[ad_1]

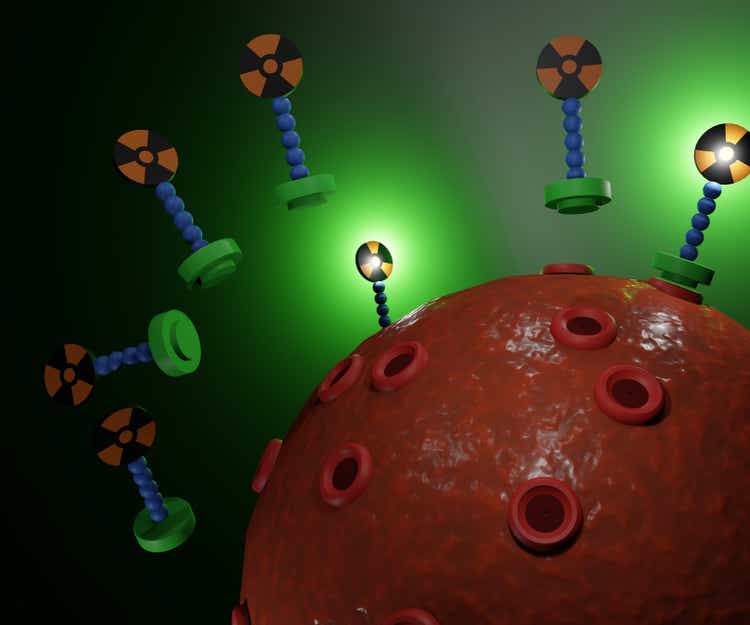

Love Worker/iStock by way of Getty Photos

Introduction

On September 15, RayzeBio (NASDAQ:RYZB) efficiently raised $358 million in an preliminary public providing (IPO) that was upsized in response to sturdy retail demand. Because the shares have bought off over the previous week in this turbulent market setting and are actually approaching the unique $18 per share provide worth, it could be time to revisit the corporate and assess its prospects.

RayzeBio has a promising platform of peptide receptor radionuclide remedy (PRRT) oncology medication in improvement for the remedy of stable tumors. PRRTs are a brand new class of medicine that supply distinct benefits over each exterior beam remedy (EBT) and antibody-drug conjugate (ADC) remedy. Whereas EBT is usually used to deal with localized lesions that may be readily visualized by imaging, PRRT is ready to selectively goal most cancers cells by recognizing and binding to particular overexpressed protein targets, leading to much less off-target toxicity. In comparison with ADCs, remedy with PRRTs gives a number of advantages, together with increased efficiency, deeper and broader tumor distribution, no want for mobile internalization, and avoidance of drug efflux transporter-mediated resistance.

The corporate’s lead drug candidate, RYZ101, a somatostatin receptor kind 2 (SSTR2) therapeutic, is presently being evaluated in a Section-3 medical trial in comparison with investigator-selected standard-of-care (SOC) remedy in sufferers with gastroenteropancreatic neuroendocrine tumors (GEP-NETs) whose most cancers has progressed following remedy with Lutetium 177 (Lu177) beta-particle radioisotope remedy. The first endpoint for the trial is progression-free survival (PFS).

The corporate estimates the incidence of GEP-NETs to be roughly 18,000 sufferers a 12 months within the US with 40-76% of them having metastatic illness on the time of analysis whereas, on a global foundation, 23,115 circumstances have been reported in 2020 within the 7MM markets (US, Germany, France, Italy, Spain, the UK, and Japan), representing a market of simply over $2.81 billion. As for the scale of the general affected person inhabitants, the corporate estimates it to be as massive as 200,000 sufferers.

The first remedy possibility for GEP-NETs is surgical elimination. Nevertheless, as many sufferers are recognized with superior localized or metastatic illness, this isn’t an possibility for a lot of sufferers. In terms of drug remedy, the present first-line remedy for metastatic illness is a somatostatin analog (SSA) reminiscent of octreotide acetate (model identify: Sandostatin) or lanreotide (model identify: Somatuline Depot). These medication deal with the signs of hormonal overproduction and might have a cytostatic impact. Historically, the popular second-line remedy was a mTor inhibitor reminiscent of everolimus (model identify: Afinitor) or sunitinib (model identify: Sutent). Nevertheless, as these medicines present a modest progression-free survival profit and sufferers generally have tolerability points, they’ve been falling out of favor amongst practitioners and are actually regularly changed by newer peptide receptor radionuclide remedy (PRRT) medication.

