[ad_1]

andreswd/E+ by way of Getty Photographs

As I’ve expressed in my latest article on the Brazilian mining large Vale (NYSE:VALE), my funding thesis for the corporate is primarily centered on its capability to constantly present strong dividends to shareholders whereas buying and selling at an exceptionally interesting valuation. The newest outcomes reported by the corporate additional assist my thesis.

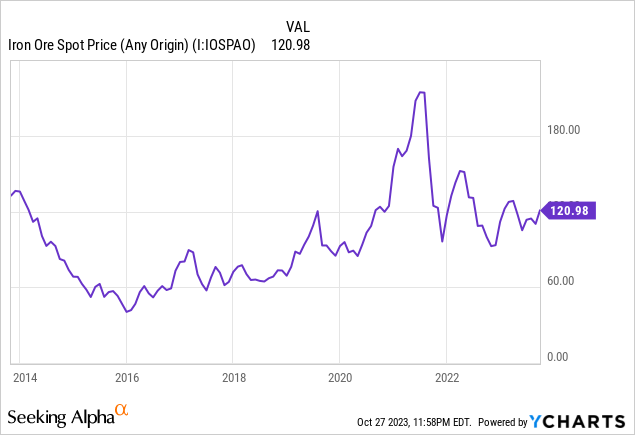

Through the third quarter, regardless of the challenges confronted within the Chinese language industrial actual property market, Vale reaped the advantages of a median iron ore value of $114 per ton, marking a 62% enhance and reaching a 2.7% peak over the earlier quarter. The worth of this commodity continued to climb, finally reaching roughly $120 per ton, a stage roughly 30% above the historic common of the previous decade.

These elements considerably contributed to Vale’s third-quarter efficiency, the place the typical realized value for high-quality iron ore reached $105 per ton. This marked a 6.7% enhance in comparison with the earlier quarter and a considerable 13.5% enhance in comparison with final yr. The worth surge was fueled by robust demand in building, infrastructure, and social housing initiatives financed by the Chinese language authorities, record-breaking exercise within the Asian automotive business, and elevated Chinese language crude metal exports to international markets, together with Brazil.

Regardless of the corporate’s vital dependence on the Chinese language economic system, Vale has constantly confirmed to be a resilient money generator, repeatedly delivering worth to shareholders by reliable dividend distributions and share buyback packages. Moreover, Vale is at the moment buying and selling at very enticing valuation multiples, remaining under its historic common, which bolsters my optimistic outlook for the corporate.

Vale Q3 Outcomes

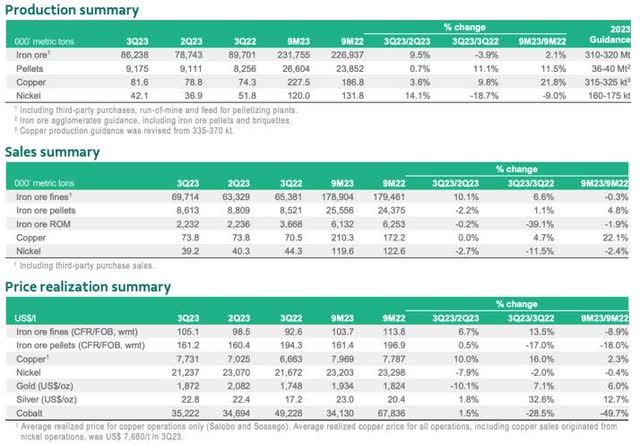

The corporate’s launched working outcomes on October 17 confirmed a 4% decline in iron ore manufacturing, Vale’s main enterprise, when evaluating the third quarter of 2023 to the identical interval in 2022. This drop may be attributed to operational points on the mines, resulting in decreased manufacturing. On the gross sales entrance, iron ore gross sales quantity within the third quarter of 2023 was 6.0% larger than within the third quarter of 2022, indicating the corporate’s effort to cut back inventories following a number of quarters of overproduction. This can be a constructive improvement in my opinion.

Vale’s IR

Relating to costs, iron ore costs confirmed a constructive development within the third quarter of this yr, reaching roughly $105 per ton, in comparison with $98 within the second quarter of 2023 and $92 within the third quarter of 2022. Moreover, there was an appreciation within the worth of the U.S. greenback towards the Brazilian actual, which benefited Vale because it’s an exporting firm.

