[ad_1]

A current Wall Road Journal article mentioned how retail merchants that made hundreds of thousands through the pandemic buying and selling the market at the moment are principally worn out.

“Novice dealer Omar Ghias says he amassed roughly $1.5 million as shares surged through the early a part of the pandemic, gripped by a speculative fervor that cascaded throughout all markets.

As his good points swelled, so did his spending on all the pieces from sports activities betting and bars to luxurious vehicles. He says he additionally borrowed closely to amplify his positions.

When the occasion ended, his fortune evaporated because of some wrong-way bets and his extreme spending. To help himself, he says he now works at a deli in Las Vegas that pays him roughly $14 an hour plus suggestions and sells space timeshares. He says he now not has any cash invested out there.

‘I’m ranging from zero,’ mentioned Mr. Ghias, who’s 25.”

His story will not be a one-off occasion. Through the pandemic lockdowns in 2020 and 2021, scores of People turned to inventory market playing to switch sports activities betting because the economic system was shuttered. Between ‘stimulus checks’, swelling financial institution accounts, no job to go to, and a free inventory buying and selling app on each cellphone, retail merchants poured into the market chasing all the pieces from cryptocurrencies to bankrupt firms.

If all this sounds acquainted, it ought to.

In June 2020, I wrote an article concerning the speculative behaviors of retail merchants resembling what we noticed in 1999 and 2007. To wit:

“Is it 1999 or 2007? Retail buyers flood the market as hypothesis grows rampant with a palpable exuberance and perception of no draw back danger. What may go fallacious?

Do you keep in mind this industrial?”

“The Etrade industrial aired throughout Tremendous Bowl XLI in 2007. The next yr, the monetary disaster set in, markets plunged, and buyers misplaced 50%, or extra, of their wealth.

Nonetheless, this wasn’t the primary time it occurred.

The identical factor occurred in late 1999. This industrial was aired 2-months shy of the start of the “Dot.com” bust as buyers as soon as once more believed “investing was as straightforward as 1-2-3.”

After all, on the time, retail merchants had been consumed by greed and the ‘concern of lacking out’. Nonetheless, as we concluded on the time:

“I get it. If you’re one in every of our youthful readers, who’ve by no means been via an precise “bear market,” I wouldn’t consider what I’m telling you both.

Nonetheless, after dwelling via the Crash of ’87, managing cash via 2000 and 2008, and navigating the “Nice Crash of 2020,” I can let you know the indicators are all there.”

