[ad_1]

JHVEPhoto

Mondelez Worldwide Inc. (NASDAQ:MDLZ) is a promising selection for worth buyers. The administration is implementing methods to foster progress, leading to favorable outcomes for shareholders. Moreover, the corporate has substantial potential for enlargement in rising markets, in addition to by way of e-commerce and progressive options.

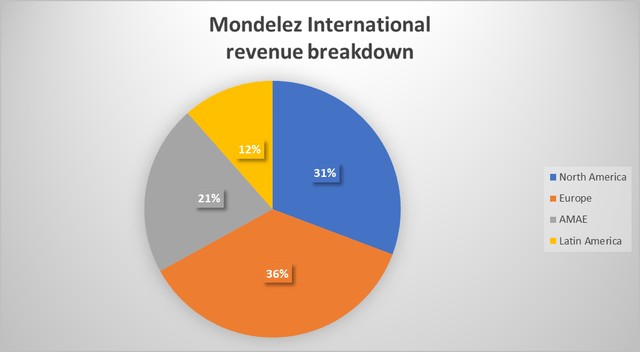

The enterprise did an excellent job of diversifying its revenue-generating sources. Europe accounts for 36% of the corporate’s income, adopted by North America (31%), Latin America accounted for 12% of the enterprise’s gross sales, whereas the AMAE space contributed 21%.

Mondelez income (Creator)

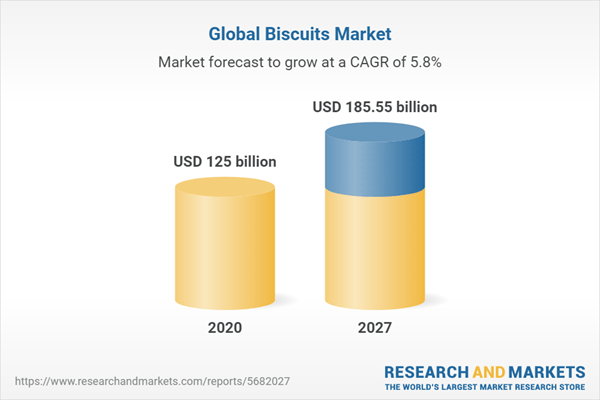

Mondelez generates virtually the third of its revenues from the biscuit phase. The business is predicted to develop at 5.81% CAGR till 2027. The expansion of the business is supported by numerous components, equivalent to the recognition of wholesome snacking and the comfort of progressive packaging. Market gamers are investing in product innovation and improvement as a result of recognition of accelerating well being consciousness, which is contributing to the enlargement of their product portfolio and the market’s progress. Furthermore, rising economies’ shoppers are keen to check out more healthy choices and regional flavors, which biscuit market gamers are capturing by together with pure substances and sharing dietary info.

Biscuit phase (Researchandmarkets)

The chocolate phase accounts for 30% of the corporate’s income and is the second-largest income. The business is predicted to report 4.5% CAGR till 2027. The expansion of the chocolate market is being pushed by a number of components, together with the growing demand for high-quality and premium chocolate merchandise. Customers are keen to pay extra for chocolate merchandise that provide distinctive packaging, flavors, and textures. As well as, the rising reputation of darkish chocolate, which is taken into account a premium and indulgent product as a result of its perceived well being advantages from its excessive cocoa content material, can also be contributing to the market’s progress.

Mondelez was in a position to generate 4% income CAGR over the last 5-year interval. Sturdy model portfolio, artistic options, enlargement into rising markets, and progress in e-commerce are primarily contributing components.

One of the vital important enterprise progress engines is rising markets. Nearly one-third of revenues come from rising areas, which recorded a 11% progress in income in 2022. The product localization technique is prioritized by the administration in rising international locations with a purpose to present items which are tailor-made to the distinct tastes and preferences of native shoppers. A profitable instance is the launch of Oreo mooncakes in China in 2013, the place they had been properly accepted for his or her distinctive taste and advertising and marketing efforts. To attraction to Chinese language tastes, the enterprise began to supply flavors like inexperienced tea and matcha. Additionally, the enterprise labored with regional companions to create distinctive packaging options. Consequently, Oreo mooncakes considerably boosted model popularity. The product has been accepted by clients as an emblem Mid-Autumn Pageant custom, which elevated model consciousness and generated growing gross sales within the area.

In an effort to produce items regionally Mondelez has constructed new manufacturing services in creating economies. These services are primarily supposed to fabricate merchandise which are extra consistent with regional shoppers’ preferences. To meet the rising demand for its merchandise in China, the agency introduced plans to take a position $100 million within the building of a brand new facility in 2019. The ability is meant to make biscuits and snacks and is predicted to contribute the corporate progress in Asia. To strengthen its presence in China the corporate companions with Alibaba Group (BABA). The cooperation brings substantial advantages to the corporate because it makes use of Alibaba’s experience in knowledge analytics and digital advertising and marketing. Knowledge analytics is getting used to be taught extra about shopper tendencies and preferences, which helps with product improvement and advertising and marketing plans.

