[ad_1]

Within the monetary market, nobody can predict precisely how an asset can transfer. In lots of cases, individuals who attempt to predict the long run costs with none evaluation fail.

It’s because the market is made up of complicated components that transfer on account of totally different triggers.

To make higher predictions, merchants, analysts, and traders use numerous evaluation strategies. Whereas these evaluation strategies are usually not correct, they assist the traders in making the absolute best selections.

Shifting averages are essential and fashionable technical indicators in day buying and selling and investments. They’re broadly utilized in trend-following, reversals, figuring out help and resistance ranges, and putting stops.

On this article, we’ll clarify what shifting averages are, sorts of shifting averages, and a number of the finest methods to make use of.

What are Shifting Averages?

Shifting Averages (MAs) are a number of the finest technical instruments to make use of to make buying and selling selections. Certainly, they’re so fashionable that they’re the muse of most technical indicators like Bollinger Bands, Envelopes, Common Directional Motion Index (ADX), and MACD, amongst others.

Shifting averages map the typical value of an asset in a sure time frame. There are a number of sorts of shifting averages.

Easy shifting common (SMA) – SMA, the most typical kind of MAs calculates the typical value of an asset by the variety of durations in that vary.Exponential shifting common (EMA) – The EMA removes the lag in SMAs by prioritising the current costs.Weighted shifting averages (WMA) – The WMA removes the lag by discounting the burden of the ‘historical’ costs of an asset.Smoothed shifting averages (SMA) – The smoothed shifting common removes the lag through the use of an extended interval to find out the typical. It assigns a weight to the value because the SMA is being calculated.

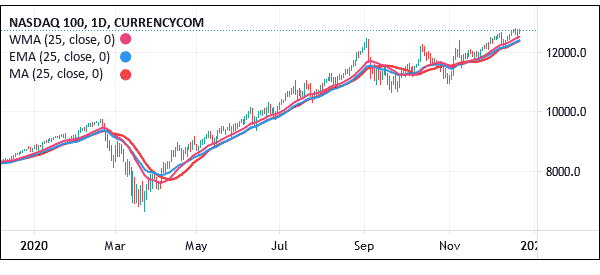

There are different sorts of shifting averages just like the least squares shifting averages, hull shifting common, and Arnaud Legoux shifting common, The chart under exhibits how the 25-day EMA, SMA, and WMA utilized on the Nasdaq 100 index.

Forms of shifting averages

Easy shifting common (SMA)

The SMA indicator is the most well-liked kind of shifting common available in the market. It’s the core of shifting averages in that it’s calculated by including the asset value in a sure interval after which dividing the whole by the durations.

Whereas the SMA is an effective one, it has its personal challenges. The largest con is that it takes all durations equally. For instance, when calculating the 200-day shifting common, all days are taken equally. Consequently, it may not mirror the latest happenings in an asset.

The SMA, like different shifting averages, is used to determine an asset’s pattern, key help and resistance ranges, reversals, and stops.

Exponential Shifting Common (EMA)

The EMA removes the lag that exists within the Easy Shifting Common (SMA). It does that by placing a precedence in the latest information. As such, in a 200-day EMA, the current information tends to have extra weight in comparison with the one which occurred 200 days earlier.

It achieves this by first calculating the SMA after which discovering a multiplier. The ultimate stage is the place you calculate the EMA utilizing the multiplier determine. As proven under, the EMA in crimson is extra reactive than the blue SMA.

Weighted Shifting Common (WMA)

Just like the EMA, the Weighted Shifting Common goals to cut back the noise that exists within the easy common. It does this by additionally placing extra weight on current information. That is completed by multiplying every bar’s value by a weighting issue. The components for this calculation is as proven under. On this case, P1 is the present value whereas P2 is the value one bar in the past.

WMA = (P1 * 5) + (P2 * 4) + (P3 * 3) + (P4 * 2) + (P5 * 1) / (5 + 4+ 3 + 2 + 1)

Once more, as you may see under, the WMA tracks the value extra carefully than the EMA and SMA. As such, it may possibly ship higher alerts.

Smoothed Shifting Common (SMMA)

Just like the EMA and VWMA, the aim of the SMMA is to cut back the noise that exists within the SMA. It’s a kind of EMA in that it applies for an extended interval.

On this, it provides the current costs an equal weighting to the historic ones. It doesn’t discuss with a set interval however fairly takes all of the obtainable information collection into consideration.

Quantity Weighted Shifting Common (VWMA)

This can be a kind of MA that includes each asset costs and volumes. Quantity is a crucial a part of the market because it exhibits the weighting The VWMA is calculated utilizing the next components: Sum of (closing value x Quantity) / Sum of Quantity.