A Change of Psychology

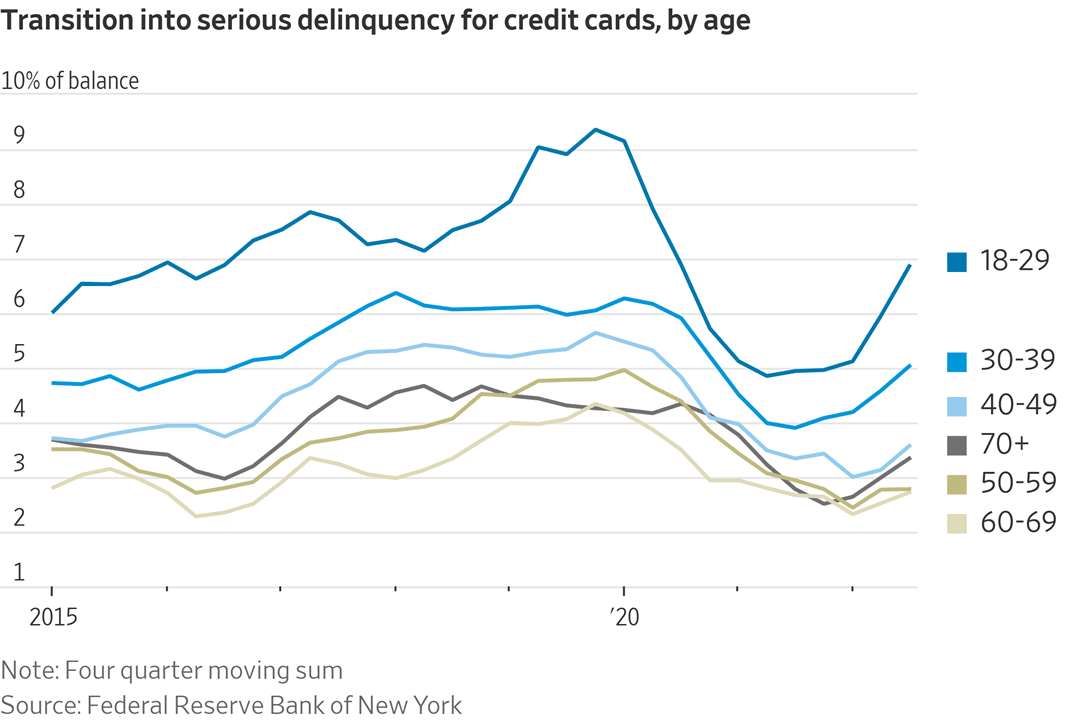

We warned a number of instances in several articles that the actions of retail merchants would result in very poor outcomes. One such word was that Gen Z’ers had been taking up debt to speculate.

“Younger buyers are taking up private debt to put money into shares. I’ve not personally witnessed such a factor since late 1999. At the moment, ‘day merchants’ tapped bank cards and residential fairness loans to leverage their funding portfolios.

For anybody who has lived via two ‘actual’ bear markets, the imagery of individuals making an attempt to ‘daytrade’ their method to riches is acquainted. The current surge in ‘Meme’ shares like AMC and Gamestop because the ‘retail dealer sticks it to Wall Road’ will not be new.”

However once more, retail merchants felt indestructible on the time because the market superior nearly every day, and the extra danger you took, the extra success you had.

Nonetheless, as is all the time the case, ‘danger’ and ‘reward’ usually are not mutually unique and taking up leverage to speculate in the end results in poor outcomes. As I concluded in August of 2021:

“Investing is a sport of ‘danger.’ It’s typically acknowledged that the extra ‘danger’ you’re taking, the more cash you can also make. Nonetheless, the precise definition of danger is ‘how a lot you’ll lose when one thing goes fallacious.’

Following the ‘Dot.com crash,’ many people realized the perils of ‘danger’ and ‘leverage.’”

Because the WSJ famous, Mr. Ghias borrowed closely to amplify his positions.

The end result was not sudden.

Nonetheless, importantly, Mr. Ghias will not be alone, and the downturn out there final yr has many retail merchants altering their psychology. To wit:

“Now a few of these so-called retail buyers are backing away from the markets after the worst yr for shares since 2008. Others are paring their positions or shifting their cash to extra conservative holdings, equivalent to bonds or money.”

