. In Alzheimer’s, acetylcholinesterase inhibitors have been used to restrict acetylcholine ranges, and in ALS and Alzheimer’s, glutamate regulators restrict extra glutamate exercise. Whereas these medication might defend cells from extreme neural transmission, they don’t assist restore the mind’s structure and they don’t considerably alter the development of illness. Newer authorised medication like Amylyx’s (AMLX) Relyvrio (for ALS) go one step additional and are thought to enhance mitochondrial perform and protein manufacturing. Biogen (BIIB) bought its new amyloid-beta concentrating on antibody authorised for Alzheimer’s (Aduhelm), and Eli Lilly (LLY) is anticipated to get its very comparable drug authorised by the tip of this 12 months. These medication sluggish the development of Alzheimer’s by eradicating poisonous protein (amyloid) buildup by activating the immune system towards these dangerous elements. Regardless of preliminary excessive expectations for billions in gross sales, these medication have modest efficacy and there’s a lot of room for enchancment by controlling persistent irritation.

So let’s simply dive into these neuroinflammation firms which have the potential to drastically change the neurodegenerative illness therapy panorama and see what’s below the hood.

Coya Therapeutics

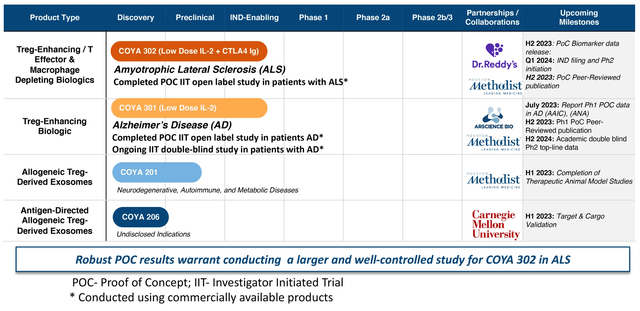

Coya Therapeutics is a biotech firm specializing in treating illnesses, particularly ALS to start with, by controlling irritation. They do that by increasing and enhancing T regulatory (Treg) cell perform. Tregs are a sort of helper T cell (CD4+), an immune cell that’s principally required to orchestrate the adaptive (antigen-specific) immune response, however may robustly affect innate (“nonspecific”) immune interactions. To simplify, Tregs restrict irritation and are usually thought of neuroprotective, particularly in persistent and progressive illnesses. The corporate’s pipeline is proven under. On this article, we’ll concentrate on the corporate’s ALS indication utilizing COYA 302, which consists of LDIL-2 (low dose IL-2) and CTLA4 Ig (CTLA4 immunoglobulin), which is a twin strategy to reinforce Treg populations and exercise endogenously. Different pipeline candidates for COYA will make the most of LDIL-2 (aka COYA 301) as a spine for various “mixture therapies.”

Coya Therapeutics Pipeline (Coya Therapeutics web site)

Coya is a mid-stage biotech firm (getting into part 2 in ALS in Q1 2024) however might be a lot nearer to FDA approval than first meets the attention. ALS therapies have just lately been superior to approval earlier than their part 3 trials had been accomplished; Amylyx’s Relyvrio and Biogen’s Qalsody had been each granted accelerated approval based mostly on small part 2 datasets. Each medication’ outcomes had been much less spectacular than the information Coya has generated to this point, which might be examined under.