The opposite sorts of shifting averages are:

Least Squares Shifting Common (LSMA) – The LSMA is a sort of MA that minimizes the impact of value outliers. It’s calculated utilizing the least squares regression methodology.Arnaud Legoux MA – This MA reduces the challenges that different MAs have by calculating every shifting common concurrently.

The way to learn the shifting common

Studying the shifting common is a comparatively easy course of. Step one to learn shifting averages is to determine the kind of MA to make use of. Some merchants concentrate on the Easy Shifting Common whereas others use the VWMA, EMA, and Weighted Shifting Common.

The subsequent stage is to seek out the interval to make use of. Ideally, a short-term MA like a 15-MA reacts to a value motion sooner than an extended common. Usually, day merchants concentrate on short-term charts. Buyers who purchase and maintain property for an extended interval have a tendency to make use of longer averages like 50-day and 200-day.

The subsequent stage is to only have a look at the chart and determine the place it’s. Usually, when the value has been in a good vary for a very long time, it can oscillate on the shifting common. If the value is rising, there are possibilities that the value will likely be above the shifting common, and vice versa.

Within the chart under, a dealer would have positioned a purchase commerce so long as it was above the 50-day shifting common. They might both exit and even place a brief commerce when it moved under the 50-day MA.

In a extremely unstable market, the value will transfer above and under the shifting common. On this interval, the shifting common will usually provide you with false alerts.

Which is the perfect MA for day buying and selling?

As talked about, there are quite a few sorts of shifting averages. Due to this fact, a standard query is on the perfect kind of shifting common to make use of in buying and selling. Some merchants concentrate on the easy shifting common whereas others imagine within the EMA or the VWMA.

We suggest utilizing the EMA or the VWMA. The VWMA is an effective indicator as a result of it incorporates each the asset value and the quantity. On the identical time, the EMA is a good indicator as a result of it’s extra reactive to the present asset value.

Whatever the shifting common you employ, the methods will all the time be the identical. You should utilize them in trend-following, reversals, and to determine help and resistance ranges.

Finest MA for a 15-minute chart

A 15-minute chart is often utilized by day merchants, who’re extra centered on opening a commerce and shutting it by the top of the day. It’s by no means ultimate for swing and long-term merchants to make use of a 15-minute chart.

Due to this fact, the perfect MA to make use of in a 15-minute chart ought to be comparatively quick. For instance, it doesn’t make any sense to make use of a 100-period MA on a 15-minute chart. It additionally doesn’t make sense to make use of a 50-MA for such a chart.

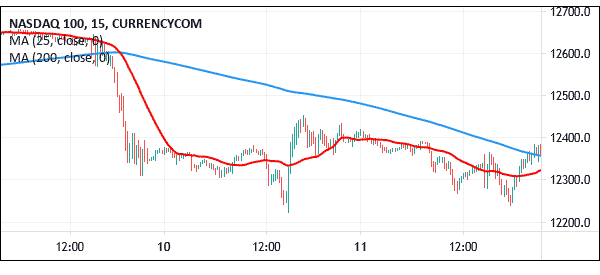

As a substitute, you must use comparatively shorter-dated shifting averages. For instance, the chart under exhibits the 15-minute chart of the Nasdaq 100 with a 200-period and 25-period EMA.

It is best to use the 50-day, 100-day, and 100-day shifting averages if you end up long-term eventualities. For instance, once you wish to purchase and maintain a safety for 2 weeks or a month, you must use a longer-term shifting common.

Equally, if you’re short-term conditions, you must have a look at shorter-term shifting averages.

Methods for Shifting Averages

There are quite a few shifting common methods to make use of available in the market.

Determine entry and exit ranges

The primary essential technique to make use of shifting averages is to determine entry and exit ranges. This technique begins with figuring out the perfect MA to make use of. You possibly can choose the EMA, VWMA, and Smoothed Shifting Common.

The subsequent step is the place you determine the proper interval to make use of and add then apply the shifting common to the chart. The chart under exhibits that the Nvidia inventory value retreated under the 50-period shifting common.

This makes it a great entry level for a short-seller. It is usually a great value to exit an extended commerce.

Shifting common crossover

The opposite fashionable shifting common technique is named the crossover. Broadly, the most well-liked crossovers are the Golden Cross and Loss of life Cross.

A golden cross occurs when the 50-day and 200-day shifting averages make a crossover when pointing upwards. It alerts that patrons. The chart under exhibits how a golden cross sample works.

Nonetheless, for many day merchants concentrate on short-term charts like 5 minutes and quarter-hour. On this case, utilizing the 200-period and 50-period may not be ultimate. As such, they use shorter timeframes like 25-period and 15-period.

Pattern-following

Pattern-following is a buying and selling technique the place you determine an present pattern after which observe it to the top. The aim is to benefit from the pattern and observe it properly.

