[ad_1]

Have you ever ever puzzled what the historical past and the components of a bank card are? How did they get began, and what constitutes a bank card?

This text will talk about the historical past and anatomy of a bank card: what are all of the numbers and magnetic bits, and why are they there?

We’ll additionally talk about how bank card issuers preserve security measures, supply advantages and perks to their members, the way forward for bank cards, and extra.

Maintain studying to study every thing you want about bank card components and the way they work.

Components of A Credit score Card

First, let’s have a look at the anatomy of the bank card:

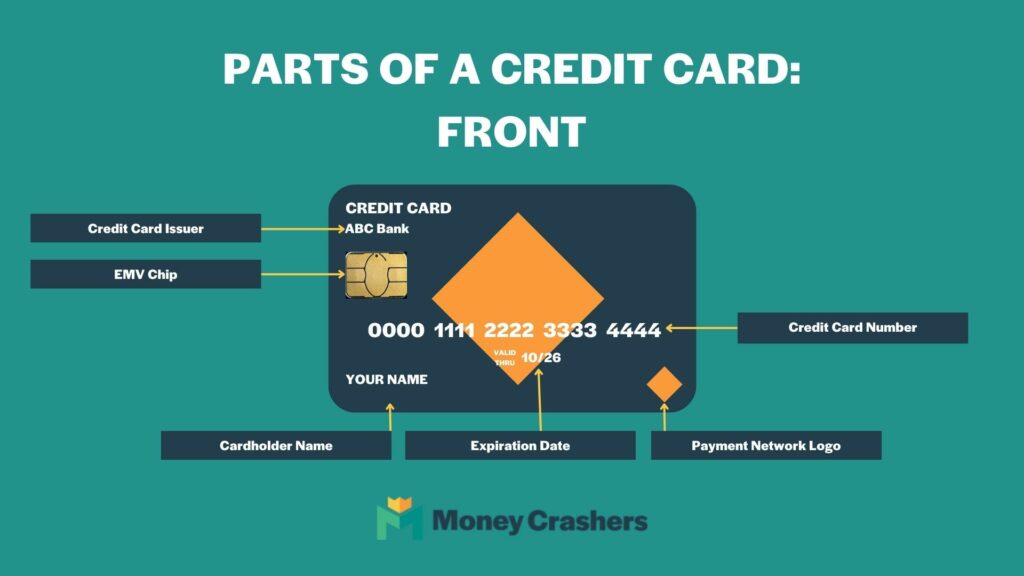

Entrance of the Credit score Card

The entrance of the bank card will usually have the next.

Bank card quantity: The numbers on the entrance of your bank card make up the bank card quantity, or your account quantity. This identifies your credit score line once you attempt to use the cardboard. It’s vital to maintain this quantity personal as a result of along with your bank card quantity, expiration date, and 3-digit quantity on the again, anybody might use your card.

Financial institution Identification Quantity: The BIN is just like your financial institution’s routing quantity on your private checking account. The primary six to eight numbers route the fee directions to the correct fee community and issuing financial institution.

Main Business Identifier (MII): The primary digit of your card is the MII and signifies the kind of establishment that issued your card. Among the many most typical MIIs, Amex playing cards begin with a 3, Visa playing cards begin with a 4, Credit cards begin with a 5, and Uncover playing cards begin with a 6.

Test digit: The final digit of your bank card quantity is a examine digit. That is used to confirm the authenticity of your card quantity and is predicated on an algorithm that considers the opposite digits in your card. If the examine digit doesn’t match a sure worth, the bank card is invalid, and the financial institution will decline the transaction. The examine digit is one function of many used to forestall fraud.

Cardholder title: The title on the cardboard identifies the particular person eligible to make use of it. This may increasingly or will not be the one that utilized for and opened the cardboard. Card house owners can get playing cards for licensed customers, corresponding to a partner or baby.

Expiration date: All bank cards expire if for nothing else than security. Getting a brand new card with a brand new expiration date and safety code reduces the chance of somebody understanding your info and utilizing your card. Playing cards additionally expire to permit all cardholders to have playing cards with the newest know-how.

EMV Chip: Steel chips in bank cards make them safer than conventional magnetic strips. The chip encrypts your bank card info because it’s processed, decreasing the chance of fraud.

Title of the bank card issuer: The bank card issuer is a financial institution. You’ll see the financial institution’s title on the bank card. That is who you make funds to and get in touch with if in case you have a problem along with your card.

Fee community brand: Every bank card is from a bank card firm, corresponding to Visa, Mastercard, Uncover, or American Specific. Once you pay on-line or over the cellphone, you usually need to determine your card sort.

Please Word: Not all bank cards have this info on the entrance, and it depends upon the kind of card. Some playing cards are shifting loads of this info to the again of the cardboard.