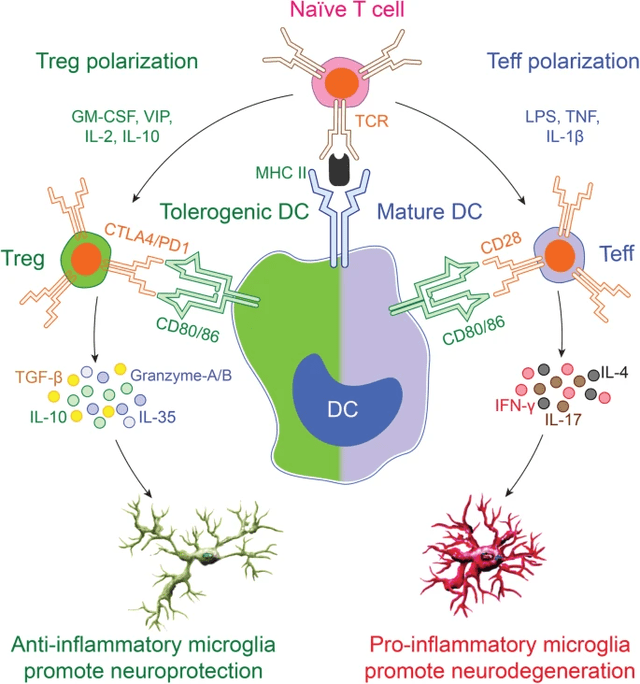

COYA 302 is a novel proprietary formulation of recombinant human LDIL-2 subcutaneously administered (the one obtainable IL-2 available on the market is a high-dose model that’s intravenously administered) to selectively increase Tregs over Teff whereas utilizing the CTLA4 Ig to cut back the inflammatory co-stimulation of T cells and induce an anti-inflammatory macrophage and microglial (brain-specific macrophage) phenotype. This promotes cell restore and axonal outgrowth. IL-2 acts as an amplifier and proliferator for CD4+ helper T cells, however Tregs have a few 100x decrease threshold to reply to IL-2. So a low dose of IL-2 will assist selectively increase Tregs and never Teff. The CTLA4 Ig works synergistically with the IL-2 to additional assist push the anti-inflammatory, “immunosuppressive” phenotype. This distinctive mixture works contained in the affected person’s personal physique. This may be essential as expanded Treg cells ex-vivo are usually not essentially uncovered to the right antigenic stimuli (which will be essential to make sure their particular suppressive response by way of TCR stimulation) and subsequently will not be as efficient when readministered. In different phrases, increasing endogenous Tregs on this method (IL-2 + TCR stimulation) may/ought to lead to a stronger and sustained response. Additionally, these biologics will possible be simpler to fabricate, retailer, and administer than cell therapies. So probably, the biology and logistics work out higher when influencing sufferers’ personal T cells in contrast with administering the precise cells.

The good thing about influencing a complete cell sort is that the immune system is extraordinarily complicated with many interacting and redundant pathways. Concentrating on one pathway might not adequately change the course of the illness or the whole state of irritation. As an example, blocking RIPK1 by way of a small molecule, will not be sufficient to affect irritation and should trigger vital antagonistic results, as evidenced by the discontinuation of Denali’s (DNLI) DNL747.

Past ALS and COYA 302, the corporate has the potential to make use of its experience and Treg-focused options to deal with different inflammatory and progressive illnesses with excessive unmet wants.

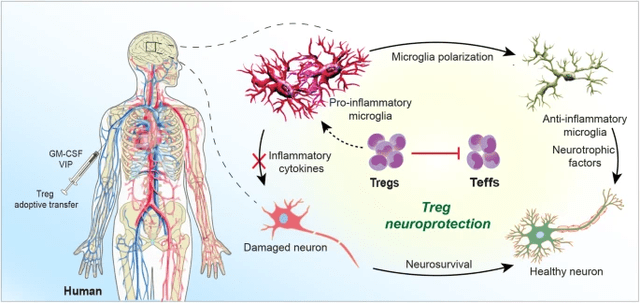

Tregs’ Function in Neuroinflammation (The Pivotal Function of Regulatory T Cells within the Regulation of Innate Immune Cells)