On this case, you place a purchase commerce so long as the value is above the shifting common and maintain it till it strikes under the typical.

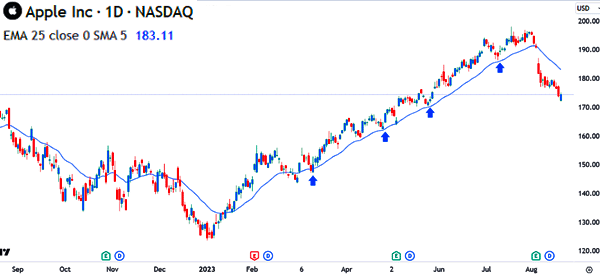

Shifting common S&R ranges

The opposite strategy for utilizing the shifting common is to determine help and resistance (S&R) ranges. Assist is seen as a flooring the place the value struggles to maneuver under whereas resistance is seen because the ceiling.

The chart under exhibits the shifting common (25-day) used to determine the help ranges of the Apple Shares.

Shifting Averages Ideas: The way to grasp them

#1 – Correct Interval

The very first thing you should grasp the abilities of shifting averages is the interval. In buying and selling, you may commerce charts on numerous timelines. It’s potential to commerce one-minute charts as much as yearly charts. Every of those charts require several types of evaluation.

An individual who seems to be at annual or month-to-month charts might be a long-term investor who needs to open trades and go away them to run for a sure time frame.

As a day dealer, it’s irrelevant to make use of these charts. As such, an investor ought to use long run durations. On this, the generally used interval is 200 days.

A day dealer will intention to enter a commerce and exit inside a couple of minutes or hours. To do that, the dealer must have a brief time period chart between 5-minutes and one-hour. Then, the interval used ought to be quick as properly. Essentially the most generally used durations are 12 and 24.

Associated » A Information to Multi-Time Evaluation

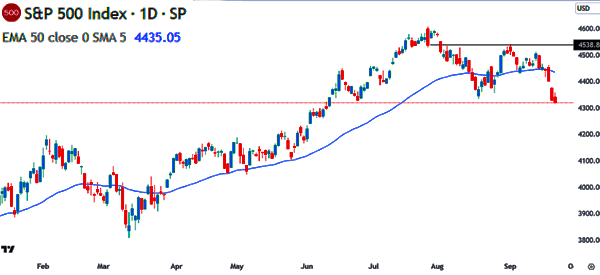

#2 Mix shifting averages with chart patterns

The opposite buying and selling technique for utilizing shifting averages is to mix them with chart patterns. There are numerous chart patterns like triangles, head and shoulders, rising and falling wedges, double-top, and rectangles.

Shifting averages can be utilized to substantiate a number of value actions. For instance, within the chart under, we see that the S&P 500 index shaped a double-top. This value motion was confirmed when it moved under the 50-day shifting common.

#3 – Mix MAs with different indicators

Shifting Averages are pattern indicators, so that they present a dealer whether or not a pattern has shaped or not. To make environment friendly selections, you will need to mix these MAs with different technical indicators. By combining two or three indicators, it can allow you to make higher selections.

A very good technique is to mix MAs with volume-based indicators, and oscillators. Personally, we advise combining MAs with stochastics, Relative energy index (RSI), and accumulation/distribution.

It is best to try to mix MAs with only some indicators as a result of doing so with many indicators will hamper your determination making. It is usually essential to all the time have a look at the basics of any asset that you simply wish to purchase or promote.

Every day, financial information is launched. It is best to use this info along with the shifting averages to make prudent monetary selections.

#4 – Mix Two Shifting Averages

One other technique that has been crucial to me is to mix two shifting averages in the identical chart. On this, you mix a long-term MA (gradual) and a brief time period MA (quick).

As an example, in a 15-minute chart, you may have a 14-day exponential shifting common and a 5-day EMA. After this, you must have a look at the areas the place the 2 strains cross.

If the quick EMA crosses the gradual EMA going up, then this is a sign of a bullish chart. The vice-versa is true too.

#5 – Create a System

One other technique that can allow you to make extra from the shifting averages is the usage of a buying and selling system. Professional Methods as they’re identified will be very useful to you.

Up to now, creating an EA required one to have a robust background in statistics and laptop science. Right this moment, numerous brokers present a drag and drop platform for creating knowledgeable programs.

Uncover Our Software program ›

When creating an knowledgeable system primarily based on shifting averages, you must have your parameters proper after which put them within the system (as acknowledged above, you may mix the Mas with different indicators).

Lastly, you must implement the system in your charts in order to get alerts when the factors are reached. Earlier than implementing it, you must do plenty of backtesting to make sure the system is correct.

Associated » The way to develop a Mechanical Buying and selling System

Exterior Helpful Hyperlinks

[ad_2]

Source link