[ad_1]

All eyes are on the Fed forward of a key rate of interest choice

Markets expect a pause from the Central Financial institution

As November’s outlook stays unsure, traders ponder the arrival of the highly-awaited pivot level

Final week, I a few noteworthy divergence in inflation information, with the headline on the rise whereas was declining. This divergence occurred alongside a 25 foundation level by the ECB.

Nonetheless, the point of interest of this week will undoubtedly be the Federal Reserve, as they’re set to make a vital price right this moment.

Market expectations now strongly lean in the direction of a pause in price hikes, with our indicating a likelihood of practically 100% (up from 92% the earlier week).

Supply: Investing.com

The outlook for the November choice, nonetheless, seems to be extra difficult, with the market presently pricing in a 32% probability of a remaining price hike by then.

Supply: Investing.com

With rising uncertainty on the horizon, many traders now ponder whether or not to regulate their methods for the remainder of the 12 months. Nonetheless, historical past has persistently proven that making predictions based mostly on day-to-day occasions and basing investments on them generally is a grave error.

Theoretically, the long-awaited pivot level ought to have already occurred between February and March, but right here we’re, nonetheless extremely unsure.

So, when will it lastly arrive?

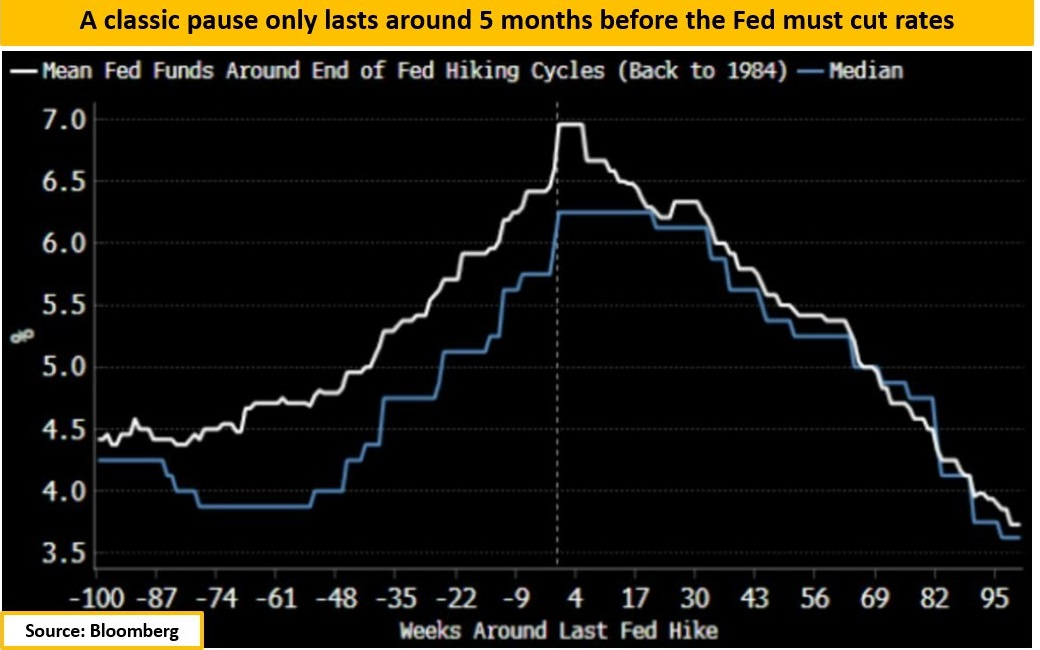

Supply: Bloomberg

Traditionally, the pause between the tip of a price hike cycle and the start of a price minimize has lasted, on common, about 5 months.

This means that if inflation exhibits indicators of slowing and the Fed is now not compelled to boost charges, we’d start to witness some easing within the first quarter of 2024, with the caveat that it is a conditional state of affairs.

In the meantime, the U.S. financial system, particularly the labor market, stays resilient and robust, offering the Fed with extra flexibility than its European counterparts, who’re starting to see indicators of financial misery of their information.

