[ad_1]

Justin Sullivan

The waning energy of US customers has been a problem of rising concern for traders and different market contributors all via the 12 months. Again in June, main retailers like Macy’s (M), Dwelling Depot (HD) and Lowe’s (LOW) warned that buyers had been slowing down on spending. Indicators of weaker shopper spending within the economic system are actually starting to indicate within the banking system, with Brian Moynihan, CEO and Chairman, Financial institution of America (BAC), stating in a current interview that median earnings households have decrease account balances and are spending down their pandemic financial savings.

“Shoppers’ exercise has slowed down … it is slowed by half, and meaning the buyer is being slowed down by the rate of interest surroundings and all of the stuff occurring,” mentioned Moynihan on CNBC. He defined that, in a given 12 months, the financial institution’s prospects spend $4 trillion. From 2021 to 2022 that spend grew by 10%. It started dropping to 9% in Q1 2023 and now that progress determine has dropped to 4.5%.

Weaker shopper spending and the potential for a recession are indicators that traders might have to start out occupied with including shopper staple shares to their portfolios. These shares are sometimes thought of protected bets throughout an financial slowdown since they promote important gadgets like meals and private hygiene merchandise. One inventory on this class that’s worthy of consideration is Monster Beverage Company (NASDAQ:MNST), the maker of a few of the hottest power drinks within the US and globally.

Variations and similarities with different shopper staple shares

Most shopper staple shares pay a strong and steady dividend. MNST, nonetheless, pays no dividend in any respect however reinvests its earnings into the enterprise. That is one in every of its key variations from different shopper staple shares.

Foregoing dividends is sensible for a long-term investor in MNST in view of how quickly the corporate has expanded its topline and backside line prior to now 5- 10 years. MNST’s historic monetary statements present that the enterprise has grown income in leaps and bounds over the previous decade.

TTM

2020

2017

2013

Revenues

$6.69 billion

$4.59 billion

$3.36 billion

$2.24 billion

Internet earnings

$1.43 billion

$1.40 billion

$820.7 million

$338.7 million

Click on to enlarge

Supply: Searching for Alpha

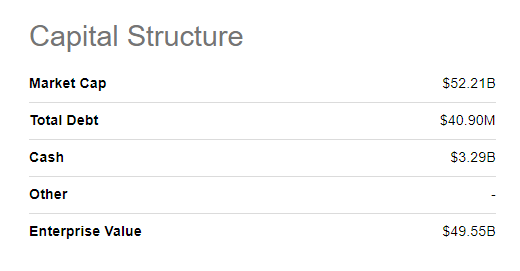

Importantly, MNST has been in a position to obtain this sturdy monetary efficiency whereas protecting its steadiness sheet squeaky clear. The California-based firm has just about no debt, having reported money and short-term investments of $3.28 billion vs whole debt of simply $40.9 million in the latest quarter.

Monster’s clear steadiness sheet (Searching for Alpha)

Because of its clear steadiness sheet, low price of capital, and constantly sturdy business efficiency, MNST has been in a position to preserve a powerful common return on invested capital (ROIC) of 25.2% for fiscal years ending December 2018 to 2022, in line with information from Finbox. ROIC is a key efficiency metric as a result of it reveals how effectively administration makes use of funds raised via debt and fairness to show a revenue. Exceptionally excessive returns above 20% imply the underlying enterprise has excessive margins and carries low stage of debt, as is the case with MNST. A enterprise with a excessive ROIC makes higher use of its capital reinvesting income than paying dividends.

Whereas MNST does not pay a dividend like most shopper staple shares, it has one hanging similarity with each different shopper staple inventory on the market: that’s, shopper demand for its merchandise is resilient to a number of exterior shocks.

MNST’s revenues and product volumes have grown healthily and steadily lately regardless of an countless collection of financial, geopolitical and public well being shocks. Folks hold shopping for the corporate’s drinks it doesn’t matter what’s taking place within the economic system, within the information or the broader world. As a pointer to this, the corporate’s revenues have grown steadily since 2019 to this point, regardless of a number of shocks over this era such because the Covid-19 pandemic, the Russia-Ukraine warfare, inflation and rising rates of interest, and the present financial slowdown and fears of recession.

The percentages drastically favor Monster

If MNST has been resilient prior to now few years (even in spite of everything that has occurred by way of inflation and the cost-of-living disaster, rising rates of interest, a number of wars and geopolitical shocks, and Covid), what are the chances that the approaching financial slowdown will negatively affect its efficiency? This for my part is the central query traders must ask when assessing MNST’s prospects as an funding alternative in a recessionary surroundings.

I imagine that, going ahead, MNST will possible hold performing as properly, identical to it has lately when it overcame the difficult macroeconomic and geopolitical backdrop and maintained its progress trajectory. The percentages drastically favor the corporate, going by its most up-to-date efficiency for Q2 2023 and H1 2023 in addition to analysts’ projections for 2023 and 2024.