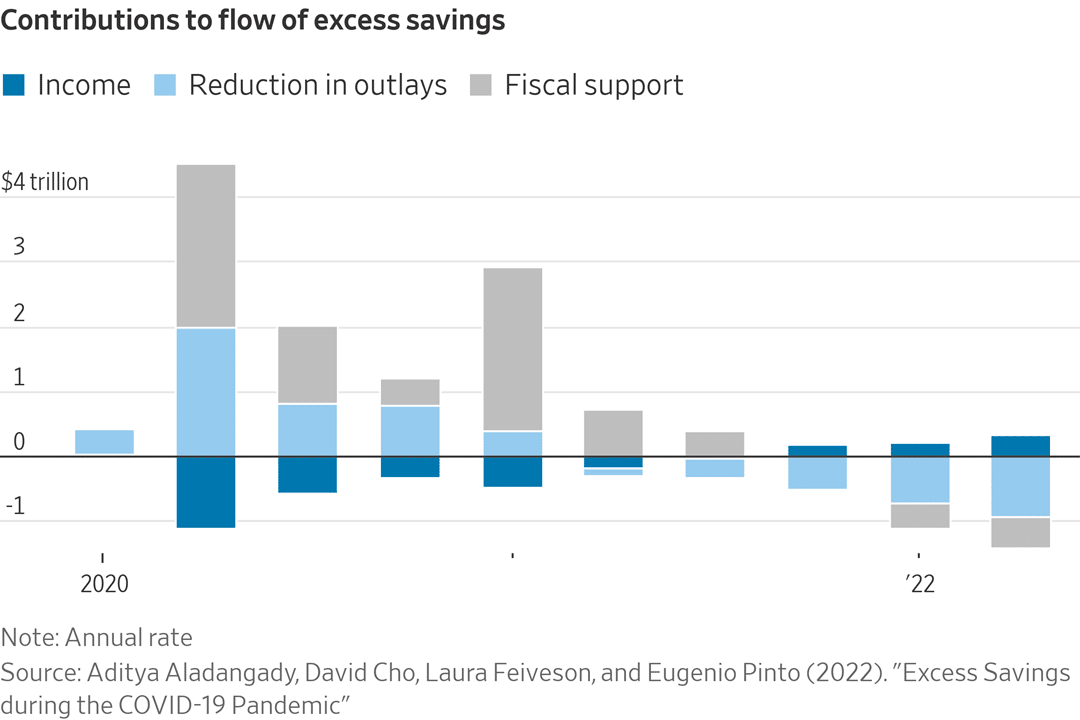

Given the impression of retail merchants on the markets in 2020 and 2021, their retreat from the market may pose an extra headwind. Nonetheless, most significantly, many of the cash utilized by retail merchants to spice up the markets got here from the pandemic-related stimulus. As one other WSJ article notes, that’s now principally gone.

After all, that lack of capital is now additionally catching up with the flexibility to repay the elevated bank card debt taken on by the youthful technology to fund their way of life. As Jeff Sparshott of WSJ notes:

“In 2020 and into 2021, a mix of presidency pandemic stimulus and decreased spending, for instance on eating places and journey, fattened People’ wallets.

“This money helped People make it via a interval of excessive inflation final yr, however the forces that had acted to spice up financial savings reversed course as pandemic aid unwound and costs soared.

“Right this moment, some persons are having to chop again on their spending or add to their credit-card balances. Many have needed to faucet their financial savings to remain afloat, say economists.”

After all, all of this can be a operate of the extremely unhealthy recommendation dished out on social media that retail merchants consumed with out query.

Don’t Be Bearish

In Could 2022, I wrote an article for the Epoch Occasions titled ”. which mentioned a WSJ article on the rise of a “new technology of economic media stars.”

“Because the U.S. retreated amid the pandemic to its couches, hundreds of thousands of would-be inventory pickers—some flush with stimulus money—fired up social-media and messaging apps and dove headlong into the world of retail investing.

Many of those influencers haven’t any formal coaching as monetary advisers and no background in skilled investing, main them to choose shares primarily based on the whims of fashionable opinion or to dispense money-losing recommendation.”

In response to the article, you wanted to be relatable, promote the dream, and never be bearish.

Type of like this couple:

Tweet

The issue with the ‘don’t be bearish’ bias needs to be evident. Solely listening to one-half of the story makes buyers ‘blindsided’ by the opposite half.

“We all know that day buying and selling doesn’t produce long-term wealth for the overwhelming majority of people that do it, however these influencers are preying on that a part of the human mind that has fewer inhibitions, that thinks: ‘I would be the exception.’ That results in hypothesis and other forms of very high-risk habits.” – Ted Klontz, Professor Of Behavioral Finance, Creighton College.

The demand by Gen Z’ers for ‘don’t be bearish’ commentary is why they ignored the identical indicators that negatively impacted each Millennials and Boomers beforehand.

Whereas social media stars ‘bought wealthy’ for his or her free ‘don’t be bearish’ investing recommendation, it’s value noting their ‘riches’ didn’t come from their investing talent. As a substitute, it got here from their talent in producing merchandise and adverts. Such will not be a lot totally different than how Wall Road makes its cash.

Expertise tends to be a brutal trainer, however it is just via expertise that we learn to construct wealth efficiently over the long run.

As Ray Dalio as soon as quipped:

“The most important mistake buyers make is to consider that what occurred within the current previous is more likely to persist. They assume that one thing that was an excellent funding within the current previous remains to be an excellent funding. Sometimes, excessive previous returns merely suggest that an asset has develop into costlier and is a poorer, not higher, funding.”

Such is why each nice investor in historical past, in several kinds, has one primary investing rule in frequent:

“Don’t lose cash.”

The reason being easy: You might be out of the sport should you lose capital.

Many younger buyers have gained a lot expertise by giving most of their cash to these with expertise.

It is likely one of the oldest tales on Wall Road.

So, whereas Millennials had been fast to dismiss the ‘Boomers’ within the monetary markets for ‘not getting it.’

There was a extra easy reality.

We did ‘get it.’

Now we have been round lengthy sufficient to understand how these items ultimately finish.

If solely somebody may have warned them.

[ad_2]

Source link