In response to a current Frontiers article:

it’s now accepted that adaptive immunity can have an effect on mind growth and homeostasis. For instance, deficiencies in CD4+ T cell quantity and performance result in impaired neurogenesis and cognition. Additionally, restoring a steadiness between divergent T cell subsets can maintain neuronal homeostasis and preclude disease-inciting pro-inflammatory occasions. Progressive neurodegenerative, neuroinflammatory, and neuroinfectious illness rests, in measure, round adaptive immunity. All are sped by elevated effector and downregulated regulatory T cells (Teffs and Tregs). Nonetheless, previous makes an attempt to appropriate such aberrant host immunity utilizing immunosuppressive brokers have did not have an effect on illness outcomes. This led to preliminary discouragements in immune-based approaches for CNS illness by some neuroimmunologists. Certainly, by some due diligence, a brand new therapeutic frontier has emerged designed to remodel neurotoxic Teffs into neuroprotective Tregs. […] What’s now broadly accepted is that activation of peripheral immunity, no matter trigger, triggers neural tissue restore and controls the tempo of CNS harm. Each innate and adaptive immunity can incite neuroinflammation and speed up aggregated misfolded protein accumulation that result in neuronal demise. Such pathogenic occasions are operative, at various levels, in Alzheimer’s and Parkinson’s illnesses (AD and PD), amyotrophic lateral sclerosis (ALS), a number of sclerosis (MS), and stroke. In distinction, peripheral immunity additionally facilitates mind restore, partly, by suppression of neurotoxic Teff responses.

Coya is specializing in balancing the helper T cell populations by augmenting the Treg response, which helps restrict neurotoxic Teff responses and, by way of a cascade of results, the inflammatory responses of different immune cells. Some might imagine that the central nervous system is totally faraway from the peripheral immune system, however there are literally brain-resident (CNS-usually mature) Tregs, not simply peripheral Tregs, that play an essential function in mind well being. That, and peripheral immunity can drastically affect the CNS.

Treg Polarization in CNS (The Pivotal Function of Regulatory T Cells within the Regulation of Innate Immune Cells) Tregs in ALS (The Pivotal Function of Regulatory T Cells within the Regulation of Innate Immune Cells)

Within the graphic above one can see how CD4+ T cell polarization influences irritation, influencing the highly-important microglia which, together with astrocytes and oligodendrocytes, can prune or restore neurons and their axons. In lots of circumstances, that is regarded as the distinction between steady/improved illness, and progressive illness. So how does all this work within the context of ALS?

What’s ALS (Amyotrophic Lateral Sclerosis)?

