[ad_1]

By Graham Summers, MBA

The Fed has now made what could be its second “profession ending” mistake if it operated in the true world.

The primary such mistake involved its ludicrous declare that inflation was “transitory” all through 2021- 2022. Anybody who bothered doing any actual analysis knew that argument was complete nonsense… but someway the Fed with its 400 researchers and analysts didn’t get it proper.

In the true world, somebody in a serious place (Fed Chair or a number of Fed Presidents) would have been fired for this diploma of incompetence. However we’re speaking concerning the Fed right here… which exists in some fantasy land in which you’ll blow up the monetary system/ economic system and nonetheless preserve your job.

Which brings us to the Fed’s second “profession ending” degree mistake… believing that inflation was underneath management as a result of some extremely manipulated knowledge advised it was.

In December, the official inflation measure, the Shopper Value Index (CPI) recorded a month over month tempo of -0.1%. Since October had been 04% and November had been 0.2%, the Fed took this to imply that “disinflation” had arrived. Fed Chair Powell used that phrase near a dozen occasions throughout the Fed’s February press convention.

The one drawback with this was that the CPI is a notoriously AWFUL measure of inflation… and is susceptible to a number of revisions. I knew that. Most analysts knew it. It’s actually staggering that the Fed would NOT understand it. And but, that appears to be the case because the Fed fell for this nonsense and started slowing the pace of its price hikes all the way down to 0.25% in early 2023.

December’s CPI has since been revised to 0.1%. November and October’s had been additionally revised greater. And January’s clocked in at 0.5% month over month. That’s inflation of 6% on an annualized foundation.

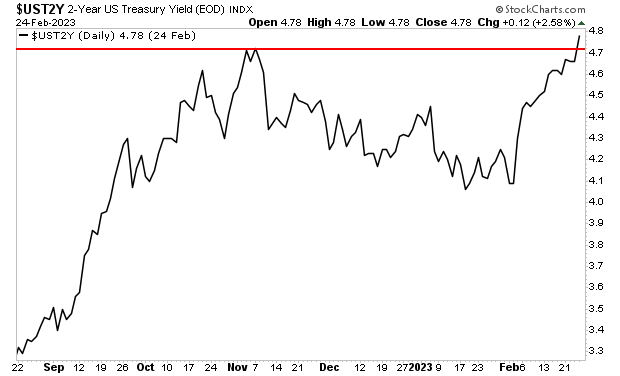

Bonds have woken as much as the very fact the Fed has misplaced the plot. The yield on the 2-12 months U.S. Treasury has erupted greater taking out its former highs with ease. The Fed will very seemingly be pressured to INCREASE the tempo of its price hikes to 0.5% and even greater within the coming months.

That is the form of atmosphere wherein crashes can occur. The Fed is quickly shedding credibility. And traders have been suckered into believing the “worst” is behind them: they poured $1.5 billion into shares every single day in January. And so they did this at a time when my proprietary Crash Set off is now on the primary confirmed “Promote” sign since 2008.

[ad_2]

Source link