In separate medical trials involving radiotherapy-naive sufferers, everolimus and sunitinib had general response charges (ORRs) of 5% and 9%, respectively. In distinction, in a Section-3 trial, Novartis’s Lutathera, a lately accepted PRRT, demonstrated a considerably increased ORR of 13% and a PFS of 28.4 months. Nonetheless, as most sufferers relapse after round 28-31 months and proceed to outlive for as much as an extra 40 months and no FDA-approved remedy choices can be found for sufferers whose illness progresses additional, RayzeBio sees a market alternative right here.

The corporate’s lead drug, RYZ101, is a PRRT that delivers a extremely potent alpha-particle radioisotope to tumors overexpressing SSTR2. The drug consists of DOTA-TATE, an FDA-approved peptide binder, and a chelator sure to the alpha-particle radioisotope. As SSTR2 is expressed in 80-90% of GEP-NET tumors however expressed at a lot decrease ranges in wholesome tissue, it is a perfect receptor to focus on. In line with the corporate, alpha-particle radioisotope PRRTs provide a number of benefits over beta-particle PRRTs reminiscent of Lutathera, together with the switch of as much as 400 instances extra radiation vitality, much less off-target mobile harm from oxygen-free radicals, higher efficacy in hypoxic tumor environments, simpler tumor killing attributable to double-stranded (versus single-stranded) DNA cleavage, and fewer post-treatment affected person restrictions.

Alongside the Section-3 ACTION-1 trial for the GEP-NETs indication, RYZ101 can be being investigated in a Section-1b trial as first-line mixture remedy with present SOC remedy in sufferers with In depth Stage Small Cell Lung Most cancers (ES-SCLC) with SSTR2 expressed in a minimum of 50% of their lesions. As lung most cancers is the second most typical most cancers within the US, with an estimated annual incidence of 238,440, and SCLC makes up 14% of those circumstances, it’s a massive addressable market.

Lastly, the corporate has a pair of investigational medication (RYZ801/811 and an unnamed small molecule compound) within the IND-enabling section for the remedy of hepatocellular carcinoma and renal cell most cancers, respectively. As these are nonetheless in an early developmental stage, I will not delve into additional element on them at this level.

The Interim Outcomes of the Section-3 Trial

RayzeBio lately reported interim outcomes as of June 30, 2023, from the Section-3 medical trial primarily based on 17 sufferers (out of an estimated goal variety of 31). A partial response (PR), outlined as a 30% discount within the sum of the goal lesion diameters, was confirmed in 5 of 17 sufferers, representing an general response price (ORR) of 29%. The corporate furthermore indicated that the remedy was nicely tolerated with no treatment-related severe opposed occasions (SAEs) or opposed event-related dose discontinuations.

Whereas this ORR sounds spectacular, evaluating the outcomes to Lutathera is like evaluating apples to oranges as a result of variations in examine design between the 2 trials (the Lutathera NETTER-2 trial concerned first-line use together with long-acting octreotide whereas RYZ101 was administered as a monotherapy to sufferers whose most cancers had progressed after remedy with Lutathera). Nonetheless, as each the NETTER-2 and ACTION-1 examine populations consisted of sufferers with superior GEP-NETs and the RYZ101 sufferers had already failed prior remedy with Lutathera, an ORR of 29% appears promising at first look. Nevertheless, because the examine isn’t anticipated to be accomplished till the tip of 2026 and we nonetheless do not know what the PFS (main endpoint) will appear like or how the drug’s efficacy and security profile will examine to the SOC therapies, we’re nonetheless within the very early innings.

RayzeBio reported the next Grade 3 or increased opposed occasions within the interim read-out: decreased lymphocyte depend (17.6%), anemia (17.6%), decreased creatinine clearance [a potential indicator of kidney damage] (11.8%), and weight reduction (5.8%). No treatment-related SAEs have been reported. This compares favorably to Lutathera, the place the next Grade 3 or increased opposed occasions have been reported: lymphopenia (44%), elevated GGT (20%), AST (5%), and ALT (4%) [potential indicators of liver damage], vomiting (7%), nausea (5%), hyperglycemia (4%), and hypokalemia (4%) together with a number of much less widespread, however probably life-threatening SAEs, reminiscent of MDS (2%), renal failure (2%), cardiac failure (2%), acute leukemia (1%), hypotension (1%), myocardial infarction (1%), and neuroendocrine hormonal disaster (1%).

Assigning a Worth to the Portfolio

There are quite a few methods to assign a worth to a biotech firm’s drug portfolio. Maybe the commonest strategies are internet current worth or risk-adjusted internet current worth, which fashions an organization’s future money flows, and competitor evaluation, the place a market worth is calculated on the idea of the quantity paid for firms in an equal developmental stage with related merchandise. As I firmly imagine that the extra variables you introduce into an evaluation, the upper the prospect that you will get it improper, I’ll maintain it easy and base my evaluation on only one variable: peak gross sales.