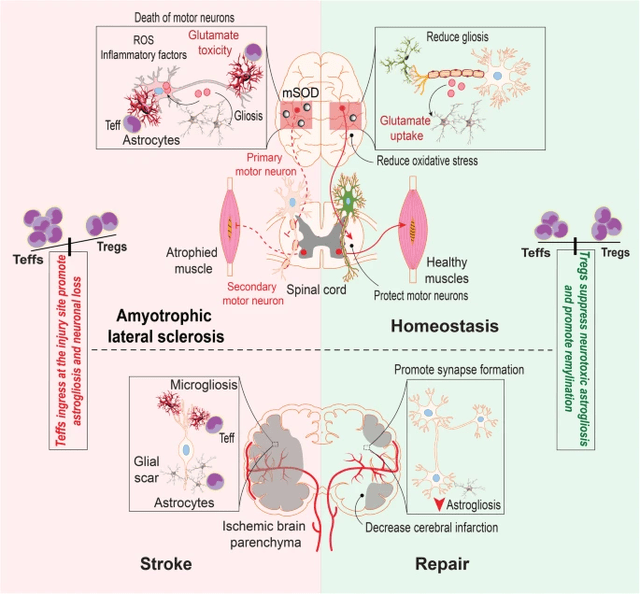

ALS is a neurodegenerative illness characterised by the progressive lack of motor neurons, resulting in lethal paralysis. The precise pathophysiological mechanisms of ALS are usually not thought of recognized, however there are a number of theories as to what causes the illness, together with immune dysfunction, redox imbalance, autophagy dysfunction, disordered iron homeostasis, and glutamate excitotoxicity. Some theories concentrate on dysfunctional signaling inside the CNS whereas others suggest that on the CNS periphery, the immune system assaults the motor neurons. With respect to glutamate excitotoxicity, there may be the drug, riluzole, which is made by Sanofi (SNY). It is the one authorised drug to increase lifespan, nevertheless it does not have an effect on the illness course. Edaravone, developed by Mitsubishi Tanabe Pharma (OTCPK:MTZPY), is an antioxidant (redox imbalance) that solely reduces ALS signs. As of 2021, these had been the one two FDA-approved medication, they usually got here with vital uncomfortable side effects.

ALS is a quickly progressing situation that normally results in dying in 2-3 years after onset of signs, in ¾ of sufferers. The opposite sufferers sometimes stay for 5-10 years. Roughly 20% might survive for a time vary between 5 and 10 years after preliminary symptom onset. The immune dysfunction and pathophysiology in ALS have develop into higher understood lately and, for my part, extra compelling than different ALS theories, although points of theories would possibly overlap. Growing proof helps autoimmune mechanisms driving pathogenesis in ALS, together with however not restricted to T-lymphocytic infiltration within the anterior horn of the spinal wire (the place the motor neurons that die are positioned), circulating immune complexes, affiliation with different autoimmune situations, and high-frequency of particular MHC varieties. Moreover, immunoglobulins from ALS sufferers have been proven to trigger apoptosis of motor neurons in vitro in addition to trigger degeneration of motor neurons in vivo. In ALS, Treg effectiveness is impaired, with larger Treg dysfunction correlating with larger illness burden and quicker development. These research on the very least present the contribution of irritation in ALS. Due to this fact, it is no shock that COYA 302 may evaluate favorably to current marketed medication.

Evaluating to Current FDA-Accredited Medicine

COYA 302 has the possibility of being granted accelerated approval based mostly on the precedent set by Amylyx’s Relyvrio and Biogen’s Qalsody.

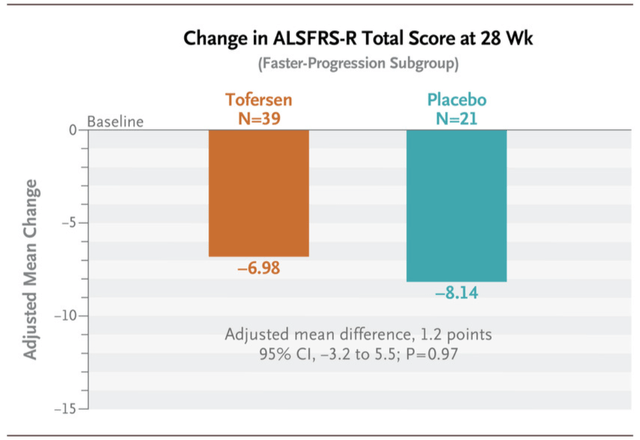

Tofersen (Qalsody) ALSFRS-R Outcomes (Trial of Antisense Oligonucleotide Tofersen for SOD1 ALS | NEJM)

Qalsody (tofersen), which targets SOD1 mutation, a mutation of curiosity in ALS, was authorised based mostly on NfL reductions, a biomarker for axonal harm and neuronal degeneration. The sufferers within the main evaluation group declined slower than placebo however this distinction was very modest and never statistically vital. The rationale might be that: since excessive NfL is taken into account a number one indicator for signs because it sometimes predates illness development, maybe there’s a delay within the separation of the placebo and lively arms in ALSFRS-R rating. Diminished NfL is subsequently thought of a biomarker that neuronal and axonal destruction is slowing. Regardless of these modest, statistically insignificant outcomes, Qalsody was authorised in April 2023 for sufferers with SOD1 mutations solely. The drug is anticipated to promote for slightly below $200,000 yearly and garner peak gross sales of about $300 million.