These elements indicated that Vale was poised to report substantial income and glorious money technology if prices remained secure. This expectation materialized when Vale launched its quarterly outcomes on October 27.

Within the third quarter of 2023, Vale reported a 7% enhance in web gross sales income in comparison with the identical interval within the earlier yr, reaching the US$10.6 billion mark. When it comes to working revenue (EBIT), there was a 16% enhance in comparison with the third quarter of 2022, totaling $3.3 billion, with an EBIT margin round 3 proportion factors larger, reaching 31%. Nonetheless, web earnings from persevering with operations skilled a 35.7% decline in comparison with the identical interval in 2022, primarily because of the absence of a constructive impression from monetary objects on this quarter.

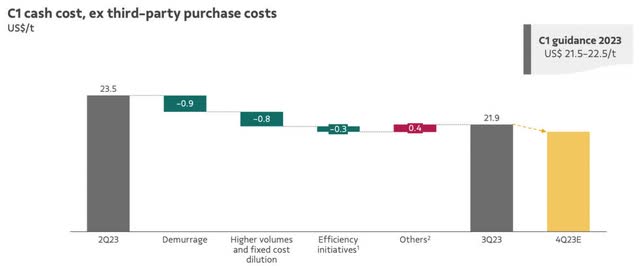

Amongst very important operational elements, one of many foremost highlights was the 13.5% enhance within the common promoting value of iron ore fines in comparison with the identical interval in 2022. This contributed to larger web gross sales income regardless of a slight drop in manufacturing. The C1 money value of iron ore, excluding purchases from third events, reached $21.9 per ton, according to the steerage offered, which ranges from $21.5 to $22.5 per ton for the yr.

Vale’s IR

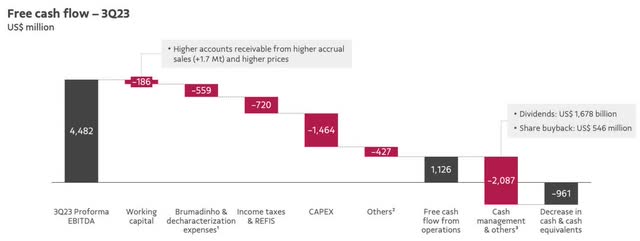

The corporate has additionally been executing a disciplined capital allocation technique. Within the third quarter, free money circulate from operations amounted to roughly $1.1 billion, marking a rise of roughly $350 million in comparison with the second quarter. This elevated working capital was primarily resulting from larger accounts receivable, ensuing from elevated iron ore gross sales and costs. Moreover, earnings taxes noticed an uptick resulting from improved efficiency.

Vale’s IR

The free money circulate from operations was employed to supply worth to our shareholders by paying $1.7 billion in dividends and $0.5 billion in share buybacks. Consistent with this strategy, Vale has accepted a brand new buyback program to repurchase as much as 150 million shares inside 18 months. Since initiating the corporate’s first buyback program, 830 million shares, equal to 60% of the share depend, have already been repurchased.

Because of this, shareholders who invested in Vale throughout this era have elevated their earnings per share participation by 19%, as the corporate’s administration highlighted.

Vale’s Outlook

The first elements straight impacting Vale’s outcomes are the worth of minerals and the amount produced. On this context, the corporate has been pursuing two interconnected methods to optimize its operational efficiency: rising manufacturing and lowering prices.

The primary technique entails value discount as a result of Vale lacks management over the worth of its product. Therefore, its focus should be on sustaining profitability even in difficult eventualities. Vale’s money value for iron ore is roughly $19.6 per ton (as of 2022 knowledge).

This value will increase to round $37.4 per ton when accounting for bills associated to royalties, distribution, upkeep investments, and freight to succeed in Asian ports, that are the first shoppers of the corporate’s ore. Due to this fact, after contemplating present investments in Vale’s operations, the breakeven level is roughly $60. Regardless of having decrease extraction prices than its opponents (Rio Tinto (RIO) and BHP (BHP)), Vale faces considerably larger freight prices resulting from Brazil’s larger distance from China than Australia.

For that reason, the corporate repeatedly seeks methods to boost its manufacturing and freight prices. In 2022, the all-in value per ton of iron ore, earlier than accounting for upkeep investments, reached $49.3. The corporate anticipates this determine to be $52-54 per ton in 2023 and to lower to roughly US$42 per ton by 2026, achieved by value dilution and decreased mounted bills from larger manufacturing volumes.