The long-lasting Cadbury Dairy Milk chocolate model is deliberate to be produced on the new manufacturing facility that Mondelez intends to develop in India for $190 million. Because of the administration’s capacity to adapt its merchandise to the distinctive tastes of Indian shoppers, the product had important success within the nation. Brazil shall be one other large funding vacation spot for the corporate. A brand new manufacturing line for Lacta chocolate model shall be constructed within the nation. The administration intends to take a position $200 million for facility improvement.

To cater to the rising demand for e-commerce and cell procuring, Mondelez Worldwide has launched a mobile-first e-commerce platform. The rise of smartphones has led to a rise in shoppers utilizing their cell gadgets to buy on-line, and Mondelez Worldwide acknowledged this development and responded by offering a mobile-first platform. The platform’s key function is its customized procuring expertise. It makes use of knowledge analytics and machine studying algorithms to supply customized suggestions to every person.

The administration prioritizes the necessity to make investments closely in progressive options. Thus the corporate established SnackFutures – its innovation and enterprise hub. The principle goal of this mission is to drive innovation and create new prospects within the snacking business. The hub is concentrated on figuring out and nurturing rising manufacturers and applied sciences which have the potential to remodel the snacking business. The corporate allotted $100 million to the mission, which goals to spend money on and collaborate with startups and entrepreneurs who’ve progressive concepts that may promote progress and generate worth within the snacking business. Usually the SnackFutures has 3 major pillars: invention, reinvention and enterprise. The invention pillar is aimed to develop new merchandise to fulfill rising shopper preferences. The reinvention part is centered on altering Mondelez Worldwide’s present manufacturers and merchandise by using fashionable applied sciences. The third – enterprise pillar is meant to spend money on startups which have ingenious concepts that may promote progress.

Dangers

The largest threat the enterprise faces is related with stiff competitors within the business. Massive behemoth-competitors which possess huge money move producing capability can make investments closely to develop progressive options and seize market share from the market.

The operations of Mondelez, which sources substances and uncooked supplies from suppliers worldwide, may very well be impacted by disruptions within the provide chain. Such disruptions could also be brought on by components equivalent to transportation interruptions or commerce disputes.

Valuation

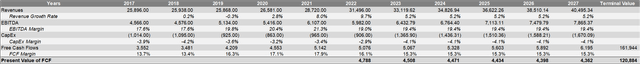

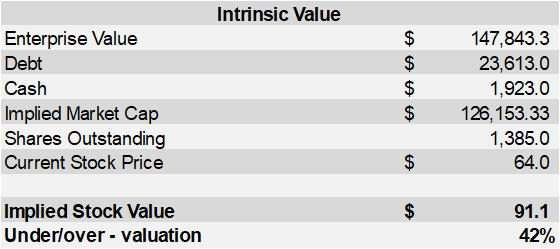

To calculate the inventory worth now we have performed a DCF evaluation. For upcoming 5-year interval we anticipate business common progress charge of 5.2% (5.81% and 4.5%). Thereafter we apply terminal progress charge of two%. For EBITDA margin we undertake friends’ common of 19.4% which is consistent with historic margin of 19.3%. For Capex margin now we have taken friends’ common of 4.1% which is extra conservative than the corporate’s historic margin of three.5%.

Assumptions Share Income CAGR (historic) 4.0% Income CAGR (estimate) 5.2% EBITDA Margin (historic) 19.3% EBITDA Margin (friends) 19.4% CapEx Margin (historic) -3.5% CapEx Margin (friends) -4.1% Terminal Development Fee 2.0% Click on to enlarge

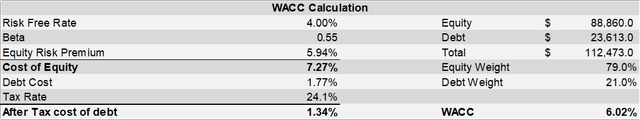

For WACC calculation now we have used beta of 0.55, fairness threat premium of 5.94% and risk-free charge of 4%.

WACC (Creator)

Constructing the mannequin we received an intrinsic worth of $91.1 which signifies that the inventory is 40% undervalued.

DCF (Creator) DCF (Creator)

Dividends

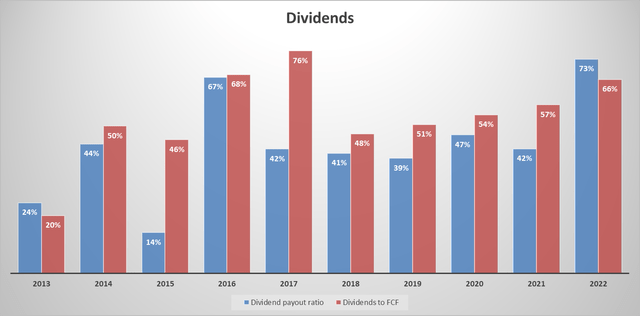

In addition to enticing valuation the corporate additionally affords steady dividends. Over the past 5-year interval the corporate managed to extend dividends at 12.38% CAGR, as at present the yield stands at 2.36% degree. The payout ratio appears to be in a secure territory as dividends to FCF ratio is under 70% degree.

Mondelez Worldwide Dividends (Creator)

Conclusion

Mondelez Worldwide enterprise is properly diversified and is ready to face up to potential financial fluctuations. The administration is actively investing to find new progress alternatives. MDLZ inventory appears considerably undervalued which is why we assign Purchase score to the inventory with $91 value goal.

[ad_2]

Source link