[ad_1]

JHVEPhoto/iStock Editorial by way of Getty Pictures

Hi there once more, Searching for Alpha Group!

It has been a whopping 313 days since I wrote my final article on this platform. At present, I will cowl one in all my favourite firms on the inventory market, Ulta Magnificence (NASDAQ:ULTA).

In my first-ever Ulta article over a 12 months in the past, there have been 3 key elements of the funding thesis.

Sturdy Model & Buyer Loyalty Rising Retailer Rely & Identical Retailer Gross sales Stellar Financials

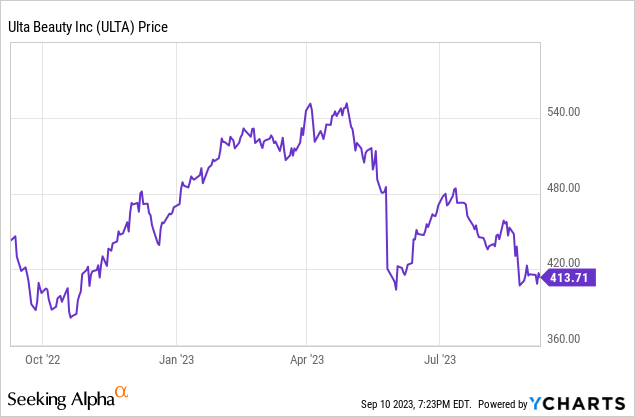

Since publishing my first article on Ulta, the inventory value has remained comparatively flat. Nevertheless, throughout that point, the corporate hit all-time highs of over $540 previous to pulling again.

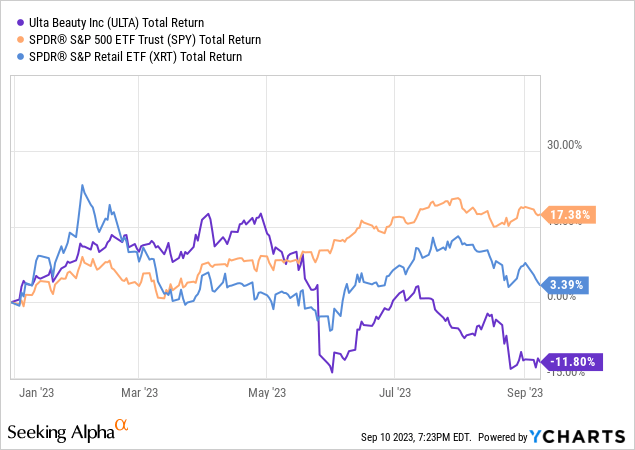

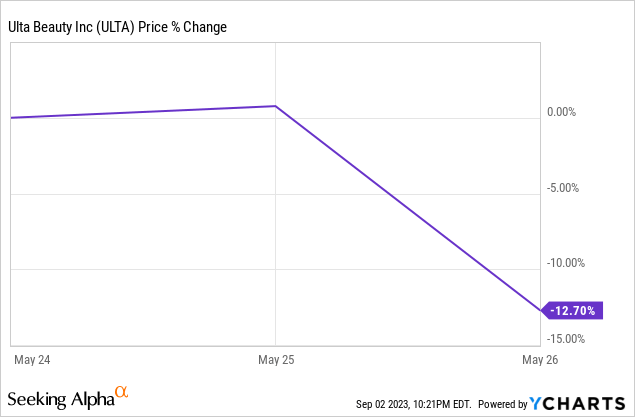

Ulta is down round 12% YTD, whereas the broader market indices (SPY) are up 17% YTD. Moreover, the S&P 500 Retail ETF (XRT) is up 3% on the 12 months, resulting in an underperformance from Ulta on each fronts of 29% and 15%, respectively. Since its first quarter earnings launch, ULTA has misplaced 1 / 4 of its worth.

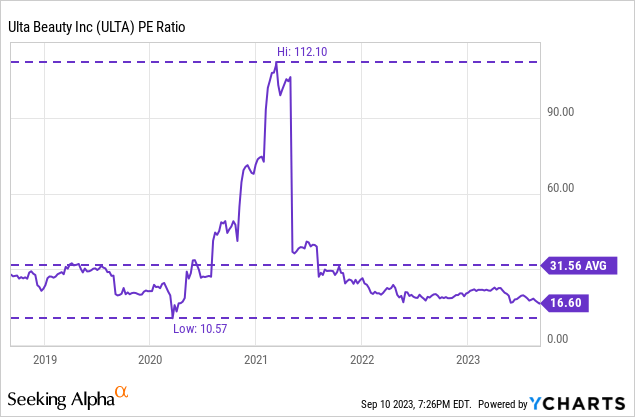

Whereas traders of late possible are upset with the wonder retailer’s efficiency, its long-term prospects nonetheless stay intact, particularly at its present valuation of 16x earnings.

On this article, I will dissect Ulta Magnificence’s fundamentals and revisit my preliminary three thesis factors from my first article. Additionally, I can be having a look at why the bears have been promoting this inventory off in mild of its most up-to-date two-quarters of earnings.