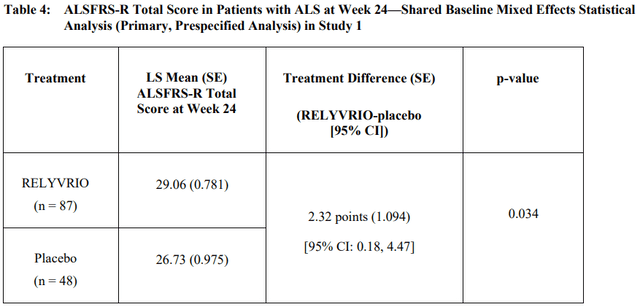

Relyvio carried out a bit extra impressively over 24 weeks.

Relyvrio ALSFRS-R Scientific Trial Outcomes (RELYVRIO US Prescribing Info)

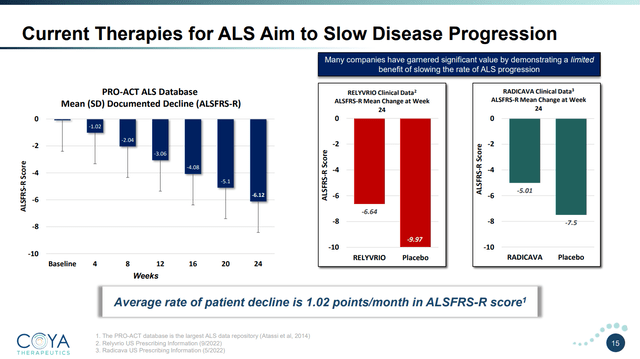

In contrast with a 1.16 distinction in rating over 28 weeks with Biogen’s Qalsody, Relyvrio was capable of present a 2.32 ALSFRS-R rating distinction at week 24. The pricing is analogous, with Relyvrio costing over $150,000 per 12 months. Each Relyvrio and Qalsody sluggish the illness development barely. Coya has a slide of the variations when in comparison with placebo (not only a delta change, which does not inform the total story). As one can see, sufferers on both drug will nonetheless progress pretty rapidly with development solely being slowed by roughly 33% for each medication.

COYA 302’s Competitors ALSFRS-R Efficiency (Coya Therapeutics June 2023 Investor Presentation)

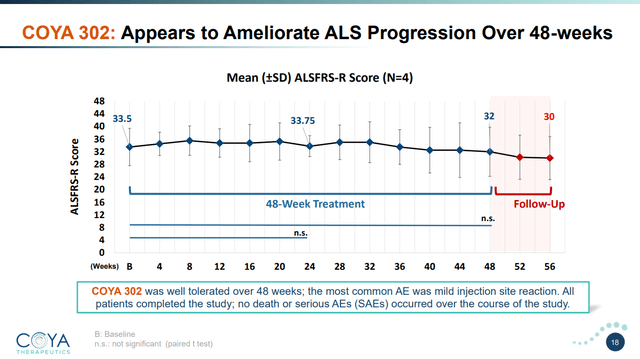

That is the place COYA 302 begins to shine. Contemplating the corporate has knowledge on solely 4 sufferers utilizing COYA 302, the noticed efficacy sign from this research may be very encouraging. The common affected person decline fell by just one.5 factors over 48 weeks. Contemplating the typical ALS affected person declines at 1.02 factors per thirty days, this represents a discount in illness development of 88%, or basically, a halting of illness development, not less than below the measured 48 weeks. Notably, sufferers taken off remedy declined on the regular charge instantly after COYA 302 remedy was terminated. Of observe, these sufferers had been declining at a median charge of 1.1 factors per thirty days earlier than initiating therapy with COYA 302. Importantly, these enhancements correlated effectively with measured Treg numbers, suppressive perform, and different biomarkers.