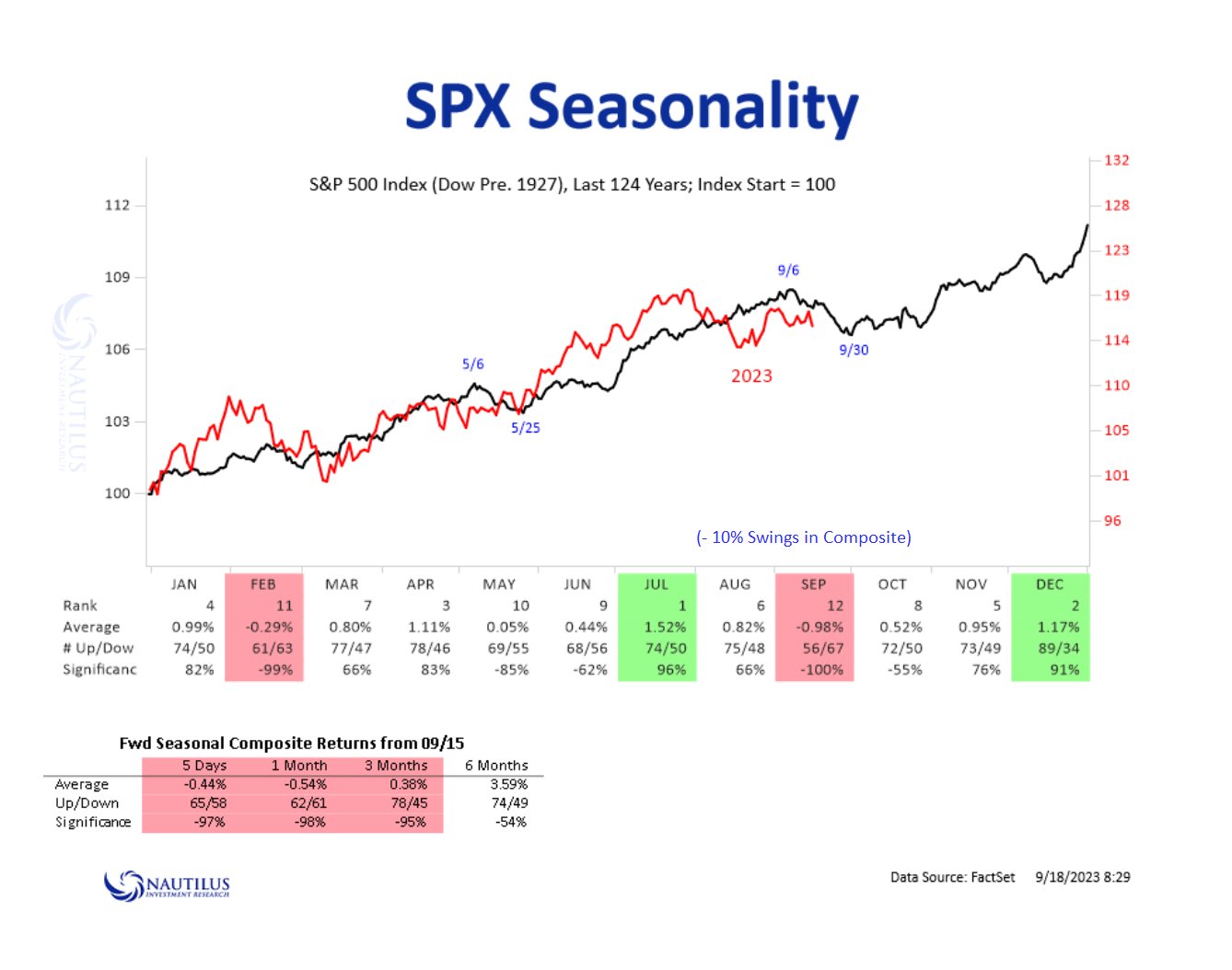

Supply: Nautilus

Historical past suggests September has confirmed to be a difficult month for the , maybe probably the most difficult when it comes to seasonality, with extra unfavourable durations than constructive ones (67 to 56).

Nonetheless, if there’s one factor we have realized on this 12 months and a half, it is that the Fed does not appear to care a lot in regards to the markets, and I do not imagine the Fed will ever tell us when it actually intends to cease mountain climbing charges.

***

Discover All of the Data you Want on InvestingPro!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to take a position as such it’s not meant to incentivize the acquisition of property in any means. As a reminder, any sort of property, is evaluated from a number of factors of view and is very dangerous and subsequently, any funding choice and the related danger stays with the investor. The writer doesn’t personal the shares talked about within the evaluation.”

[ad_2]

Source link