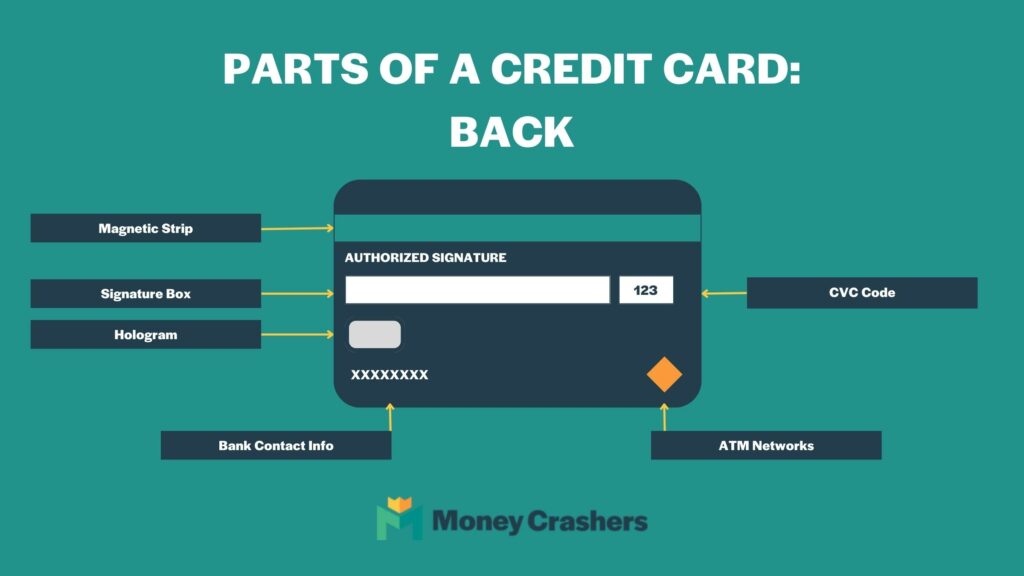

Again of the Credit score Card

The again of a bank card usually has a number of figuring out markers.

Magnetic stripe or magstripe: The black strip on the again of the cardboard is magnetic and, when swiped, supplies all the mandatory info to course of a fee, together with your title, the account quantity, and card expiration. It’s vital to maintain it secure as a result of thieves can steal this info and create a faux strip to make use of as your bank card.

Card Verification Code (CVC): The Card Verification Worth (CVV) is the 3-digit safety code for further safety measures. It might be after an extended code, however they ask for the three-digit code when making a fee. It helps restrict fraudulent exercise, particularly with on-line or cellphone purchases. Distributors will ask for the code to confirm you’ve got the cardboard. Whereas it doesn’t assure the cardholder is utilizing the cardboard, it decreases the chance of fraud.

Signature field: The white field on the again of the cardboard is a signature field that retailers use to confirm your signature once you signal for transactions. This may also help forestall fraudulent exercise; nevertheless, it’s not as useful since most transactions are digital or no-contact at present.

Hologram: Most playing cards have a hologram brand on the again. As a result of holograms aren’t simply replicated, recognizing a faux bank card is simpler with holograms.

ATM networks: You could discover different logos of ATM networks on the again of your card. This means the place you should utilize your bank card to make money withdrawals.

Issuing financial institution’s contact info: The data to contact the issuing financial institution is on the again of the cardboard, together with the cellphone quantity, bodily mailing deal with, and/or web site.

How Do Credit score Playing cards Work?

A financial institution or monetary establishment points bank cards and permits cardholders to pay for items or companies at retailers that settle for fee by bank card.

In the US, Visa, Mastercard, Uncover, and American Specific dominate the bank card community. Capital One, Chase Financial institution, and Wells Fargo are three frequent issuing banks.

The financial institution or monetary establishment pays the retailer on your buy — primarily based on an settlement you’ve got with the creditor to pay these fees, which is your accrued debt. By means of your bank card, your financial institution gives you a line of revolving, unsecured credit score.

The quantity of unsecured credit score they prolong to you is predicated on varied elements, together with creditworthiness (credit score rating), fee historical past, revenue, whole debt load, and size of your relationship with the financial institution. Credit score limits might be lowered, elevated, and even canceled primarily based on the phrases outlined in your settlement.

Many bank cards supply rewards, like money again, airline miles, or factors you may redeem for perks.

Professional Tip: In case your chip isn’t working, some retailers won’t take your card, even when it does have a magnetic strip. However don’t fear! In case your chip isn’t working, it might simply be from a build-up of grime, and an excellent wiping might mend your chip pretty much as good as new.

What Can You Do With A Credit score Card?

Bank cards are a handy solution to make purchases, however there are different methods to make use of them too.

In-person purchases: Making a purchase order in a retailer with a bank card is its most typical use. You swipe, insert, or faucet the cardboard on the bank card reader and if accredited, you employ a portion of your credit score line to pay for the acquisition.

On-line purchases: Making a purchase order on-line is just potential with a credit score (or debit ) card. When shopping for on-line, you should manually enter your bank card info together with the bank card quantity, expiration date, and safety code. The identical is true for purchases revamped the cellphone.

Arrange autopay: To keep away from late funds, you may arrange many invoice funds, corresponding to utilities, cell telephones, and web payments, on autopay. The invoice quantity comes out of your credit score line on the required date, after which you’ve got a bank card invoice to pay.