COYA 302 Scientific Outcomes (Coya Therapeutics June 2023 Investor Presentation)

So whereas the variety of sufferers is small, the efficacy sign was very robust and sufferers tolerated the therapy with none vital antagonistic results. Dr. Stanley Appel performed an ex-vivo expanded Treg mobile remedy trial which had comparable outcomes for responders with sure biomarkers. As I reviewed, I imagine the endogenously expanded Tregs will carry out higher so it is no shock that the part 1 trial with COYA 302 (biologics, not ex-vivo expanded Tregs) carried out higher and extra constantly than the cell remedy trial. Whereas the biomarker evaluation on Neurofilament Mild Chain (NfL) on this research remains to be below evaluate, the corporate has recognized an much more delicate potential biomarker in ALS with vital predictive worth (outcomes to be introduced in 2H 2023). If these encouraging outcomes are replicated in a bigger part 2 trial, together with the potential biomarker for ALS famous above, it will likely be troublesome to disclaim that COYA 302 is just in a unique league than any of the obtainable ALS therapies at the moment available on the market and collectively the FDA might view COYA 302 very favorably.

The corporate additionally just lately launched open-label Alzheimer’s illness outcomes this 12 months. The outcomes look promising with no cognitive decline measured by ADAS-Cog or CDR-SB, and reductions of key proinflammatory cytokine and chemokine biomarkers. However one has to warning towards any detailed interpretation of the information given Alzheimer’s research cohorts are possible extra vulnerable to placebo responses than in ALS. As an investor or as an organization govt, my opinion is that one doesn’t wish to run into the controversy that Cassava Sciences (SAVA) endured by leaning too closely on a non-placebo-controlled research. Due to this fact, the corporate is awaiting the completion of a double-blind placebo-controlled research with low dose IL-2 that’s funded by the Gates Basis in 46 sufferers with delicate to reasonable Alzheimer’s illness and expects to have a readout in Q2 2024.

Approximate Valuation

What’s COYA 302 price? One has to take note of that the drug might obtain accelerated approval after finishing a well-sized part 2 trial (N=120). This may increasingly solely require $12-15 million in funding, so the returns might be fast (not ready for part 3, operating a 24-week part 2 research) and strong (solely requiring $12-15 million for potential approval). A little bit of simplified math would peg COYA 302’s worth within the a whole lot of hundreds of thousands. Assuming the drug is not less than nearly as good as Biogen’s, it ought to be capable of herald not less than $300 million in peak gross sales about 8 years from now. Utilizing a 15% low cost ratio, a 4x peak gross sales a number of, a 40% chance of success (approval after part 2), and subtracting $40 million for a post-approval part 3 trial, we will arrive at an approximate present valuation of $117 million for COYA 302.

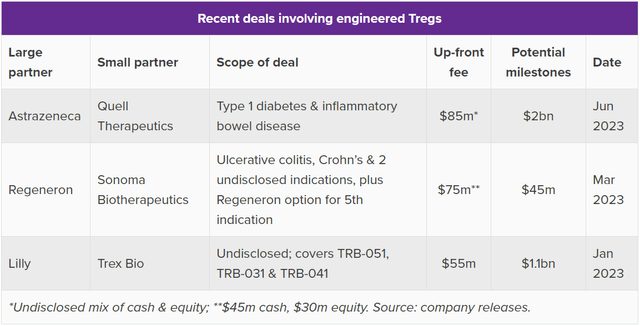

What’s the remainder of the corporate price? In all probability the easiest way to find out that is to know COYA 301 (LDIL-2) as a know-how platform for enhancing endogenous Tregs and a possible “spine” remedy for different combos. Large Pharma has put cash down on Treg offers just lately. Consider Pharma printed a pleasant chart summarizing the current deal area. Since Tregs have broad therapeutic potential, it is price taking a look at Treg offers for illness indications unrelated to ALS.