Iron Ore’s Outlook

The first dangers related to this thesis stem from the extremely risky and unpredictable nature of the sector through which the corporate operates. The iron ore business depends closely on demand, significantly infrastructure and building. China, at the moment experiencing financial challenges, performs a vital position as it’s answerable for 50% of the world’s metal manufacturing, a major client of iron ore. Final yr, China accounted for 62.9% of Vale’s iron ore shipments, whereas Asia represented 77%.

Due to this fact, Vale’s outcomes are carefully linked to the Chinese language economic system. Within the years forward, there may be an expectation that China’s demand for iron ore will develop into extra secure, not reaching the excessive progress charges of previous many years however nonetheless sustaining an affordable stage. Optimistic developments additionally emerge from developed areas, emphasizing sustainable metal manufacturing and renewable vitality infrastructure improvement. Moreover, the continuing migration of individuals from rural to city areas in China will contribute to elevated metal demand. Moreover, there may be an expectation that metal manufacturing capability in Southeast Asia will double by 2030, additional benefiting the sector.

Valuation and Dividends

Vale trades with an Enterprise Worth (EV), the market worth plus web debt, of R$340 billion. This means the corporate trades at an EV/EBITDA a number of of 4x, under its historic common. It is essential to focus on that the corporate is anticipated to generate an EBITDA vary of R$80 to R$98 billion for the yr.

Moreover, Vale has lately declared a dividend of R$2.33 per share (roughly $0.47 per share), with R$1.56 as dividends and R$0.76 by way of JCP (Shareholder’s Fairness Curiosity). That is roughly $2 billion, equal to three.6% of Vale’s market worth.

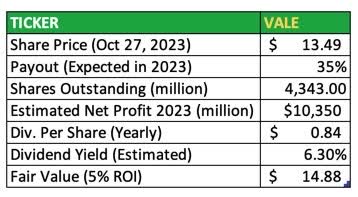

In my evaluation, contemplating the typical consensus of analysts predicting a 44% lower in EPS for Vale by the tip of 2023, the corporate is anticipated to generate $10.35 billion in web earnings. A payout ratio of 33.5% interprets to an annual dividend per share (Vale pays semi-annual dividends) of $0.84, indicating a yield of 6.3%.

Making use of a 5% return on funding [ROI] suggests a good value of $14.88 per share for Vale. This helps an upside potential of 10% from the present value, which I think about a secure level for buying Vale shares to generate worth by dividends.

Firm’s knowledge, desk compiled by the writer

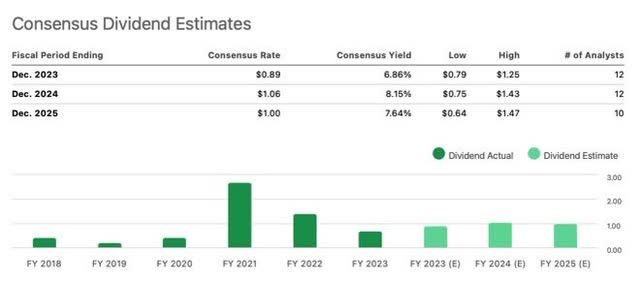

The outlook for the subsequent few years seems extra optimistic, significantly contemplating a potential payout ratio extra consistent with the corporate’s historic common of 68% over the past 5 years. Whereas it is unsure whether or not this program will make the most of the $2.4 billion, there is a good likelihood, in my opinion, that Vale will not hold the funds idle and will use them to generate shareholder worth, both by dividends or share buybacks.

In search of Alpha

Conclusion

My bullish outlook on Vale stays unaltered following the discharge of its Q3 earnings report.

Vale displayed a exceptional restoration, marked by a 7.8% sequential enhance in EBITDA within the third quarter and an 11.2% annual progress. This may be attributed, partly, to the favorable seasonality within the third quarter, which boosted gross sales and decreased mounted prices, consequently resulting in a sequential lower within the C1 value. Moreover, the rise in iron ore costs inspired Vale to expedite the disposal of inventories accrued within the first quarter and enhance its stability sheet.

I proceed to understand a wonderful alternative to spend money on Vale at its current valuation. The corporate trades at an EV/EBITDA a number of of 4x, under its historic common. Moreover, it affords an interesting dividend yield of roughly 6% for 2023.

[ad_2]

Source link