For RYZ101, RayzeBio estimates that the addressable affected person inhabitants consists of roughly 7,000 sufferers present process prior remedy with Lutathera. As a number of firms are presently creating focused alpha-based PRRTs for the remedy of most cancers, together with Bayer (OTCPK:BAYRY), Novartis (NVS), Johnson & Johnson (JNJ), Abdera Therapeutics, Actinium Prescribed drugs (ATNM), Aktis Oncology, Convergent Therapeutics, Debiopharm, Fusion Prescribed drugs (FUSN), ITM Isotope Applied sciences Munich SE, Lantheus Holdings (LNTH), Mariana Oncology, Perspective Therapeutics (CATX), POINT Biopharma (PNT), RadioMedix, Telix Prescribed drugs (OTCPK:TLPPF), and Y-mAbs Therapeutics (YMAB), I feel it could be optimistic to imagine that they may seize greater than 50% of this inhabitants (i.e., 3,500 sufferers).

Whereas the value/remedy of Lutathera is presently round $230,000, as a result of later line of remedy, improved efficiency, and simpler drug dealing with, the corporate believes that it will likely be capable of cost a premium worth for RYZ101. If we throw a dart (because the firm has not indicated precisely what they may worth the drug at) and assume a 50% premium, it offers us a worth/remedy of $345,000. Multiply that by a peak inhabitants of three,500 sufferers and we arrive at peak gross sales of about $1.2 billion. This appears slightly excessive contemplating that the majority peak gross sales estimates for Lutathera vary from round $650 million to over $800 million. Nevertheless, the Lutathera estimates are solely primarily based on the accepted mid-gut indication. Growth into different kinds of GEP-NETs has been estimated to extend the potential affected person inhabitants threefold.

For the web current worth calculation, I’ve made the next assumptions:

FDA approval in 2030 (approx. 2 years after completion of the Section-3 trial)

Peak gross sales reached in 2036 (primarily based on the typical of 5-7 years after approval for oncology medication)

Low cost price utilized: the present 10-year US treasury bond price (4.54%)

Threat-adjusted approval issue (primarily based on the medical success charges for oncology medication): Section 3: 35.5%; Section 2: 6.7%; Section 1: 3.4%

This offers us a gift worth of $673.8 million for RYZ101. Making use of the risk-based low cost issue to account for the chance of approval, we arrive at a gift worth of $239.2 million for the height gross sales of RYZ101 for the GEP-NET indication. Nevertheless, as a number of PRRT medication, reminiscent of Pluvicto and Lutathera are already available on the market and the FDA has already accepted using RYZ101’s peptide binder, DOTA-TATE, for SSTR2 diagnostic imaging and therapeutic brokers, the drug has been de-risked to a sure extent. Due to this fact, I imagine that the general success price for Section-3 trials (59%) is a extra appropriate risk-adjusted approval issue. This leads to a risk-adjusted current worth of $397.5 million for the height gross sales.

As RYZ101 can be concerned in a Section-1 trial for first-line use in ES-SCLC, it is usually included within the internet current worth computation. Nevertheless, as I can not discover any steerage from the corporate estimating the scale of the focused affected person inhabitants or worth per remedy, it’s unimaginable to precisely predict what the height gross sales would possibly appear like as soon as the drug is finally accepted for this indication. As RayzeBio signifies within the S-1/A that 33,400 new circumstances of SCLC are recognized every year, the place 66% of the sufferers have metastatic illness and roughly 50% specific SSTR2, we are able to arrive at an estimated affected person inhabitants within the US of round 22,000 sufferers yearly (the addressable inhabitants would naturally be bigger if we embrace different 7MM nations).

The height gross sales of Roche’s Tecentriq have been estimated at $2.8 billion, together with a modest quantity of gross sales from second-line use, whereas its price per remedy is simply over $160,000. If we make the belief that RYZ101 can be priced equivalently and assume a affected person inhabitants of simply 11,000 (50% of US sufferers) within the 12 months by which peak gross sales are reached, we arrive at a determine of $1.76 billion (that is most likely on the conservative facet because it ignores gross sales in worldwide markets).