Treg Pharma Offers (Consider Pharma)

Quell Therapeutics is in Part 1 with a number of collaborations and is reportedly price $780 million. The corporate inked a collaboration with AstraZeneca (AZN) with upfront charges of $85 million, tiered royalties, and $2 billion in milestones. Sonoma was reportedly valued over $1.1 billion in the course of the market bubble in 2021, the place it raised $265 million in an oversubscribed deal. Each of those firms are in early medical levels with engineered Tregs, and Sonoma is aiming for one-time dosing. Trex Bio is reportedly price slightly below $300 million and inked a similar-sized take care of Lilly in contrast with Quell’s take care of AstraZeneca.

These offers and valuations showcase Coya’s potential undervaluation. It appears Coya must be not less than buying and selling for $200 million given COYA 302’s promise, its potential for accelerated approval, and different Treg firms’ valuations reaching into the billions whereas these firms are nonetheless shifting by way of part 1 trials whereas Coya is getting into what might be a pivotal part 2. A $200 million based mostly on 9.95 million shares excellent interprets to $20.10/share. Absolutely diluted, the quantity comes out to $15.20/share based mostly on 13.12 million shares.

Maybe probably the most fascinating thought of COYA’s market potential is the dimensions of the ALS market (5,000 People identified yearly) regardless of the very quick 2-3 12 months lifespan most of them have. In 2022, the ALS market measurement was an estimated $673 million. If sufferers can have their illness development halted as Coya confirmed of their proof of idea, these sufferers might not die and the market measurement may explode. The market measurement for COYA 302 may probably be considerably larger than the present ALS market right now, although that is optimistic hypothesis.

Financials

The corporate just lately launched its quarterly report exhibiting it had $13.1 million in money and money equivalents as of June thirtieth. The corporate had a price of operations of $12.9 million within the final 12 months. In addition they owe Dr. Reddy’s, the corporate that they in-licensed abatacept (a-CTLA-4 a part of COYA 302) from, $2.9 million in pre-approval milestones. In response to the settlement press launch:

COYA 302 is comprised of two elements – COYA 301 and CTLA4-Ig. Coya will develop COYA 301. Below the phrases of the Settlement, Coya has been granted an unique, royalty-bearing license to Dr. Reddy’s proposed biosimilar Abatacept for the event and commercialization of Coya 302 for the therapy of sure neurological illnesses on the market in a number of territories together with North and South America, the EU, United Kingdom, and Japan. As consideration for the license, Coya can pay a one-time non-refundable upfront charge to Dr. Reddy’s. As well as, Coya will owe tiered funds to Dr. Reddy’s based mostly upon Coya’s achievement of sure developmental milestones. Coya can even owe royalties to Dr. Reddy’s on Web Gross sales of Coya 302 inside its licensed territory on a tiered foundation. The Settlement doesn’t preclude Dr. Reddy’s from launching its proposed biosimilar Abatacept globally for authorised indications publish regulatory approval. […] The Settlement additionally gives for the license of Coya 301, Coya’s low dose IL-2 to Dr. Reddy’s to allow the commercialization by Dr. Reddy’s of Coya 302 in territories not in any other case granted to Coya. Coya will obtain royalties on Web Gross sales by Dr. Reddy’s of their territories based mostly on the identical tiered construction as Coya owes Dr. Reddy’s. The Settlement additionally permits Dr. Reddy’s and Coya to enter right into a mutually passable business provide settlement at an applicable time.

So the settlement goes each methods; there are parallel royalty-bearing licenses. The corporate additionally owes $13.25 million in milestones to ARScience Biotherapeutics for the low-dose IL-2 formulations in addition to royalties (10-20% on sublicensed merchandise), all for COYA 302. How a lot is due quickly is unknown.

Due to this fact, it’s affordable to assume {that a} license with upfront funds is executed within the close to time period and/or the corporate raises further funds, almost certainly by way of an fairness providing. The corporate’s enterprise growth govt has a very good monitor document however there are by no means any ensures.