MNST posted file efficiency within the second quarter of 2023. Internet gross sales had been $3.55 billion for the six-months ended June 30, 2023, a rise of roughly $380.1 million, or 12.0% larger than internet gross sales of $3.17 billion for the six-months ended June 30,2022, in line with the corporate’s SEC filings. The corporate is anticipated to earn revenues of $7.17 billion in 2023 and $8.00 billion in 2024, in line with consensus estimates from Wall Avenue analysts protecting the inventory. MNST’s consensus EPS is anticipated to broaden to $1.54 in 2023 and $1.80 in 2024, from $1.13 in 2022.

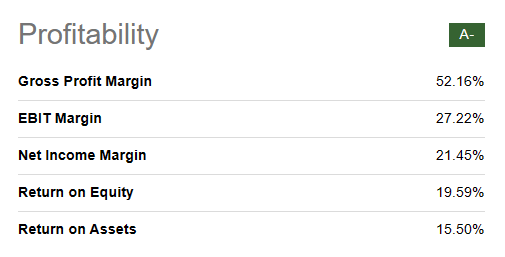

If these projections materialize, or MNST surpasses them, shareholders will possible proceed having fun with excessive inventory costs given the corporate’s considerably excessive margins, which have traditionally contributed to sturdy EPS progress and share worth appreciation.

Monster enjoys excessive margins (Searching for Alpha)

A confirmed winner over time

Up to now 5 years, MNST has handily outperformed the S&P 500, delivering a return of 93% vs the S&P’s 54%. Assuming predictions of a recession come true, traders will possible flock to shares like MNST that may beat the market in occasions of turmoil – identical to they’ve prior to now few tumultuous years. Because of this MNST’s outperformance may possible speed up in coming quarters and years as fears of an financial slowdown take maintain available in the market and traders flee to corporations like MNST which have a confirmed historical past of rising profitably in turbulent occasions.

MNST has outperformed the market prior to now 5 years (Searching for Alpha)

MNST is a market darling that counts The Coca-Cola Firm (KO) as one in every of its key shareholders and strategic companions. KO purchased a stake in MNST in 2015 as a part of a strategic partnership involving an fairness funding and expanded distribution within the world power drink class. In reference to the closing of this deal, KO made a internet money cost of roughly $2.15 billion to MNST.

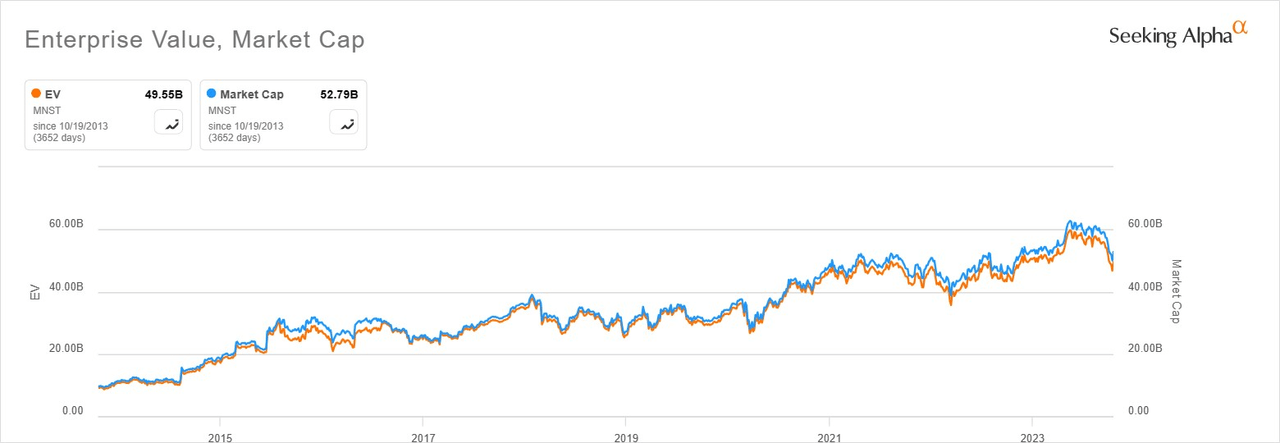

With the caveat that “previous outcomes should not an indicator of future efficiency”, a have a look at MNST’s historic efficiency reveals that it has been a constantly superior performer. Not solely has it outperformed the S&P by virtually 100% prior to now 5 years, however its valuation by way of market cap and enterprise worth has elevated greater than fivefold prior to now 10 years.