Sturdy Model Repute & Buyer Loyalty

As America’s largest specialty magnificence retailer in the USA, Ulta Magnificence boasts over 1,350 shops throughout the US sporting over 600 magnificence manufacturers comprising over 25,000 merchandise.

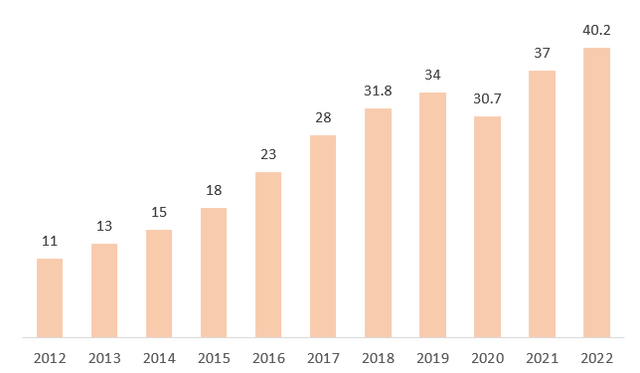

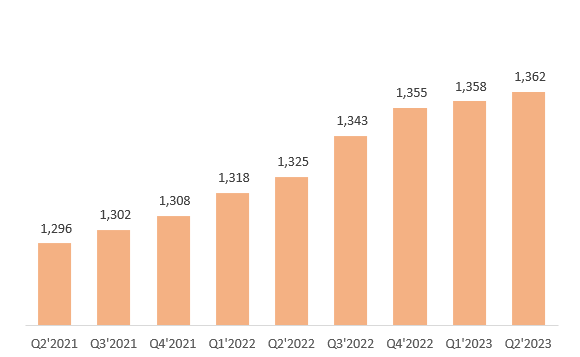

Boasting a whopping 40 million “Ultamate Reward” loyalty members in year-end 2022, Ulta’s model popularity continues to be a linchpin of the corporate’s total success. The under chart demonstrates Ulta’s skill to constantly develop its lively loyalty member base. Following COVID-19 struggles, the retailer was capable of develop its member base by 31% from 2020 – 2022.

Loyalty Members (Tens of millions) (Writer Created)

Extra impressively, a staggering 95% of Ulta’s income is derived from their loyalty members. With Ulta’s funding in its omnichannel progress, particularly e-commerce, the wonder retailer has cultivated a loyal and cult-like shopper base. Briefly, clients who spend at Ulta Magnificence as soon as are prone to be clients for all times.

On the provision aspect of the equation, Ulta continues to onboard new, well-renowned manufacturers similar to Bubble, BYOMA, and Beautycounter, whereas fostering innovation and product progress from current manufacturers. Successfully, Ulta has created a aggressive ecosystem the place cosmetics and wonder manufacturers vie for beneficial shelf area inside Ulta shops.

Rising Retailer Rely & Identical Retailer Gross sales

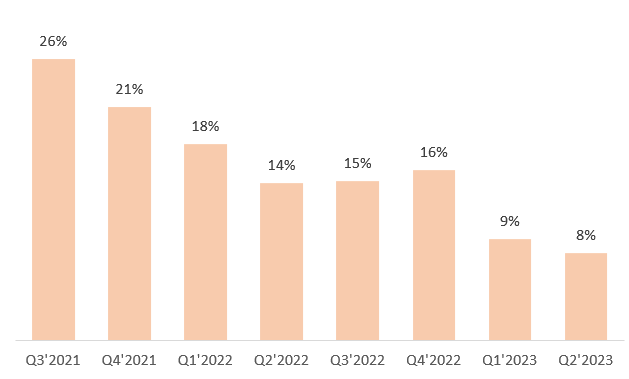

Since its inception, Ulta has stayed true to its retailer progress targets and has constantly continued to ship on its guarantees. In fiscal 12 months 2022, Ulta Magnificence opened 47 internet new shops, with no retailer closures. The chart under depicts the final 9 quarters of retailer progress for Ulta Magnificence.

Writer Created

Though comparable gross sales skilled a sequential decline within the first and second quarters of 2023, these figures remained robust at 9.3% and eight%, respectively. This acts as a optimistic sign to traders that the wonder retailer isn’t relying solely on its retailer depend to bolster its top-line progress.

Writer Created

The decline in comparable gross sales on a QoQ foundation in 2023 is as a result of unprecedented progress Ulta skilled post-COVID in 2021 and 2022. Ulta’s historic comparable gross sales during the last 10 years have been within the excessive single digits and low double digits, on par with its latest quarterly figures.

The dual engines fueling Ulta’s progress proceed to be opening new shops whereas driving income progress and operational efficiencies inside its current retailer base.

Stellar Financials – Have Religion in Gross sales Development

Regardless of short-term headwinds, Ulta’s monetary place stays robust.