Assuming that peak gross sales are reached in 2039 and making use of the remainder of the assumptions listed above, we acquire a internet current worth of $865.0 million for peak RYZ101 gross sales from the ES-SCLC indication. Making use of the risk-adjusted approval issue for Section-1 medication offers us a risk-adjusted current worth of $29.4 million. As soon as once more, nevertheless, because the drug has been considerably de-risked, I feel it’s extra applicable to use the general success price for Section-1 medication (13.8% versus 3.4% for oncology medication), which then offers us a risk-adjusted internet current worth of $119.4 million.

Since the remainder of the corporate’s drug portfolio has but to advance into the clinic, I’m not assigning any worth to those medication.

If we err on the facet of warning and apply the extra conservative estimates, the web current values for the height gross sales of each medication add as much as $268.6 million. In any other case, if we assume that the medication have been de-risked sufficient to advantage the upper risk-adjusted approval elements, we arrive at a significantly increased general internet current worth determine ($516.9 million).

Dividing the corporate’s present market cap ($1.144 billion as of Sep. 25) by the extra conservative risk-adjusted approval elements leads to a Value/Gross sales a number of of 4.26 in comparison with the trade common for biotech firms of 5.78. If we as a substitute concentrate on the corporate’s present enterprise worth ($945.7 million as of Sep. 25), we arrive at an EV/Income a number of of three.52 in comparison with the trade common of 6.18. Utilizing the much less conservative figures yields much more enticing multiples: 2.21 (P/S) and 1.83 (EV/Income).

Upcoming Catalysts

Essentially the most instant upcoming catalysts on the horizon are the scores that may pour in from funding analysts as soon as the quiet interval expires on October 25. Apart from this, there are a number of potential catalysts subsequent 12 months, together with up to date Section-1b knowledge from the RYZ101 ACTION-1 trial, IND submission for RYZ801/811, human imaging outcomes for the corporate’s small-molecule CA9 drug, preliminary Section-1b knowledge from the RYZ101 ES-SCLC indication, and the graduation of compassionate-use remedy for RYZ801/811 in hepatocellular carcinoma sufferers.

The Bull Case

As a result of their improved efficiency, deeper, broader tumor distribution, and higher avoidance of drug resistance mechanisms, PRRTs have the potential to be a recreation changer, changing ADCs because the remedy of selection for a lot of stable tumors. FDA-approved alpha- and beta-based PRRT medication reminiscent of Xofiga, Pluvicto, and Lutathera all boast projected peak gross sales that strategy or exceed $1 billion whereas the US TAM for the GET-NETs indication RayzeBio is focusing on has been estimated at round $800 million. Alpha-based radioisotope PRRTs reminiscent of RYZ101 provide a number of necessary advantages over beta-based ones like Lutathera, together with stronger radiation vitality switch, extra environment friendly most cancers cell killing, and fewer post-surgical affected person restrictions. Furthermore, there may be further optionality in RayzeBio’s pipeline if the corporate is profitable at figuring out further stable tumor cancers, reminiscent of ES-SCLC, the place the SSTR2 receptor is expressed.

With profitable healthcare hedge fund backers reminiscent of VenBio and Viking World, an skilled administration workforce, and a money runway via 2025 (per the corporate’s assertion within the S-1/A), on the present worth, I really feel that RayzeBio makes a compelling funding case with quite a lot of photographs on purpose.

The Bear Case

As with all development-stage biotechs, there are quite a few dangers concerned with any funding. There’s a lengthy checklist of rivals with alpha- and beta-based PRRTs presently present process medical trials, a few of whom have far higher sources than RayzeBio. Furthermore, the corporate’s success in acquiring FDA approval for his or her drug candidates will depend upon their potential to boost capital to fund the medical trials in addition to the efficacy and security profile of their medication compared to different remedy choices. As well as, as an rising progress firm, as outlined within the JOBS Act, the corporate is exempt from sure public reporting necessities. Lastly, as a vertically built-in firm, manufacturing missteps might happen, reminiscent of failure to acquire cGMP certification, which may consequence within the delayed approval or rejection of the corporate’s drug candidates.

Total Score

Total, I feel that the inventory is an effective worth at this degree and am very enthusiastic in regards to the potential for alpha-based PRRTs to shift the paradigm relating to the remedy of superior stable tumors. With a product in superior Section-3 testing and a promising drug pipeline with optionality for different stable tumor functions, I price RayzeBio as a speculative Lengthy-term Purchase.

So far as the timing goes, with out the privilege of a crystal ball, I’d most likely accumulate shares both proper earlier than the tip of the quiet interval (October 25) or across the time that the 180-day lock-up interval expires.

Score (on a scale of 1-5, the place 1 pepper is a supreme fail and 5 peppers is a smashing hit)

rawpixel.com

[ad_2]

Source link