Money advances: For those who want money quick, you might be able to get a money advance at a accomplice ATM, as famous on the again of your card. Beware, although, money advances normally have a a lot larger APR than purchases and don’t have a grace interval. Learn your bank card settlement intently to find out what to anticipate.

Earn rewards: For those who qualify for a rewards bank card, you may earn factors or miles which you can convert to assertion credit, or redeem for different rewards, corresponding to airline tickets, resort reservations, or present playing cards.

Historical past of Credit score Playing cards

Types of bank cards have existed for at the very least 5,000 years in historical Mesopotamia. They used clay tablets to indicate a report of transactions amongst neighboring retailers.

Bank cards grew to become extra well-known and initially began as “Diners Membership” playing cards within the Nineteen Fifties. Founding father of the Diner Membership, Frank McNamara, by accident left his pockets whereas eating in New York Metropolis. This incident prompted the concept of a solution to pay for gadgets with out having your pockets.

The restaurant would ship the invoice to the Diners Membership, the place fee can be remitted on to the restaurant’s financial institution. Then, the cardholders can be required to pay their invoice in full every month to the Diner’s Membership, and they might obtain a small fee.

American Specific developed its first cost card in 1958. Since then, bank cards have revolutionized the banking, service provider, and shopper buying expertise. There isn’t a longer any want to hold money when making a purchase order normally.

Credit score Playing cards vs. Debit Playing cards vs. Pay as you go Playing cards

Whereas some might imagine bank cards, pay as you go playing cards, and debit playing cards can be utilized interchangeably, they differ.

Pay as you go Credit score Card

Typically talking, a pay as you go bank card is a card you load cash onto and use till it’s gone. Some pay as you go bank cards permit reloading, and others don’t. A pay as you go card will not be linked to a financial institution checking account. For those who lose the pay as you go bank card, there could also be little safety to get well your cash.

Credit score Card

A bank card typically means you might be utilizing cash that isn’t yours. You make funds and pay an rate of interest to your bank card issuer for the funds that you just borrowed once you made purchases.

Debit Card

A debit card is linked to your checking account and is as near money as playing cards get. A debit card is immediately tied to your checking account, so no matter cash you’ve got is pulled straight out of your account once you use your debit card.

This normally occurs instantaneously, whereas bank cards have a grace interval of some days earlier than the cash clears. There are fewer protections with debit card use versus bank cards.

Often Requested Questions

What’s the anatomy of a bank card quantity?

A bank card quantity is normally 16 digits. The primary six are the cardboard issuer’s quantity (Visa, Mastercard, and so on.), the following 5 numbers point out the issuing financial institution, and the final numbers are your particular person account quantity.

How do bank card statements work?

You obtain bank card statements month-to-month. Every month, it exhibits your transactions from the final billing date to the present one. It additionally exhibits any accrued curiosity fees from unpaid balances and every other fees. The assertion exhibits the minimal required fee that you should pay, however you might be free to pay the complete steadiness to keep away from curiosity fees or any increment you may afford.

Why do I’ve to signal the again of my bank card?

Earlier than the newest know-how, a signed bank card was the best solution to forestall fraud. Retailers would examine the signature on the cardboard to the signature you full in entrance of them. With at present’s know-how, although, most individuals use playing cards with out contact or exhibiting them to the cashier, so the signature panel isn’t as useful.

Are bank card signature containers a factor of the previous?

It’s potential that we might even see signature strains go away altogether as microchips and different know-how grow to be extra superior. Mastercard introduced in 2018 that cardholder signatures can be non-compulsory on playing cards and receipts.

Why is the magnetic stripe mandatory if we use the chip?

Magstripe could also be pointless — or turning into pointless. Since many debit and bank card issuers are shifting to EMV (Europay, Mastercard, and Visa) chip playing cards, magnetic stripes have gotten out of date.

In response to Mastercard, they’ll part out magnetic stripes in 2024, relying on the area. Banks in the US will not be required to situation chip playing cards with magnetic stripes beginning in 2027.

How do I alter the expiration date of my bank card?

You possibly can’t change the expiration date of your bank card; you’ll need to get a brand new one.As soon as your bank card expires, it doesn’t imply your bank card issuer will shut or cancel your account; it simply means you want a brand new bodily card.

Bank card firms do that for a number of causes, together with bodily card use, safety, and inspiring shoppers to reevaluate and replace their bank card plans if mandatory.

Most card issuers will mail you a brand new card earlier than expiration, however different firms require you to name. In case your card is nearing its expiration, it might be a good suggestion to contact your issuer and ensure a alternative is coming.

What’s the distinction between a CVC and a CVV?

The CVC and CVV are the identical regardless of having totally different names. CVC stands for Card Verification Code, and CVV stands for Card Verification Worth. They each reference the three digit safety code on the again of your bank card to forestall fraud.

Backside Line

Realizing the components of a bank card is vital as they’re an important a part of making purchases on the planet. Realizing the anatomy of a bank card may also help you perceive your card’s security measures and community attain and select the proper bank card.

Since many of those options are being phased out over the subsequent few years, you might wish to begin altering now the way you entry and use your bank card for each in-store and on-line purchases.

[ad_2]

Source link