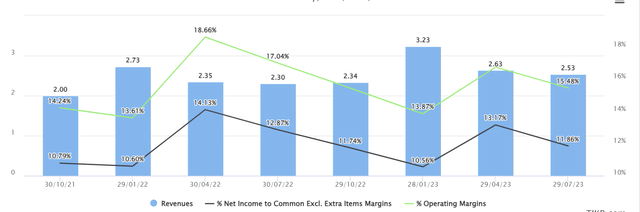

Tikr

As depicted above, Ulta continues to exhibit strong top-line progress on a quarter-over-quarter foundation. The lower in internet and working margins is a results of investments Ulta is making into its enterprise to enhance its operational efficiencies.

Causes for Concern?

The final two quarterly earnings had the bears quickly promoting off Ulta inventory. In Q1, Ulta Magnificence declined by 13% following the earnings launch.

Regardless of beating income expectations, issues arose round profitability, particularly the decline in working margin.

CFO Scott Settersten commented on the lower:

Working margin was 16.8% of gross sales, in comparison with 18.7% of gross sales within the first quarter of 2022. As anticipated, the decline in working margin primarily displays the impression of SG&A deleverage and lapping our extraordinary leads to the primary quarter of fiscal 2022.

Within the 2nd quarter earnings name, administration additionally alluded to potential adverse EPS Development in Q3 as a result of decrease working margins.

Mr. Settersten additionally commented, stating that:

Working margin goes to be down considerably — you recognize, meaningfully versus what we noticed earlier this 12 months. And that is going to end in, you recognize, adverse EPS progress 12 months over 12 months for the third quarter.

With ULTA’s investments into its IT infrastructure and Enterprise Useful resource Planning via its Venture SOAR initiative, administration famous that that is the important thing cause that SG&A will see an incremental enhance YoY, thereby placing stress on its working margin.

Moreover, administration additionally portrayed a stage of uncertainty for Fiscal Yr 2024 by not offering steering to shareholders throughout this transitionary part. CFO Scott Settersten suggested traders that ULTA’s venture initiatives ought to begin to yield fruit in 2024 and past.

Yeah, and also you’re precisely proper. We’re not offering steering for 2024 right here as we speak, however yeah, traders ought to count on that we are going to domesticate, recoup advantages from the numerous investments that we’re making in our core methods right here in ’22 into ’23 and that we’ll see advantages materialize in 2024 and past. Once more, you have heard us speak about these are main initiatives right here that we count on to pay dividends for quite a few years into the longer term. However I might — you recognize, I would additionally warning traders, simply to be ready.

As depicted by the administration excerpts above relating to uncertainty and unwillingness to offer steering for 2024, ULTA’s inventory value shortly declined from its all-time highs earlier within the 12 months.

Belief the Administration Staff – Goal Partnership

Traditionally, Ulta’s administration workforce has demonstrated a constant monitor document of reaching targets, targets, and timelines. Thus, with administration alluding to short-term stress on working margins and profitability as a result of ongoing investments into the enterprise, this shouldn’t be a trigger for concern for long-term traders.

In November 2020, Ulta introduced its partnership with Goal (TGT) to develop its retail presence within the US magnificence market via a shop-in-shop idea.

The distinctive, branded shop-in-shop will function as an extension of the welcoming Ulta Magnificence expertise, mirroring the retailers’ current shops and designed to find established and rising status manufacturers. With roughly 1,000 sq. ft of retail area, Ulta Magnificence at Goal can be prominently positioned subsequent to the prevailing magnificence part.

As of Fiscal Yr 2022, Ulta had a presence in over 350 Goal areas throughout America, with a long-term purpose of 800 Goal areas. Because it stands, Ulta is effectively on monitor to hit its long-term shop-in-shop projections, reaching nearly 50% of its goal within the first two years.

Is the Thesis Nonetheless Intact?

Whereas it has been a rocky begin for Ulta in 2023, the long-term prospects and fundamentals of the enterprise stay robust.

1. Sturdy Model & Buyer Loyalty

Regardless of short-term headwinds, Ulta continues to develop its loyalty membership depend for the tenth consecutive 12 months. Its robust model consciousness and loyalty act as a moat round Ulta’s enterprise via community results and intangible asset worth (via its model).

2. Rising Retailer Rely and same-store gross sales

Ulta’s administration workforce has continued to develop its retailer depend and generate optimistic comp gross sales YoY and QoQ. A rise in its retailer depend and comparable gross sales proceed to behave as twin engines that drive Ulta Magnificence’s income progress, confirming the long-term funding thesis.

3. Stellar Financials & Valuation

At one in all its lowest valuations in 5 years, Ulta’s 16x earnings a number of makes it a sexy long-term funding. Coupled with its debt-free stability sheet and strong top-line progress, Ulta Magnificence seems to be extra engaging than ever.

Thus, for the explanations outlined above, I can be instituting a “Purchase” suggestion on Ulta Magnificence. Whereas short-term headwinds and stress on its working and gross margins might trigger short-term declines in its inventory value, Ulta stays poised for long-term progress and success as America’s main magnificence retailer.

[ad_2]

Source link