Monster’s valuation has elevated fivefold in previous decade (Searching for Alpha)

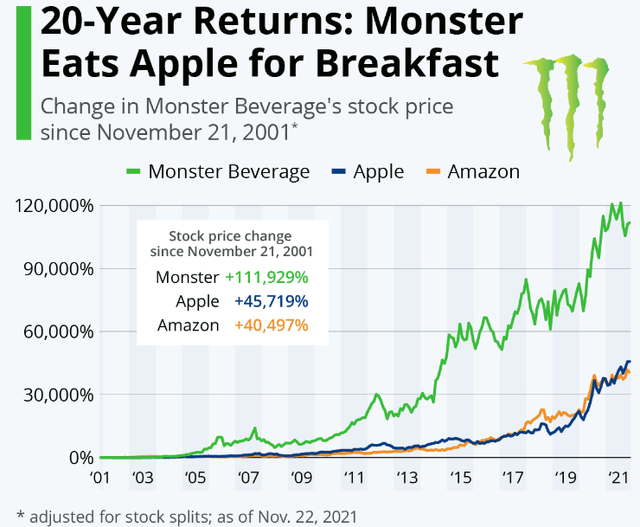

Its noteworthy that for the reason that flip of the brand new millennium, MNST has delivered a considerably larger return for traders than Apple (AAPL) and Amazon (AMZN).

“Whenever you ask folks to guess the best-performing inventory within the S&P 500 over the previous 20 years, the solutions would most likely be fairly tech-heavy. Apple? Amazon? Microsoft or Google possibly? Properly, it is neither,” notes Statista information journalist, Felix Richter, in an insightful Nov 2021 chart and article evaluating the 20-year inventory efficiency of MNST to these of AAPL and AMZN.

MNST considerably outperformed AMZN and AAPL prior to now 20 years (Statista)

The primary dangers and key catalysts

Whereas shopping for MNST to climate a attainable coming financial slowdown does not look like a nasty thought. I am cautious in regards to the inventory’s valuation. It has a P/E (FWD) of 32.91 and an EV/EBITDA (FWD) of 23.44 vs the buyer staples sector’s median P/E (FWD) of 17.63 and median EV/EBITDA (FWD) of 10.60.

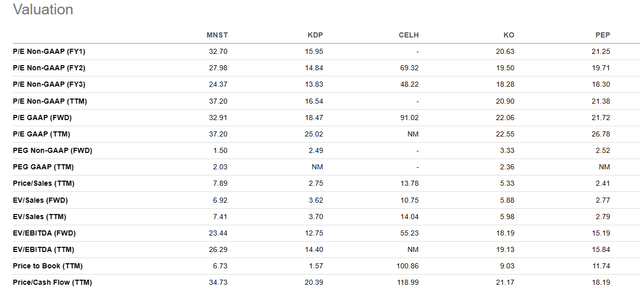

Compared to different main beverage makers, MNST can also be priced at a premium. The chart under, evaluating MNST vs KO, PepsiCo (PEP) Keurig Dr Pepper (KDP)and Celsius Holdings (CELH), reveals that, apart from CELH, Monster is pricey when in comparison with friends.

Searching for Alpha

MNST’s excessive valuation metrics could possibly be an indication that the inventory has restricted future returns, so traders must proceed cautiously. I do not, nonetheless, maintain this to be the case and as a substitute imagine the corporate will continue to grow profitably and having fun with excessive margins. MNST is for my part priced extra like a excessive progress tech inventory than a shopper staples inventory, therefore the excessive P/E. Its noteworthy that giant tech corporations like AAPL and AMZN, each of which MNST has outperformed prior to now 2 many years, have valuation metrics as excessive or larger than MNST. AAPL has a

P/E ((FWD)) of 28.98 whereas AMZN has a P/E ((FWD)) of 59.70.

When it comes to the primary optimistic catalysts for traders to control, the 2 primary ones are MNST’s capability to proceed driving progress with zero debt, and the sturdy model fairness that the corporate has constructed with customers.

One of the crucial dependable indicators of a model’s energy with customers is the power for an organization to extend costs and nonetheless report improved volumes. On account of continued price pressures, MNST carried out worth will increase in 2022 and the primary half of 2023.

“We are going to proceed to evaluate additional alternatives for pricing actions with a purpose to mitigate inflationary pressures,” famous Chairman and Co-CEO Rodney Sacks within the Q2 2023 earnings name. Its noteworthy that, regardless of these worth will increase, SEC filings present that MNST case gross sales for MNST’s power drink merchandise, in 192-ounce case equivalents, had been 380.8 million circumstances in H1 2023, a rise of roughly 27.8 million circumstances or 7.9% larger than case gross sales of 353.0 million circumstances in H1 2022. The corporate’s volumes have grown robustly even after costs went up, underlining its sturdy model amongst customers.

Conclusion

MNST’s reputation with customers, its high-growth, excessive margin underlying enterprise, and its clear steadiness sheet have given it the liberty to experiment in new areas like alcoholic drinks. The corporate’s efforts within the alcohol drinks section may assist maintain long-term progress even additional. Whereas MNST’s valuation appears to be like wealthy right this moment, it may nonetheless ship a robust return over the long-term and act as an excellent hedge towards the potential recession coming our manner.

[ad_2]

Source link