Administration And Traders

First issues first, David Einhorn, the well-known billionaire who runs Greenlight Capital, has invested a big sum into Coya (and likewise Achieve Therapeutics (GANX), one other firm I’ve written about). Einhorn’s typical investments are usually not high-risk biotech firms, so it is a good vote of confidence. As for the remainder of administration, it is price highlighting Dr. Stanley Appel’s involvement on the corporate’s scientific advisory board. Appel is a world-renowned, distinguished ALS researcher and clinician who has led Treg analysis into neurological illness. Administration has invested personally together with board members, with the CEO, Howard Berman, proudly owning virtually 1 million shares.

The corporate just lately introduced on Arun Swaminathan, a seasoned enterprise growth govt who has an ideal monitor document of constructing offers with main pharma as evidenced by Alteogen’s inventory value efficiency below his tenure. Swaminathan additionally has had a powerful profession at Covance (now LabCorp (LH)) and Bristol-Myers (BMY). His LinkedIn web page highlights his biz dev accomplishments effectively:

Inside 1 12 months of becoming a member of Actinium, he efficiently moved ahead negotiations to closure and executed a $452M take care of $35M upfront. Previous to Actinium, he was the CBO at Alteogen (196170.KQ) the place he spearheaded over $6B in offers, together with offers with two of the highest 10 international pharma firms and a $1B+ deal inside the first 12 months of assuming the function of CBO.

The corporate has been publicly open about partnering COYA 301 with different therapeutics for various indications, in addition to licensing its exosomes platform for additional analysis. With Swaminathan becoming a member of the crew, nice early ALS knowledge, and a platform product all below the brand new Chief Enterprise Growth Officer’s watch, it isn’t unreasonable to assume the corporate might be seeing some thrilling offers inked inside the subsequent 12 months or two.

Dangers

Coya is a mid-stage, pre-revenue biotech. With that comes dangers together with however not restricted to dilution, funding issues, medical and preclinical research failures, regulatory dangers, and excessive market volatility. Almost about funding, there are additionally unknowns within the firm’s present licensing agreements with ARS and DRL relating to abatacept and the IL-2 formulations.

There may be additionally the danger of different market entrants that additionally might carry out equally to COYA 302. It is also essential to notice that the part 1 trial Coya ran is a really small pattern measurement and it is solely attainable that these outcomes seemed so constructive as a consequence of probability. Nonetheless, one does have to notice the affected person ALSFRS-R rating declined resuming instantly after remedy was terminated.

At the moment, the corporate additionally has fairly a low buying and selling quantity and so getting into and exiting an funding place might be difficult, although buying and selling quantity might change. Definitely, portfolio weighting must be taken into consideration given the low buying and selling quantity, quite a few comparatively excessive dangers, and low market capitalization.

Conclusion

Coya presents traders a novel strategy to investing in illnesses pushed by immune dysfunction, beginning with ALS. The corporate has generated extraordinarily encouraging early-stage knowledge, with ALS development basically eradicated throughout remedy. COYA 302 may grow to be one of the best ALS remedy available on the market if subsequent medical trials mirror early-stage outcomes. With the corporate’s part 2 trial probably being pivotal, they might have a shorter path to approval and commercialization than different biotech firms of their stage of growth.

COYA 301 might be used as a spine for added mixture therapies for different illnesses pushed by immune dysfunction. There could also be a further upside to the inventory if the corporate can ink growth offers with different firms utilizing COYA 301 together with different therapeutic brokers. Nonetheless, the bottom case for an funding in Coya is the ALS indication, the place the inventory seems considerably undervalued based mostly on COYA 302 in a risk-adjusted peak gross sales a number of estimation.

An funding within the firm comes with vital dangers that are widespread to early to mid-stage biotech firms working with restricted budgets and in want of further future capital. Traders concerned with Coya ought to measurement positions appropriately to their portfolio measurement and threat tolerance.

Editor’s Word: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]

Source link